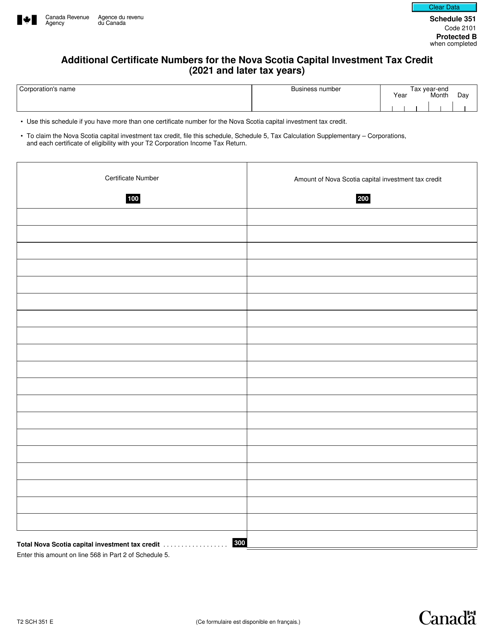

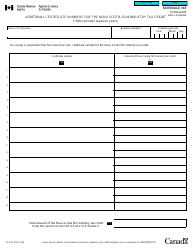

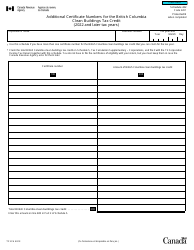

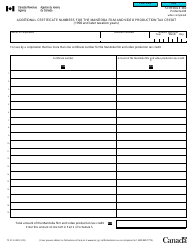

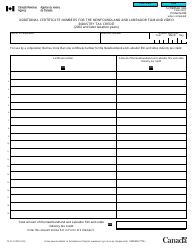

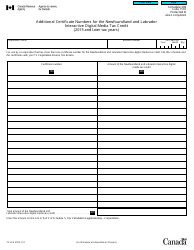

Form T2 Schedule 351 Additional Certificate Numbers for the Nova Scotia Capital Investment Tax Credit (2021 and Later Tax Years) - Canada

The entity or individual that files the Form T2 Schedule 351 for the Nova Scotia Capital Investment Tax Credit in Canada is the taxpayer or corporation eligible for the credit.

FAQ

Q: What is T2 Schedule 351?

A: T2 Schedule 351 is a form for reporting additional certificate numbers for the Nova Scotia Capital InvestmentTax Credit.

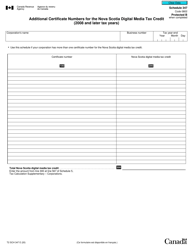

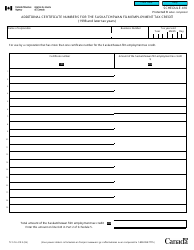

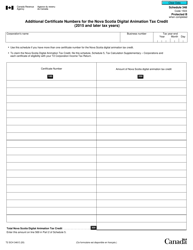

Q: What is the Nova Scotia Capital Investment Tax Credit?

A: The Nova Scotia Capital Investment Tax Credit is a tax credit available in Nova Scotia to encourage investments in certain businesses.

Q: What is the purpose of reporting additional certificate numbers?

A: Reporting additional certificate numbers allows businesses to claim the tax credit for investments made with multiple certificates.

Q: Are there any specific tax years for reporting?

A: Yes, the form is for reporting in the tax years 2021 and later.

Q: Is the form applicable only to Canada?

A: Yes, this form is specific to Canada, specifically to the province of Nova Scotia.