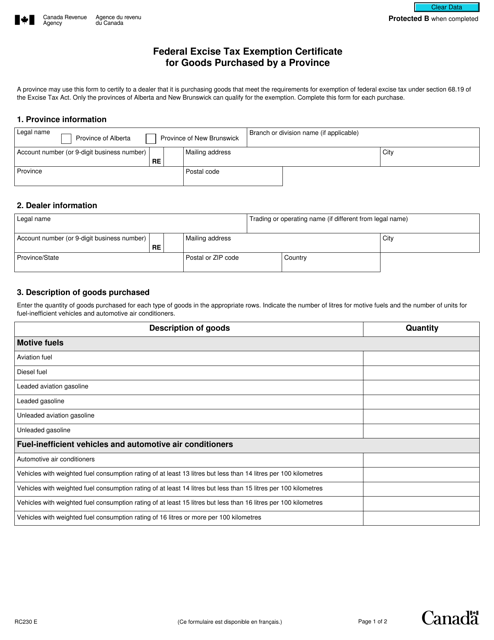

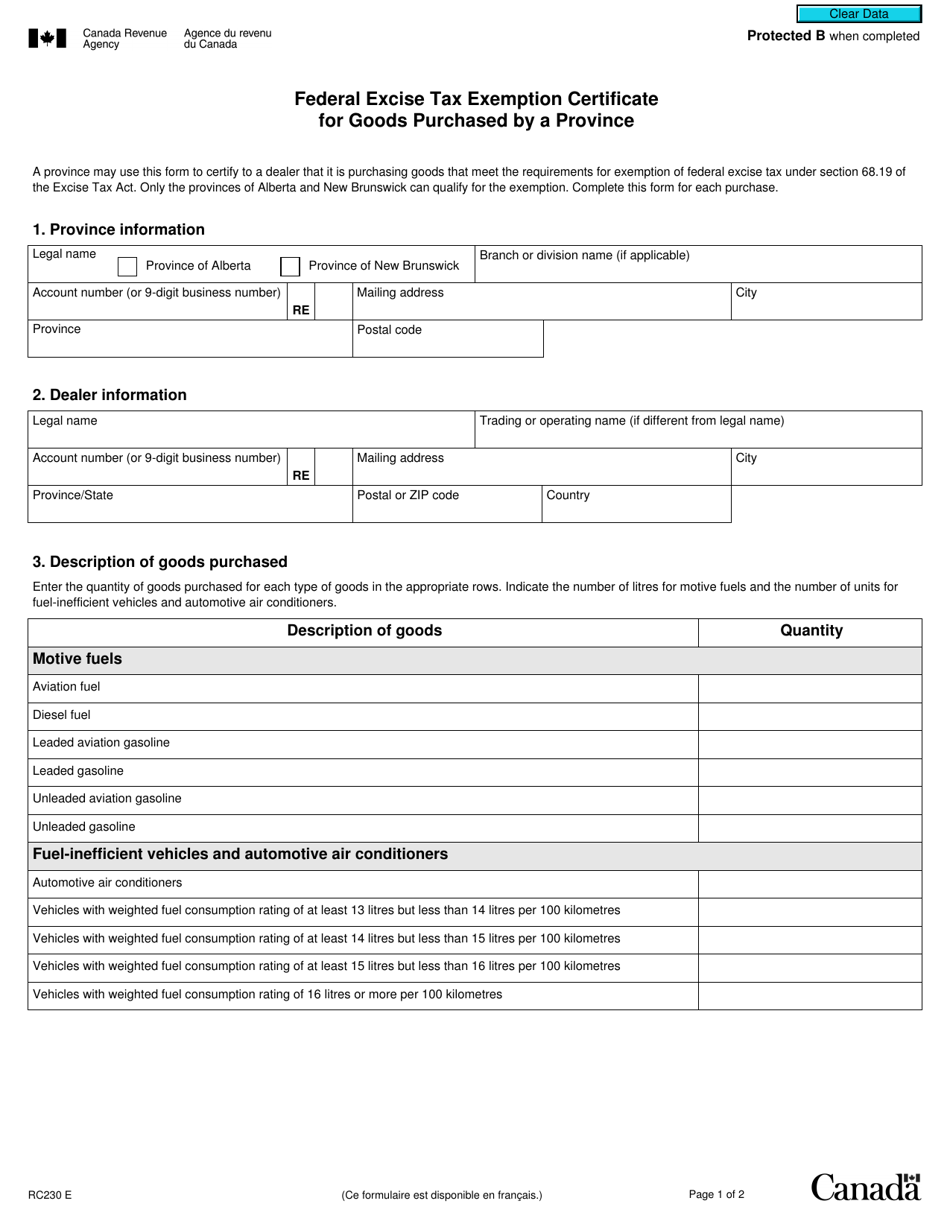

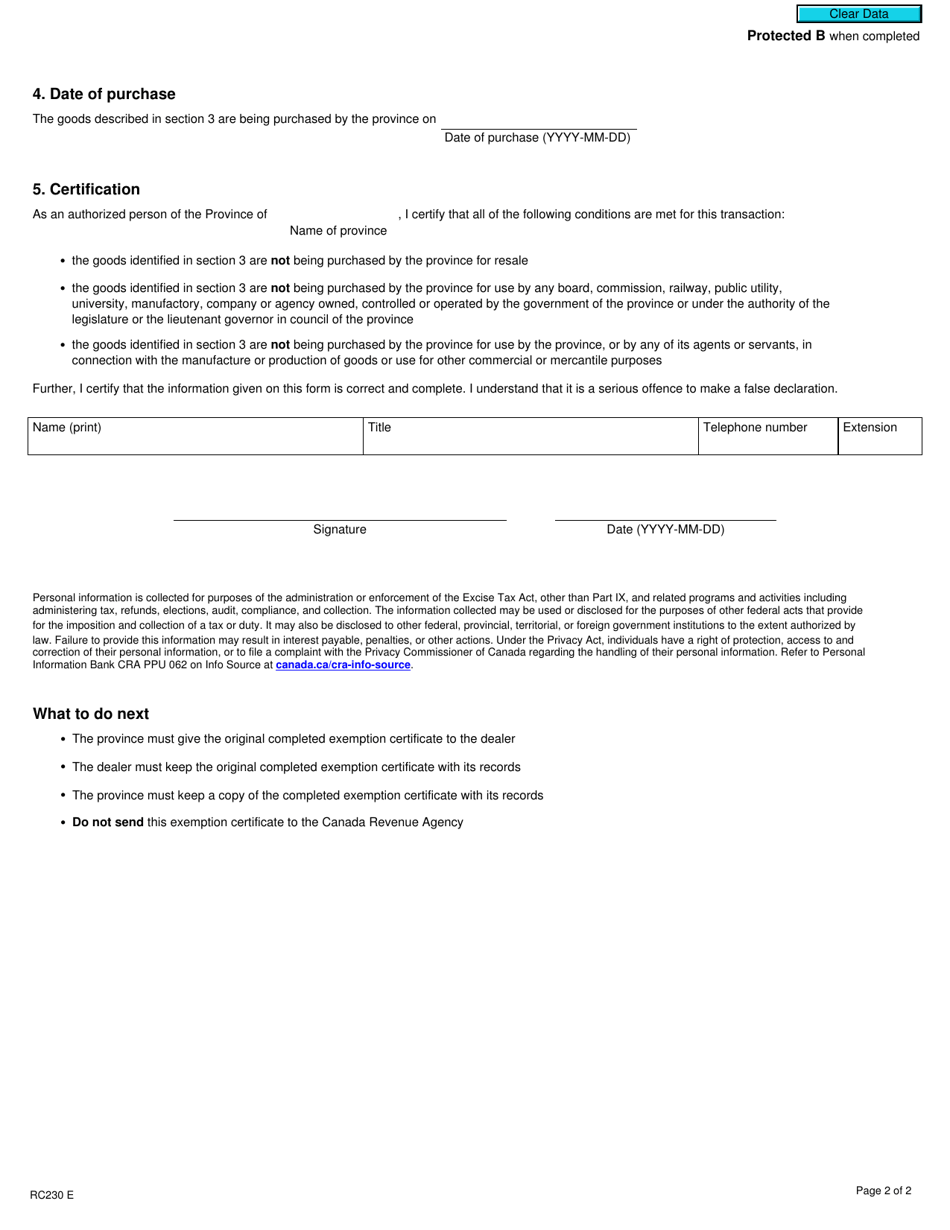

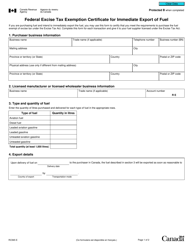

Form RC230 Federal Excise Tax Exemption Certificate for Goods Purchased by a Province - Canada

Form RC230 Federal Excise Tax Exemption Certificate for Goods Purchased by a Province in Canada is used by provinces to claim an exemption from federal excise tax when purchasing goods.

The Form RC230 Federal Excise Tax Exemption Certificate for Goods Purchased by a Province in Canada is filed by the provincial government or their authorized representative.

FAQ

Q: What is Form RC230?

A: Form RC230 is the Federal Excise Tax Exemption Certificate for Goods Purchased by a Province in Canada.

Q: What is the purpose of Form RC230?

A: The purpose of Form RC230 is to claim exemption from federal excise tax on goods purchased by a province in Canada.

Q: Who can use Form RC230?

A: Form RC230 can only be used by provinces in Canada to claim exemption from federal excise tax on goods.

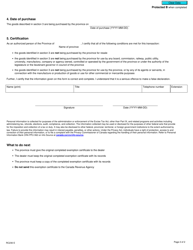

Q: Do I need to provide any supporting documents with Form RC230?

A: Yes, you may be required to provide supporting documents, such as invoices or purchase orders, to support your claim for federal excise tax exemption.

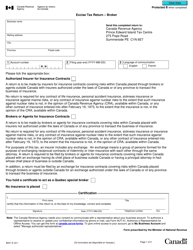

Q: How do I submit Form RC230?

A: You can submit Form RC230 by mail or through the electronic filing system provided by the Canada Revenue Agency (CRA).

Q: Is there a deadline for filing Form RC230?

A: There may not be a specific deadline for filing Form RC230, but it is recommended to file it as soon as possible after the purchase of exempt goods.

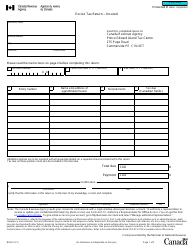

Q: What happens after I submit Form RC230?

A: Once you submit Form RC230, the Canada Revenue Agency (CRA) will review your claim and may contact you for further information or clarification.

Q: Can Form RC230 be used for all types of goods?

A: No, Form RC230 can only be used for specific goods that are eligible for federal excise tax exemption as determined by the Canada Revenue Agency (CRA).

Q: Can I claim a refund if my Form RC230 is approved?

A: If your Form RC230 is approved, you may be eligible for a refund of the federal excise tax paid on the exempt goods.

Q: Can I use Form RC230 for goods purchased outside of Canada?

A: No, Form RC230 is specifically for goods purchased by a province within Canada. Goods purchased outside of Canada may be subject to different tax rules.