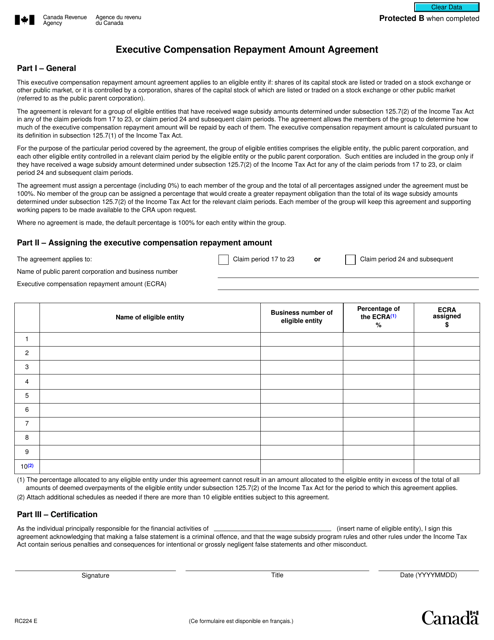

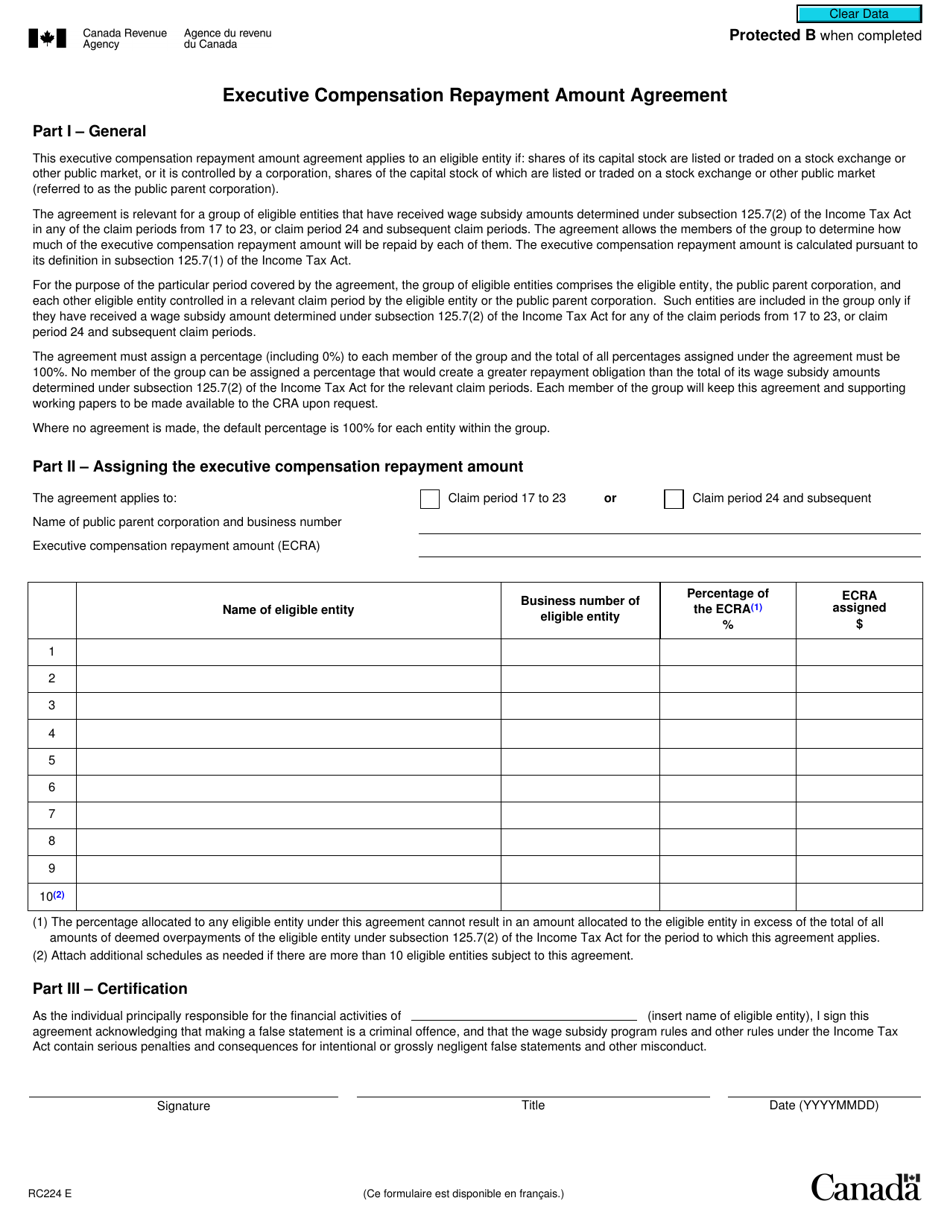

Form RC224 Executive Compensation Repayment Amount Agreement - Canada

Form RC224 Executive Compensation Repayment Amount Agreement in Canada is used by individuals to enter into an agreement with the Canada Revenue Agency (CRA) to repay a portion of their executive compensation that was disallowed for tax purposes. This form is specifically for individuals who have participated in a specified tax avoidance transaction.

The Form RC224 Executive Compensation Repayment Amount Agreement in Canada is filed by the individual who received excessive executive compensation.

FAQ

Q: What is Form RC224?

A: Form RC224 is an Executive Compensation Repayment Amount Agreement form in Canada.

Q: What is the purpose of Form RC224?

A: The purpose of Form RC224 is to document an agreement for the repayment of executive compensation.

Q: Who should use Form RC224?

A: Form RC224 should be used by individuals in Canada who are agreeing to repay executive compensation.

Q: How do I fill out Form RC224?

A: You need to provide your personal information, the details of the executive compensation being repaid, and the repayment terms.

Q: What happens after I submit Form RC224?

A: After you submit Form RC224, the Canada Revenue Agency will review the agreement and process it accordingly.

Q: Are there any penalties for not repaying executive compensation?

A: Failure to repay executive compensation as agreed may result in penalties and interest charges.

Q: Can Form RC224 be used for any type of compensation repayment?

A: Form RC224 is specifically designed for executive compensation repayment, but it may be used as a template for other repayment agreements as well.

Q: Is Form RC224 mandatory?

A: Form RC224 is not mandatory, but it is recommended to document the agreement for repayment of executive compensation.