This version of the form is not currently in use and is provided for reference only. Download this version of

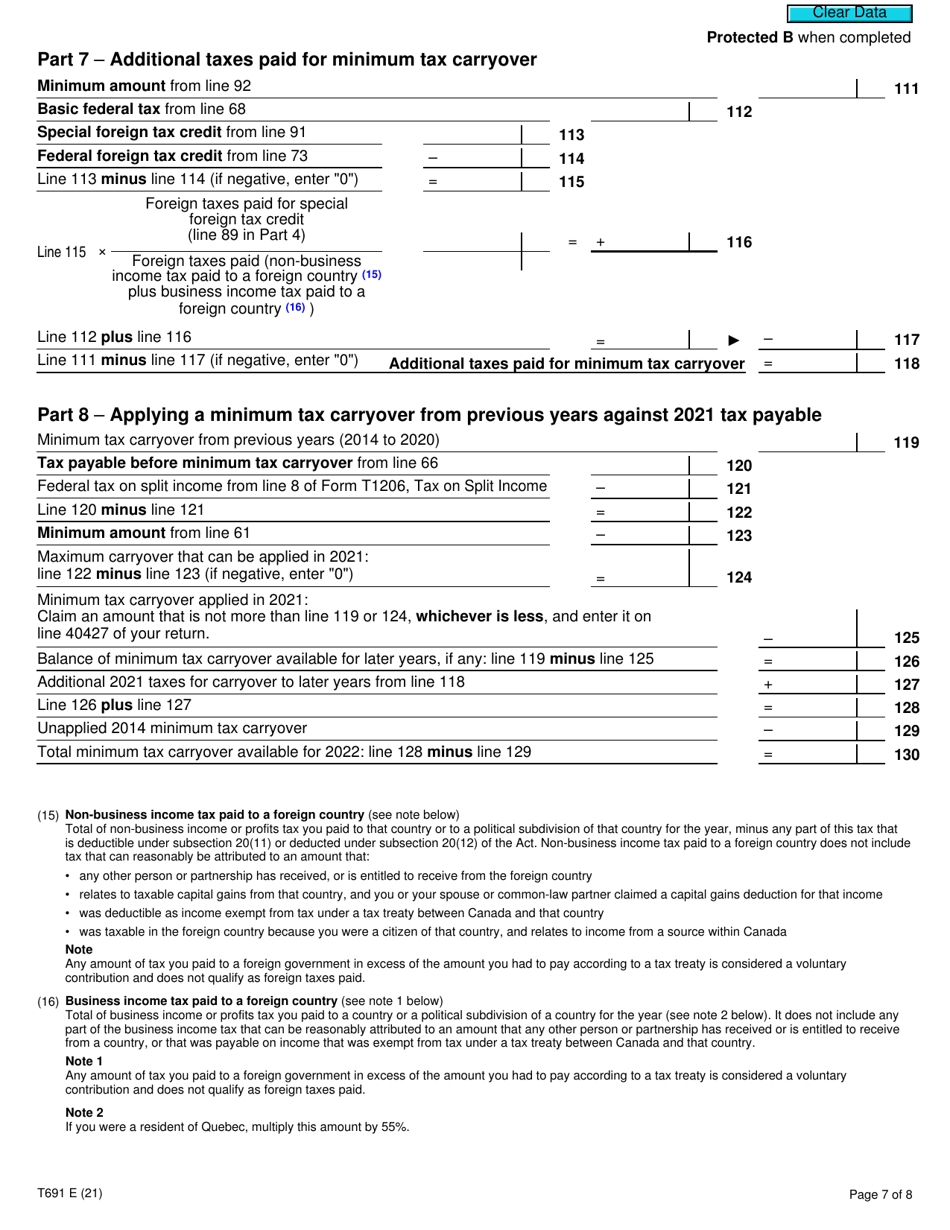

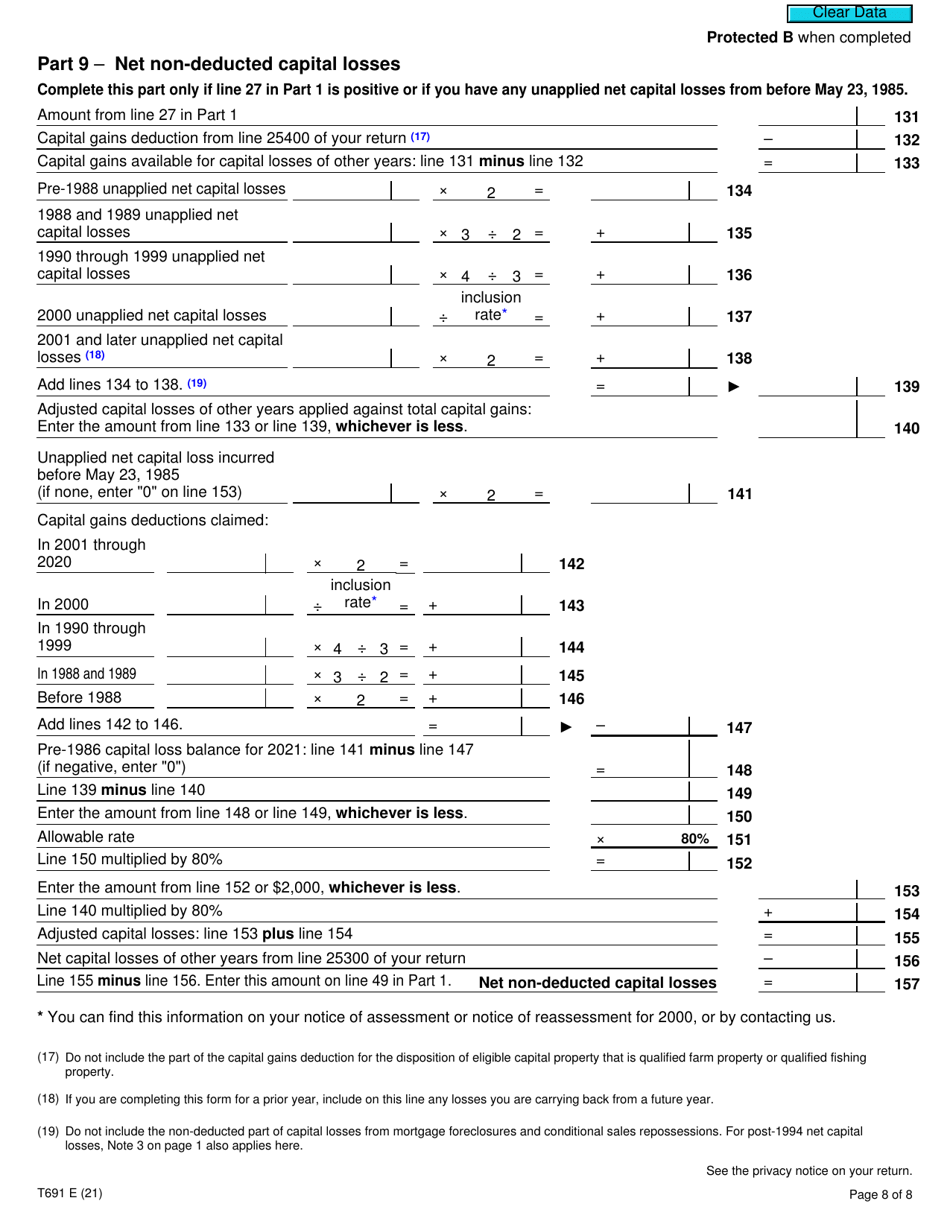

Form T691

for the current year.

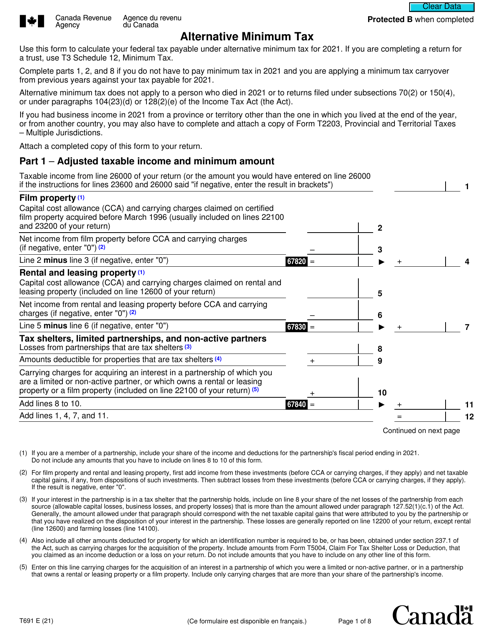

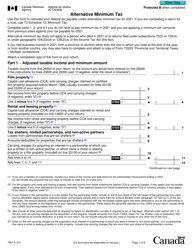

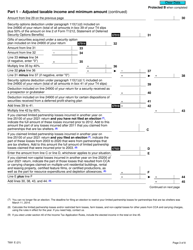

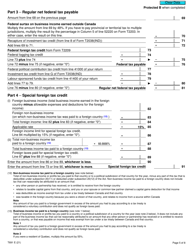

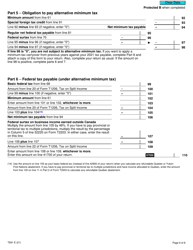

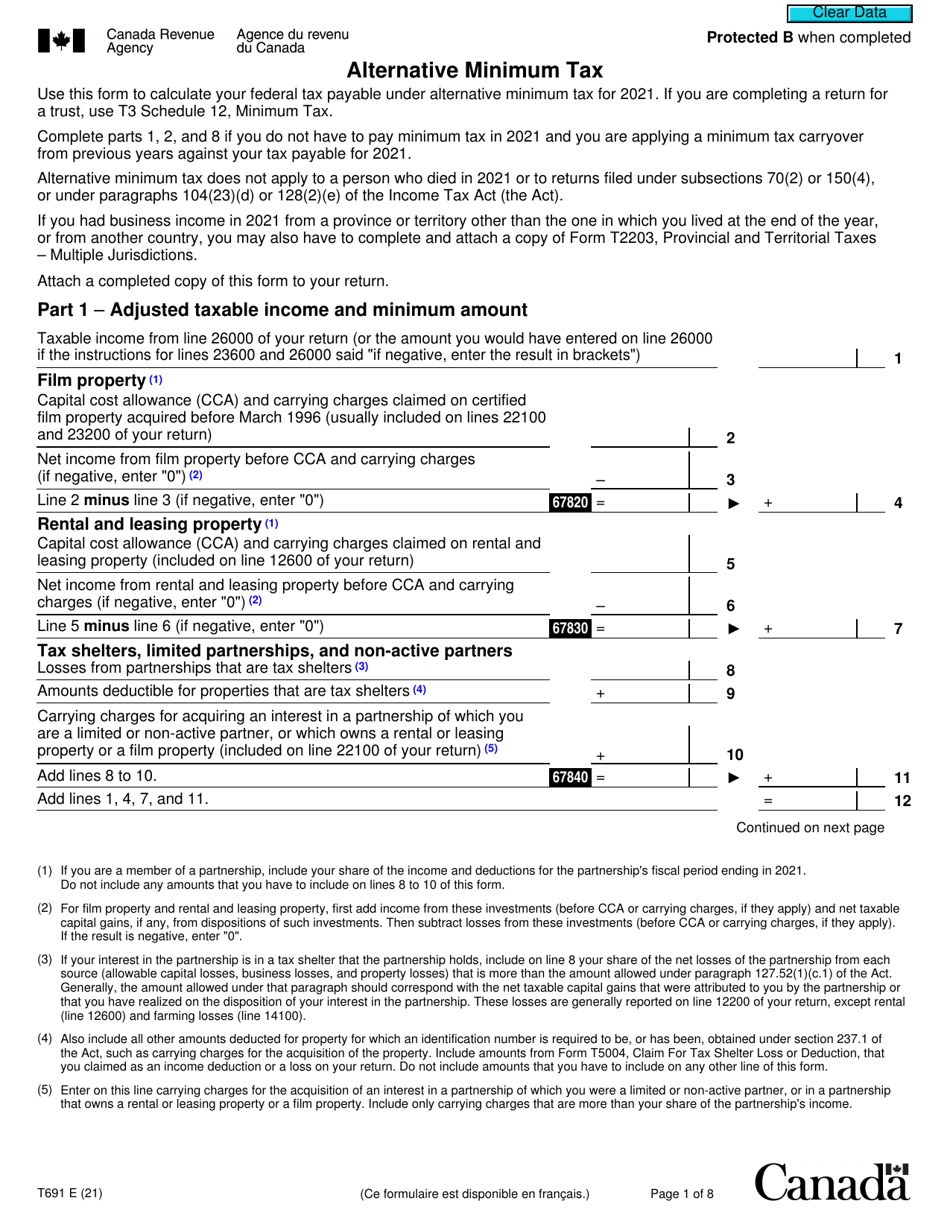

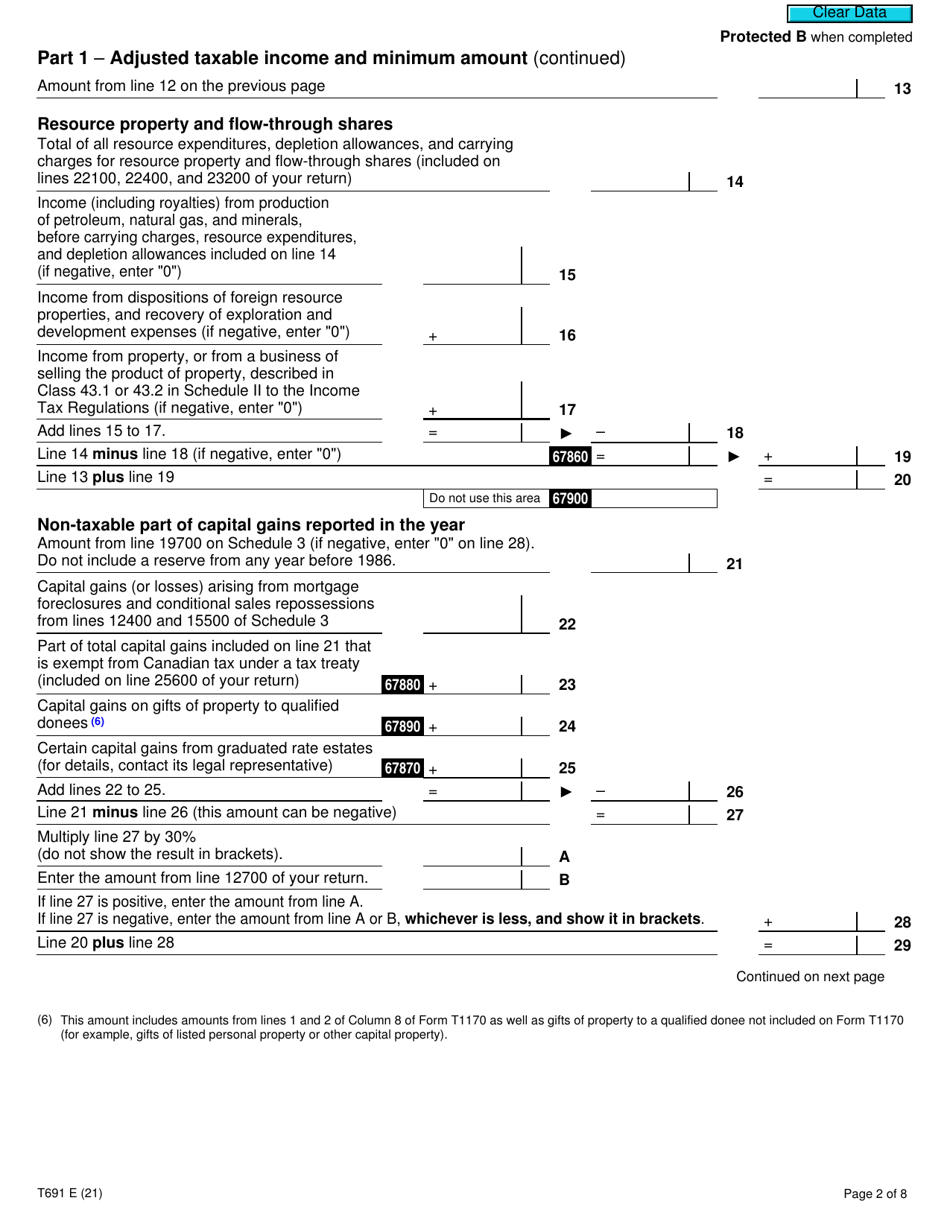

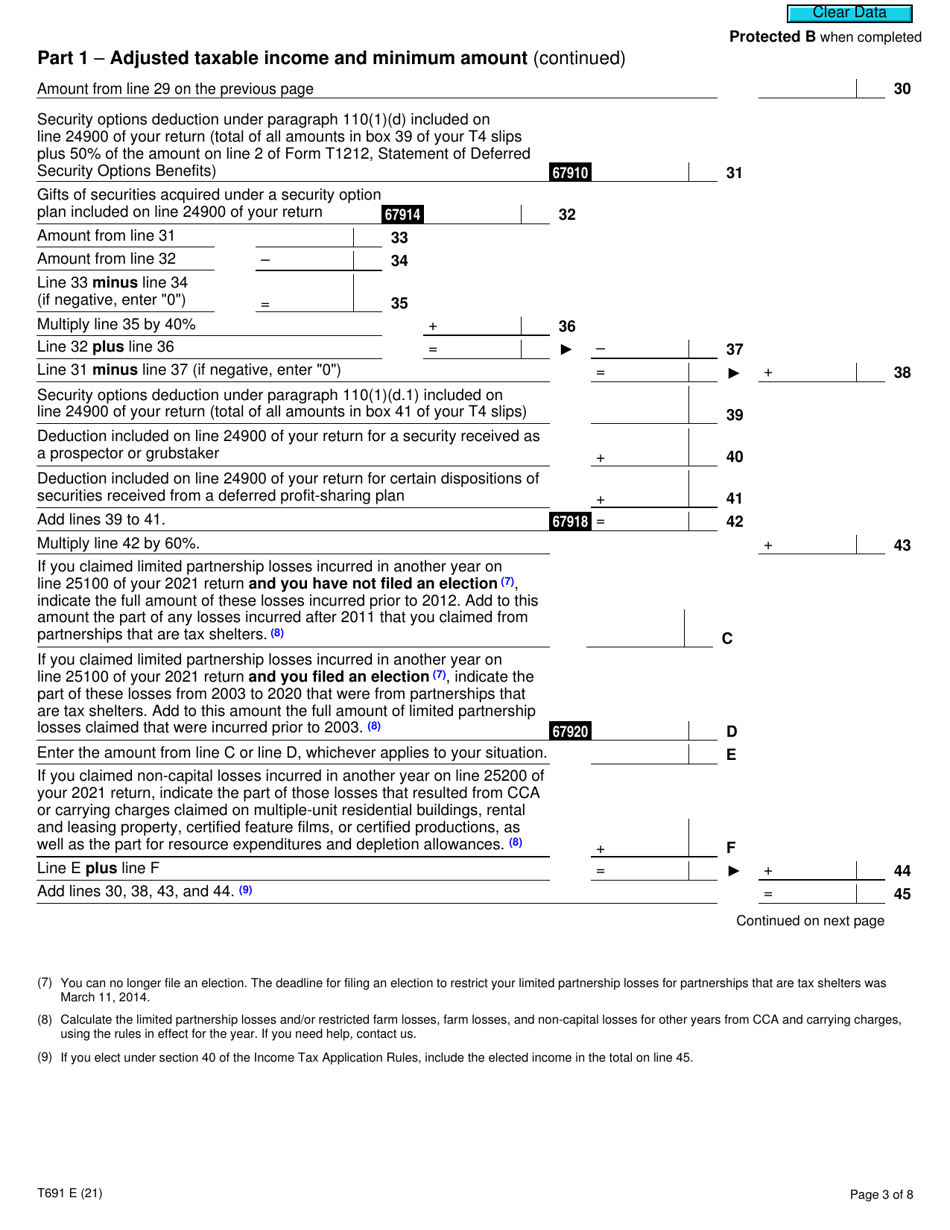

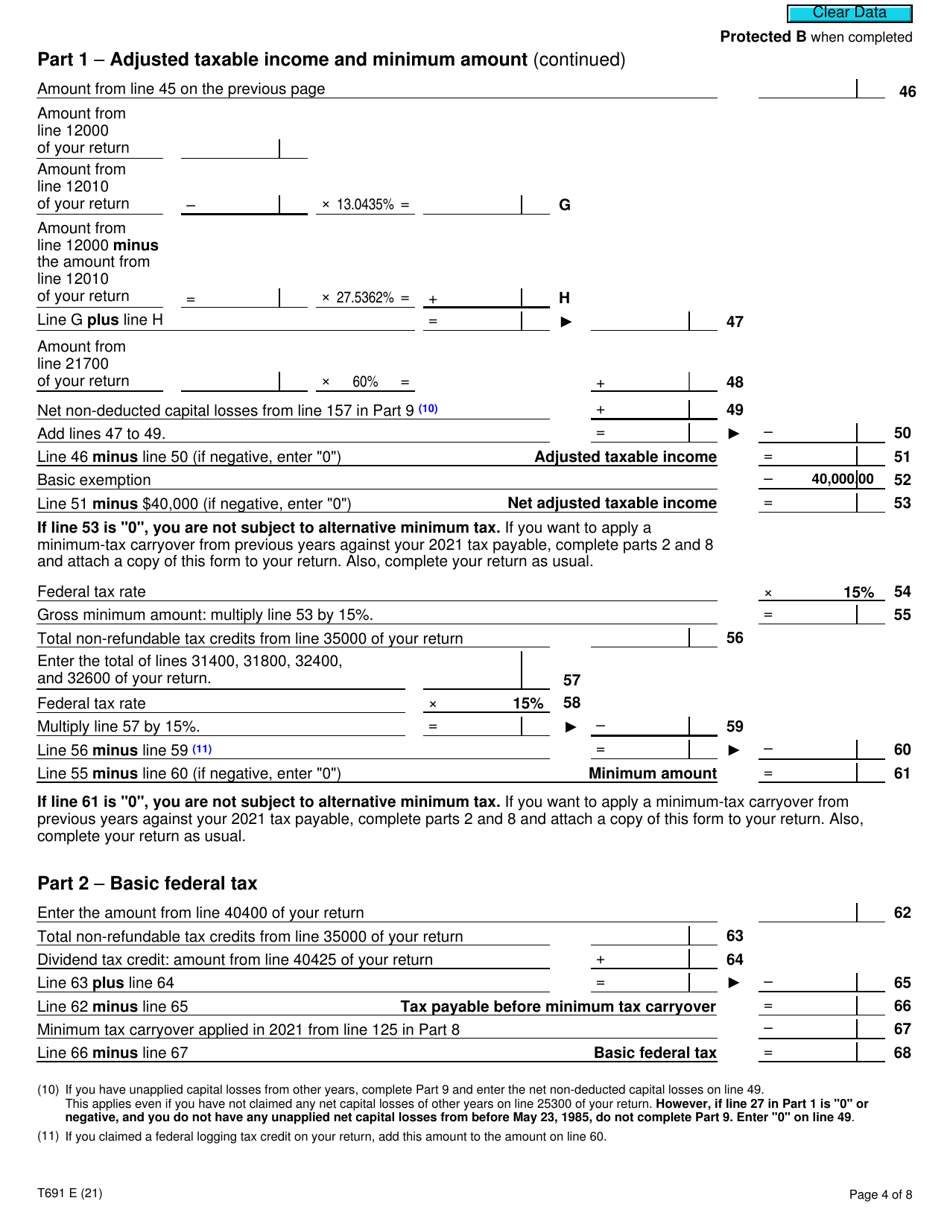

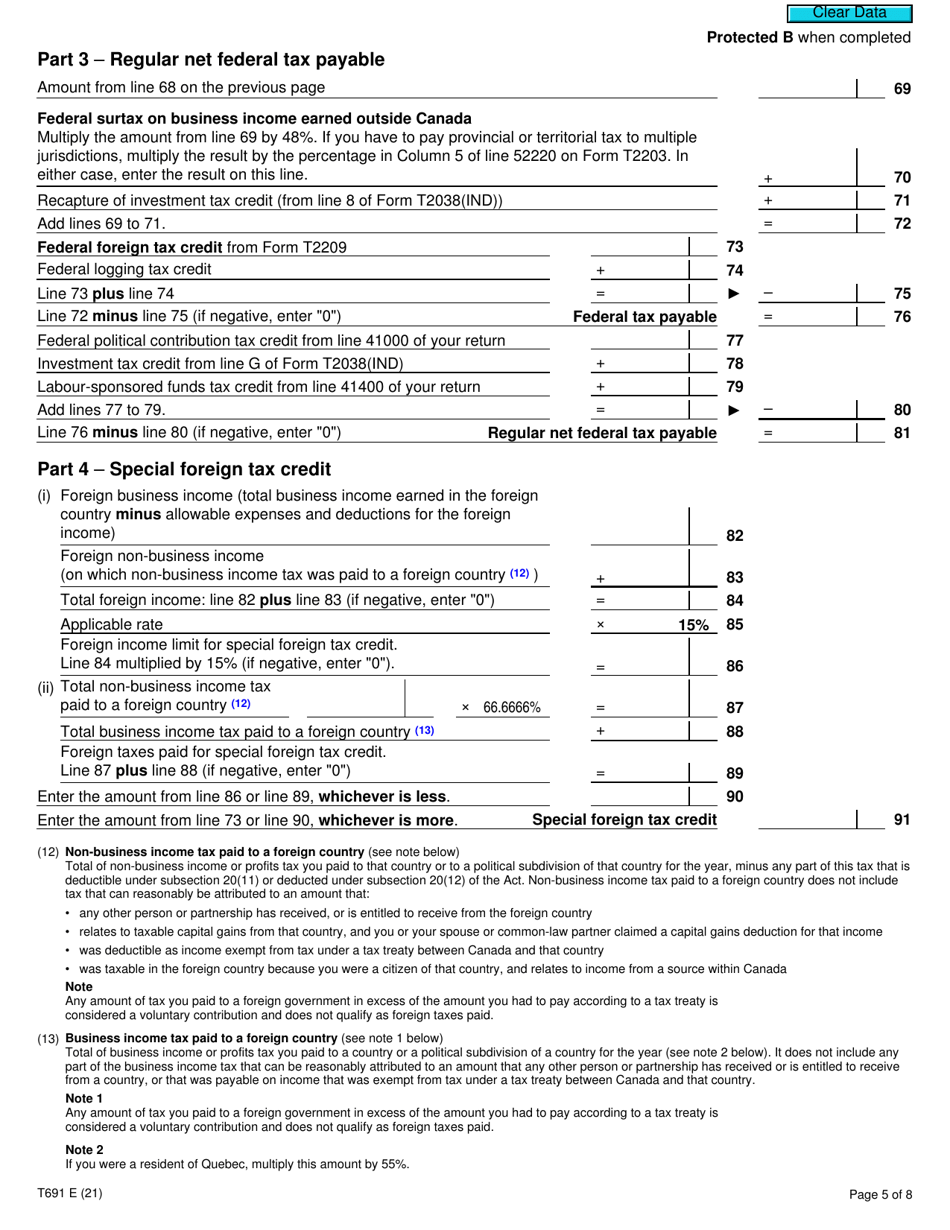

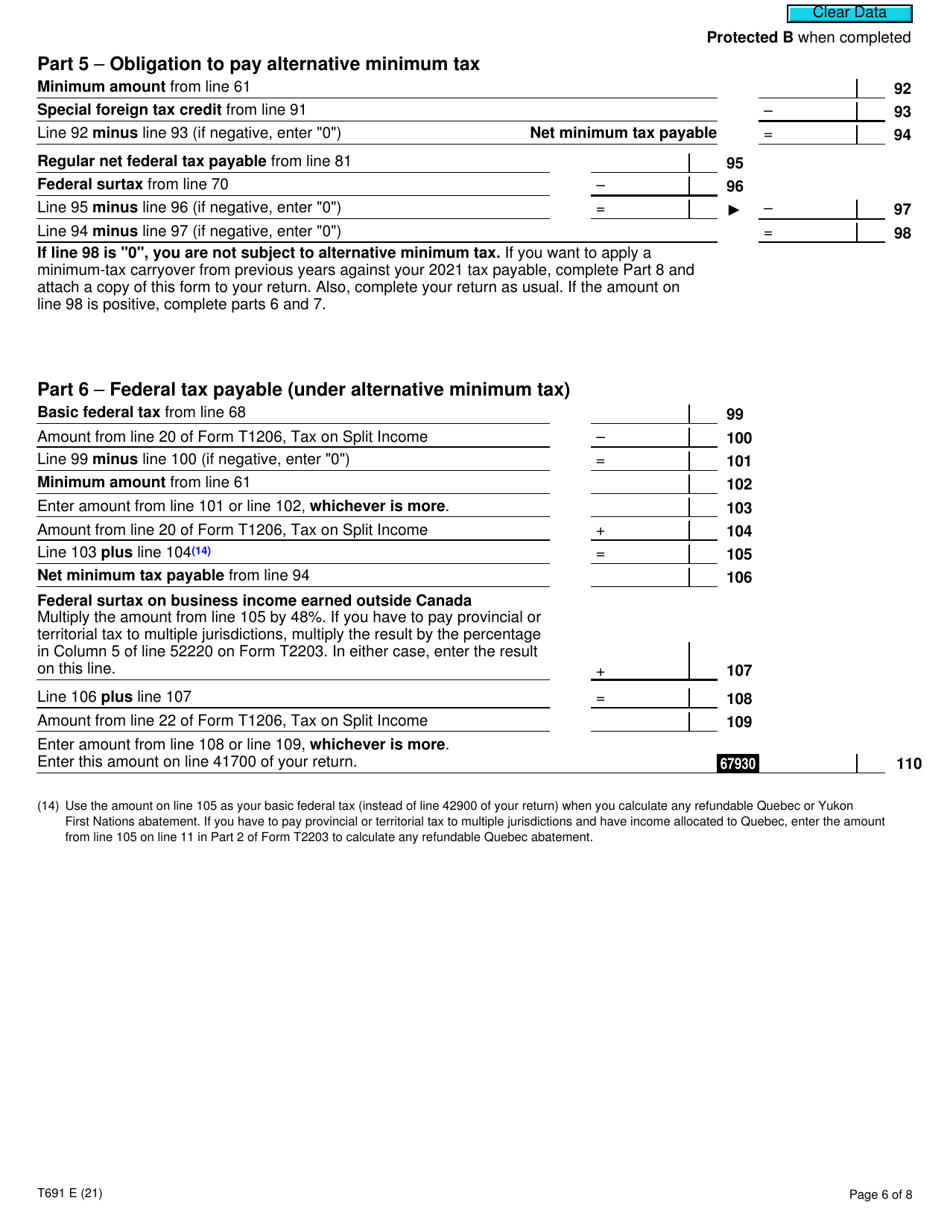

Form T691 Alternative Minimum Tax - Canada

Form T691 Alternative Minimum Tax is used in Canada to calculate and report the alternative minimum tax (AMT) for individuals and corporations. The AMT is an additional tax that may be applicable to taxpayers who have certain tax deductions or credits that reduce their regular tax liability significantly. This form helps determine if the taxpayer owes any AMT and if so, how much.

The individual taxpayer would file the Form T691 Alternative Minimum Tax in Canada.

FAQ

Q: What is Form T691?

A: Form T691 is a tax form used in Canada to calculate the Alternative Minimum Tax (AMT).

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate tax system in Canada that ensures taxpayers with high income or certain types of deductions pay a minimum amount of tax.

Q: Who needs to file Form T691?

A: Individuals or corporations in Canada who meet specific criteria, such as having certain tax preferences or deductions, may need to file Form T691 to calculate and pay the Alternative Minimum Tax.

Q: How do I complete Form T691?

A: To complete Form T691, you must follow the instructions provided by the Canada Revenue Agency (CRA). You will need to report your income, deductions, and any tax preferences or adjustments that may apply.

Q: When is Form T691 due?

A: Form T691 is generally due on the same date as your income tax return. For most individuals, this is April 30th of the following year. However, different deadlines may apply to corporations and individuals with different filing requirements.

Q: What happens if I don't file Form T691?

A: If you are required to file Form T691 and fail to do so, you may be subject to penalties and interest charges imposed by the Canada Revenue Agency (CRA). It is important to meet all filing requirements to avoid any potential penalties.

Q: Can I e-file Form T691?

A: As of now, the Canada Revenue Agency (CRA) does not offer electronic filing options for Form T691. You must file a paper copy of the form by mail or deliver it in person to a tax service office.

Q: Is the Alternative Minimum Tax (AMT) the same as regular income tax?

A: No, the Alternative Minimum Tax (AMT) is a separate tax system that operates alongside the regular income tax system in Canada. It has its own rules and calculations.

Q: Do I need to calculate the Alternative Minimum Tax (AMT) if I only have regular income?

A: If you have only regular income and do not meet the criteria for the Alternative Minimum Tax (AMT), you do not need to calculate or pay AMT. However, it is always a good idea to consult with a tax professional or the Canada Revenue Agency (CRA) to ensure you are meeting all your tax obligations.