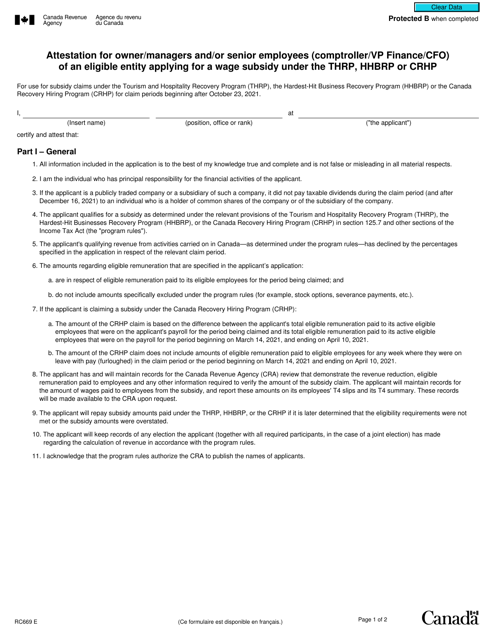

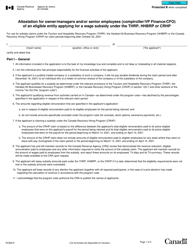

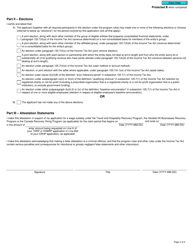

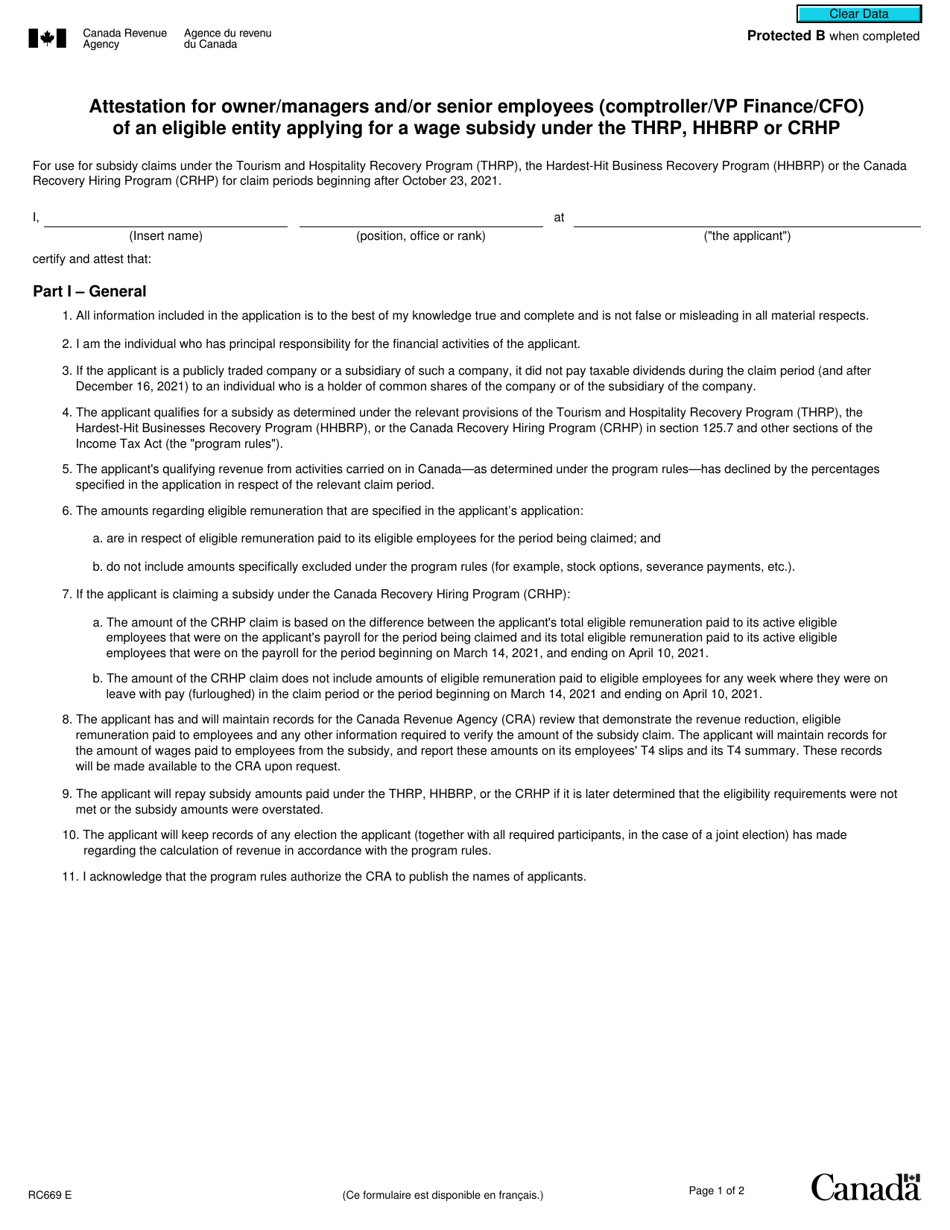

Form RC669 Attestation for Owner / Managers and / or Senior Employees (Comptroller / Vp Finance / Cfo) of an Eligible Entity Applying for a Wage Subsidy Under the Thrp, Hhbrp or Crhp - Canada

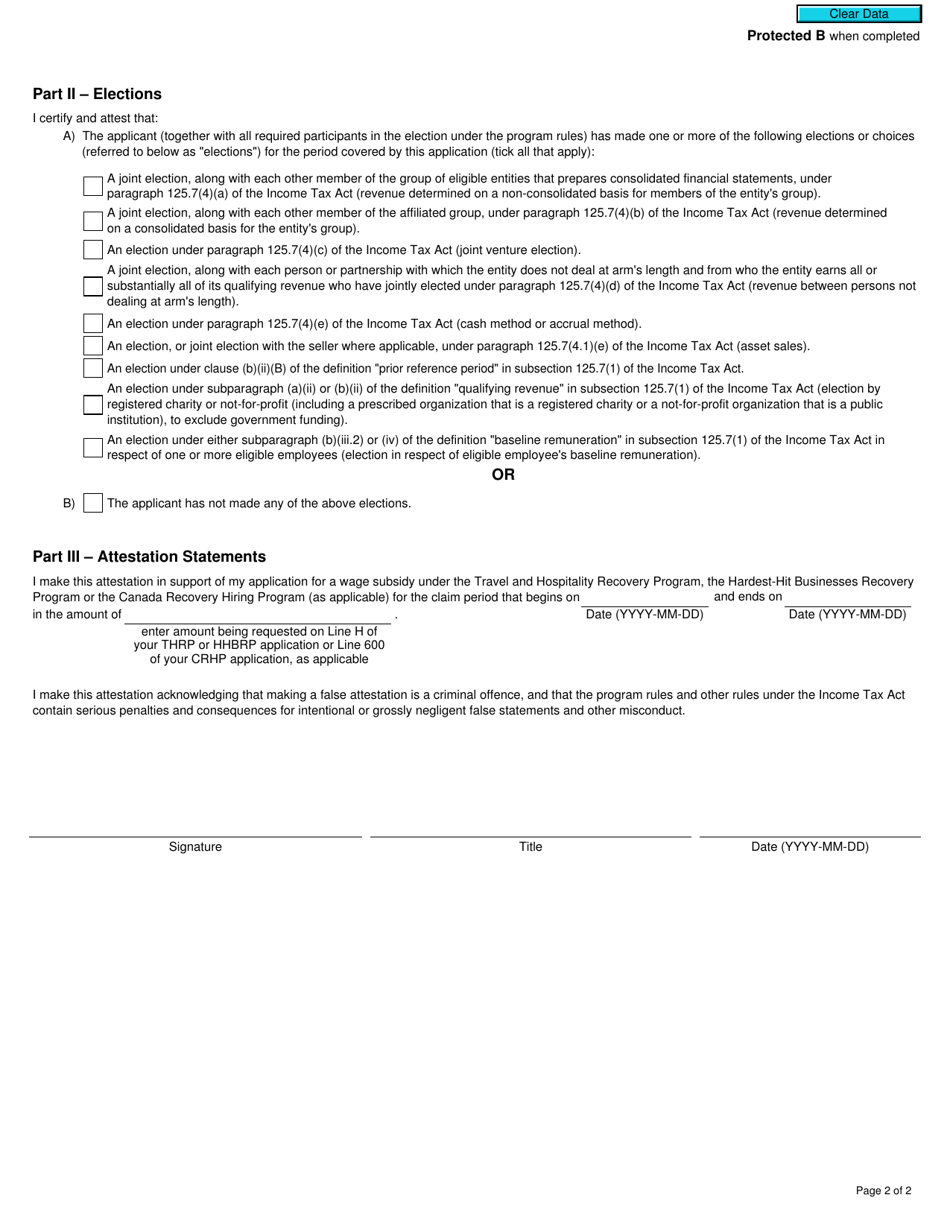

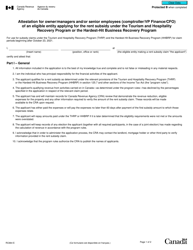

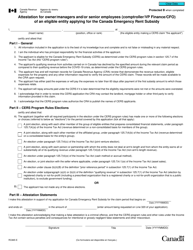

Form RC669 Attestation for Owner/Managers and/or Senior Employees is used by eligible entities in Canada who are applying for wage subsidies under the Temporary Wage Subsidy for Employers (TWSE), the Canada Emergency Wage Subsidy (CEWS), or the Canada Recovery Hiring Program (CRHP). It is a form that requires owner/managers and/or senior employees to provide attestation about their eligibility and compliance with the program requirements.

The owner/manager or senior employees of an eligible entity in Canada would file the Form RC669 Attestation.

FAQ

Q: What is Form RC669?

A: Form RC669 is an attestation for owner/managers and/or senior employees applying for a wage subsidy in Canada.

Q: Who is required to complete Form RC669?

A: Owner/managers and/or senior employees, such as Comptrollers, VP Finance, or CFOs, of an eligible entity applying for a wage subsidy in Canada.

Q: What is the purpose of Form RC669?

A: The purpose of Form RC669 is to attest that the owner/manager and/or senior employees meet the eligibility criteria for the wage subsidy under THRP, HHBRP, or CRHP.

Q: Which wage subsidy programs does Form RC669 apply to?

A: Form RC669 applies to the wage subsidy programs: THRP (Temporary Wage Subsidy for Employers), HHBRP (Highly Affected Sectors Credit Availability Program), and CRHP (Canada Recovery Hiring Program).