This version of the form is not currently in use and is provided for reference only. Download this version of

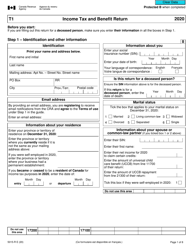

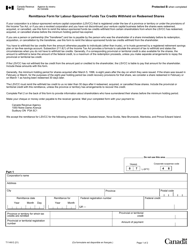

Form T3S

for the current year.

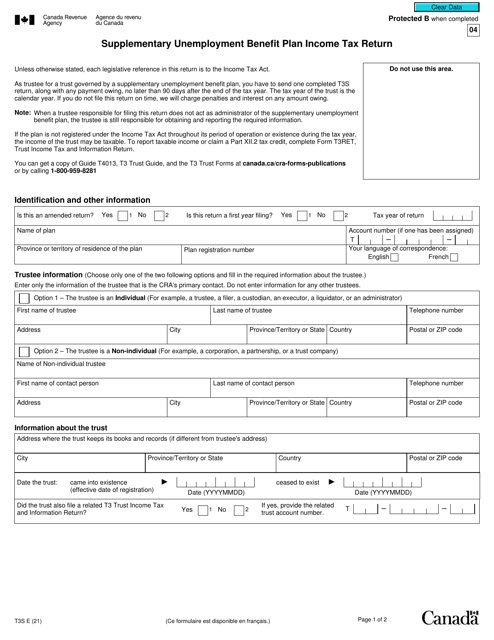

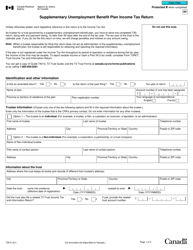

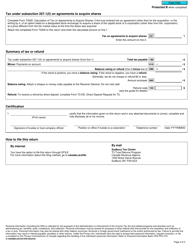

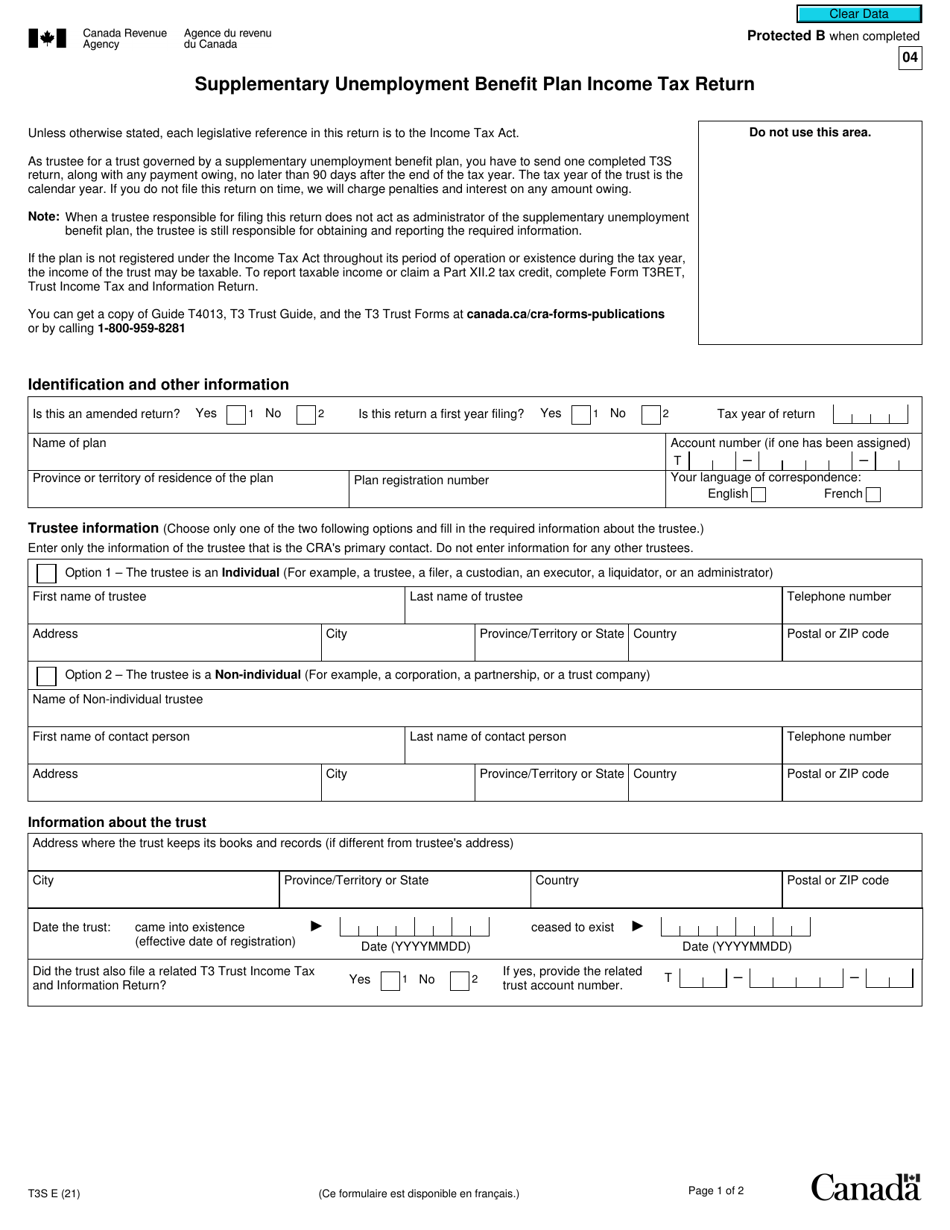

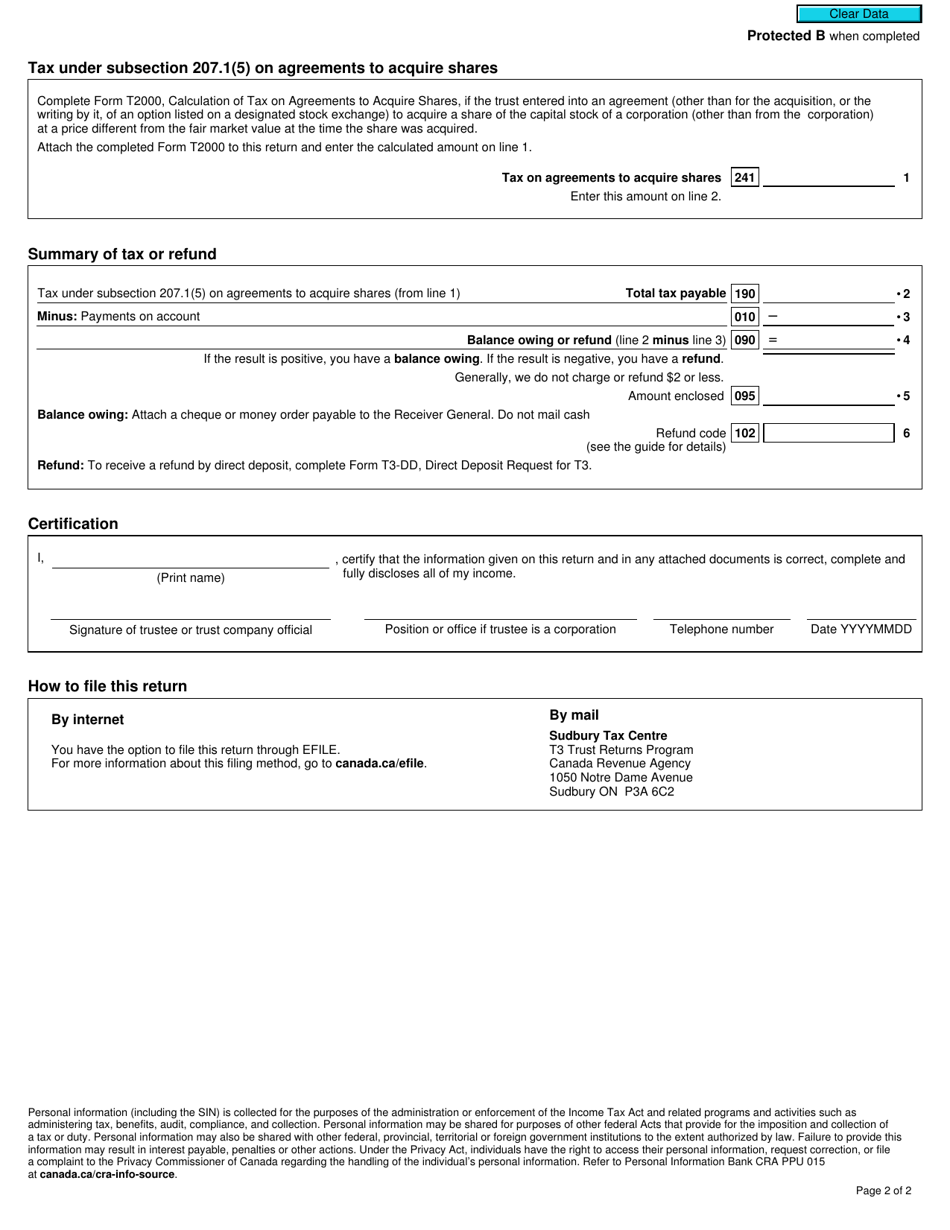

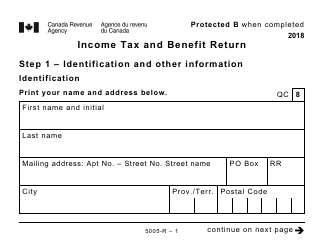

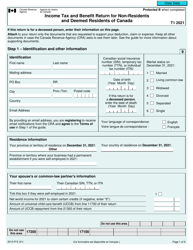

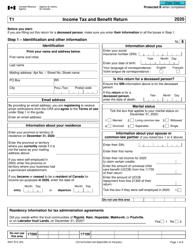

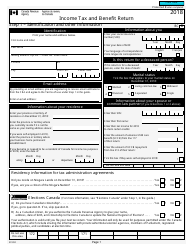

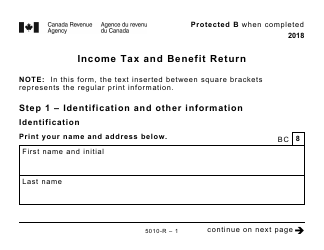

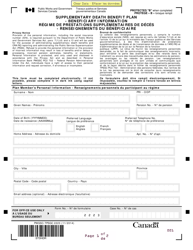

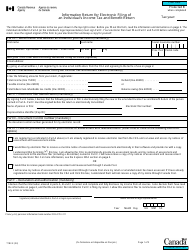

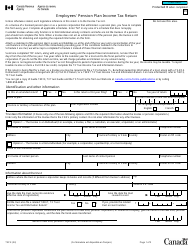

Form T3S Supplementary Unemployment Benefit Plan Income Tax Return - Canada

Form T3S Supplementary Unemployment Benefit Plan Income Tax Return in Canada is used by employers to report the payments made to employees under a supplementary unemployment benefit plan.

The employer or the trust administrator files the Form T3S Supplementary Unemployment Benefit Plan Income Tax Return in Canada.

FAQ

Q: What is the purpose of Form T3S Supplementary Unemployment Benefit Plan Income Tax Return?

A: The purpose of Form T3S is to report income from supplementary unemployment benefit plans in Canada.

Q: Who needs to file Form T3S?

A: Organizations that have established a supplementary unemployment benefit plan in Canada need to file Form T3S.

Q: What income should be reported on Form T3S?

A: All income received by the employees from the supplementary unemployment benefit plans should be reported on Form T3S.

Q: When is Form T3S due?

A: Form T3S is due within 90 days after the end of the tax year of the organization.