This version of the form is not currently in use and is provided for reference only. Download this version of

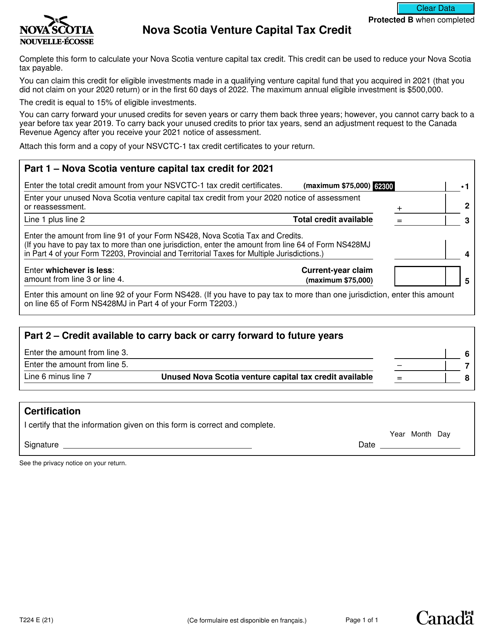

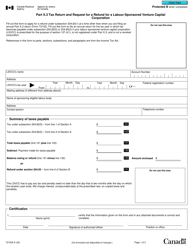

Form T224

for the current year.

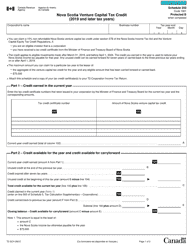

Form T224 Nova Scotia Venture Capital Tax Credit - Canada

Form T224 Nova Scotia Venture Capital Tax Credit is used to claim an investment tax credit for individuals who invest in eligible Nova Scotia corporations. The credit is aimed at promoting venture capital investment in Nova Scotia.

The Form T224 for the Nova Scotia Venture Capital Tax Credit is filed by the eligible corporations seeking to claim the tax credit in Nova Scotia, Canada.

FAQ

Q: What is Form T224?

A: Form T224 is the form used to claim the Nova Scotia Venture Capital Tax Credit in Canada.

Q: What is the Nova Scotia Venture Capital Tax Credit?

A: The Nova Scotia Venture Capital Tax Credit is a tax credit offered by the government of Nova Scotia to encourage investment in qualifying venture capital funds.

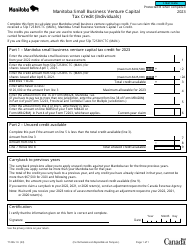

Q: Who is eligible to claim the Nova Scotia Venture Capital Tax Credit?

A: Individuals and corporations who have invested in qualifying venture capital funds in Nova Scotia are eligible to claim the tax credit.

Q: How much is the Nova Scotia Venture Capital Tax Credit?

A: The tax credit is equal to 15% of the eligible investment made in qualifying venture capital funds.

Q: What is the purpose of the Nova Scotia Venture Capital Tax Credit?

A: The tax credit is designed to incentivize investment in Nova Scotia's start-up and innovation ecosystem, helping to grow the province's economy.

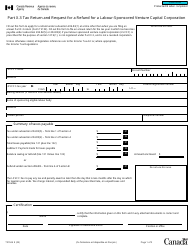

Q: How do I claim the Nova Scotia Venture Capital Tax Credit?

A: To claim the tax credit, you must complete and submit Form T224 along with your income tax return to the Canada Revenue Agency (CRA).

Q: Are there any limitations on the Nova Scotia Venture Capital Tax Credit?

A: Yes, there are limitations on the amount of tax credit that can be claimed in a given year. The maximum credit that can be claimed by an individual is $25,000, while corporations have a maximum credit of $500,000.