This version of the form is not currently in use and is provided for reference only. Download this version of

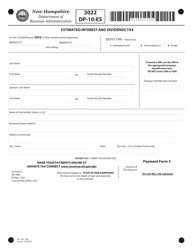

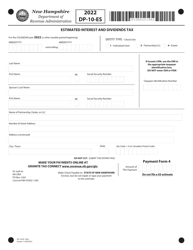

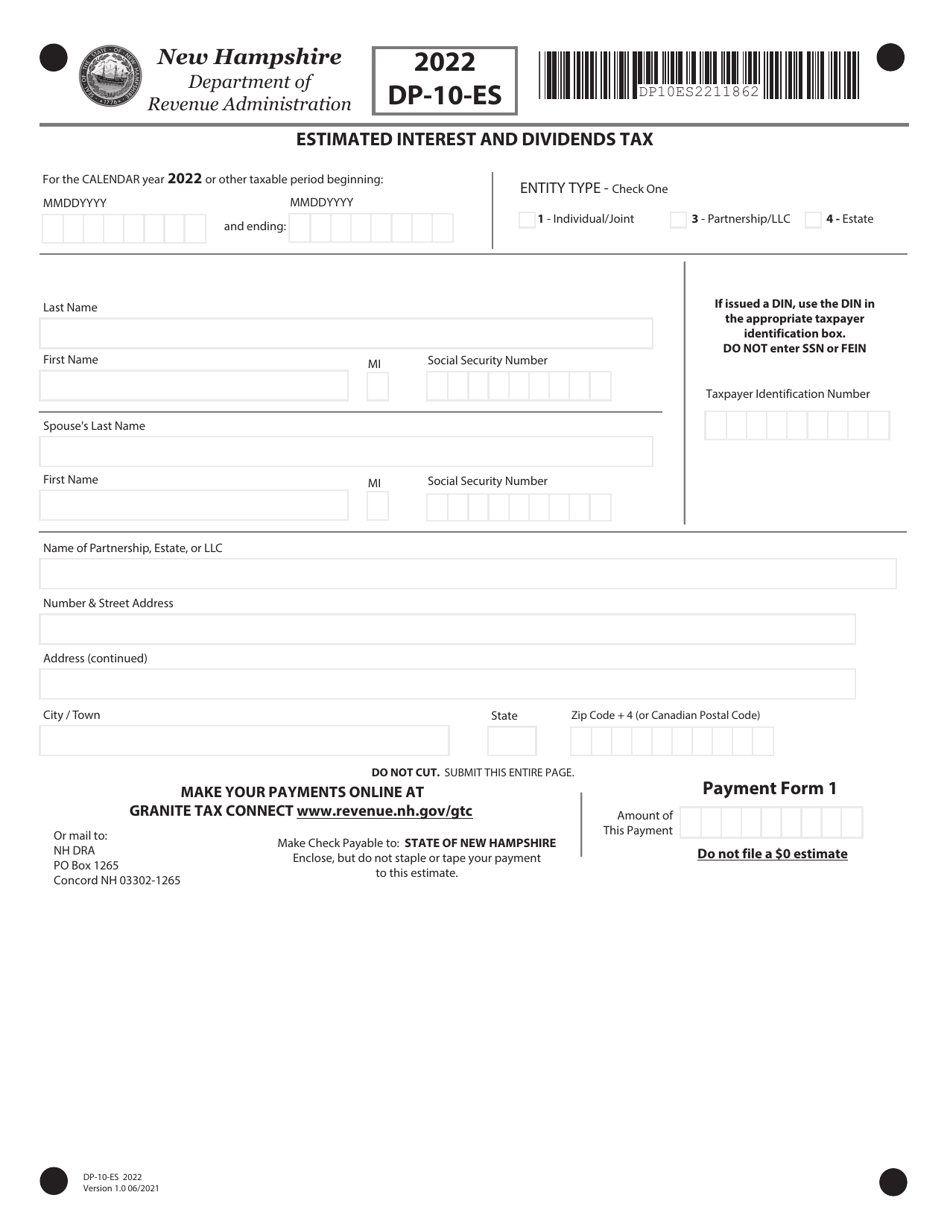

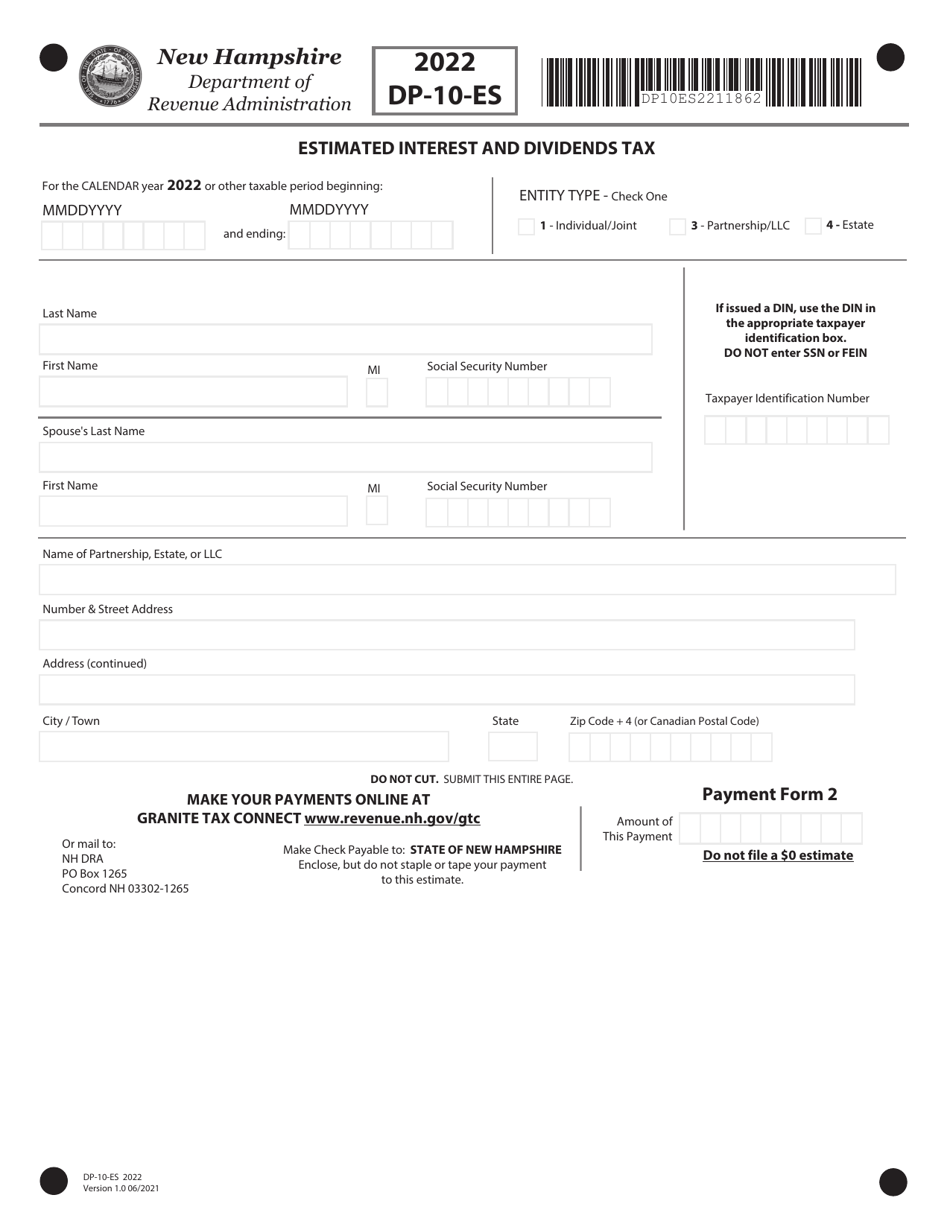

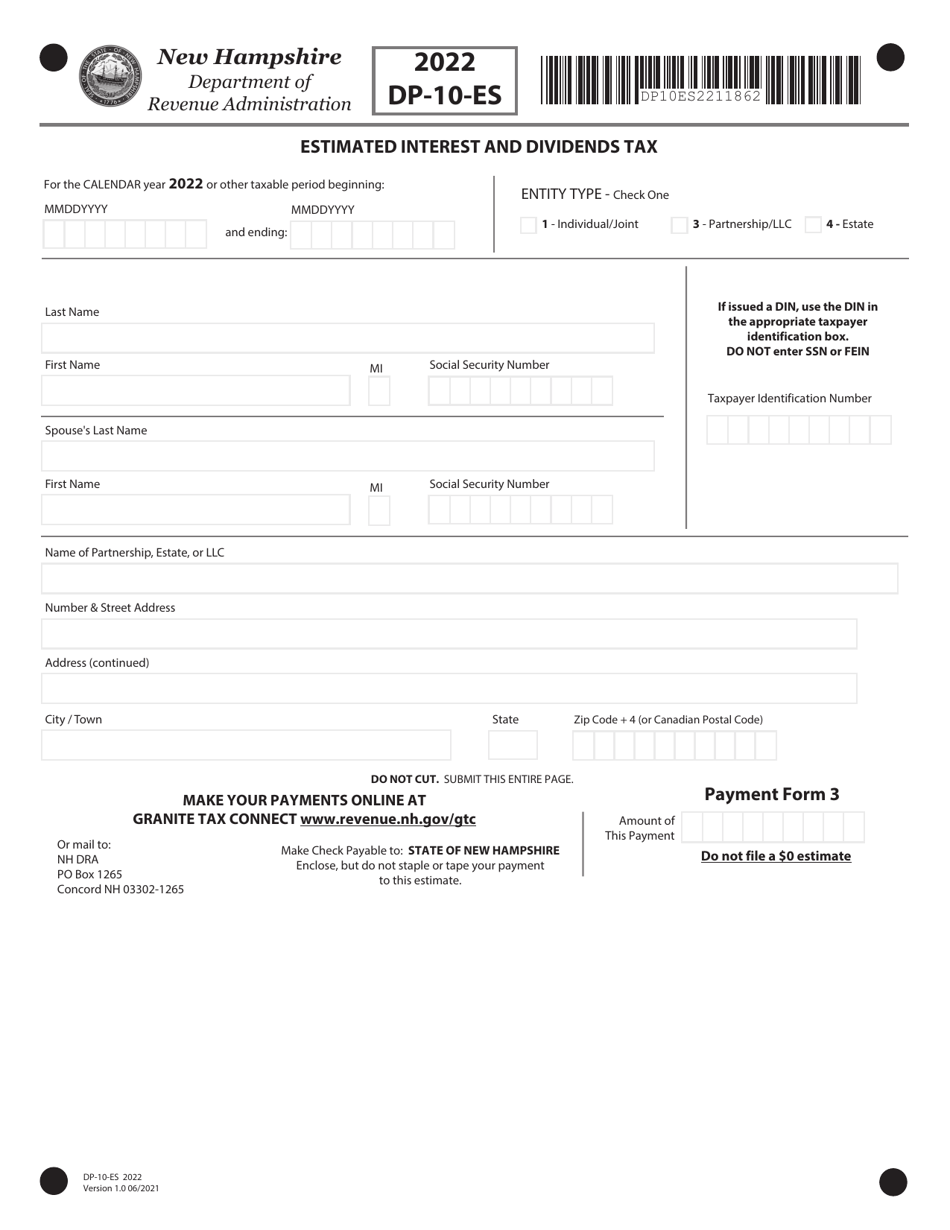

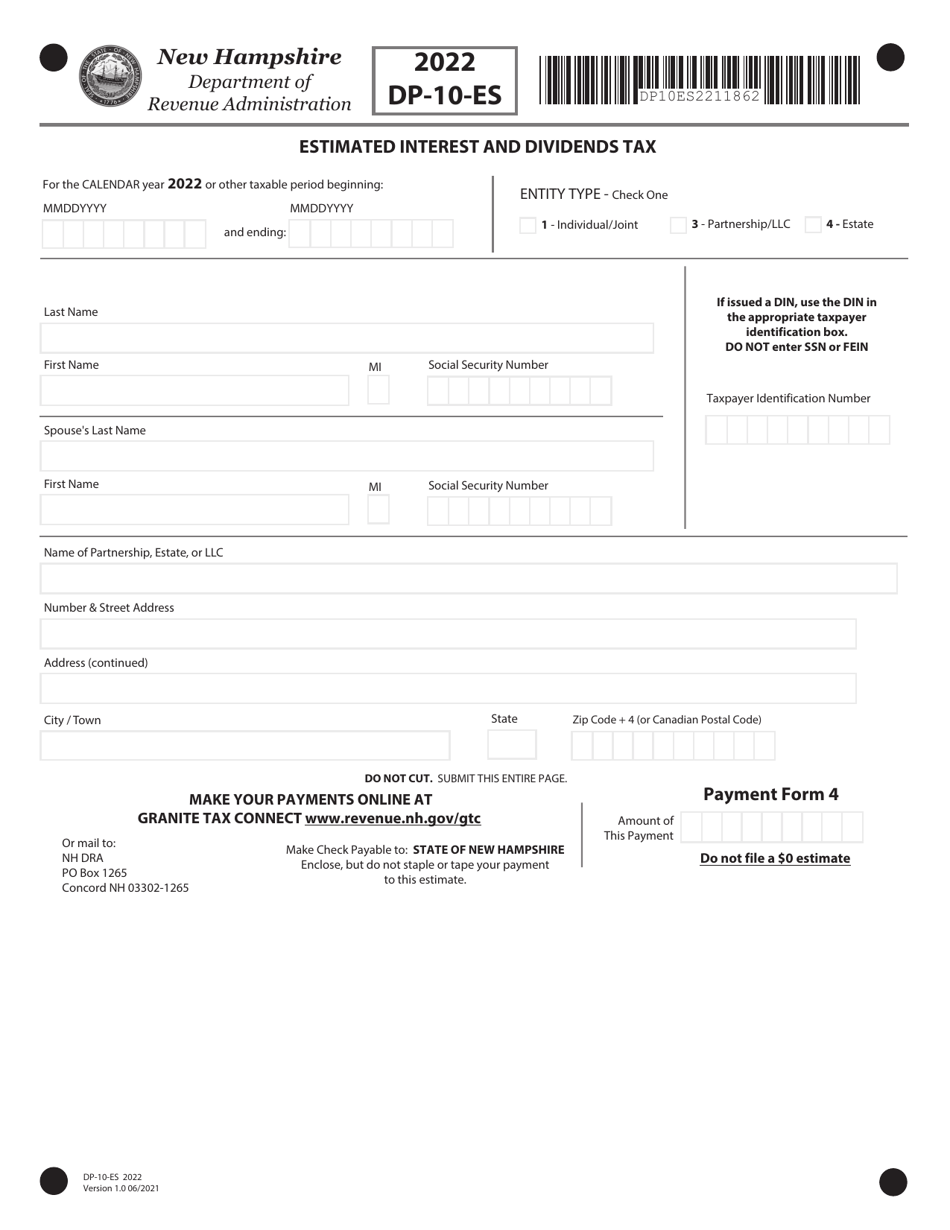

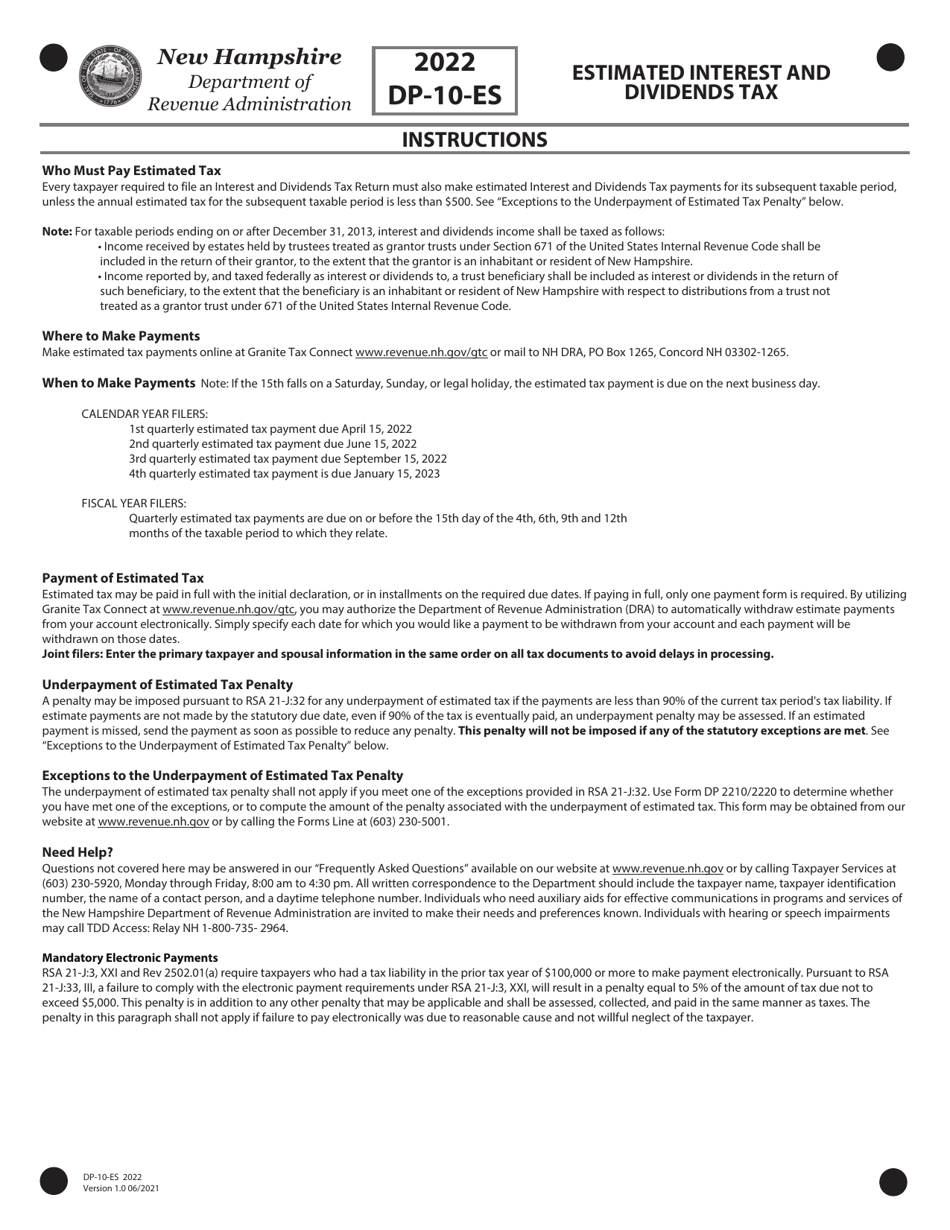

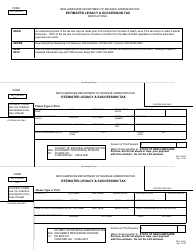

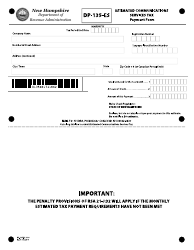

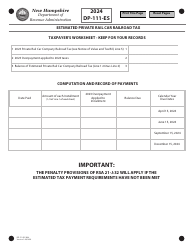

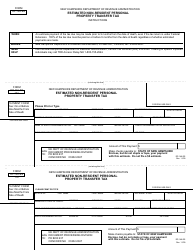

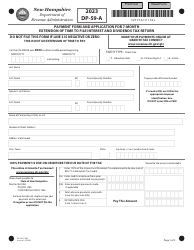

Form DP-10-ES

for the current year.

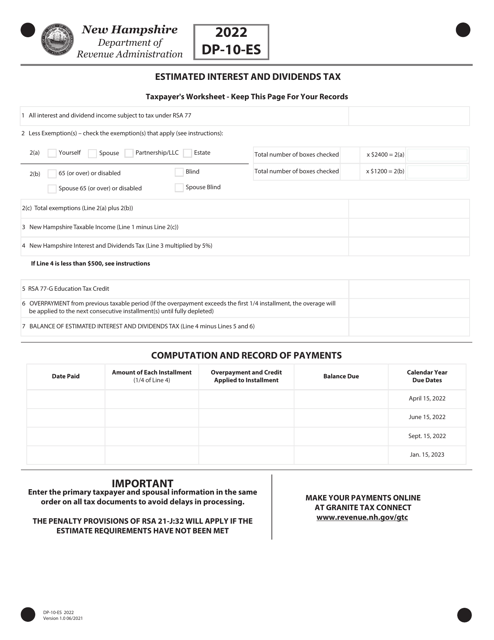

Form DP-10-ES Estimated Interest and Dividends Tax - New Hampshire

What Is Form DP-10-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-10-ES?

A: Form DP-10-ES is the Estimated Interest and Dividends Tax form for New Hampshire.

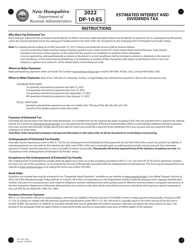

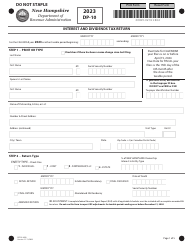

Q: Who needs to file Form DP-10-ES?

A: Individuals who receive interest and dividends income in New Hampshire may need to file Form DP-10-ES.

Q: What is the purpose of Form DP-10-ES?

A: The purpose of Form DP-10-ES is to estimate and pay the interest and dividends tax owed to the state of New Hampshire.

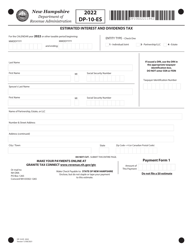

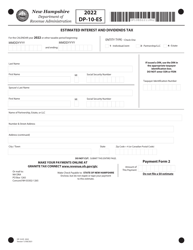

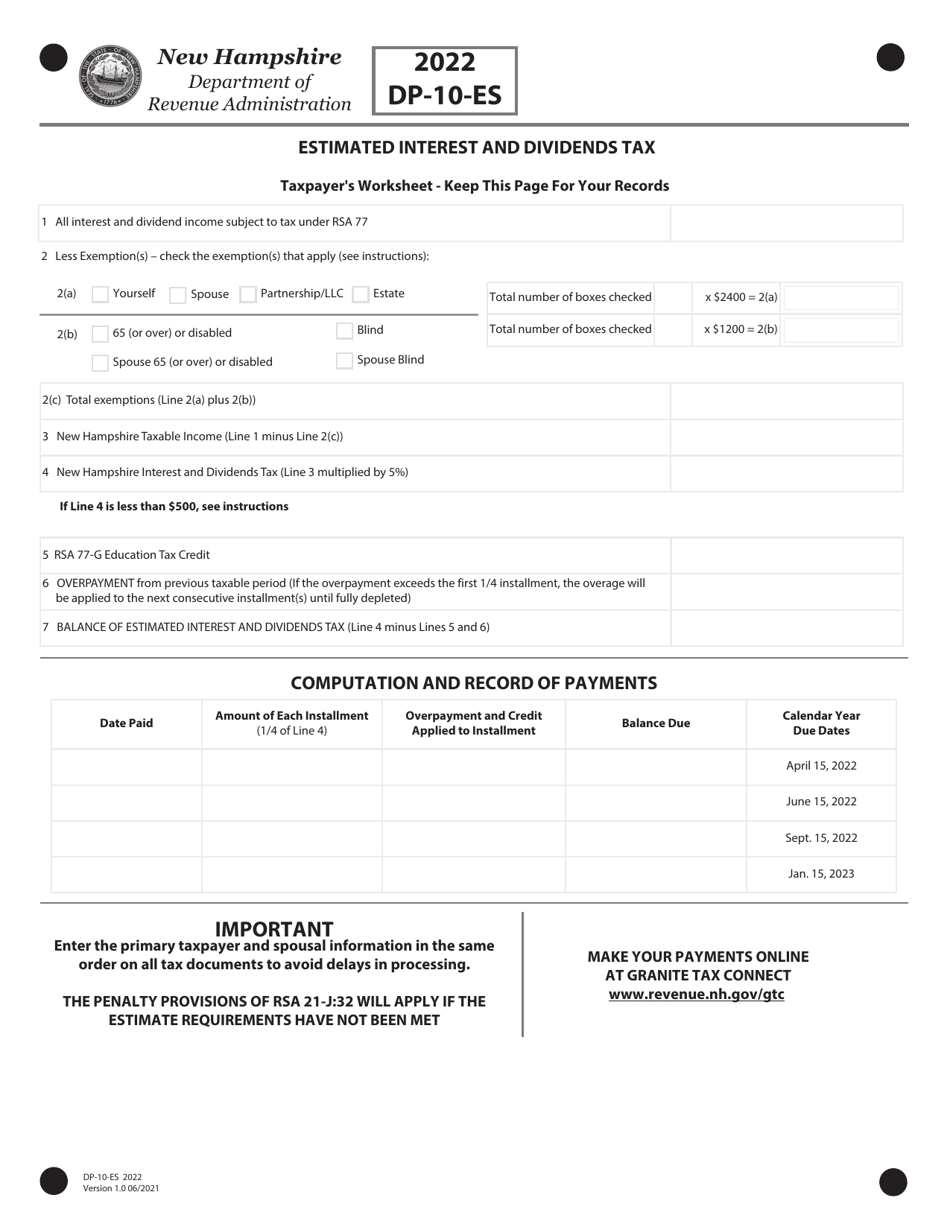

Q: When is the deadline to file Form DP-10-ES?

A: The deadline to file Form DP-10-ES is on or before April 15th of each year.

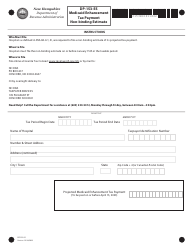

Q: Can I e-file Form DP-10-ES?

A: Yes, New Hampshire allows e-filing of Form DP-10-ES.

Q: What happens if I don't file Form DP-10-ES?

A: If you are required to file Form DP-10-ES and you don't, you may be subject to penalties and interest on the tax amount owed.

Q: Do I need to attach any other documents with Form DP-10-ES?

A: Typically, you do not need to attach any additional documents with Form DP-10-ES, unless specifically instructed by the form instructions or the Department of Revenue Administration.

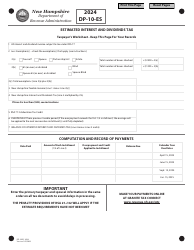

Q: How do I calculate the amount of tax due on Form DP-10-ES?

A: The amount of tax due on Form DP-10-ES is calculated based on the interest and dividends income you received in New Hampshire, as well as any applicable deductions or credits.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.