This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3-RCA

for the current year.

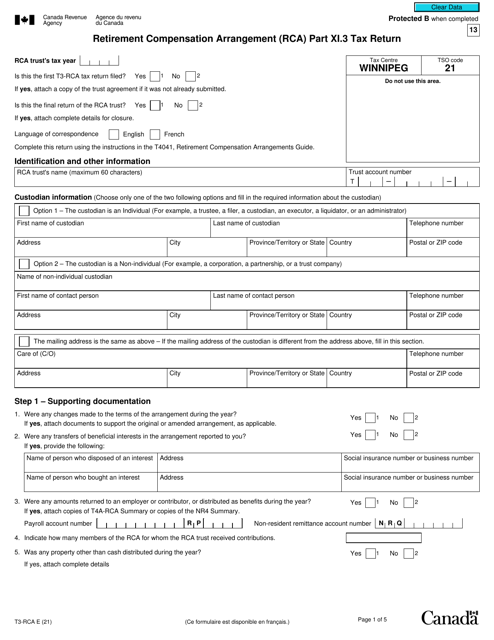

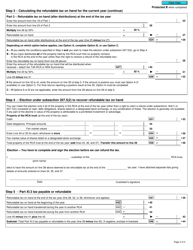

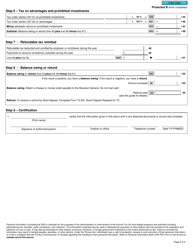

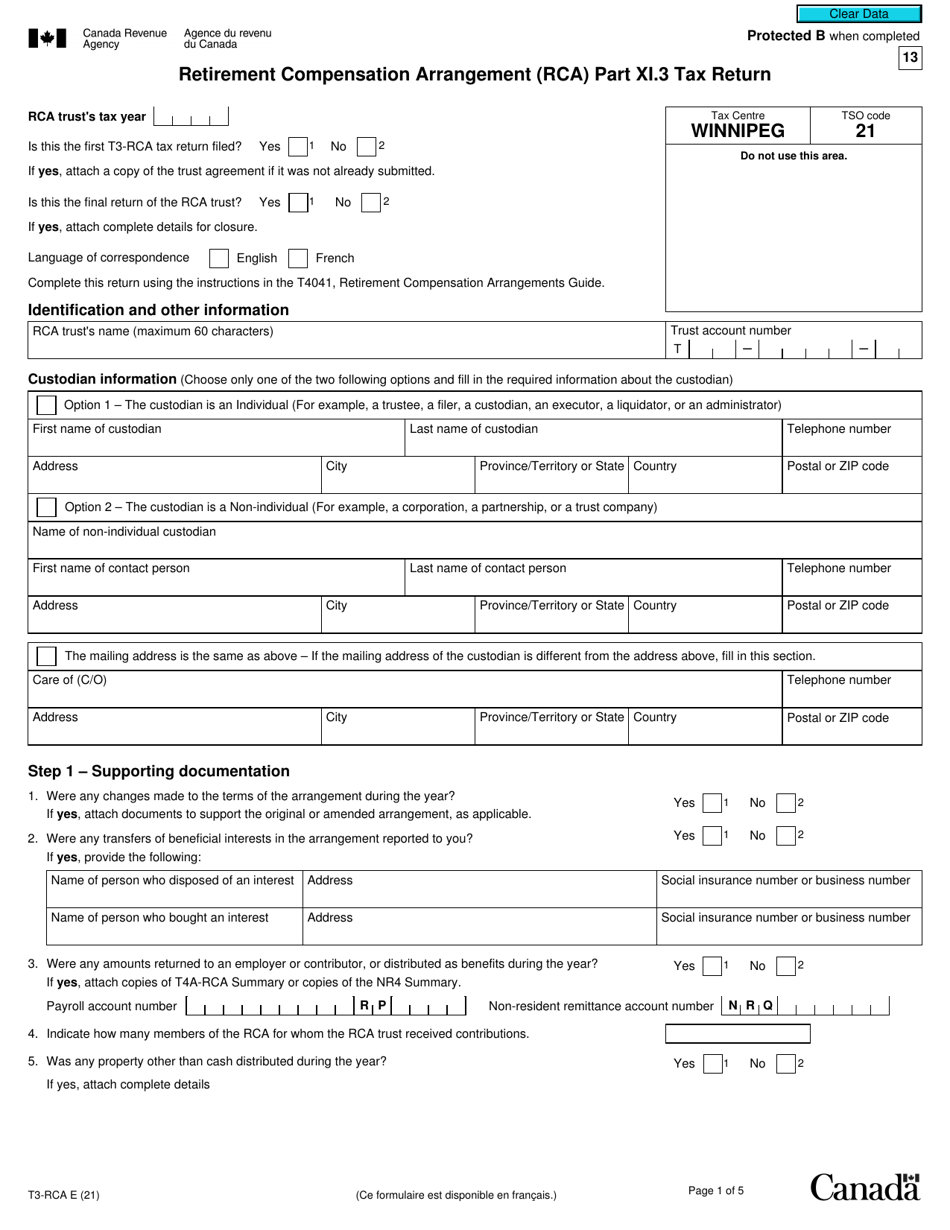

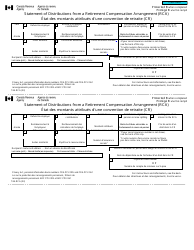

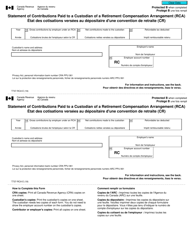

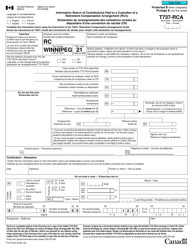

Form T3-RCA Retirement Compensation Arrangement (Rca) Part XI.3 Tax Return - Canada

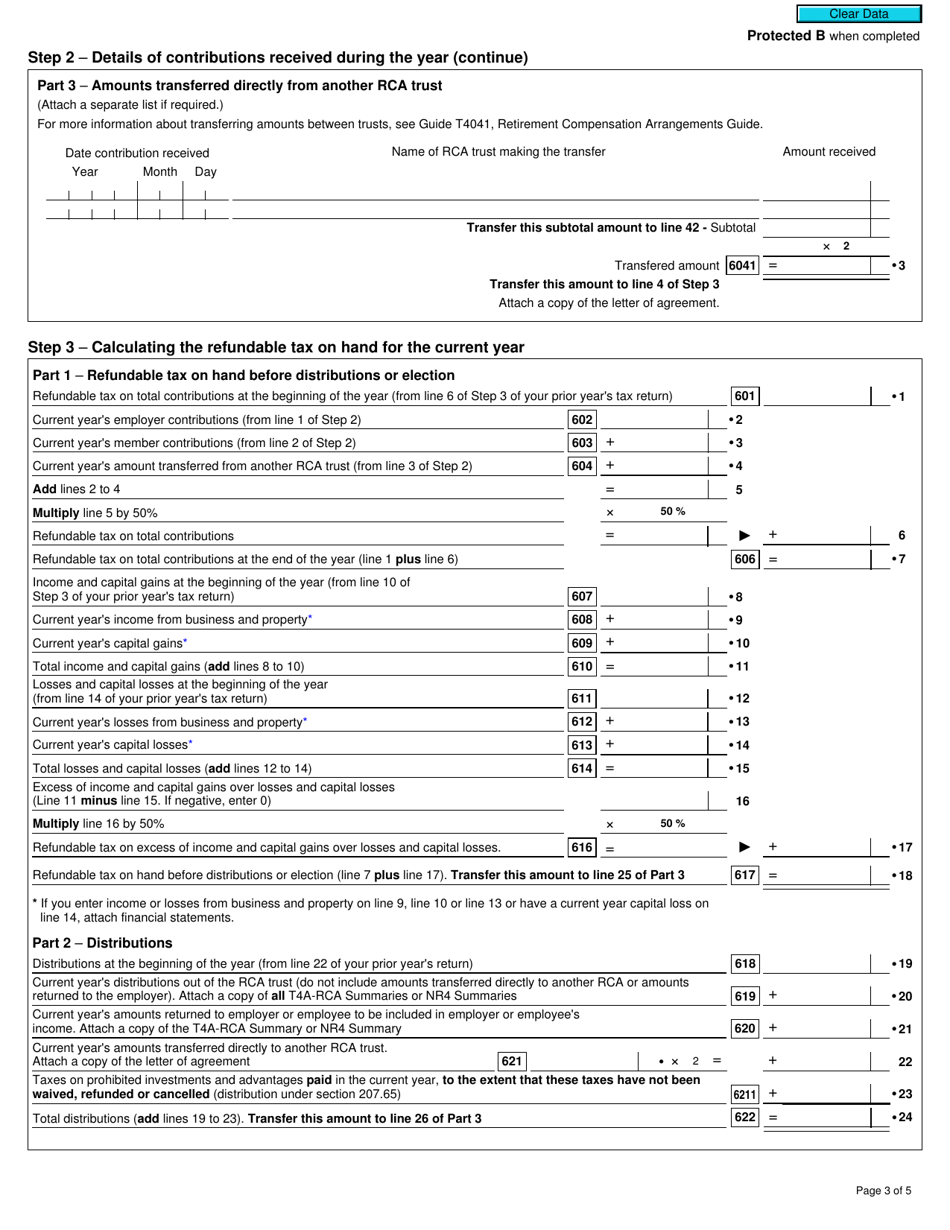

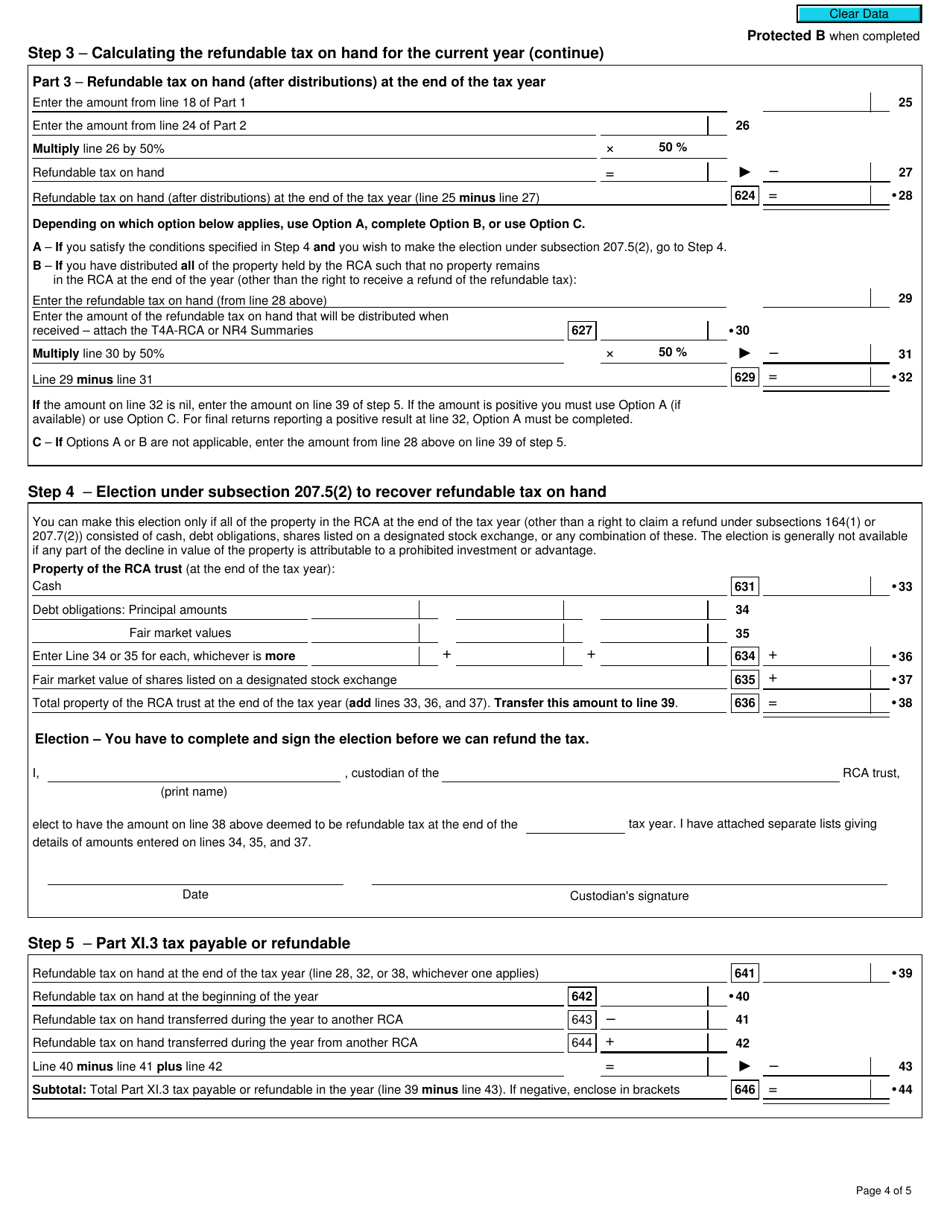

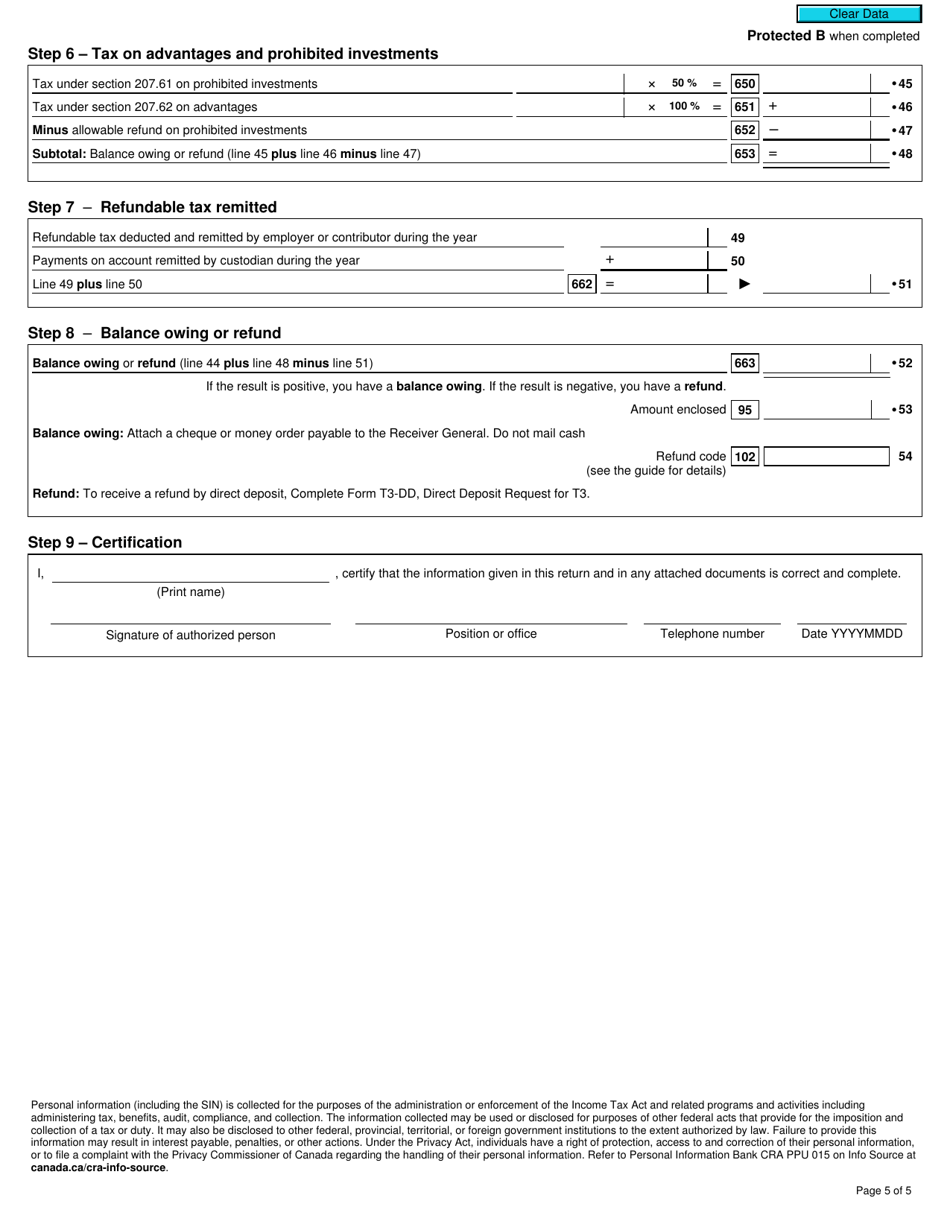

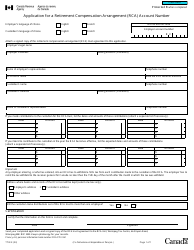

Form T3-RCA (Retirement Compensation Arrangement) Part XI.3 Tax Return is used in Canada to report income earned within a Retirement Compensation Arrangement. An RCA is a type of retirement plan established by an employer. This form is used to calculate and report the tax owed by the plan on its income and the allocated income to the plan's beneficiaries.

The Form T3-RCA Retirement Compensation Arrangement (RCA) Part XI.3 tax return is filed by the individual or entity that administers the RCA in Canada.

FAQ

Q: What is Form T3-RCA?

A: Form T3-RCA is a tax return form specific to Canada, used to report income from Retirement Compensation Arrangements (RCAs).

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of pension plan in Canada, usually set up by employers to provide retirement benefits to their employees.

Q: Who needs to file Form T3-RCA?

A: Individuals or entities who have an RCA and received income from it during the tax year need to file Form T3-RCA.

Q: When is the deadline to file Form T3-RCA?

A: The deadline to file Form T3-RCA is generally 90 days after the end of the tax year.

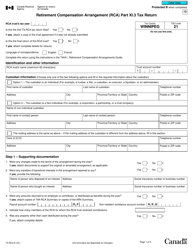

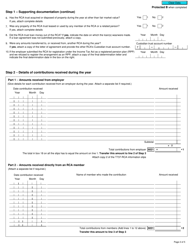

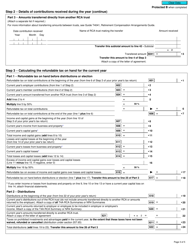

Q: What information is required to complete Form T3-RCA?

A: Form T3-RCA requires information about the RCA itself, such as the plan number, as well as details about the income received and any taxes paid.

Q: Are there any penalties for late filing of Form T3-RCA?

A: Yes, there may be penalties for late filing of Form T3-RCA. It is important to file the form on time to avoid any potential penalties or interest charges.