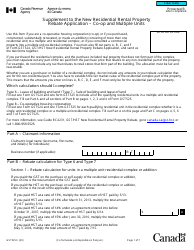

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T776

for the current year.

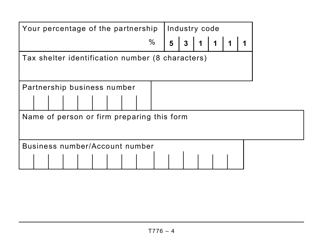

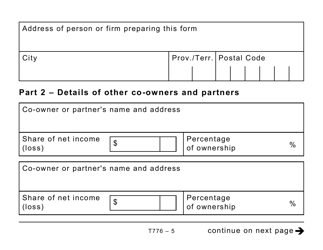

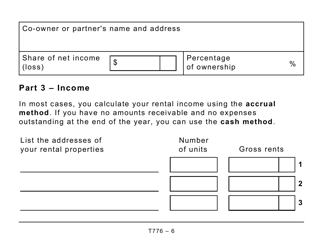

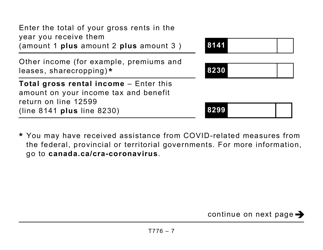

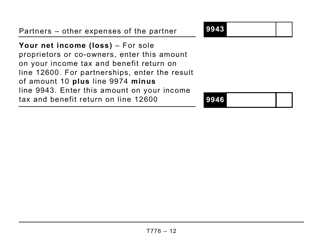

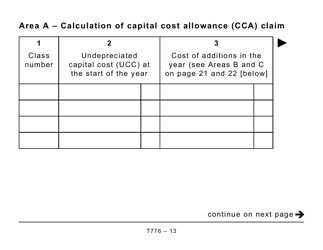

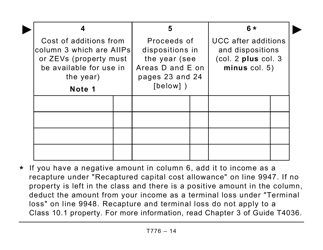

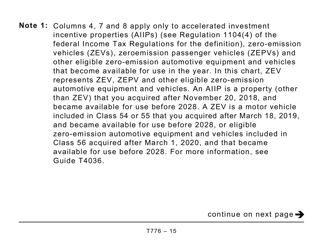

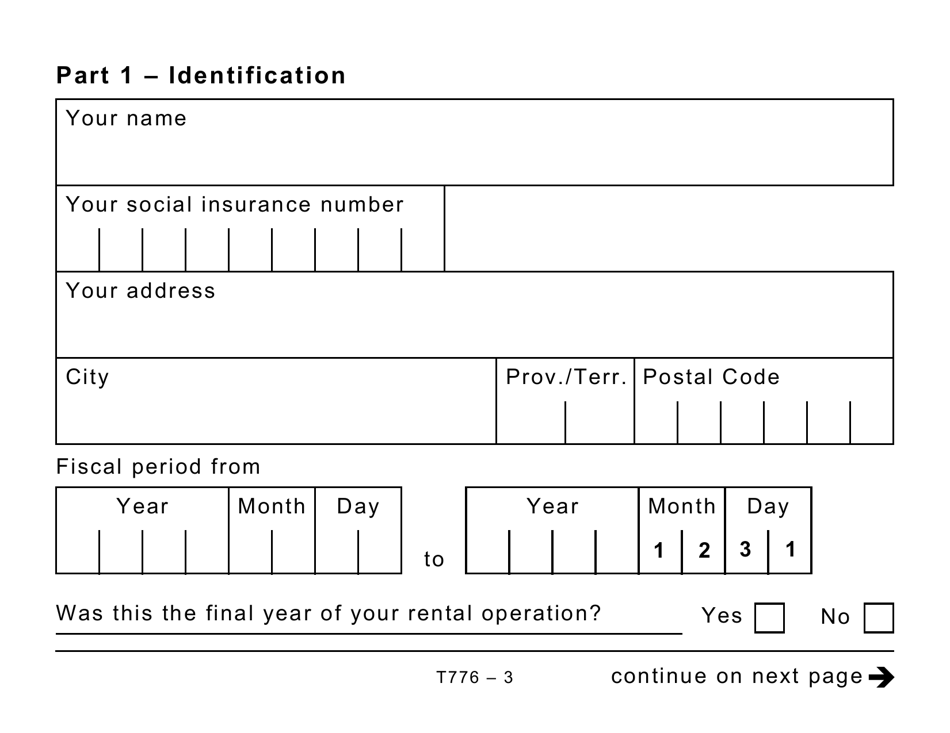

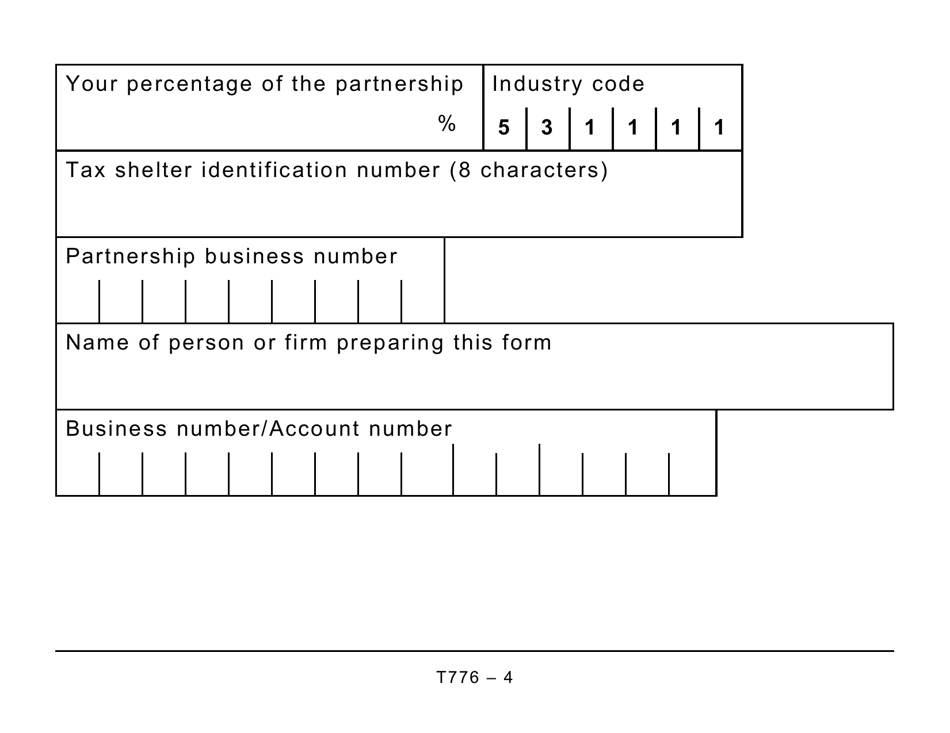

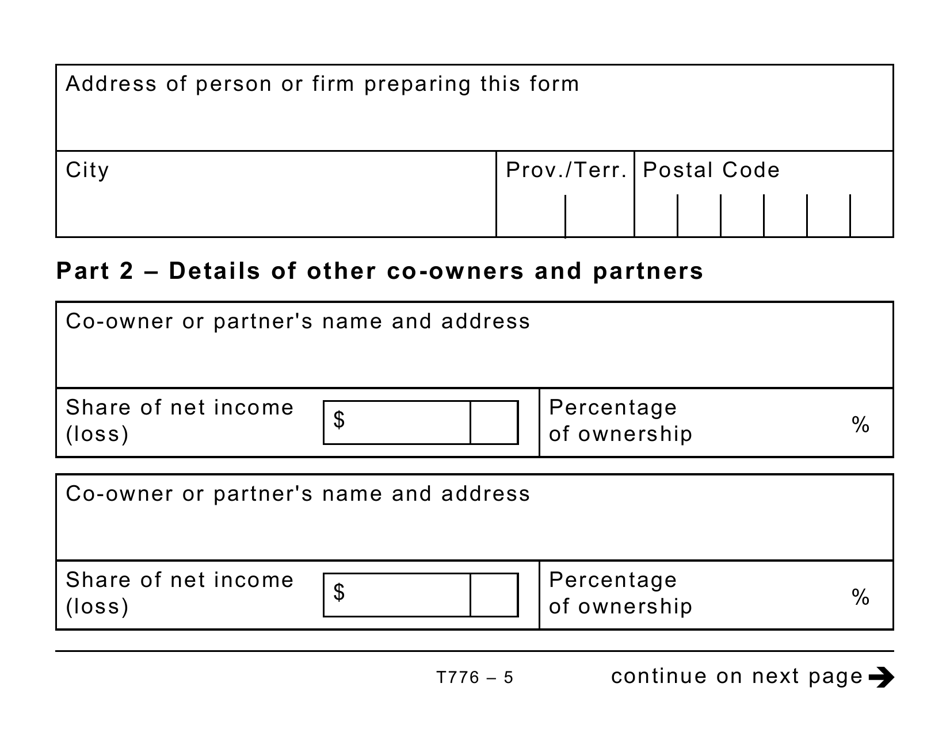

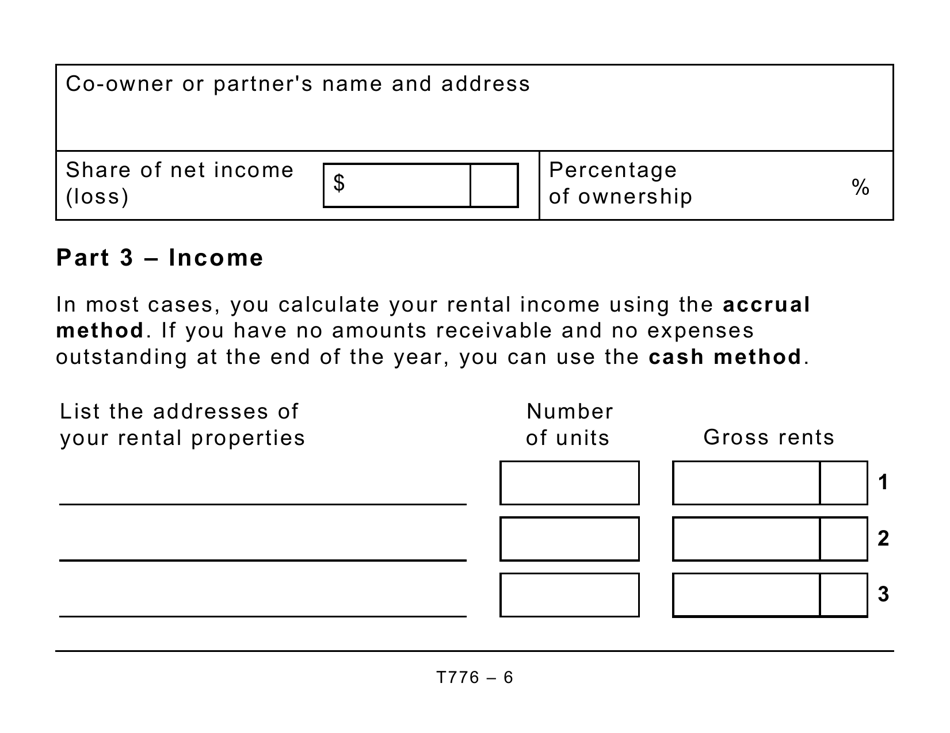

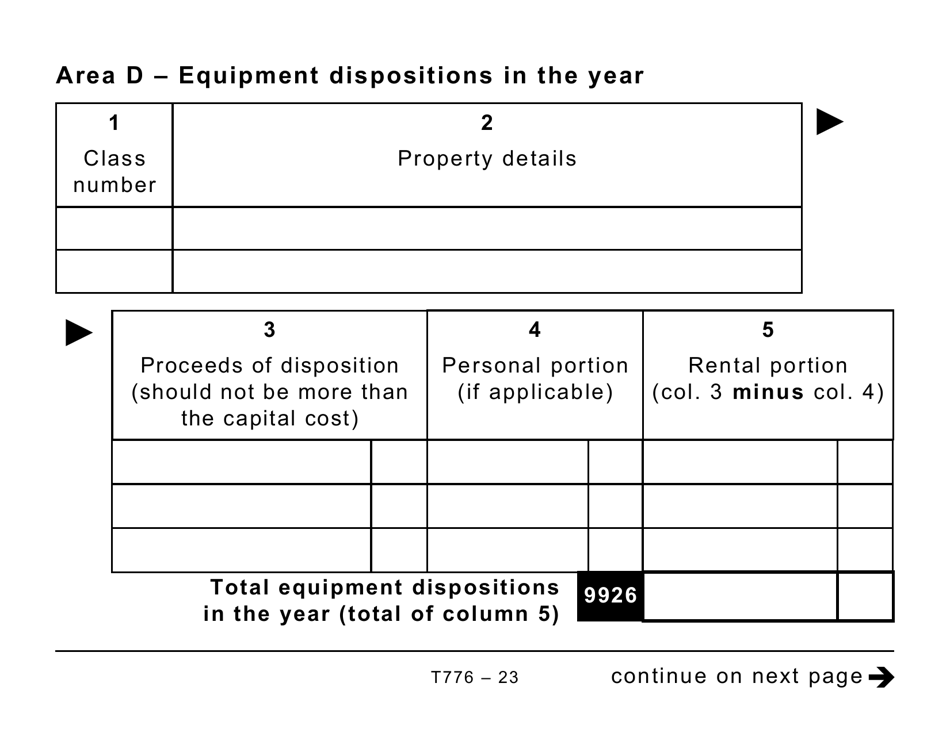

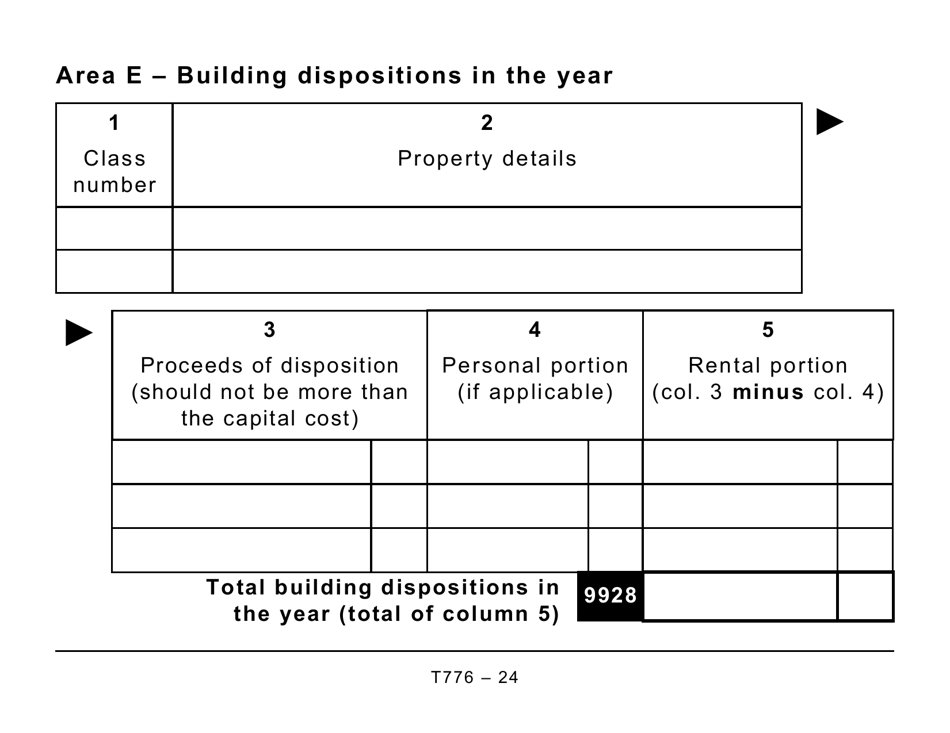

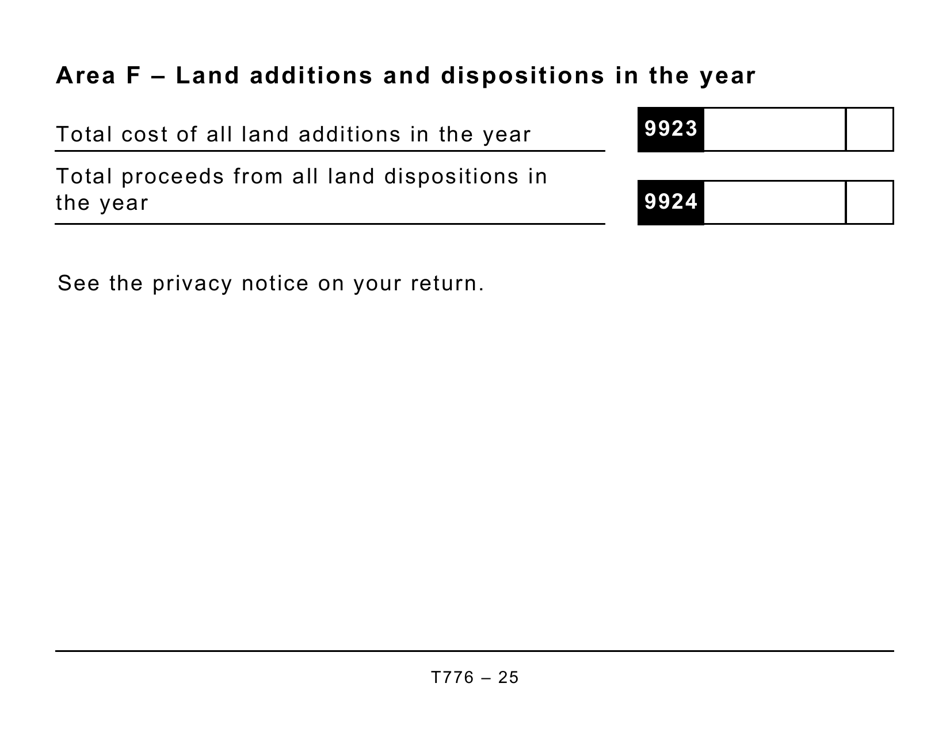

Form T776 Statement of Real Estate Rentals - Large Print - Canada

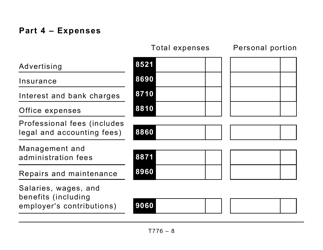

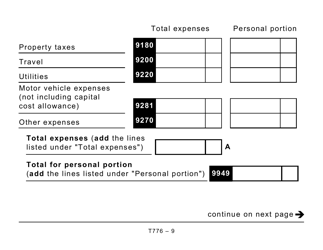

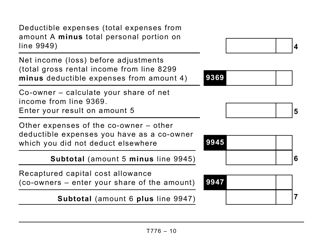

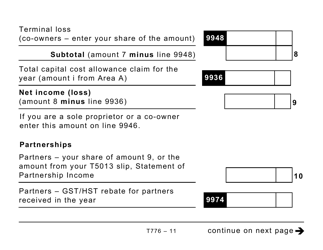

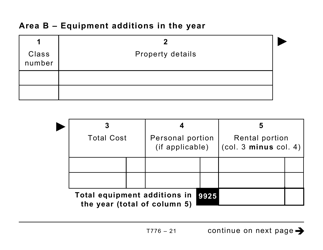

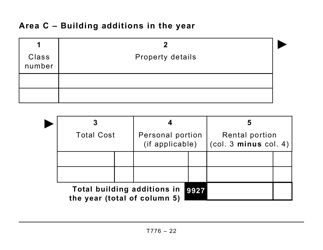

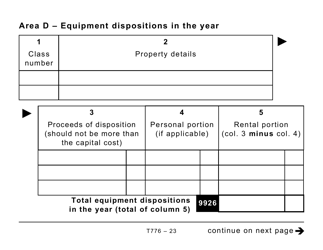

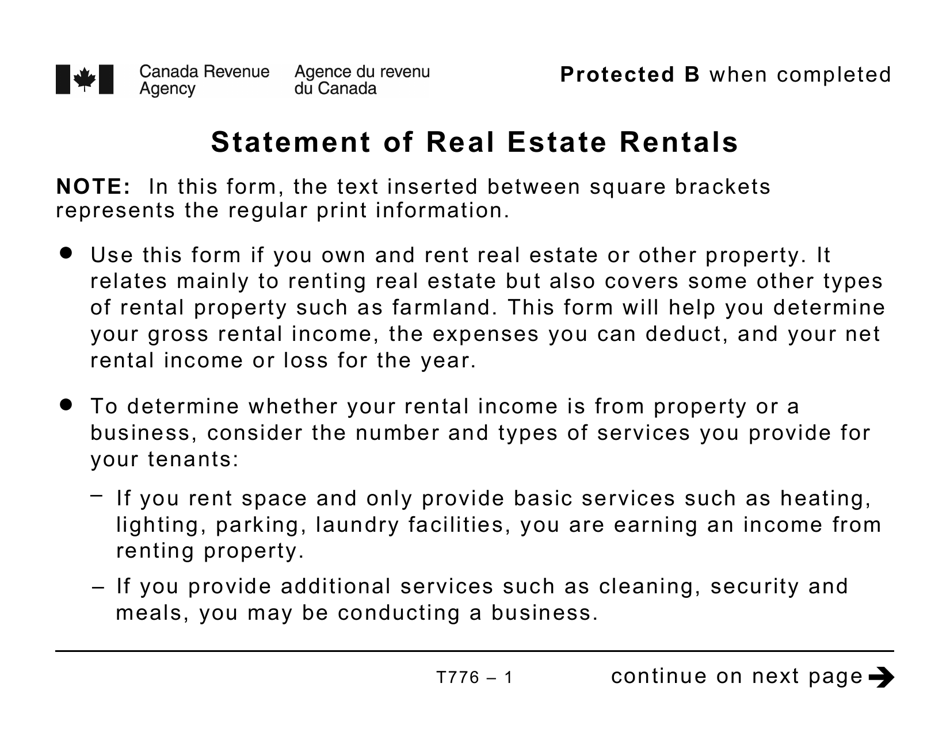

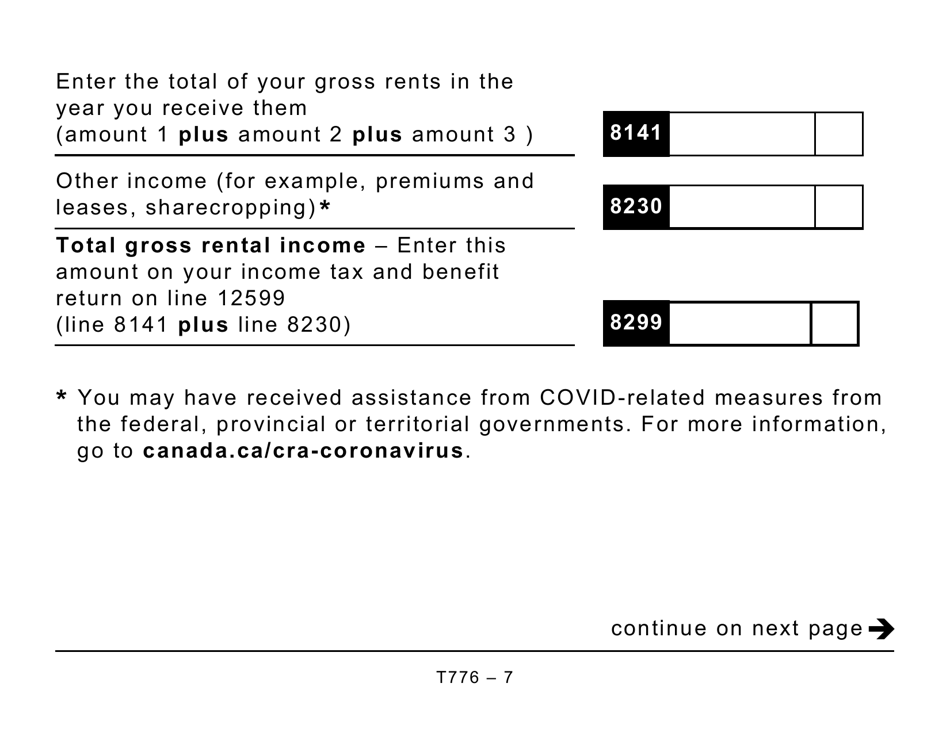

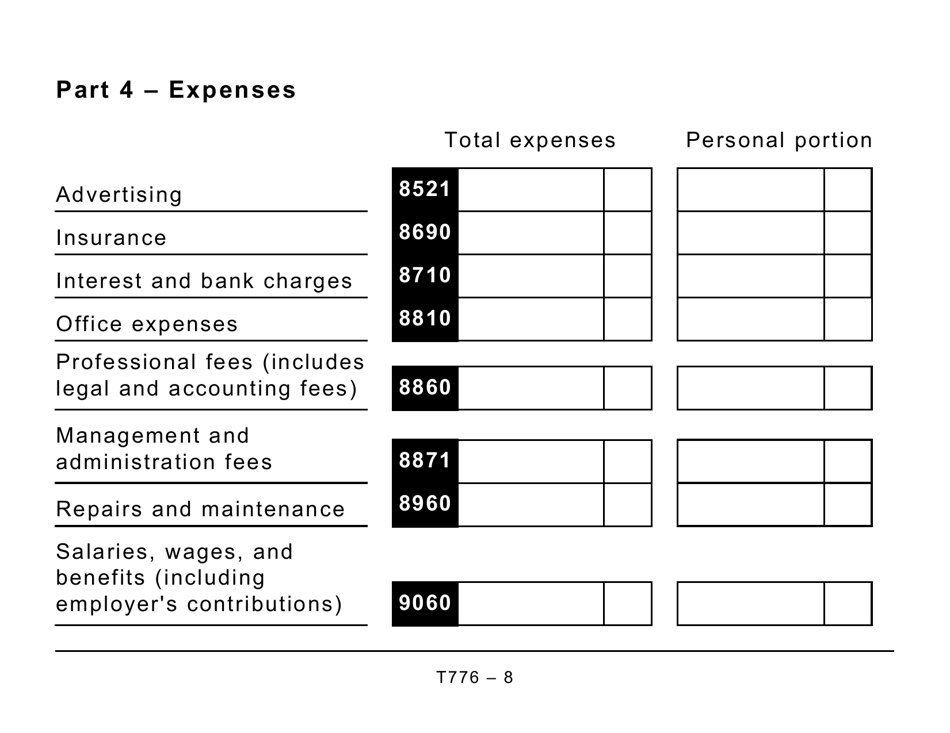

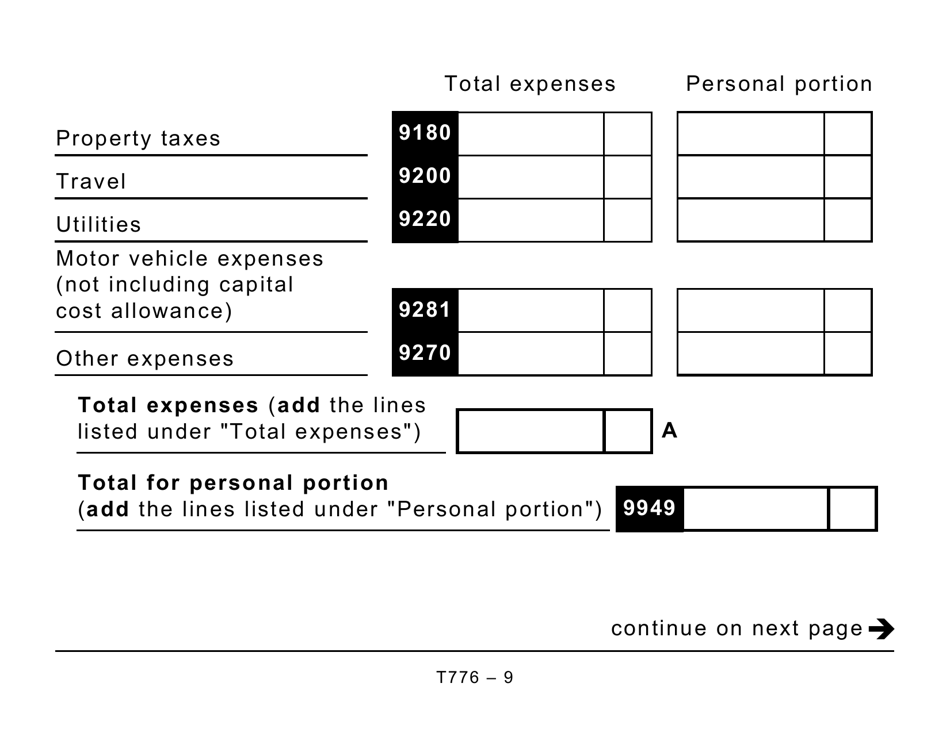

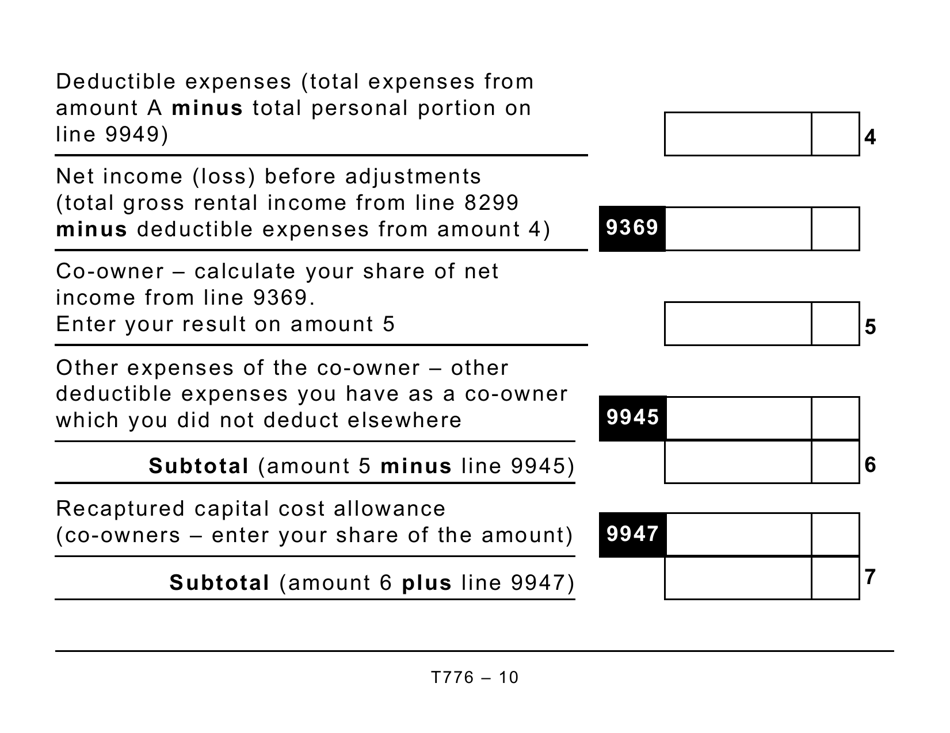

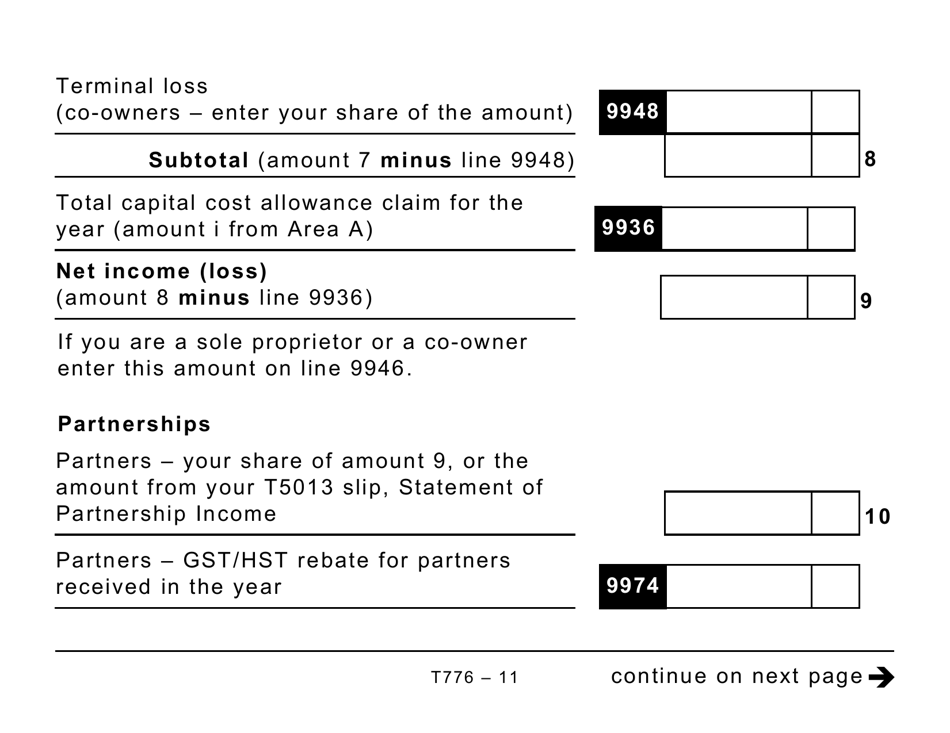

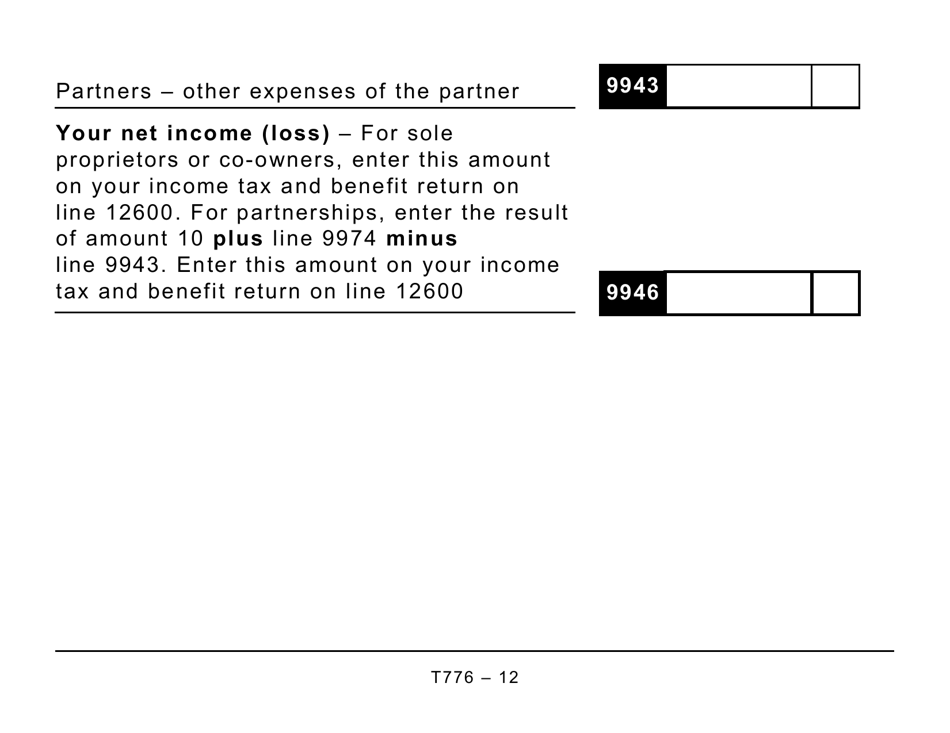

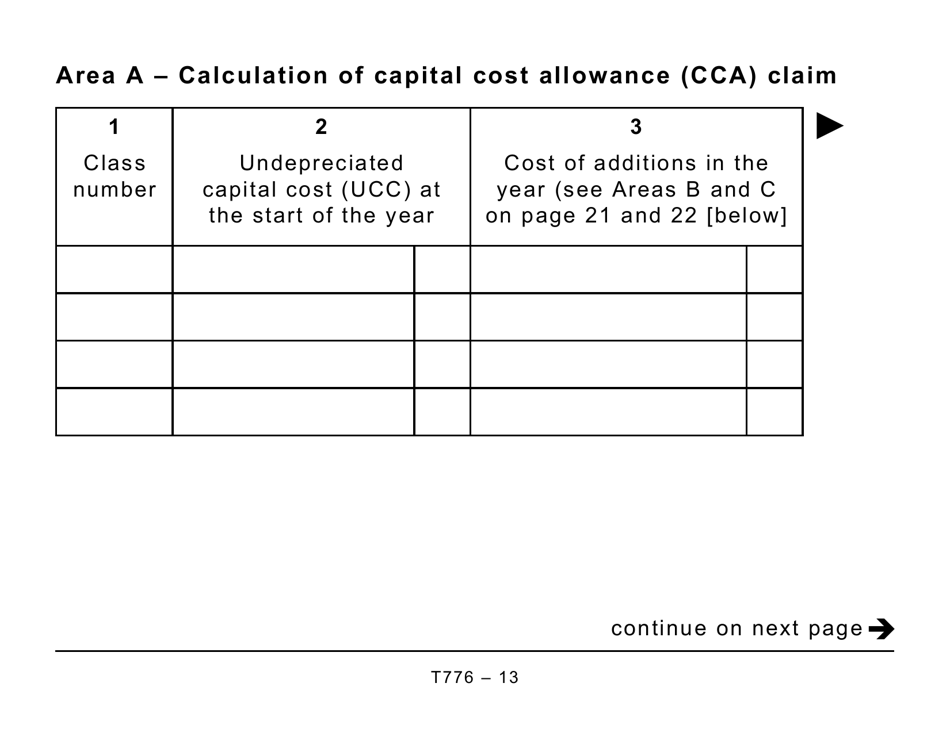

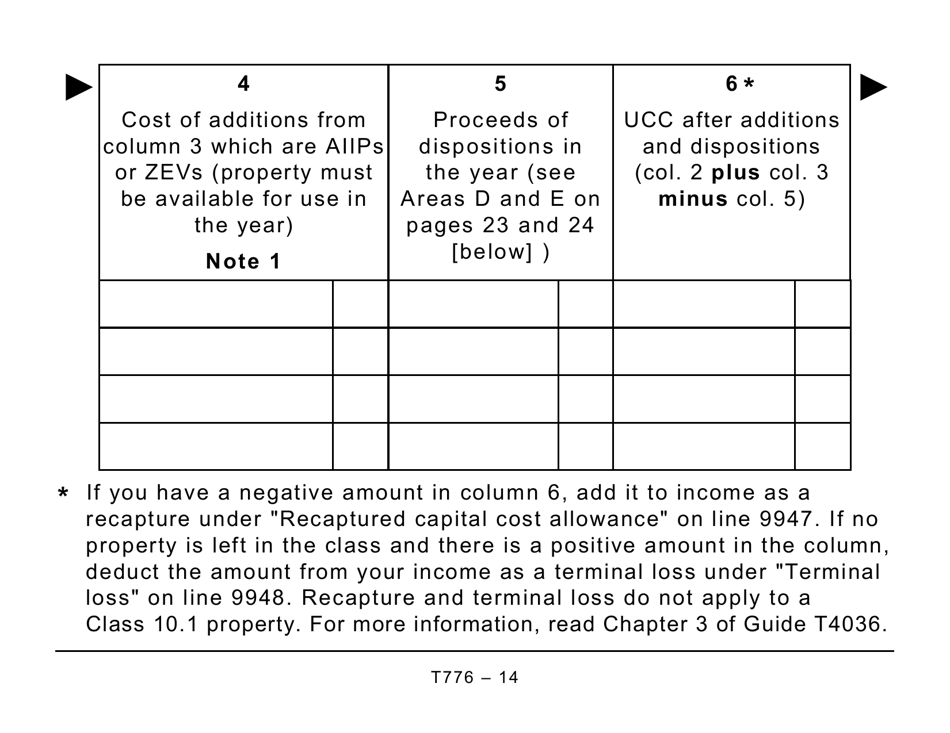

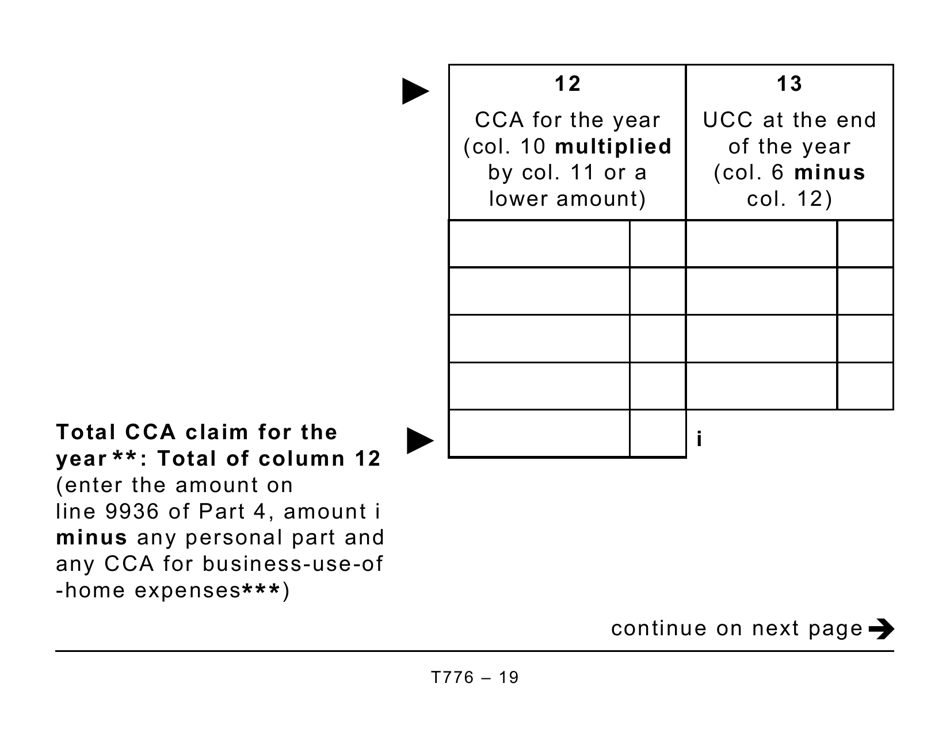

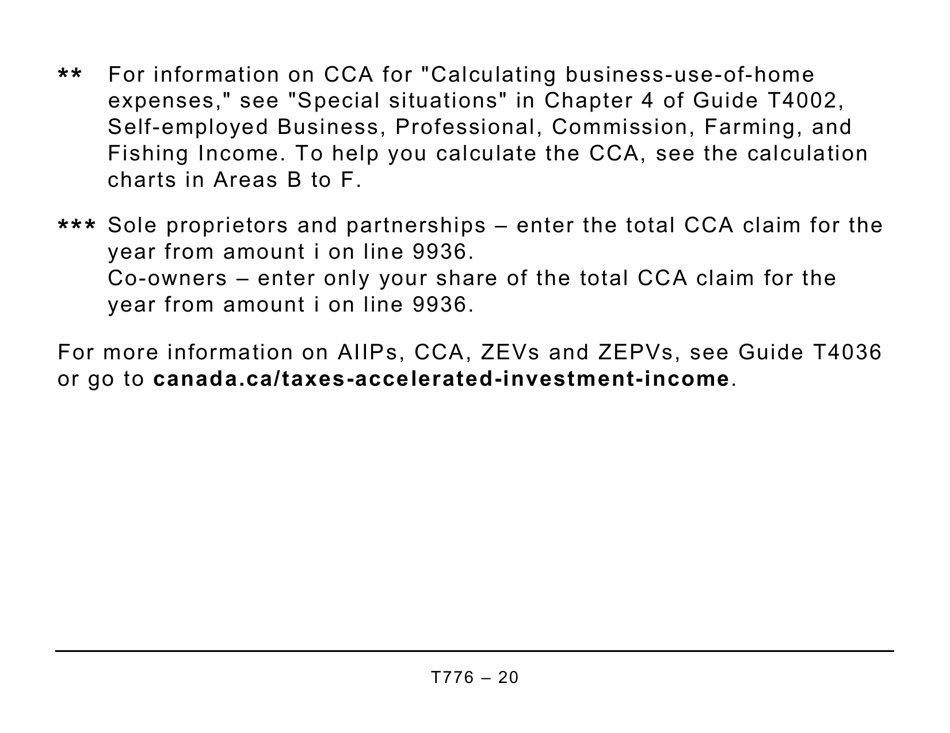

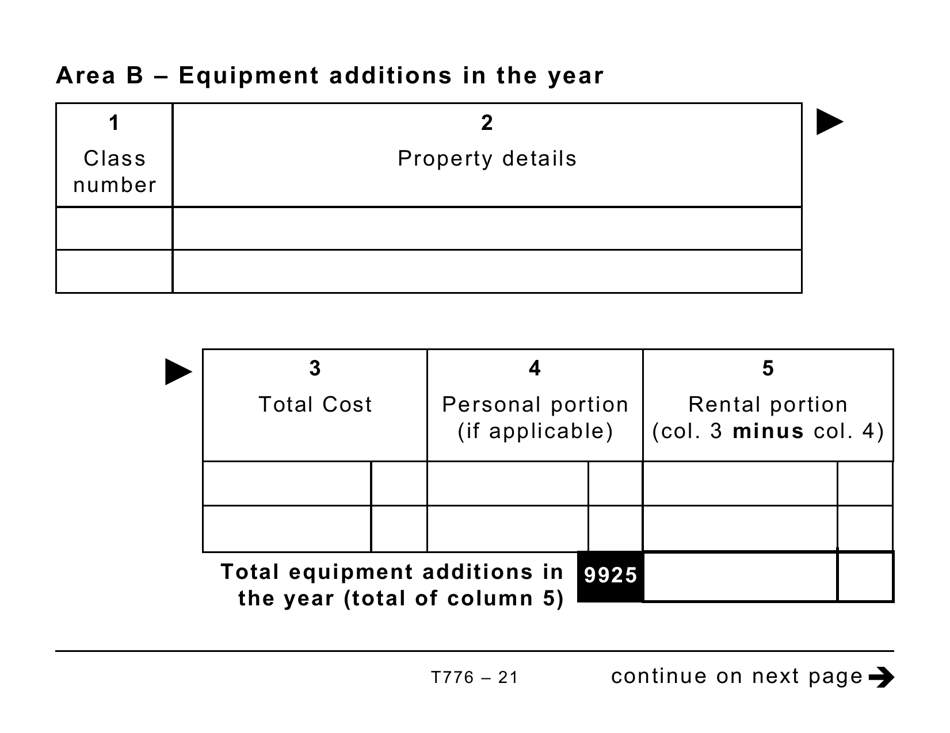

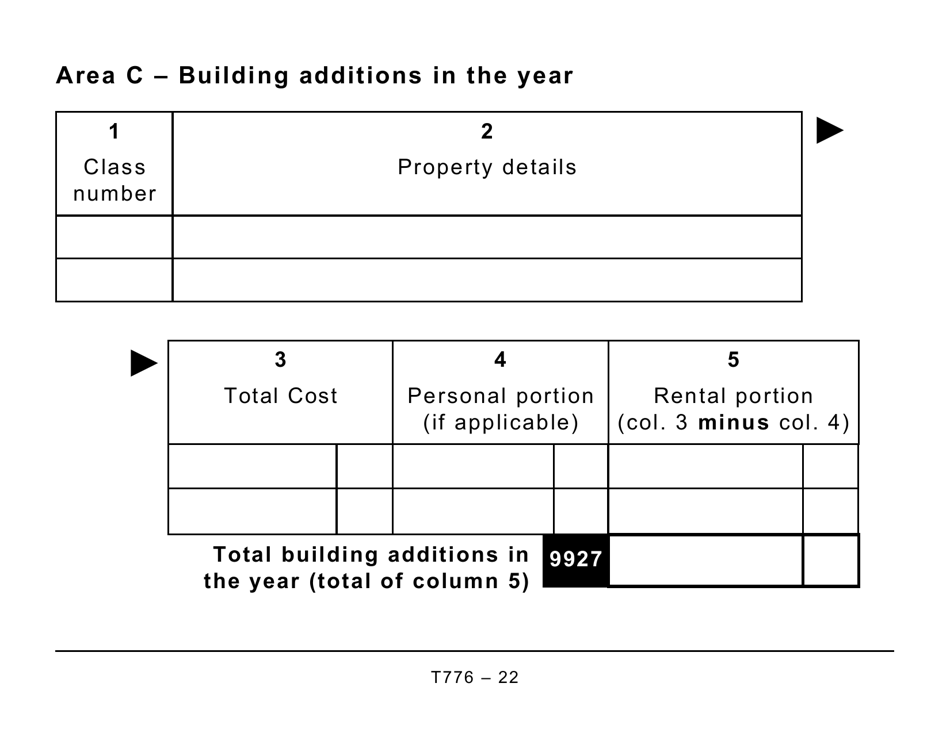

Form T776, the Statement of Real Estate Rentals, is used in Canada by individuals who have rental income from real estate properties. It is used to report the rental income earned and to claim any related expenses incurred for tax purposes. The large print version of this form is designed to assist individuals who have visual impairments or difficulties reading small print.

The form T776 Statement of Real Estate Rentals - Large Print in Canada is filed by individuals who own rental properties and need to report rental income and expenses for tax purposes.

FAQ

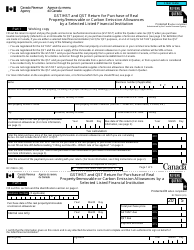

Q: What is Form T776?

A: Form T776 is the Statement of Real Estate Rentals which is used in Canada for reporting rental income and expenses.

Q: What is the purpose of Form T776?

A: The purpose of Form T776 is to report rental income and expenses related to real estate properties in Canada.

Q: Who needs to file Form T776?

A: Anyone who earns rental income from a real estate property in Canada needs to file Form T776.

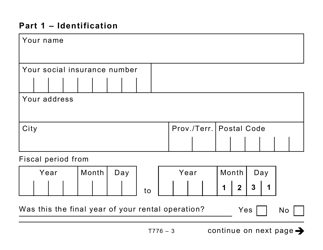

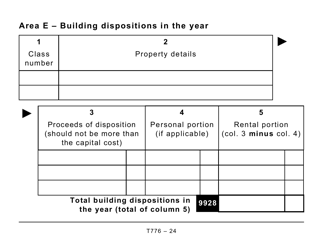

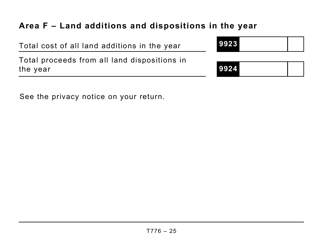

Q: What information is required on Form T776?

A: Form T776 requires information such as rental income, expenses, and details about the rental property.

Q: Is Form T776 available in large print?

A: Yes, Form T776 is available in large print format for individuals with visual impairments.

Q: When is the deadline to file Form T776?

A: The deadline to file Form T776 is generally April 30th of each year.

Q: Are there any penalties for not filing Form T776?

A: Yes, there may be penalties for not filing Form T776 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Can I claim expenses on Form T776?

A: Yes, you can claim eligible expenses on Form T776, such as mortgage interest, property taxes, and repairs.

Q: Do I need to include supporting documents with Form T776?

A: You should keep supporting documents such as receipts and invoices in case the Canada Revenue Agency (CRA) requests them for verification.

Q: Who can I contact for assistance with Form T776?

A: You can contact the Canada Revenue Agency (CRA) or consult a tax professional for assistance with Form T776.