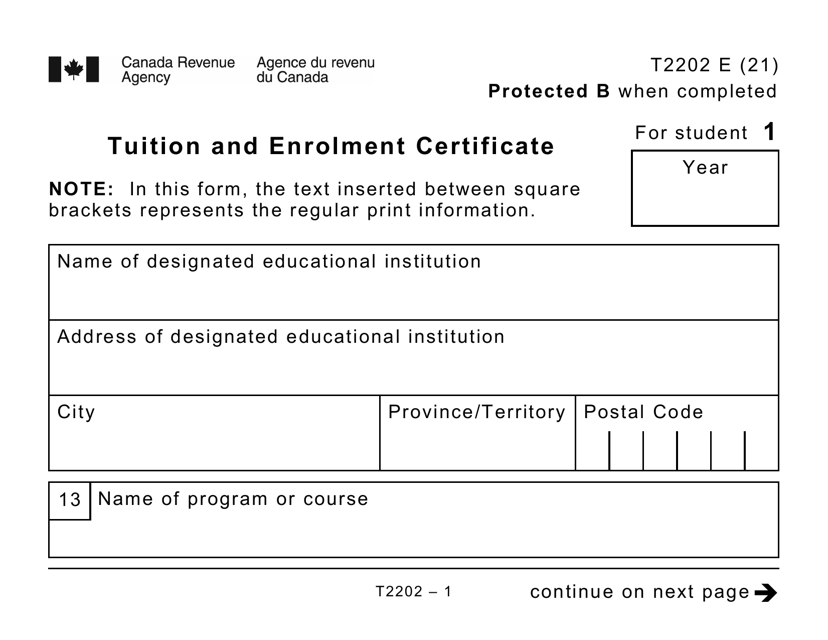

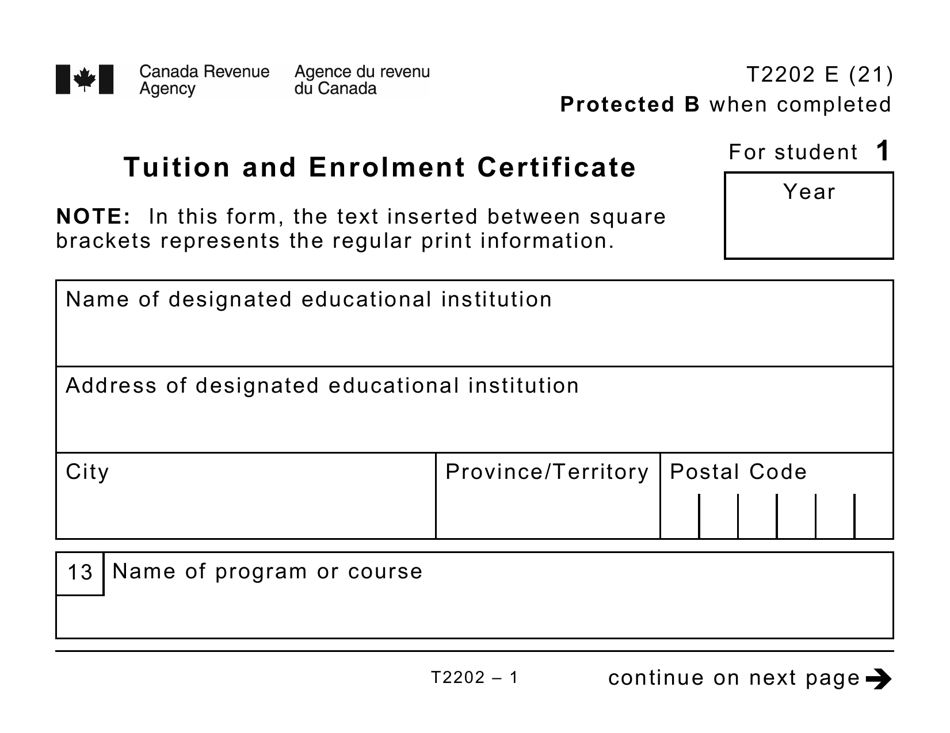

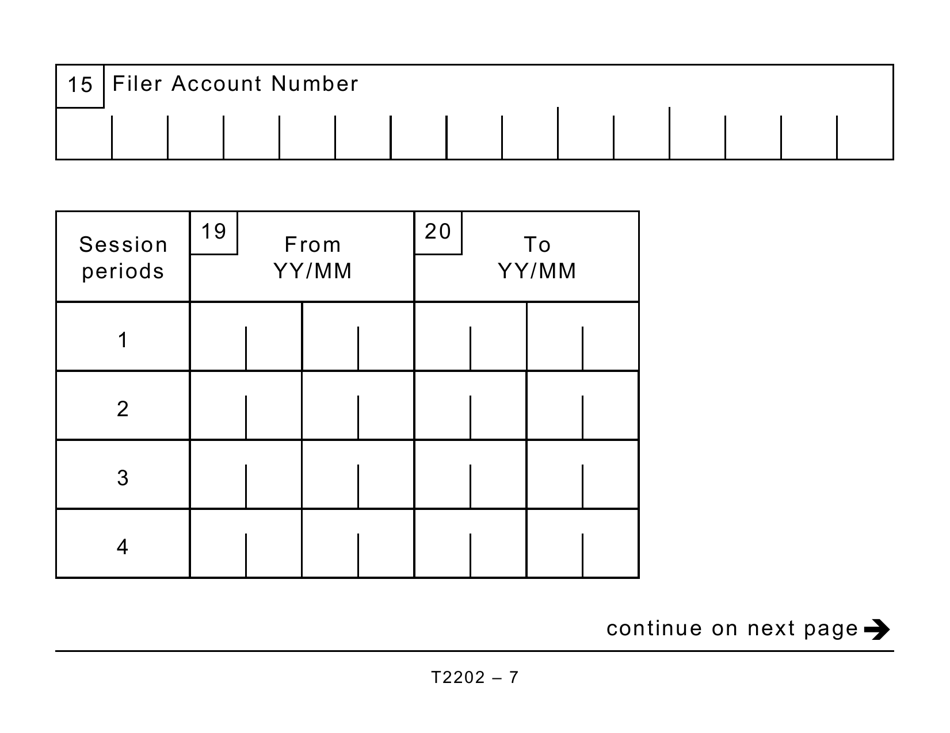

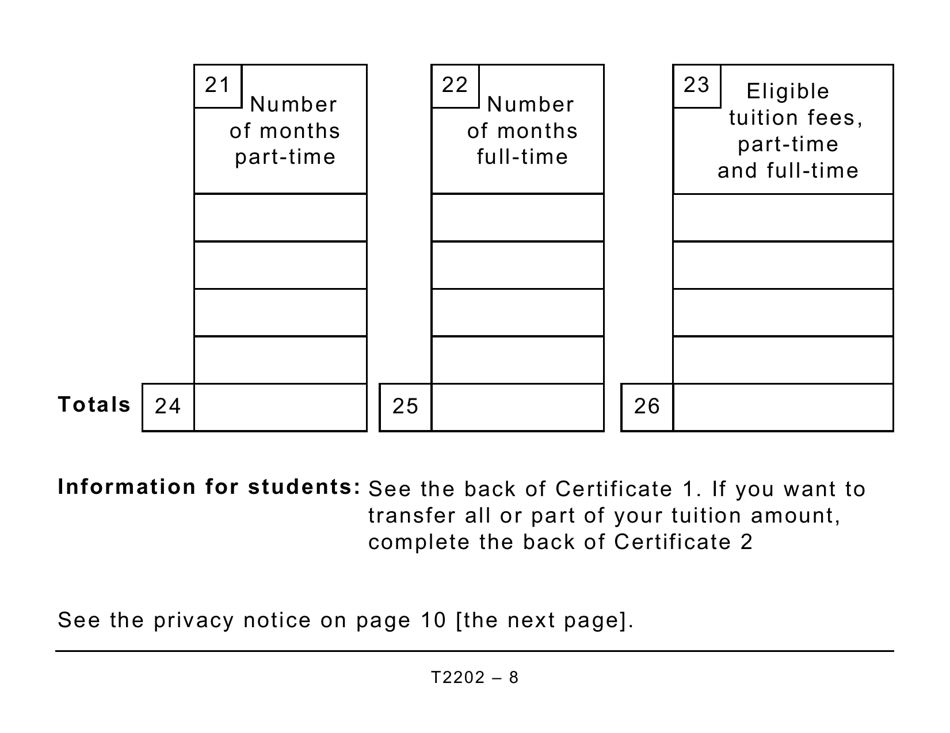

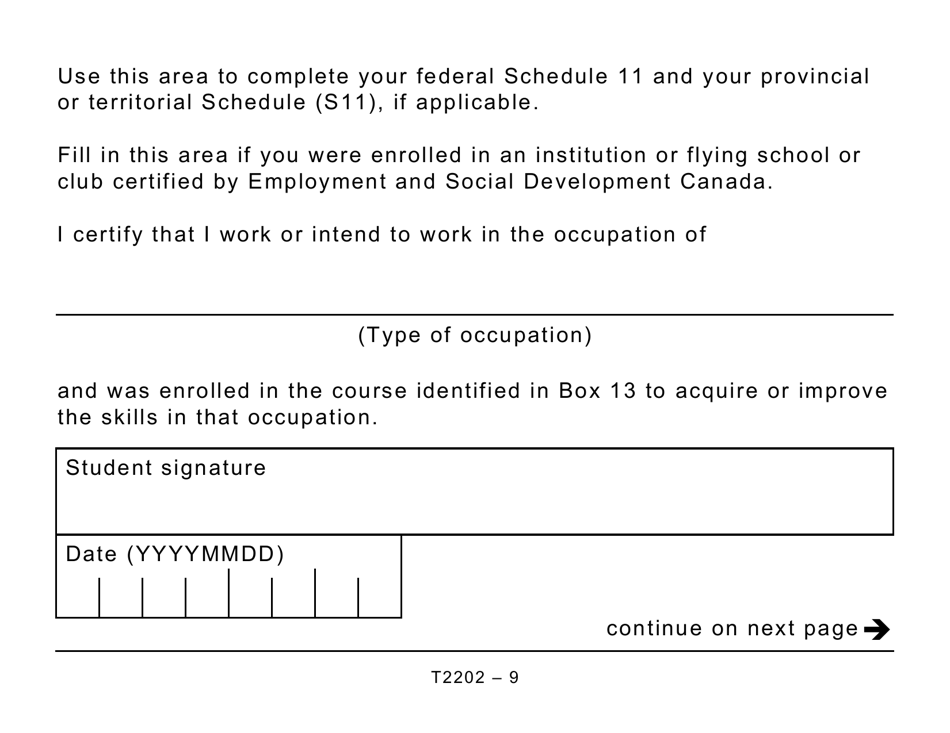

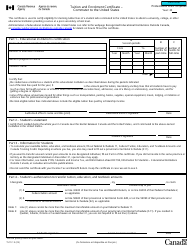

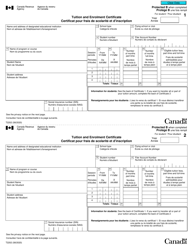

Form T2202 Tuition and Enrolment Certificate - Canada

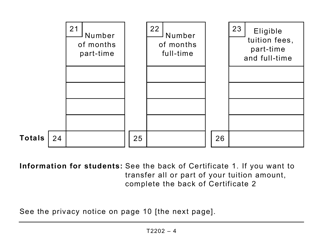

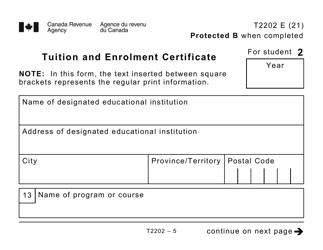

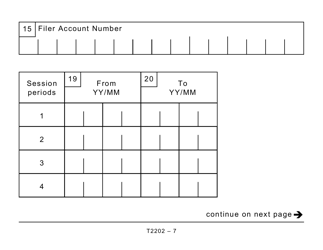

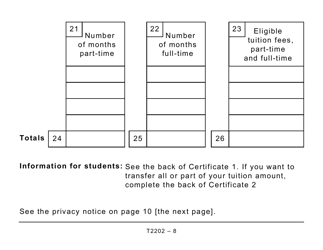

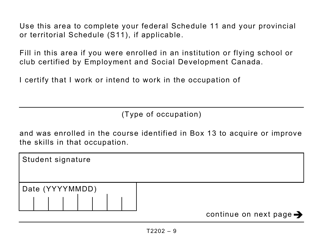

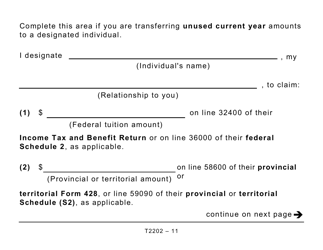

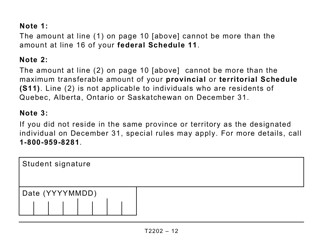

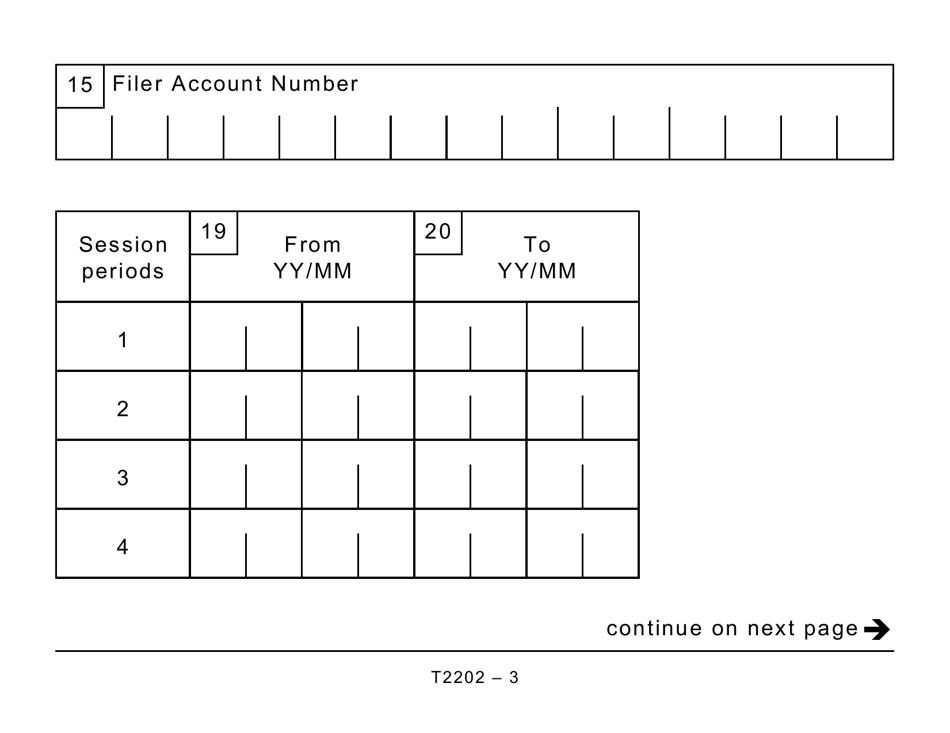

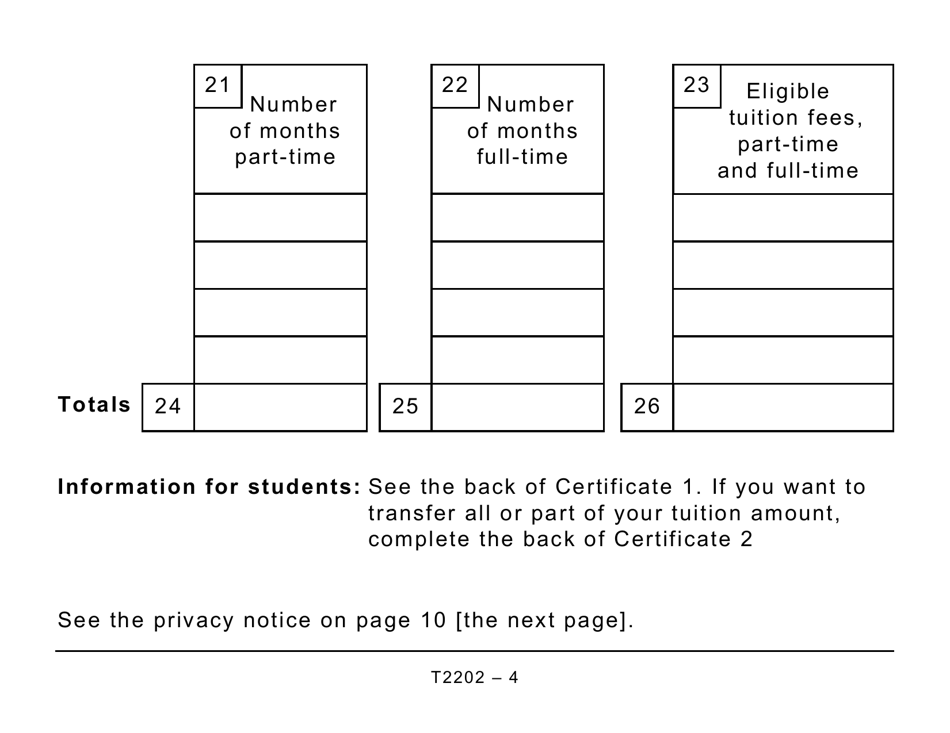

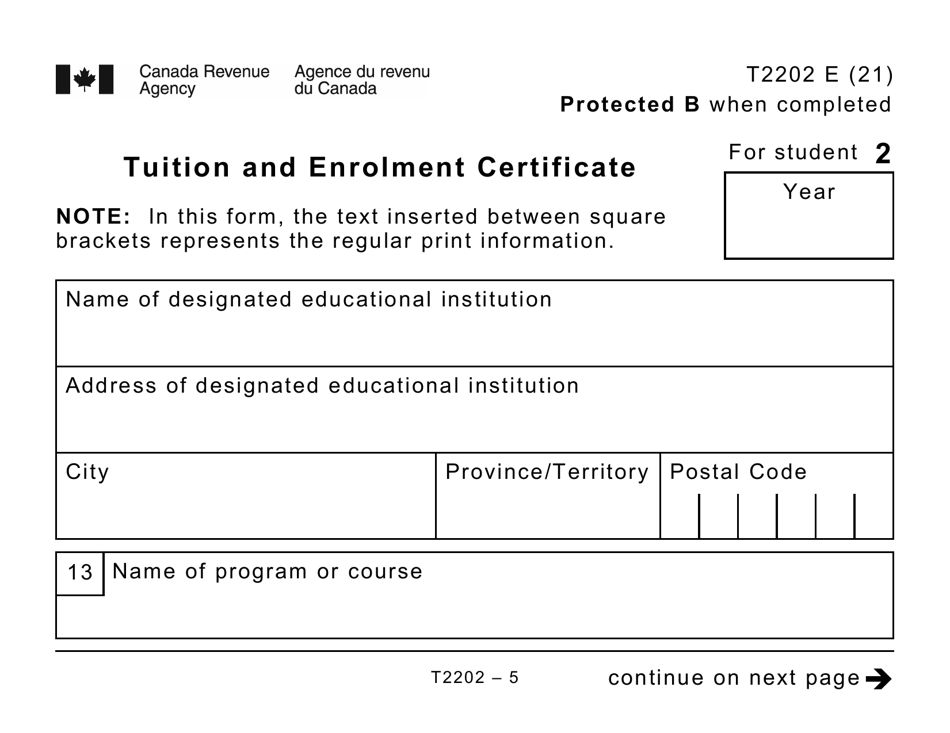

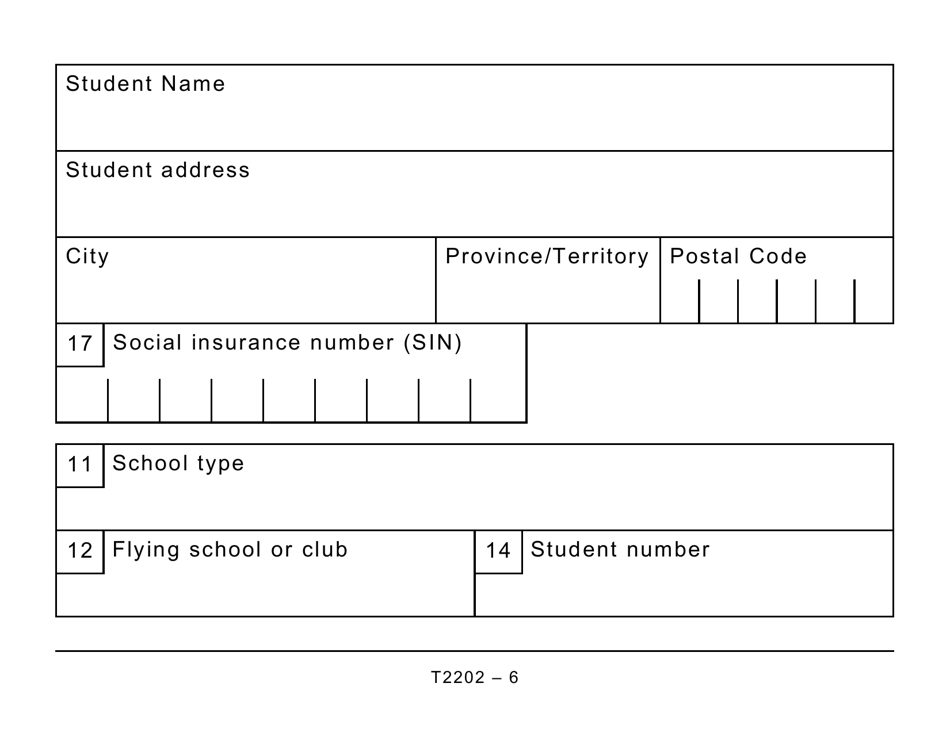

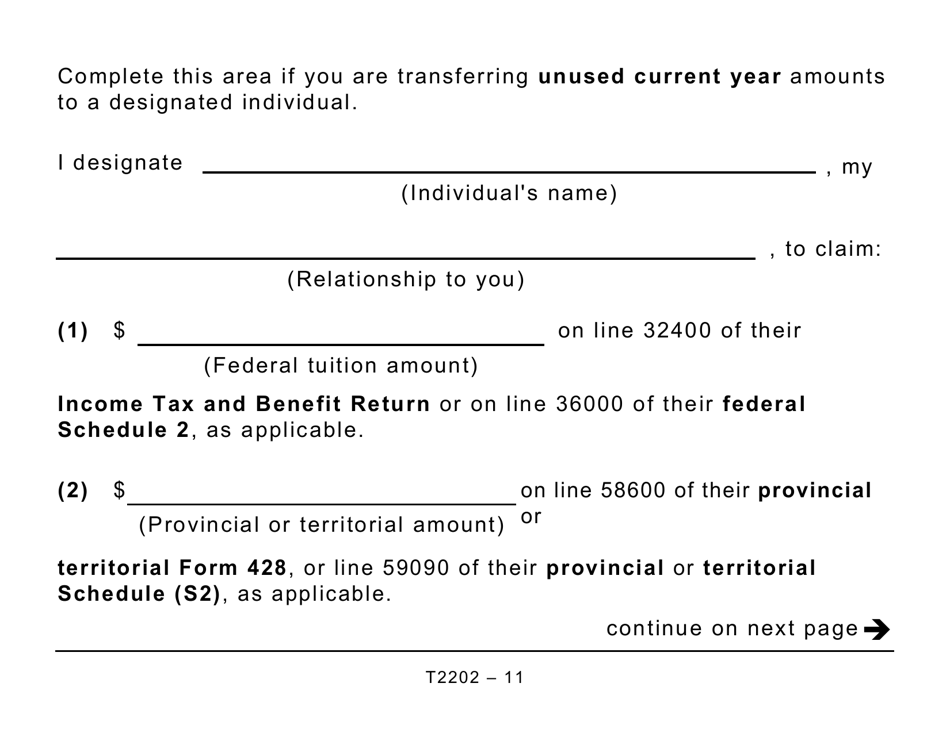

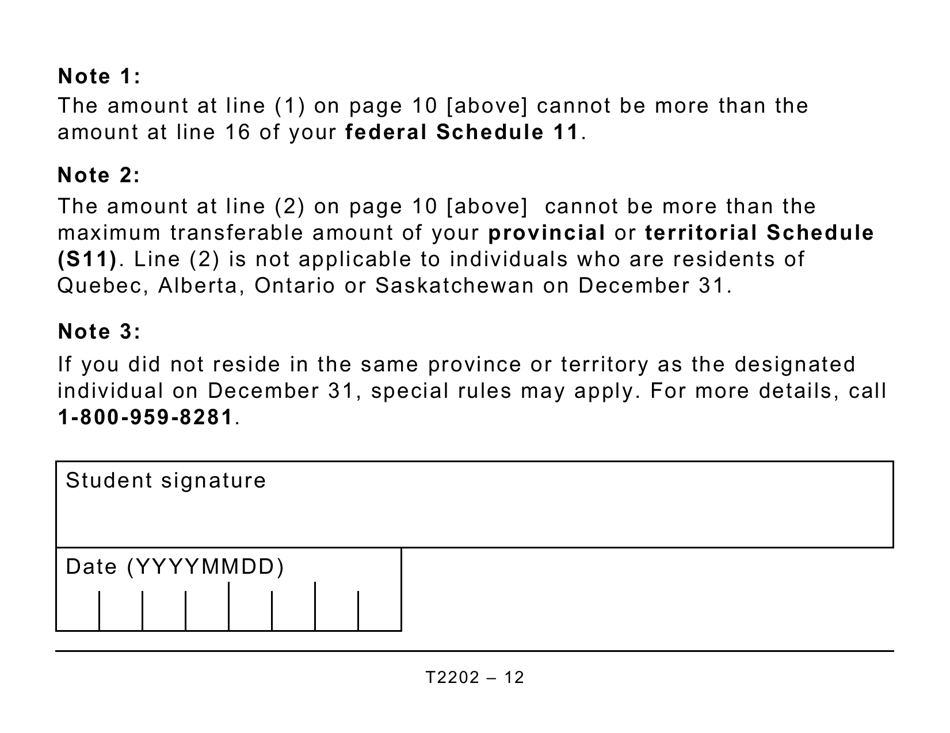

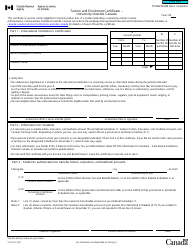

Form T2202, also known as the Tuition and Enrolment Certificate, is used by Canadian students to claim education-related tax credits. This form provides information on the eligible tuition fees paid and the number of months that the student was enrolled in a qualifying educational program. Students can use this form to claim deductions or credits on their tax returns.

The Canadian educational institution that issued the Form T2202, such as a college or university, files this form with the Canada Revenue Agency (CRA).

FAQ

Q: What is the T2202 certificate?

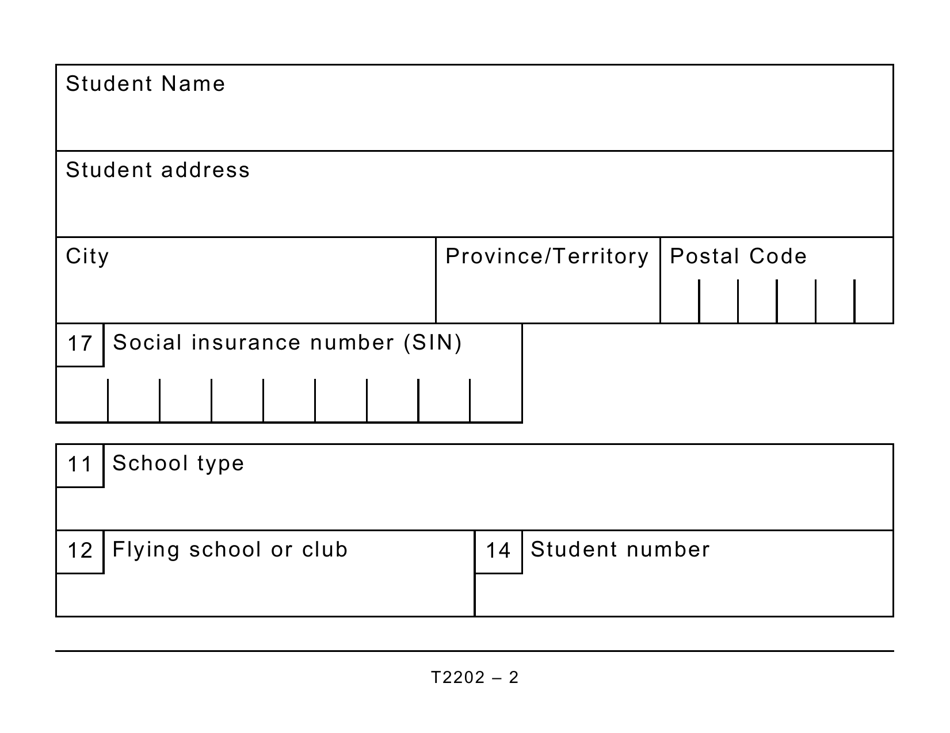

A: The T2202 certificate is an official document issued by Canadian educational institutions to report the amount of tuition paid and the number of months of full-time or part-time enrollment.

Q: Who is eligible to receive a T2202 certificate?

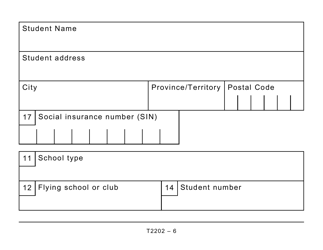

A: Students who were enrolled in an eligible educational program at a qualifying institution in Canada may be eligible to receive a T2202 certificate.

Q: What is the purpose of the T2202 certificate?

A: The T2202 certificate is used by students to claim tuition and education-related expenses on their income tax return.

Q: How do I obtain a T2202 certificate?

A: Contact your educational institution to request a T2202 certificate. They will provide you with the necessary information and guidance.

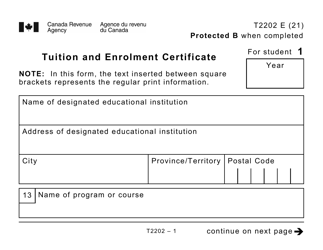

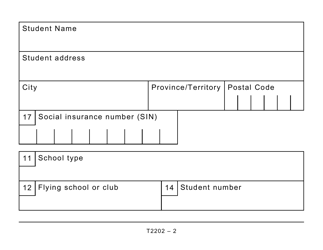

Q: What information does the T2202 certificate contain?

A: The T2202 certificate typically includes the name of the educational institution, the student's name and address, the amount of eligible tuition fees paid, and the number of months of full-time or part-time enrollment.