This version of the form is not currently in use and is provided for reference only. Download this version of

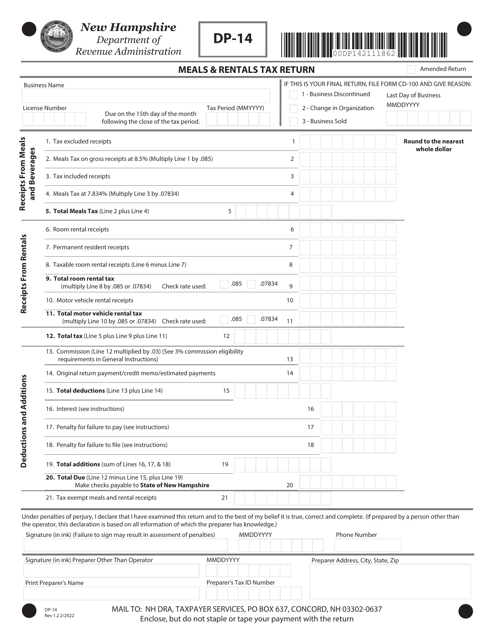

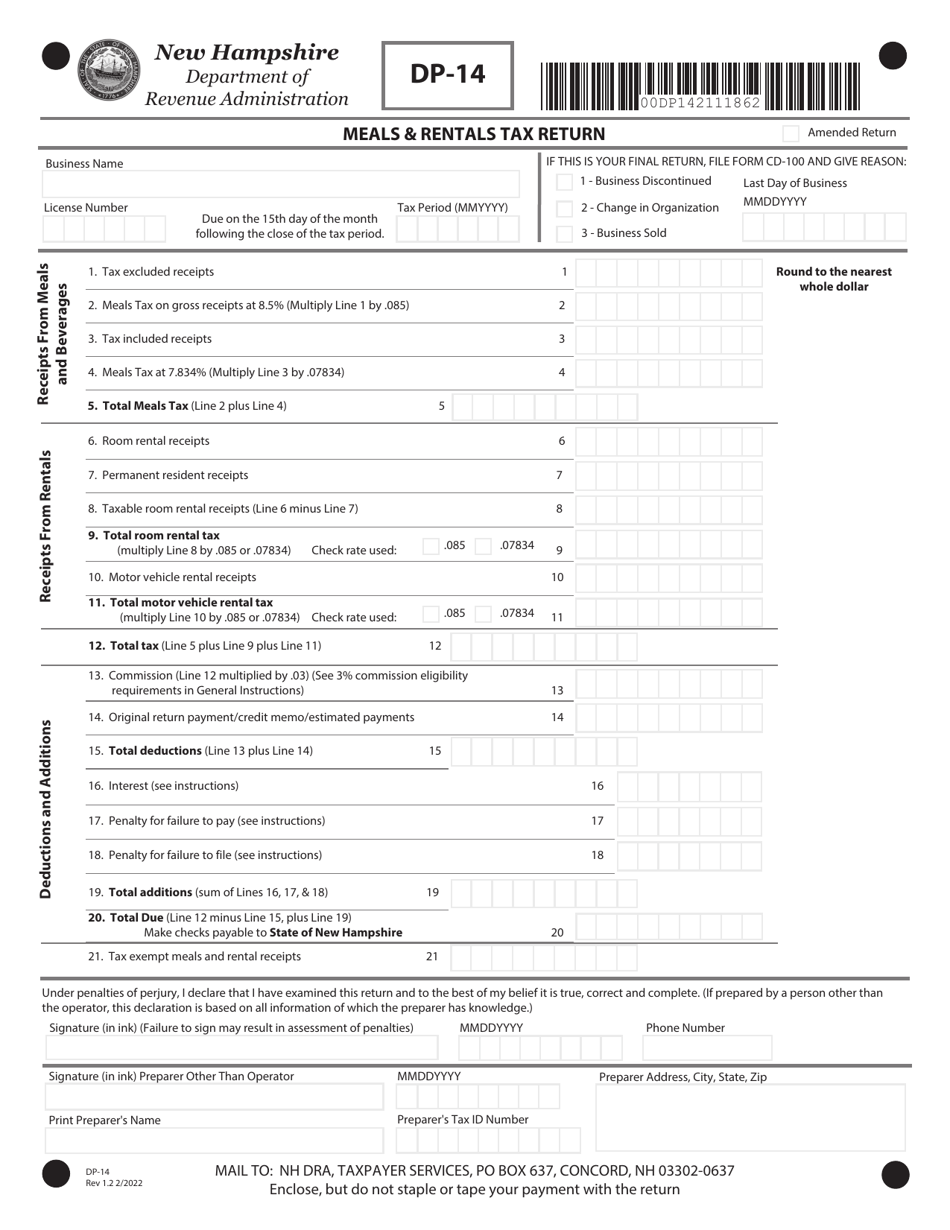

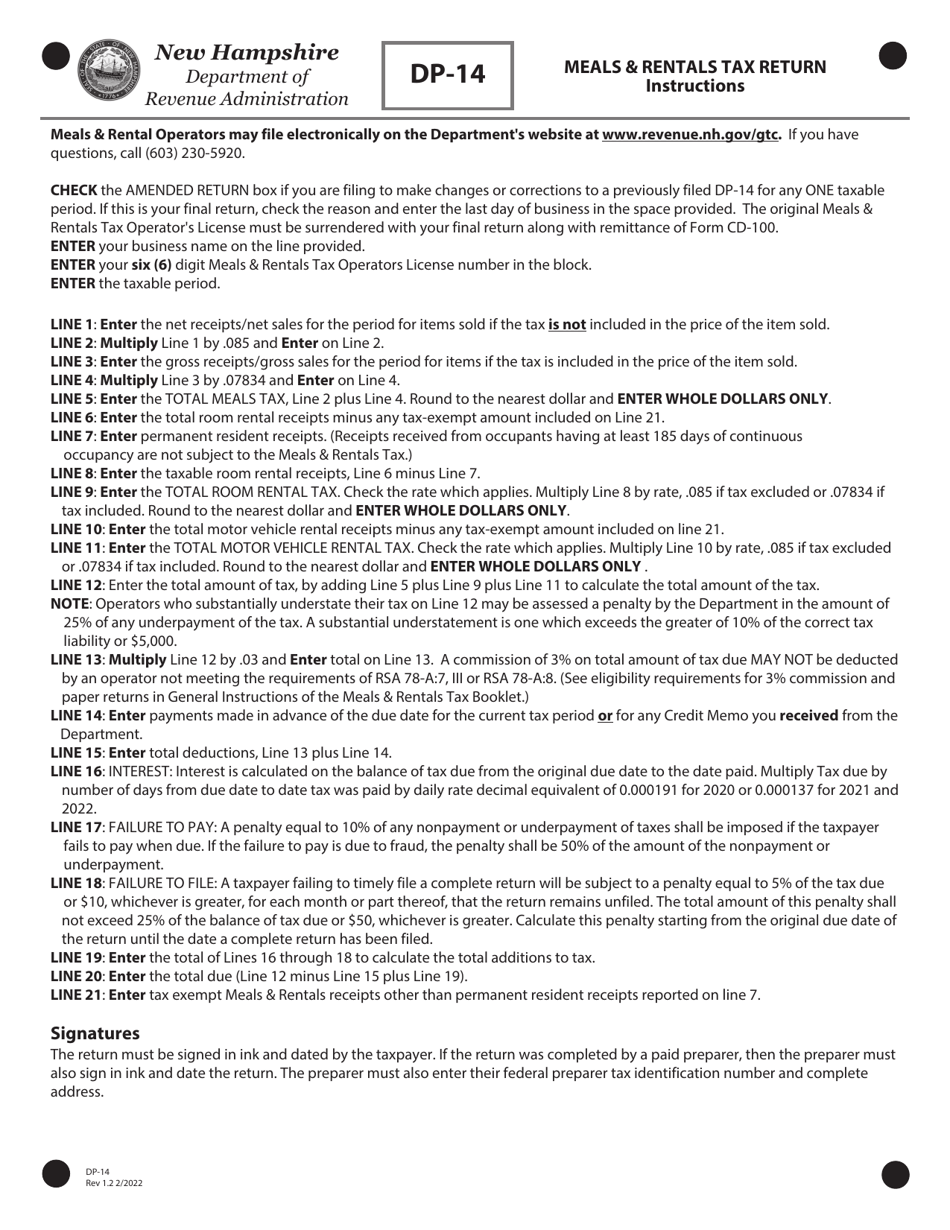

Form DP-14

for the current year.

Form DP-14 Meals & Rentals Tax Return - New Hampshire

What Is Form DP-14?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-14?

A: Form DP-14 is the Meals & Rentals Tax Return for New Hampshire.

Q: What is the purpose of Form DP-14?

A: Form DP-14 is used to report and remit Meals & Rentals Tax in New Hampshire.

Q: Who needs to file Form DP-14?

A: Any business or individual who collects Meals & Rentals Tax in New Hampshire needs to file Form DP-14.

Q: When is Form DP-14 due?

A: Form DP-14 is due on a quarterly basis, with the due dates falling on the 15th day of the month following the end of each quarter.

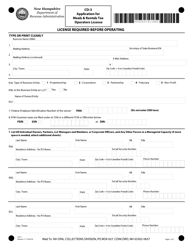

Q: What information is required on Form DP-14?

A: Form DP-14 requires information such as the taxpayer's name, contact information, gross sales, taxable sales, and the amount of Meals & Rentals Tax collected.

Q: Are there any penalties for late filing of Form DP-14?

A: Yes, there are penalties for late filing of Form DP-14. It is important to file and remit the tax on time to avoid any penalties or interest charges.

Q: Are there any exemptions or deductions available for Meals & Rentals Tax?

A: Yes, there may be certain exemptions or deductions available for Meals & Rentals Tax. It is advised to consult the New Hampshire Department of Revenue Administration or a tax professional for further guidance.

Q: What should I do if I have further questions or need assistance with Form DP-14?

A: If you have further questions or need assistance with Form DP-14, you can contact the New Hampshire Department of Revenue Administration for guidance.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-14 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.