This version of the form is not currently in use and is provided for reference only. Download this version of

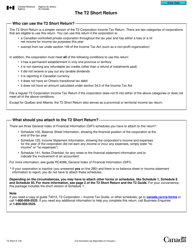

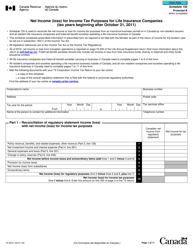

Form T3 Schedule 4

for the current year.

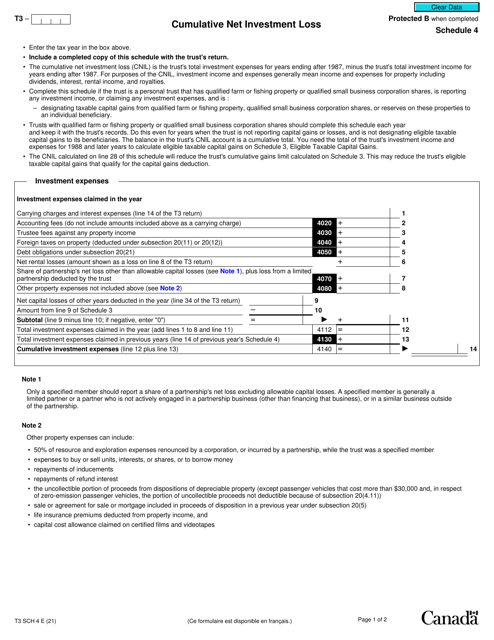

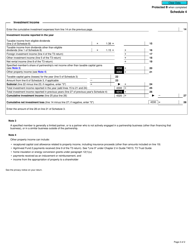

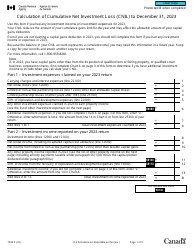

Form T3 Schedule 4 Cumulative Net Investment Loss - Canada

Form T3 Schedule 4 Cumulative Net Investment Loss in Canada is used to calculate the net investment loss for a trust for each taxation year. It helps determine if the trust is eligible to carry forward the loss to future years for tax purposes.

The Form T3 Schedule 4 Cumulative Net Investment Loss in Canada is filed by individuals who have a cumulative net investment loss for a particular tax year.

FAQ

Q: What is Form T3 Schedule 4?

A: Form T3 Schedule 4 is a tax form used in Canada by individuals and corporations to report their cumulative net investment loss.

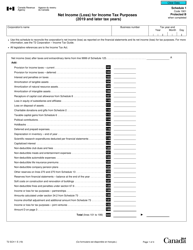

Q: What is a cumulative net investment loss?

A: A cumulative net investment loss refers to the total amount of investment losses you have incurred over multiple tax years.

Q: Who needs to file Form T3 Schedule 4?

A: Individuals and corporations in Canada who have a cumulative net investment loss need to file Form T3 Schedule 4.

Q: How do I file Form T3 Schedule 4?

A: Form T3 Schedule 4 can be filed electronically using tax software or by mail with the Canada Revenue Agency (CRA).

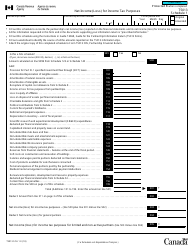

Q: What information do I need to complete Form T3 Schedule 4?

A: You will need to gather information about your investment losses from previous tax years, including the amounts and relevant supporting documents.

Q: When is the deadline to file Form T3 Schedule 4?

A: The deadline to file Form T3 Schedule 4 is the same as the deadline for your annual income tax return, which is usually April 30th.