This version of the form is not currently in use and is provided for reference only. Download this version of

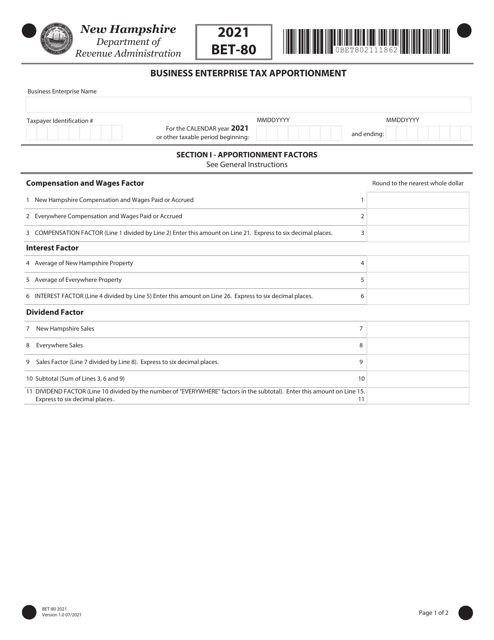

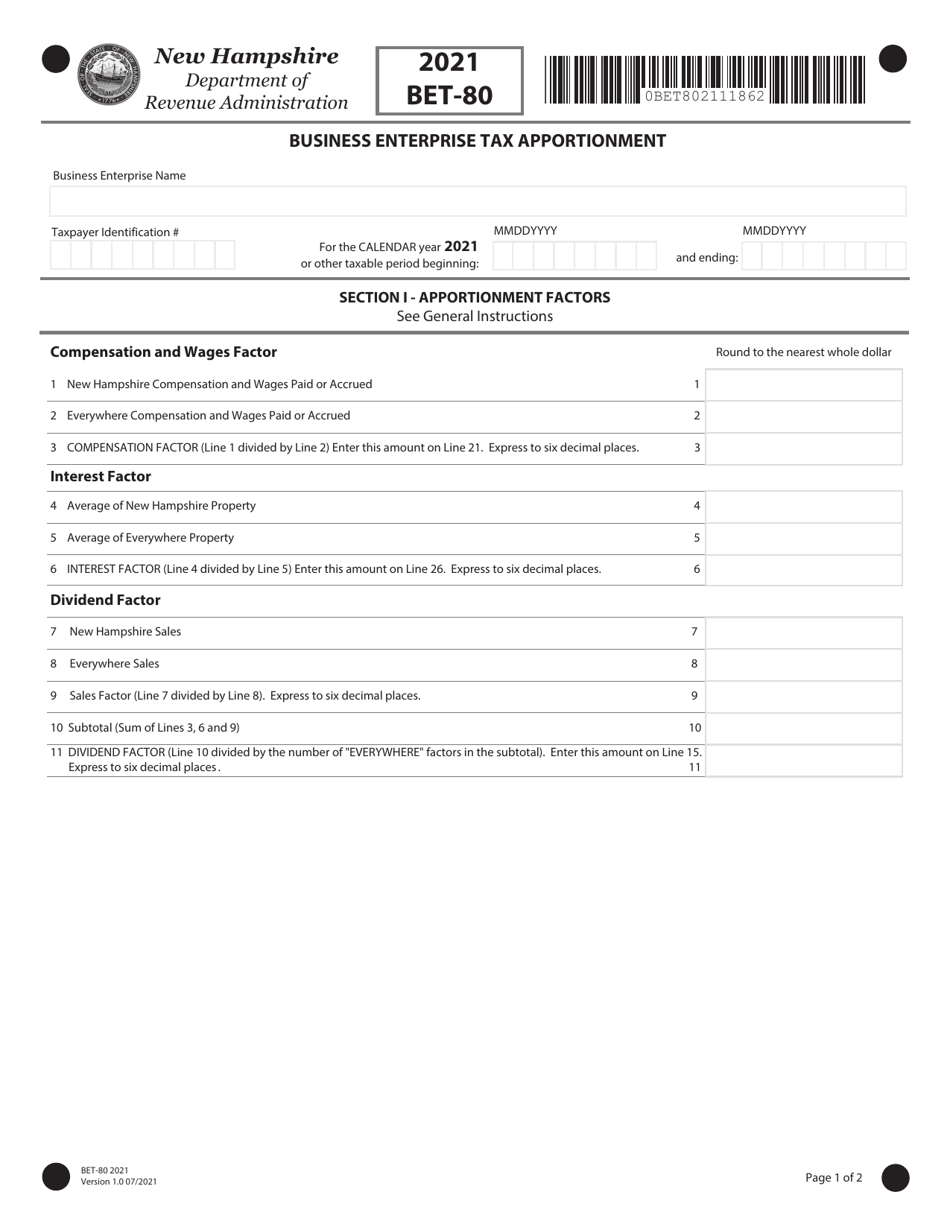

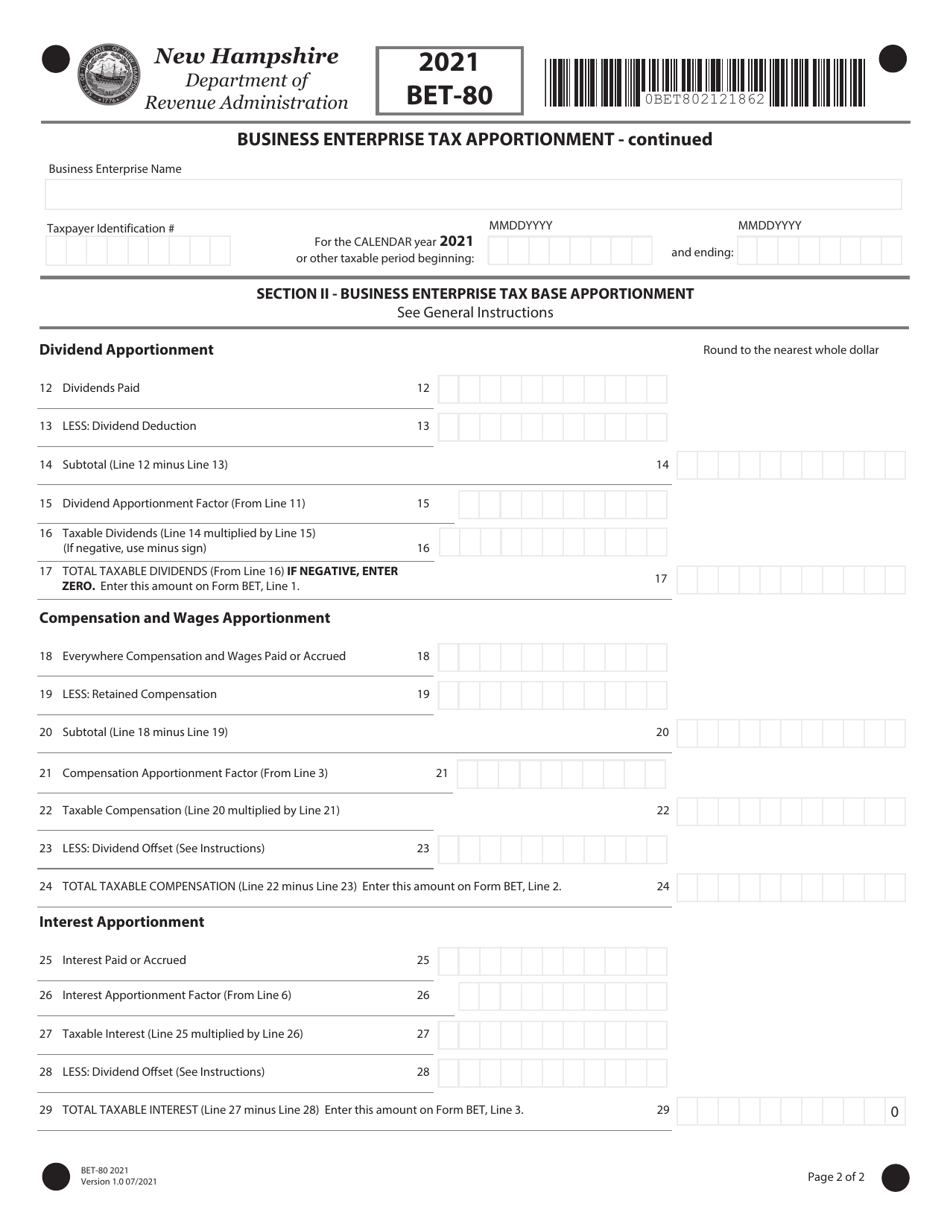

Form BET-80

for the current year.

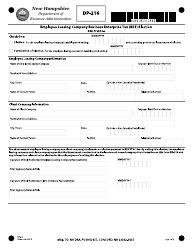

Form BET-80 Business Enterprise Tax Apportionment - New Hampshire

What Is Form BET-80?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BET-80?

A: Form BET-80 is the Business Enterprise Tax Apportionment form used in New Hampshire.

Q: Who needs to fill out Form BET-80?

A: Businesses in New Hampshire that are subject to the Business Enterprise Tax and have apportionment factors need to fill out Form BET-80.

Q: What is the purpose of Form BET-80?

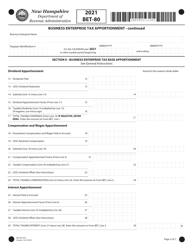

A: The purpose of Form BET-80 is to apportion the Business Enterprise Tax based on factors such as sales, payroll, and property in and out of New Hampshire.

Q: What information is required on Form BET-80?

A: Form BET-80 requires information about the business's sales, payroll, and property both within and outside of New Hampshire.

Q: When is Form BET-80 due?

A: Form BET-80 is typically due on or before the 15th day of the fourth month following the end of the business's taxable period.

Q: Are there any penalties for not filing Form BET-80?

A: Yes, failure to file Form BET-80 or filing it late may result in penalties and interest.

Q: Who can I contact for help with Form BET-80?

A: For assistance with Form BET-80, you can contact the New Hampshire Department of Revenue Administration directly or consult with a tax professional.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BET-80 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.