This version of the form is not currently in use and is provided for reference only. Download this version of

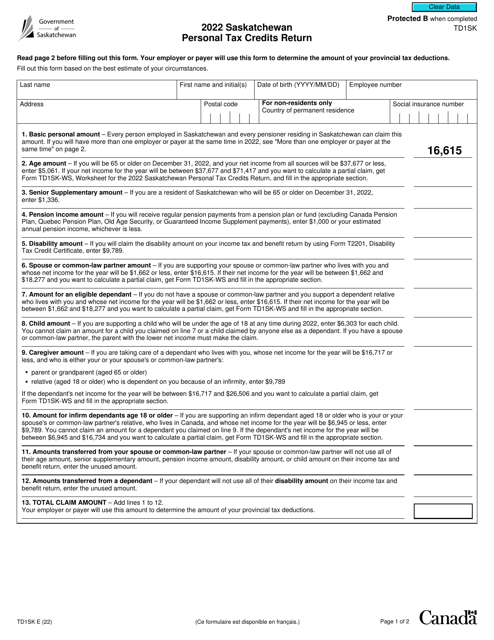

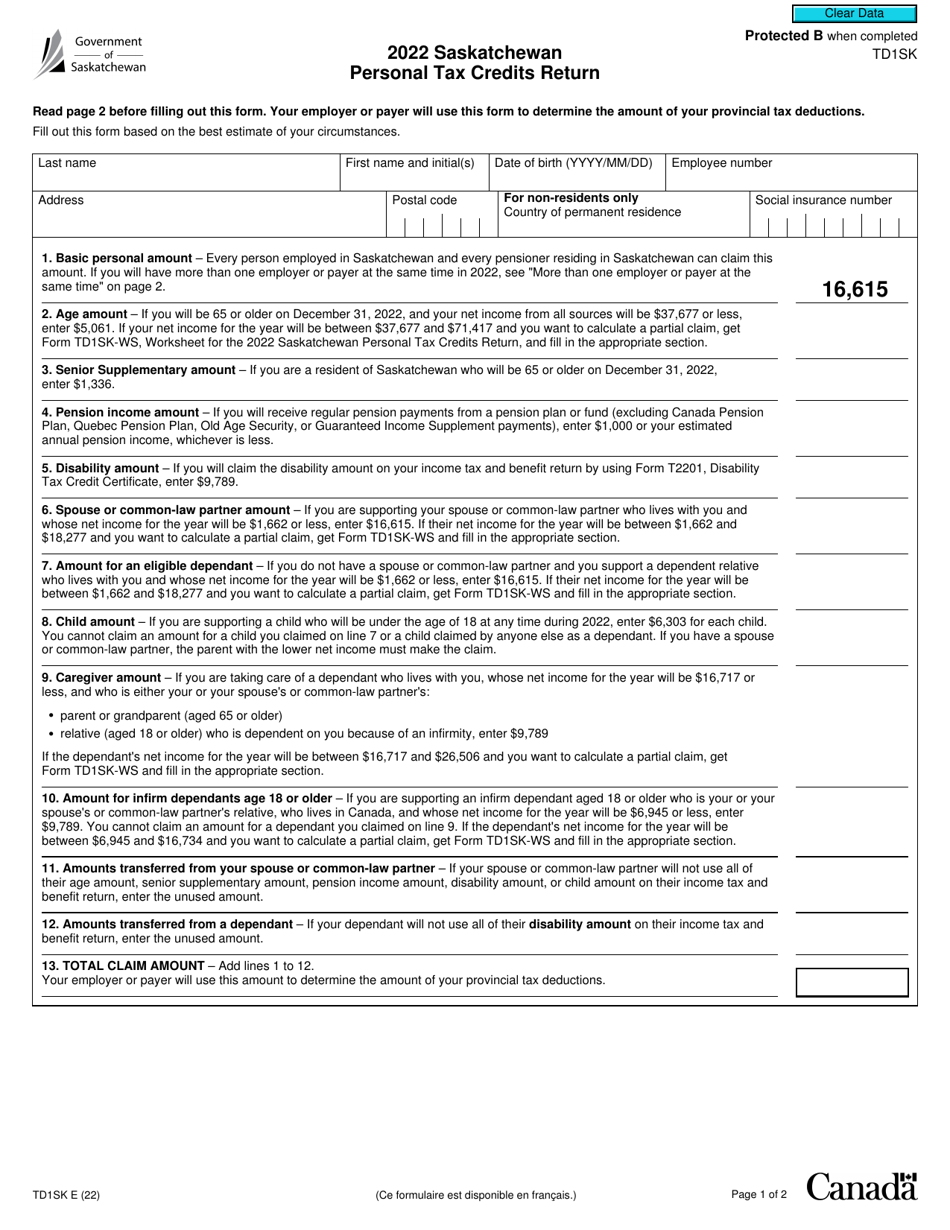

Form TD1SK

for the current year.

Form TD1SK Saskatchewan Personal Tax Credits Return - Canada

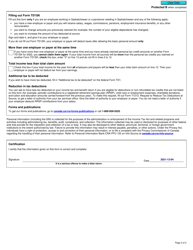

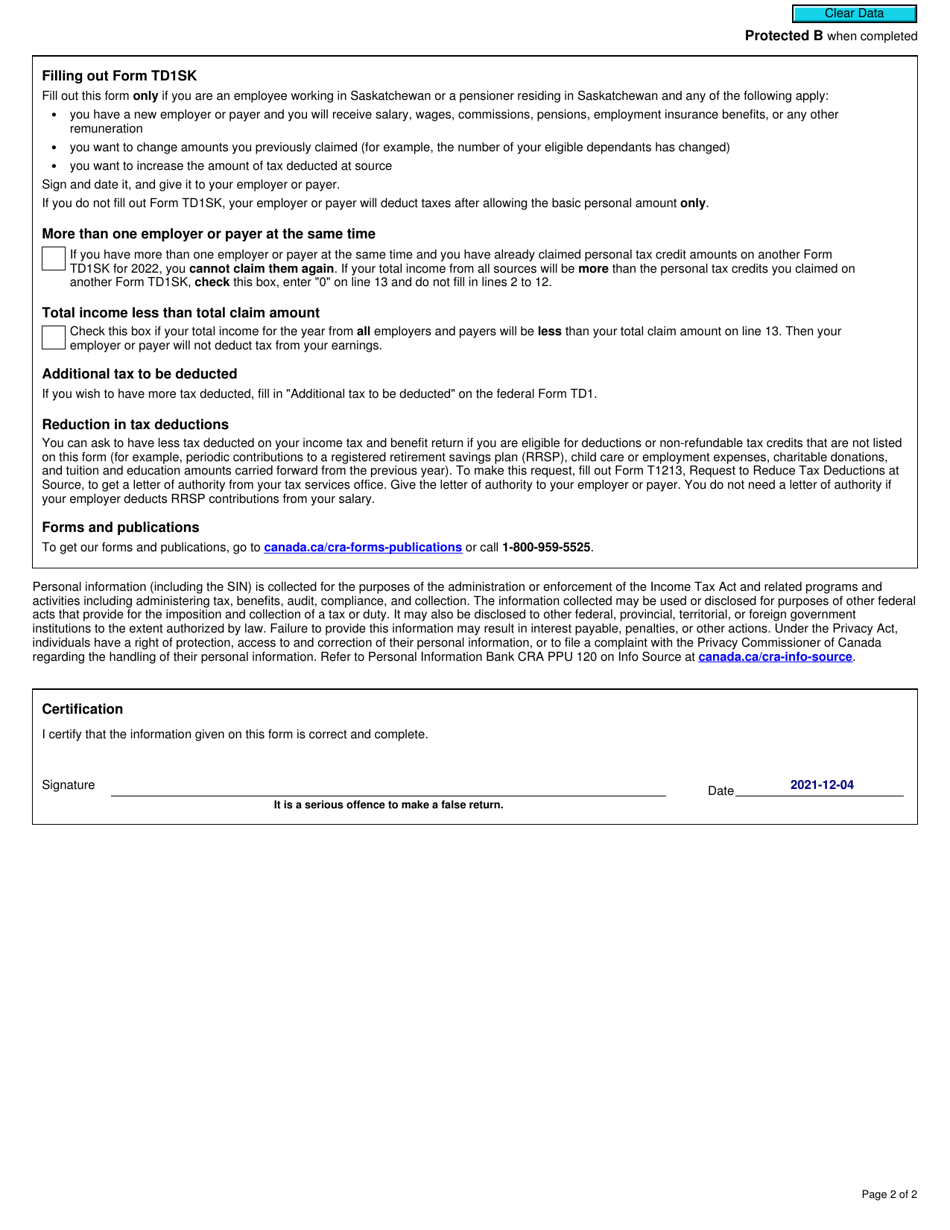

Form TD1SK, Saskatchewan Personal Tax Credits Return, is used by individuals who reside in Saskatchewan, Canada, to determine the amount of their provincial tax credits. This form helps determine how much income tax should be deducted from your paycheck by your employer. It allows you to claim various tax credits and exemptions that you may be eligible for, such as the Basic Personal Amount, Disability Amount, tuition credits, and more. By completing this form, you can ensure that the correct amount of tax is withheld from your income throughout the year.

The Form TD1SK Saskatchewan Personal Tax Credits Return in Canada is filed by individuals who are residents of Saskatchewan and want to claim provincial tax credits.

FAQ

Q: What is Form TD1SK?

A: Form TD1SK is a Saskatchewan Personal Tax Credits Return form.

Q: Who needs to fill out Form TD1SK?

A: Resident employees in Saskatchewan need to fill out Form TD1SK.

Q: What is the purpose of Form TD1SK?

A: Form TD1SK is used to determine the amount of provincial income tax to be deducted from an employee's salary or wages.

Q: Do I need to submit Form TD1SK every year?

A: No, you only need to submit Form TD1SK when there are changes to your personal tax credits or if you start a new job.

Q: What information do I need to fill out Form TD1SK?

A: You will need to provide your personal information, such as your name, address, and social insurance number, as well as details about your eligibility for various tax credits.

Q: Can I claim both federal and provincial tax credits on Form TD1SK?

A: Yes, Form TD1SK allows you to claim both federal and provincial tax credits.

Q: What happens if I don't fill out Form TD1SK?

A: If you don't fill out Form TD1SK, your employer will deduct the maximum amount of provincial income tax from your salary or wages.

Q: Can I make changes to my Form TD1SK throughout the year?

A: Yes, if your personal tax credits change during the year, you can submit a new Form TD1SK to your employer.

Q: Do I need to keep a copy of Form TD1SK for my records?

A: Yes, it is recommended to keep a copy of Form TD1SK for your records in case of future reference or audit.