This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3YT

for the current year.

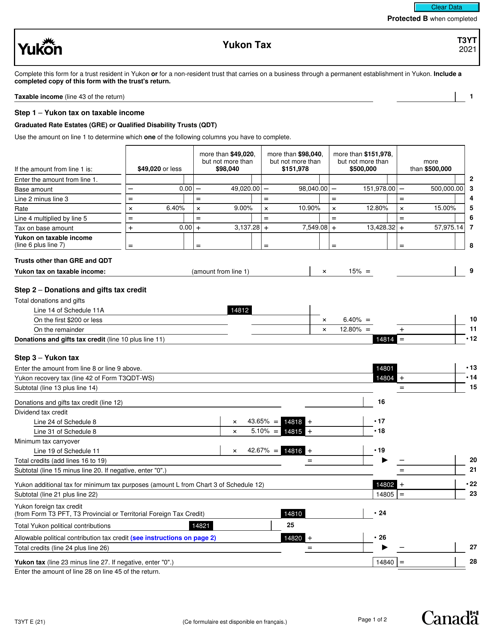

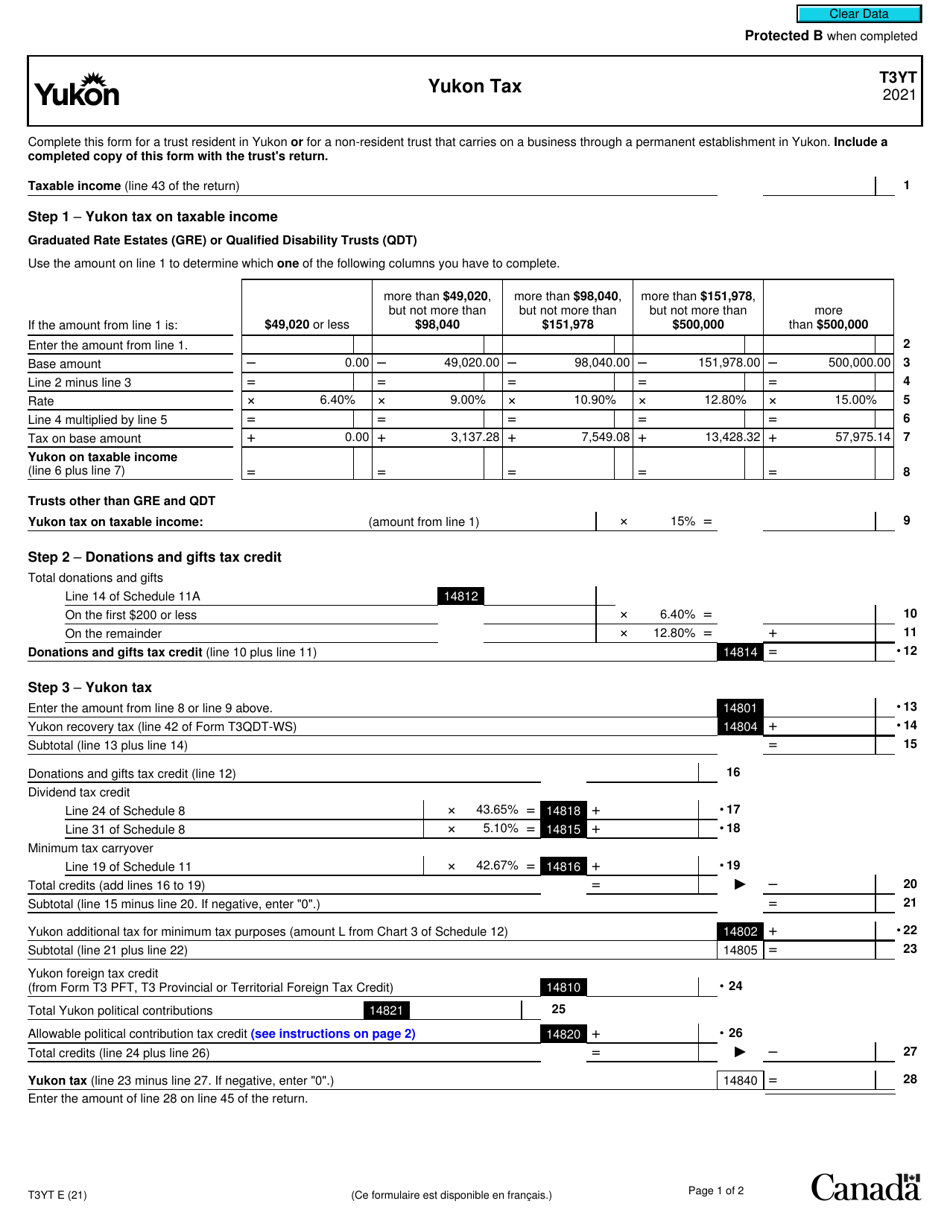

Form T3YT Yukon Tax - Canada

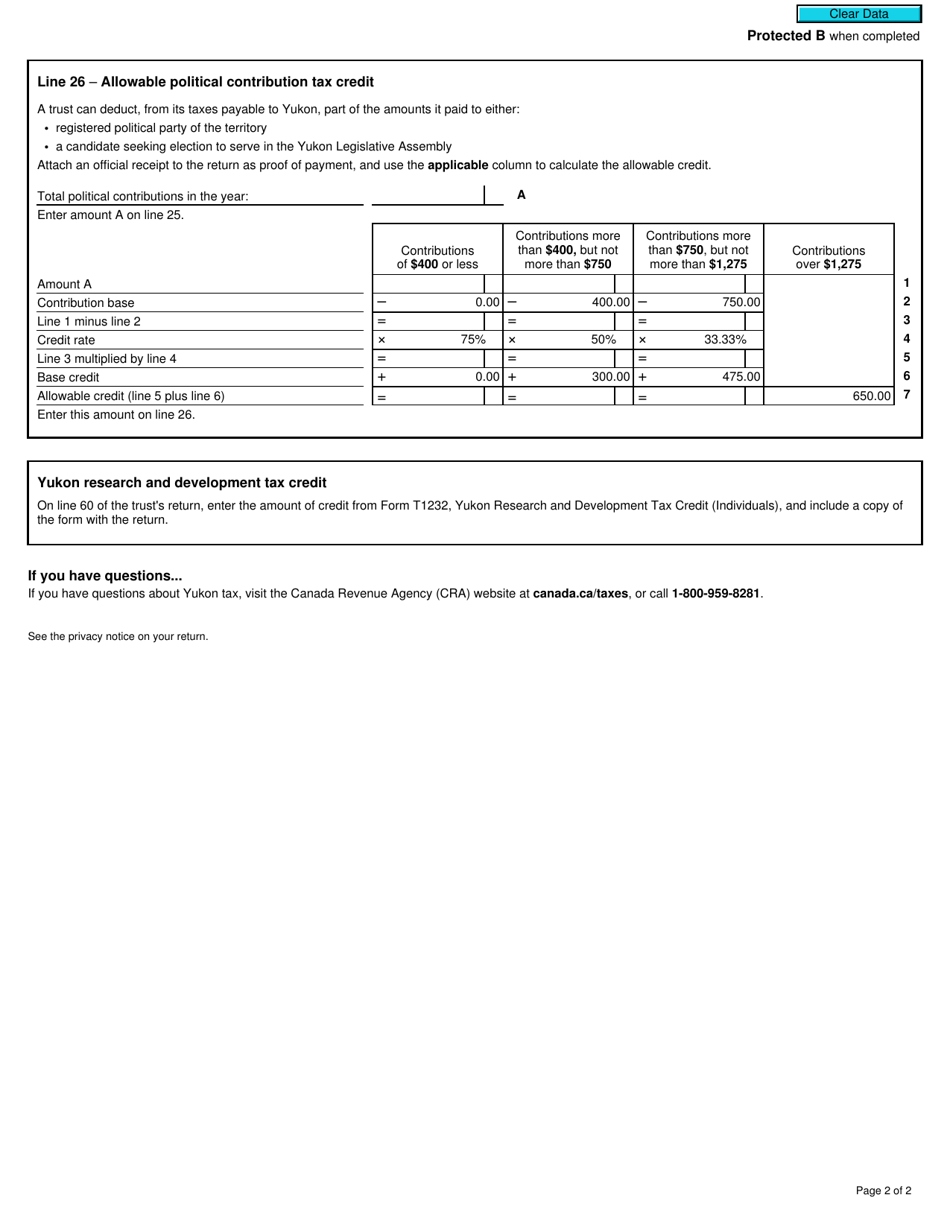

Form T3YT is used in Yukon, Canada for reporting and paying territorial taxes. It is specifically designed for individuals, corporations, and trust beneficiaries who have taxable income in Yukon. The form allows taxpayers to report their income, deductions, and calculate the amount of tax owed to the Yukon government.

The Form T3YT Yukon Tax is filed by individuals or businesses in Canada who have income earned in the Yukon territory.

FAQ

Q: What is Form T3YT?

A: Form T3YT is a tax form used in Yukon, Canada.

Q: What is Yukon Tax?

A: Yukon Tax is the tax system in the Canadian territory of Yukon.

Q: Who needs to file Form T3YT?

A: Residents of Yukon who have taxable income need to file Form T3YT.

Q: What is the purpose of Form T3YT?

A: Form T3YT is used to report and calculate taxes owed by residents of Yukon.

Q: When is the deadline to file Form T3YT?

A: The deadline to file Form T3YT is usually April 30th of each year.

Q: Are there penalties for late filing?

A: Yes, there may be penalties for late filing, including interest charges on unpaid taxes.

Q: Is Yukon Tax the same as federal tax?

A: No, Yukon Tax is separate from federal tax and has its own rules and rates.

Q: What should I do if I need help with Form T3YT?

A: If you need help with Form T3YT, you can contact the Canada Revenue Agency or seek assistance from a tax professional.