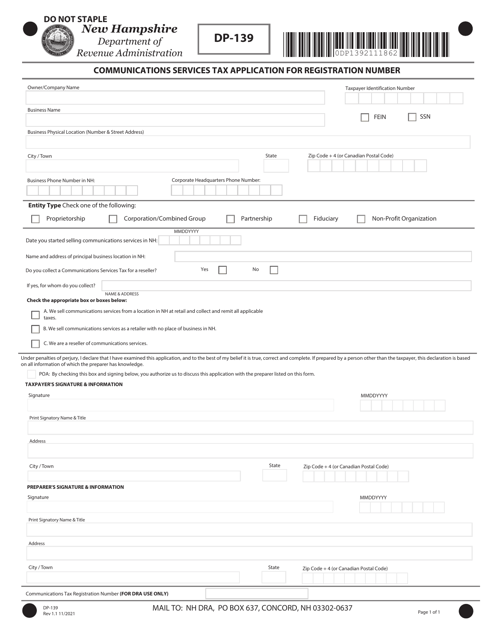

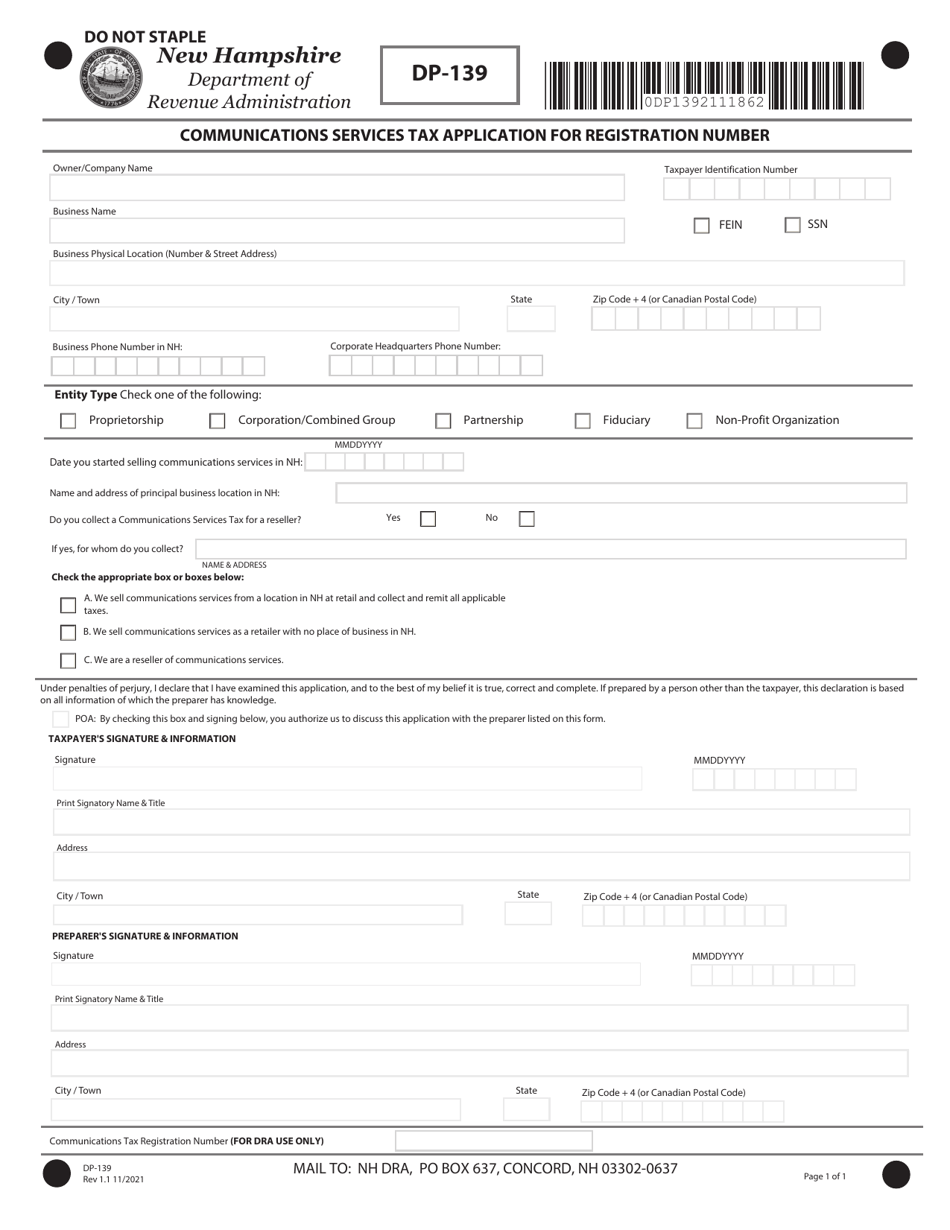

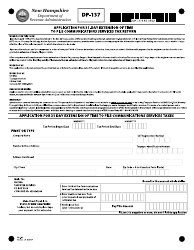

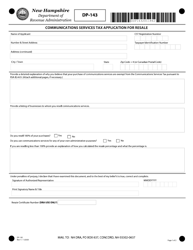

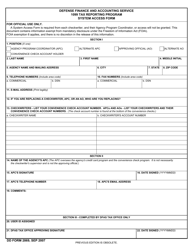

Form DP-139 Communications Services Tax Application for Registration Number - New Hampshire

What Is Form DP-139?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-139?

A: Form DP-139 is the Communications Services Tax Application for Registration Number.

Q: What is the purpose of Form DP-139?

A: The purpose of Form DP-139 is to apply for a registration number for the Communications Services Tax in New Hampshire.

Q: Who needs to file Form DP-139?

A: Any person or business engaged in providing taxable communications services in New Hampshire needs to file Form DP-139.

Q: What information is required on Form DP-139?

A: Form DP-139 requires you to provide your name or business name, address, federal employer identification number (FEIN), contact person, and other relevant details about your communications services.

Q: Is there a filing fee for Form DP-139?

A: No, there is no filing fee for Form DP-139.

Q: When should I file Form DP-139?

A: You should file Form DP-139 at least 30 days before you begin providing taxable communications services in New Hampshire.

Q: Are there any penalties for not filing Form DP-139?

A: Yes, failure to file Form DP-139 may result in penalties and interest charges.

Q: Can I amend Form DP-139?

A: Yes, you can amend Form DP-139 by submitting a new form with the updated information.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-139 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.