This version of the form is not currently in use and is provided for reference only. Download this version of

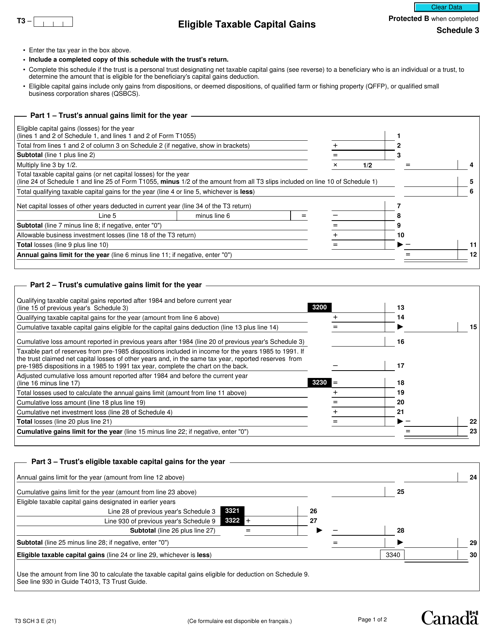

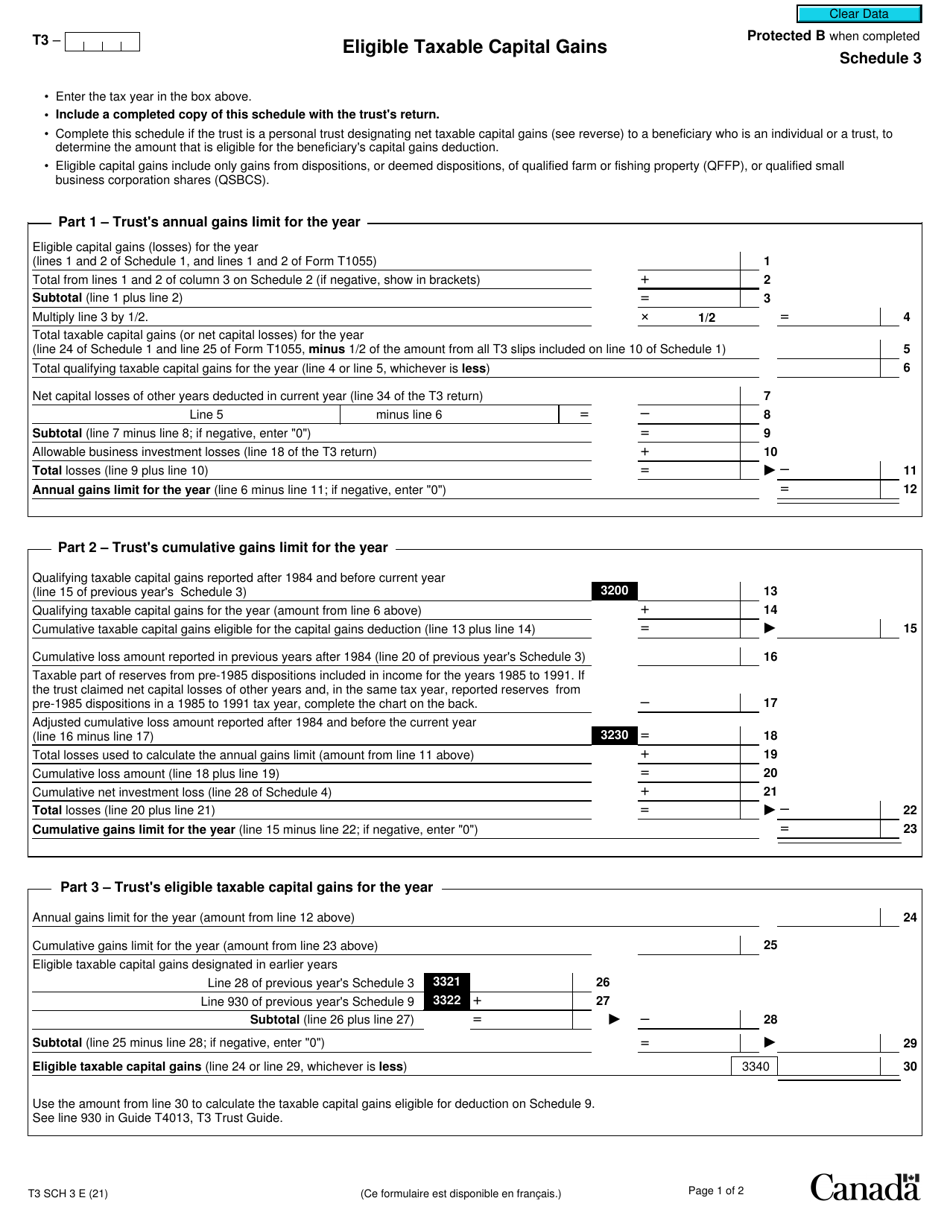

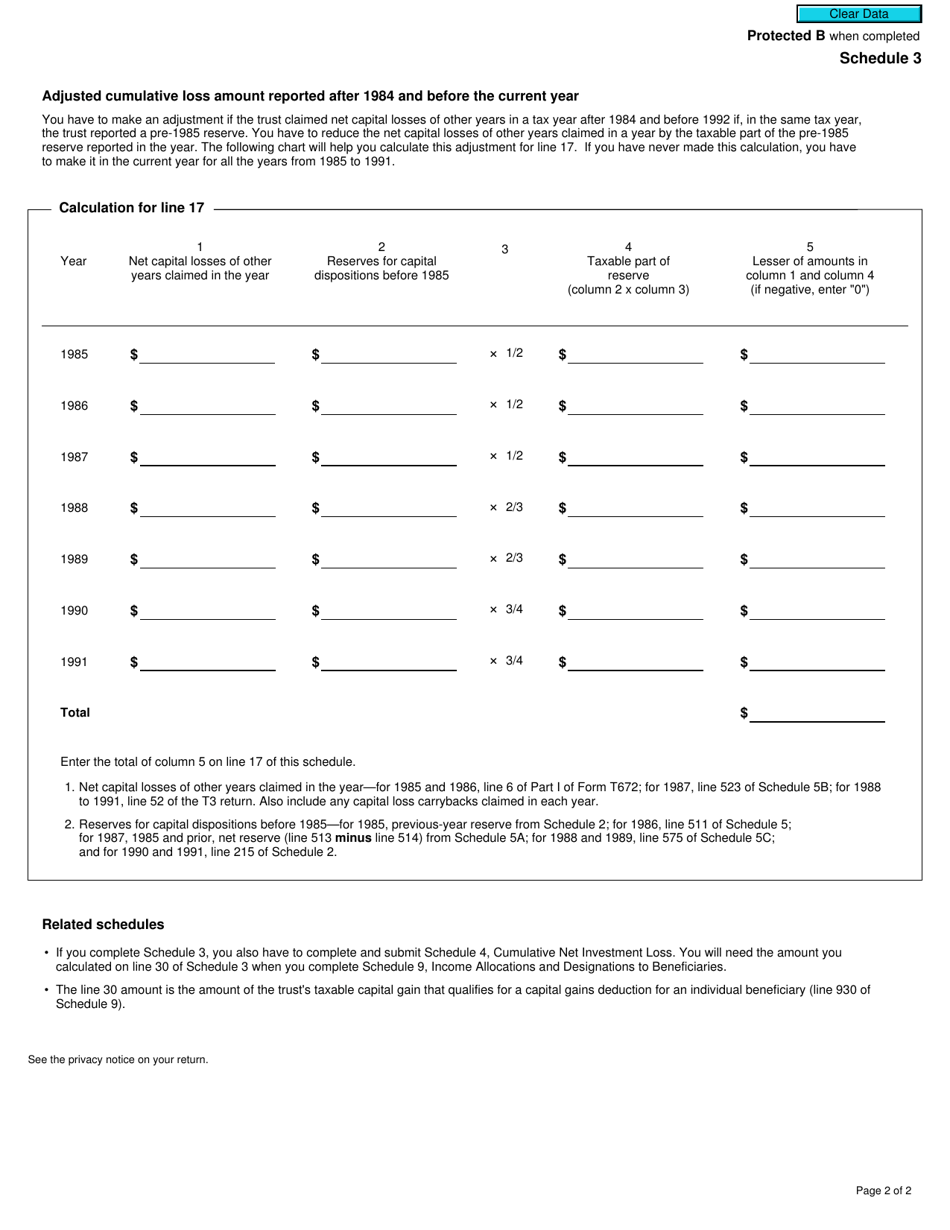

Form T3 Schedule 3

for the current year.

Form T3 Schedule 3 Eligible Taxable Capital Gains - Canada

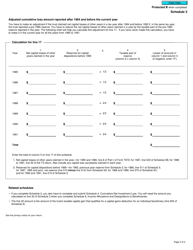

Form T3 Schedule 3, Eligible Taxable Capital Gains, is used in Canada to report and calculate the amount of taxable capital gains from eligible properties held in a trust. It helps determine the tax liability for the trust and is filed along with the T3 Trust Income Tax and Information Return.

In Canada, the Form T3 Schedule 3 for eligible taxable capital gains is filed by individuals or corporations who have received eligible capital gains from sources such as the sale of capital property.

FAQ

Q: What is Form T3 Schedule 3?

A: Form T3 Schedule 3 is a form used in Canada to report eligible taxable capital gains.

Q: What are eligible taxable capital gains?

A: Eligible taxable capital gains are gains from the sale of certain types of property that are subject to tax.

Q: Who needs to file Form T3 Schedule 3?

A: Individuals or entities who have eligible taxable capital gains need to file Form T3 Schedule 3.

Q: How do I fill out Form T3 Schedule 3?

A: You need to provide information about the property sold, the cost or adjusted cost base, and the proceeds of disposition.

Q: When is the deadline to file Form T3 Schedule 3?

A: The deadline to file Form T3 Schedule 3 is the same as the deadline for filing your tax return in Canada.

Q: What happens if I don't file Form T3 Schedule 3?

A: If you have eligible taxable capital gains and don't file Form T3 Schedule 3, you may face penalties and interest charges from the Canada Revenue Agency.

Q: Can I claim any deductions or credits on Form T3 Schedule 3?

A: No, Form T3 Schedule 3 is specifically for reporting eligible taxable capital gains and does not allow for deductions or credits.

Q: Is Form T3 Schedule 3 only for individuals?

A: No, Form T3 Schedule 3 can also be used by estates and trusts to report eligible taxable capital gains.