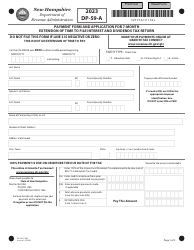

This version of the form is not currently in use and is provided for reference only. Download this version of

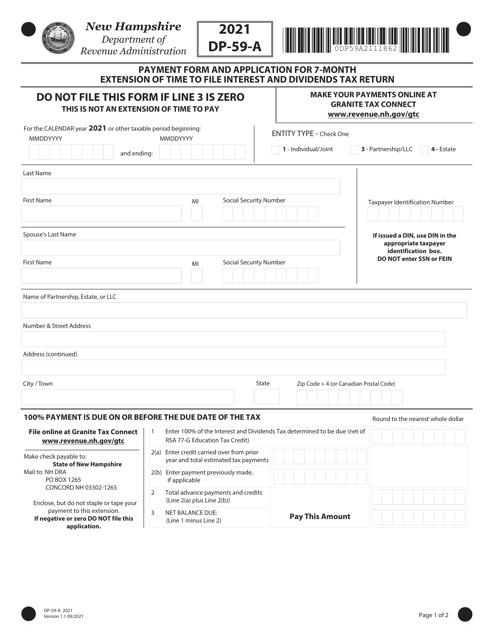

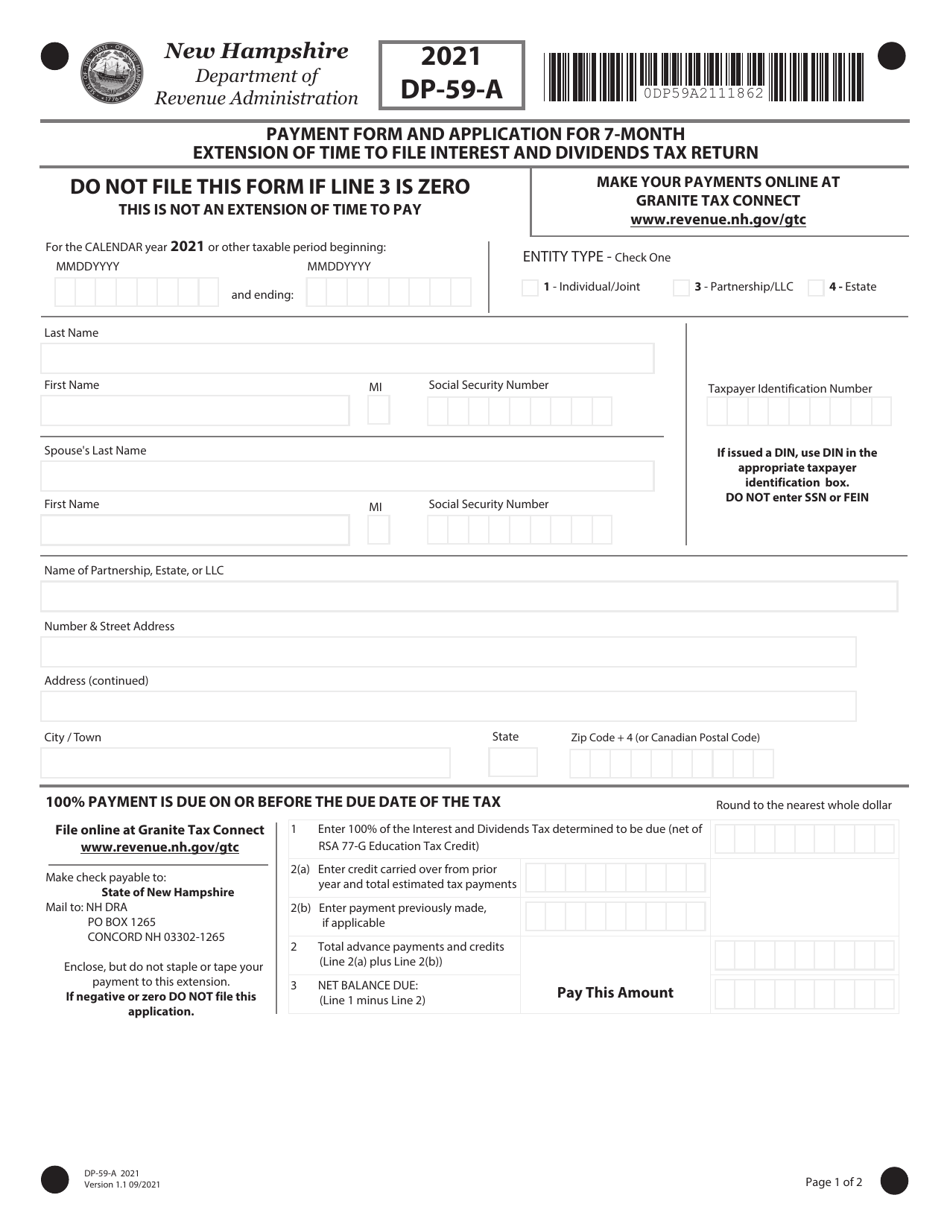

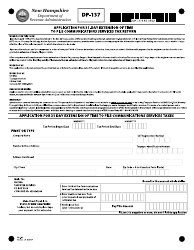

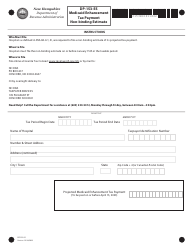

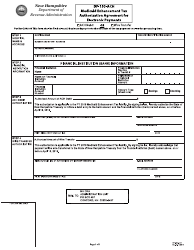

Form DP-59-A

for the current year.

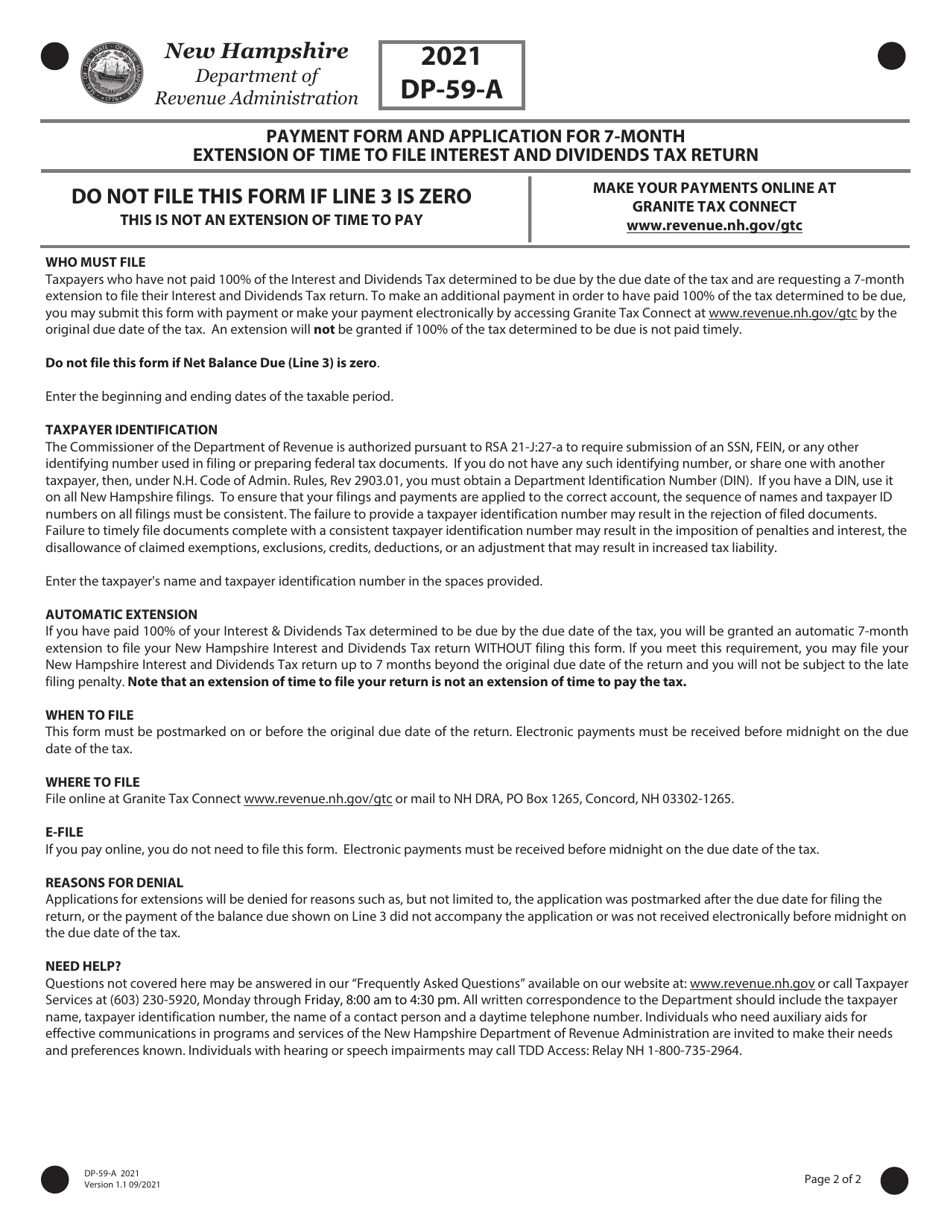

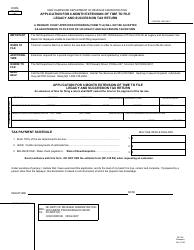

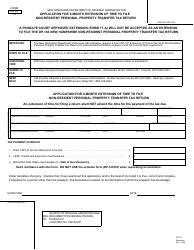

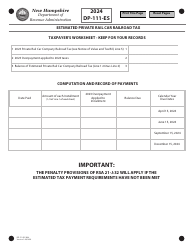

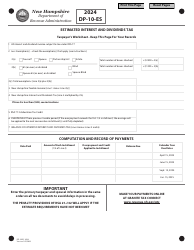

Form DP-59-A Payment Form and Application for 7-month Extension of Time to File Interest and Dividends Tax Return - New Hampshire

What Is Form DP-59-A?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

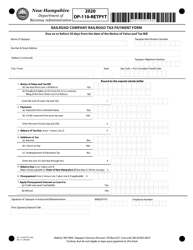

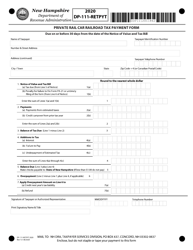

Q: What is Form DP-59-A?

A: Form DP-59-A is a payment form and application for a 7-month extension of time to file the interest and dividends tax return in New Hampshire.

Q: What is the purpose of Form DP-59-A?

A: The purpose of Form DP-59-A is to request an extension of time to file the interest and dividends tax return and make a payment.

Q: How long is the extension granted with Form DP-59-A?

A: Form DP-59-A grants a 7-month extension of time to file the interest and dividends tax return in New Hampshire.

Q: What type of tax return does Form DP-59-A apply to?

A: Form DP-59-A applies to the interest and dividends tax return in New Hampshire.

Q: Is payment required with Form DP-59-A?

A: Yes, payment is required with Form DP-59-A when requesting an extension of time to file the interest and dividends tax return.

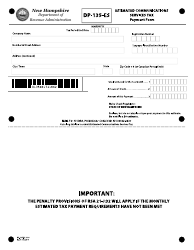

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-59-A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.