This version of the form is not currently in use and is provided for reference only. Download this version of

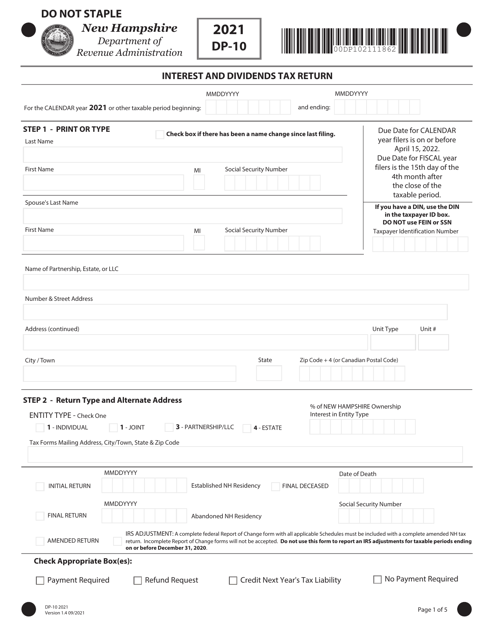

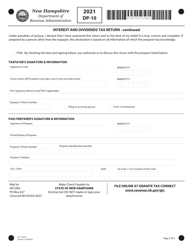

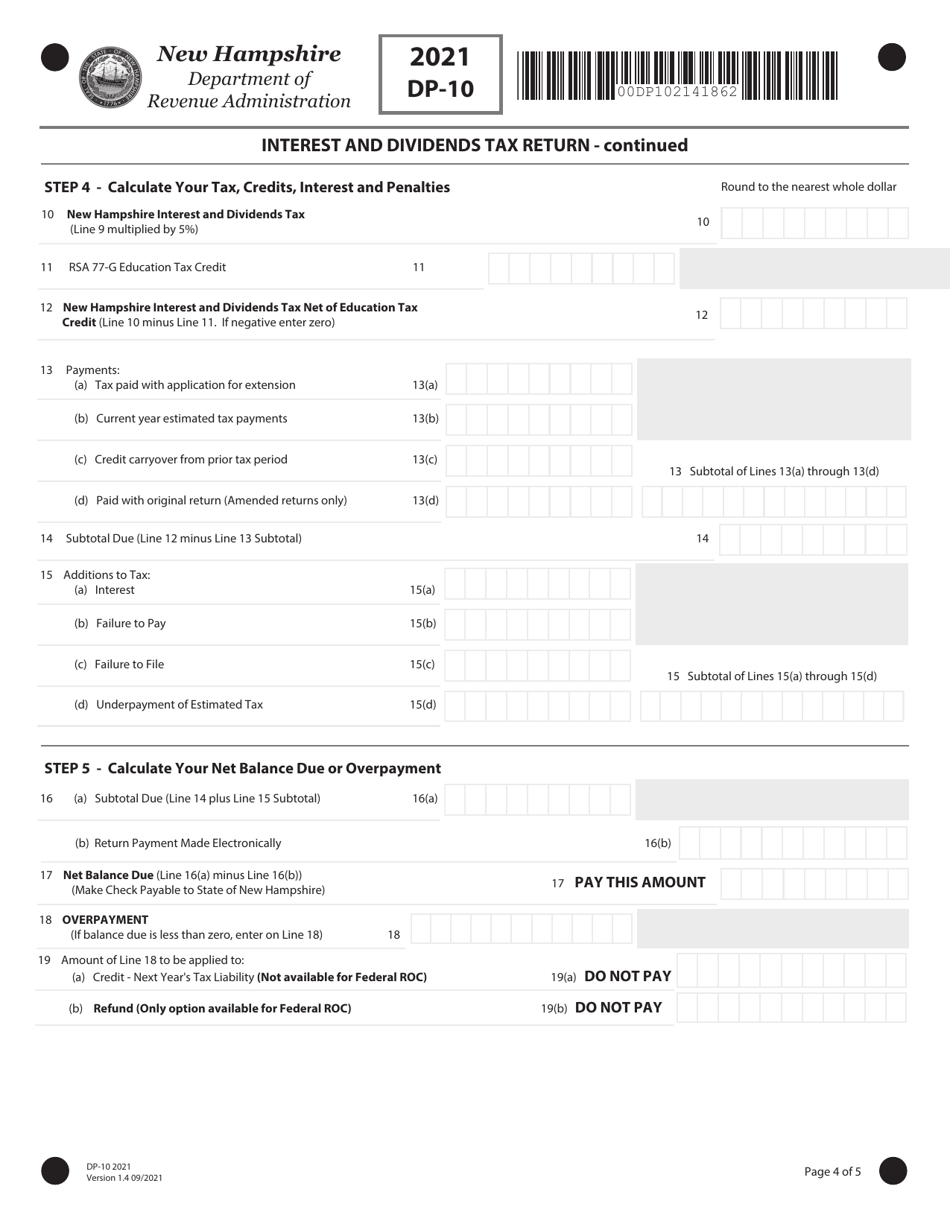

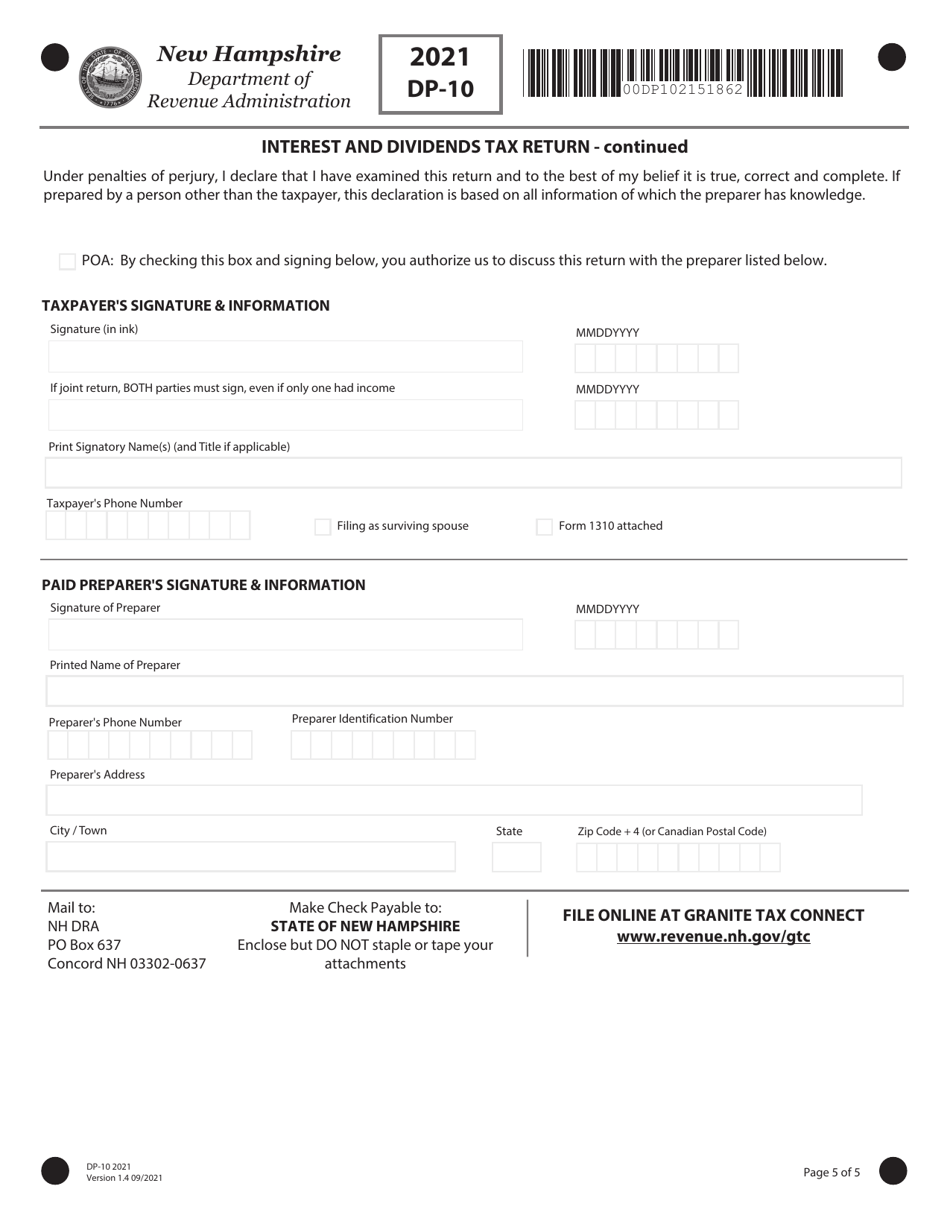

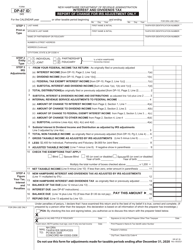

Form DP-10

for the current year.

Form DP-10 Interest and Dividends Tax Return - New Hampshire

What Is Form DP-10?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-10?

A: Form DP-10 is the Interest and Dividends Tax Return for the state of New Hampshire.

Q: Who needs to file Form DP-10?

A: Any individual who received interest and dividends income in New Hampshire is required to file Form DP-10.

Q: When is the deadline to file Form DP-10?

A: The deadline to file Form DP-10 is April 15th.

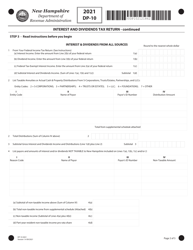

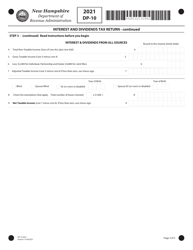

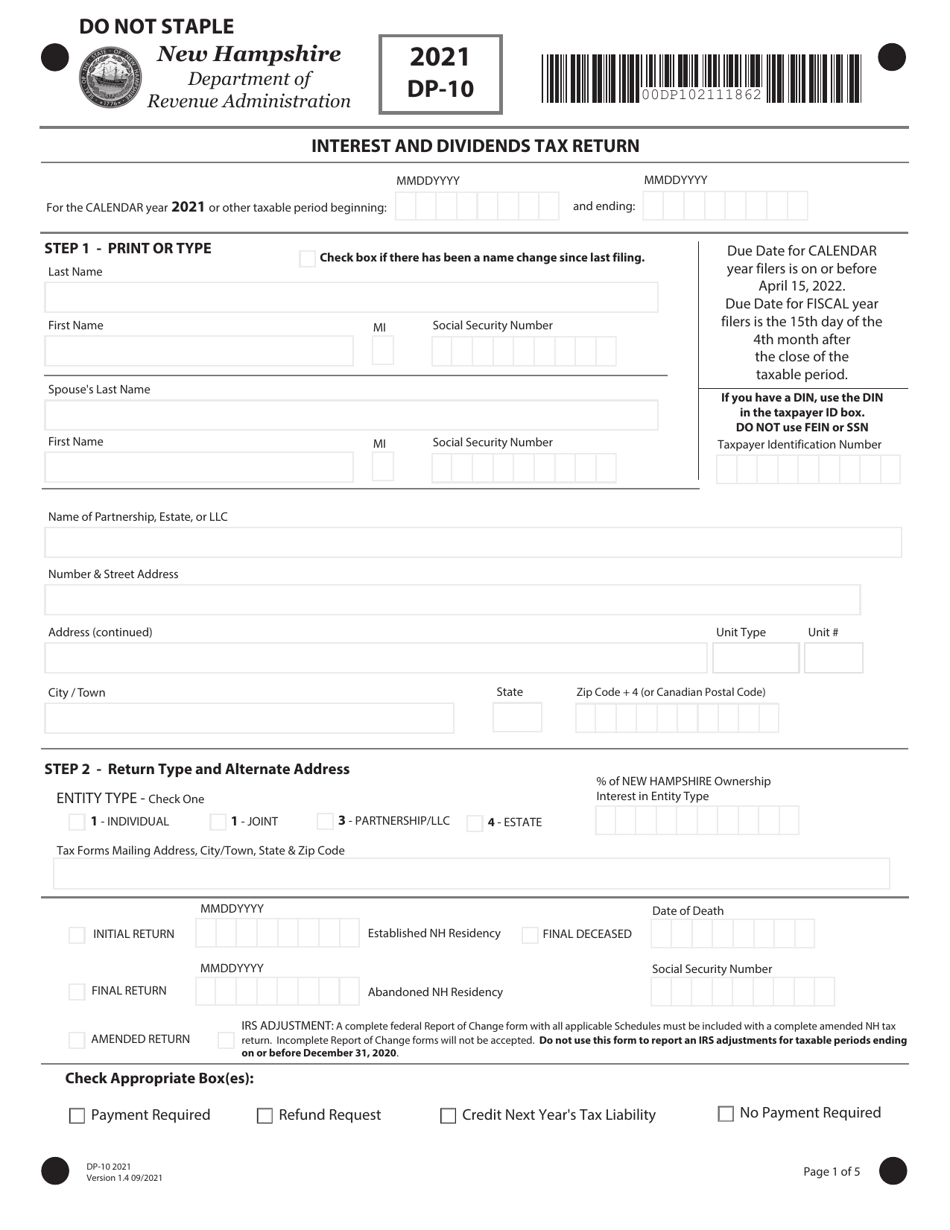

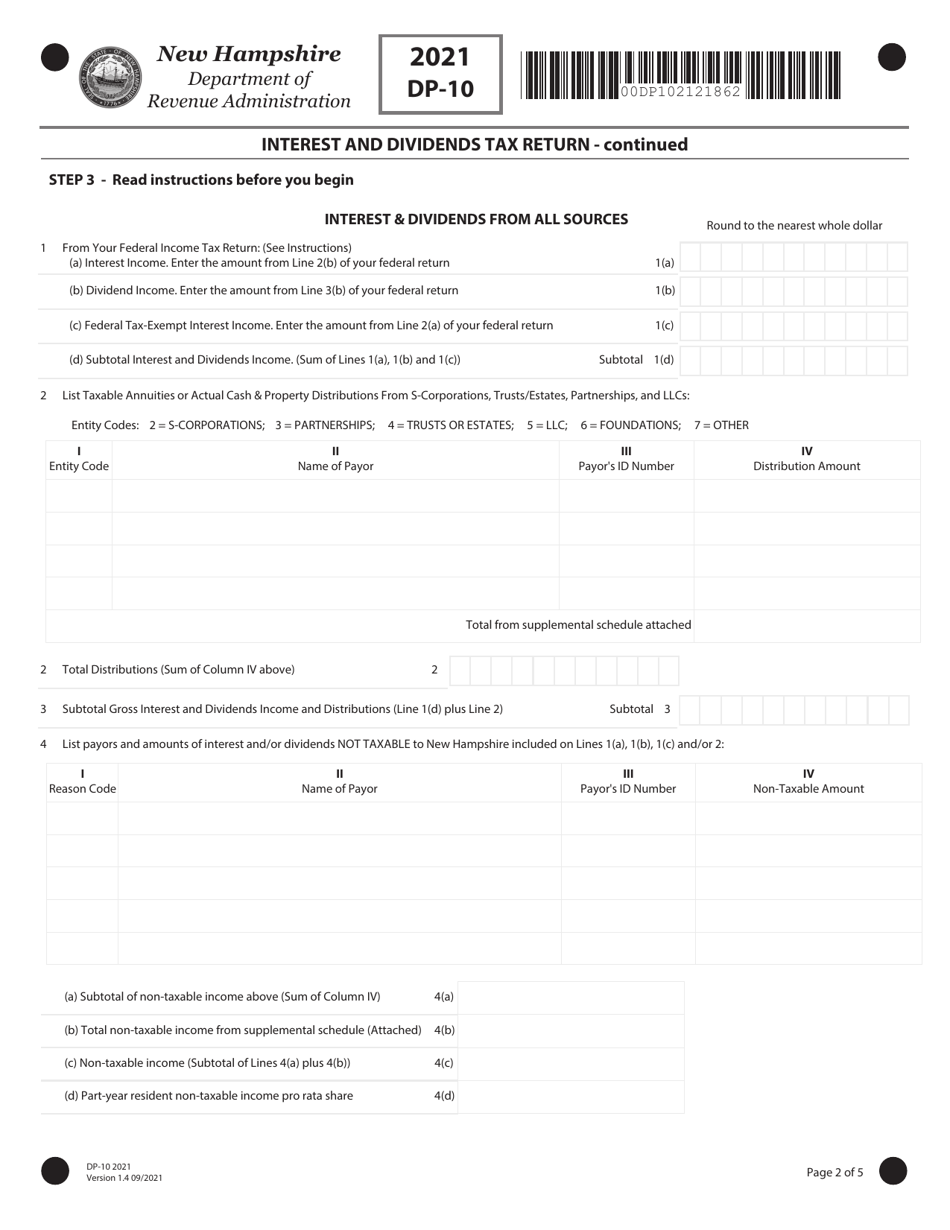

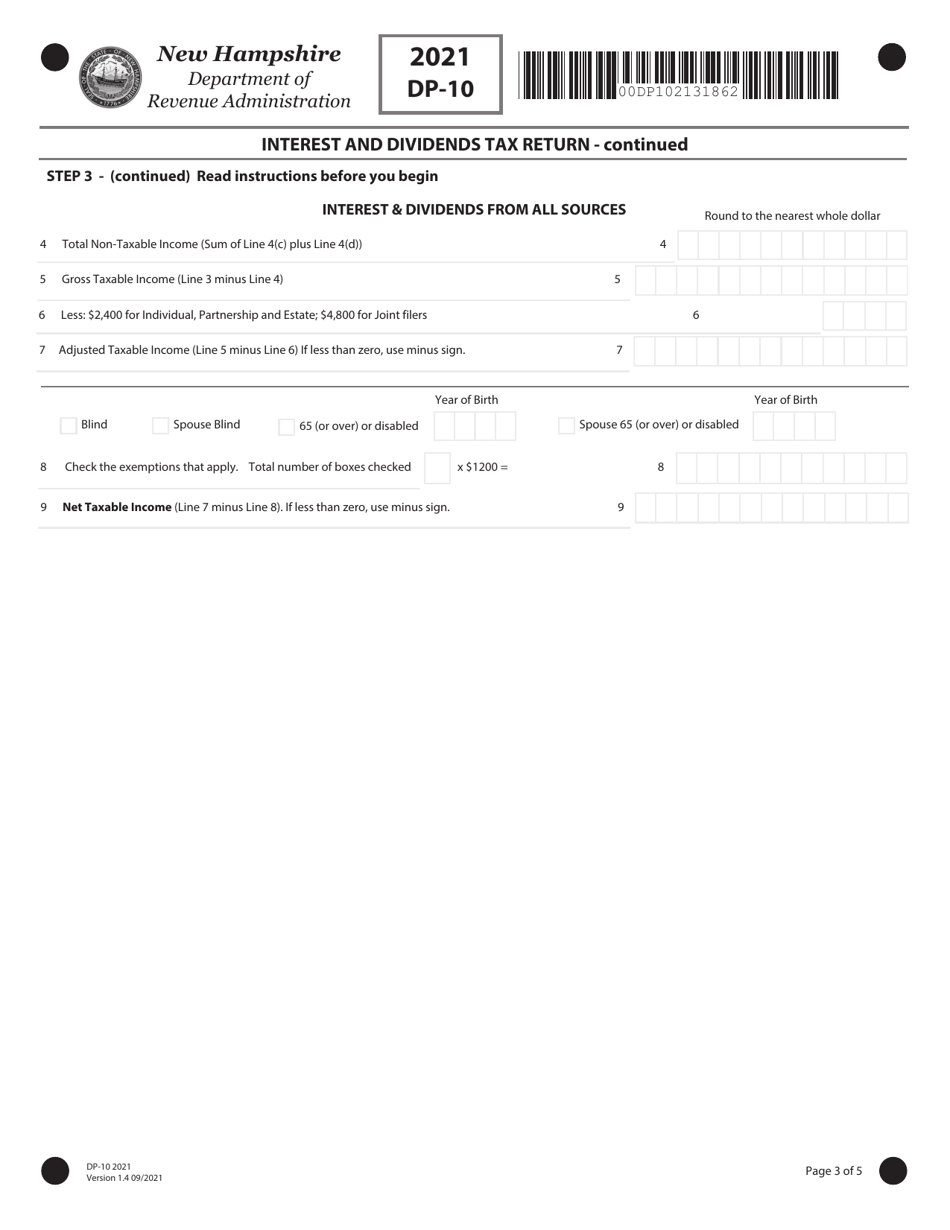

Q: What information is required to complete Form DP-10?

A: You will need to provide your personal information, details of your interest and dividends income, and any applicable exemptions and deductions.

Q: Is there a minimum income threshold for filing Form DP-10?

A: Yes, if your interest and dividends income is below $2,400 ($4,800 for married couples filing jointly), you are not required to file Form DP-10.

Q: Are there any penalties for late filing of Form DP-10?

A: Yes, there are penalties for late filing of Form DP-10. It is best to file your return on time to avoid any penalties or interest charges.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.