This version of the form is not currently in use and is provided for reference only. Download this version of

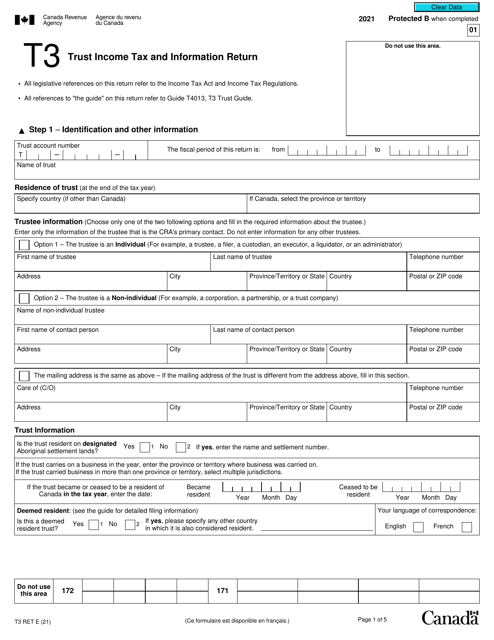

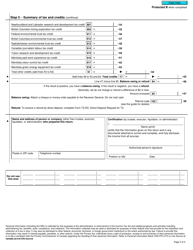

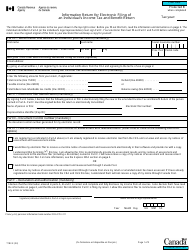

Form T3 RET

for the current year.

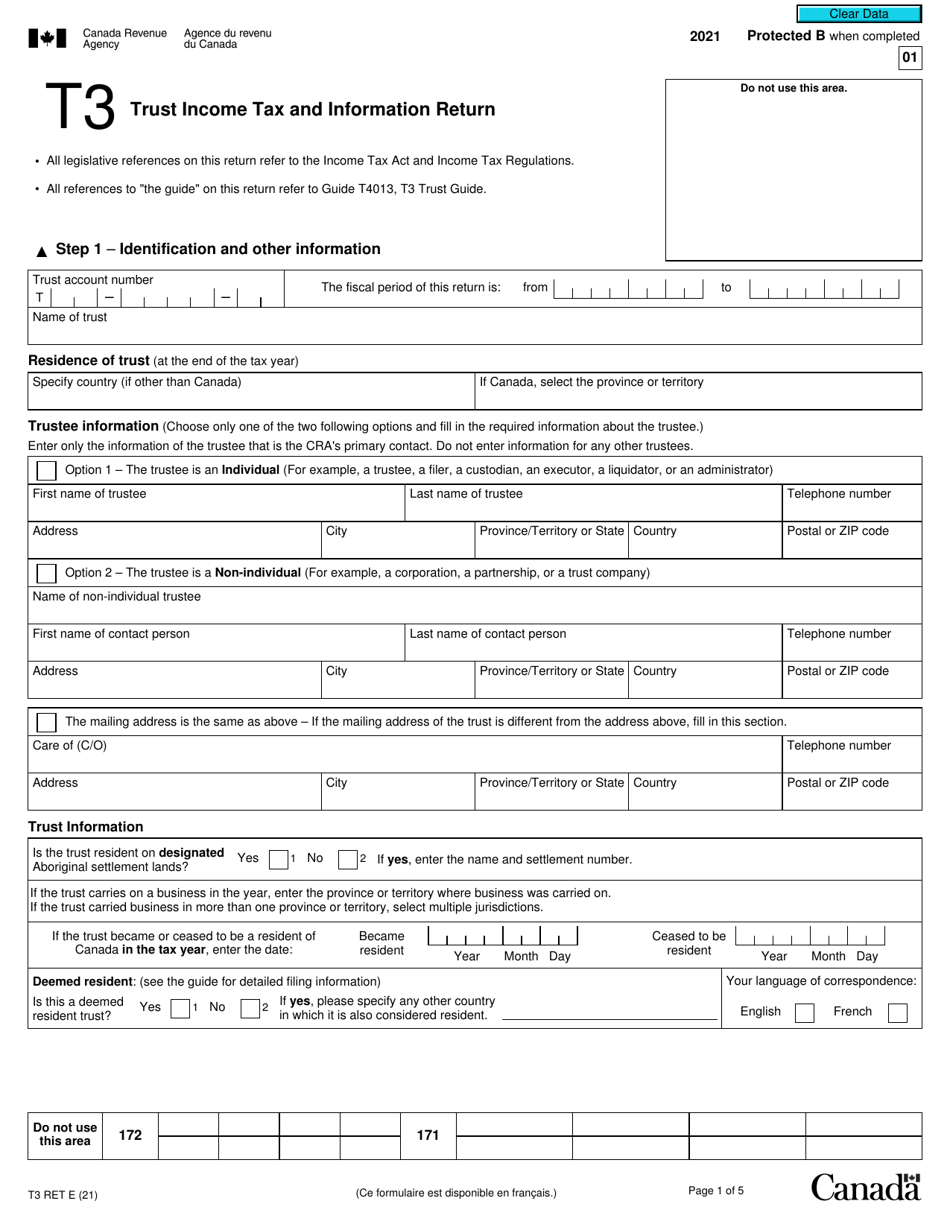

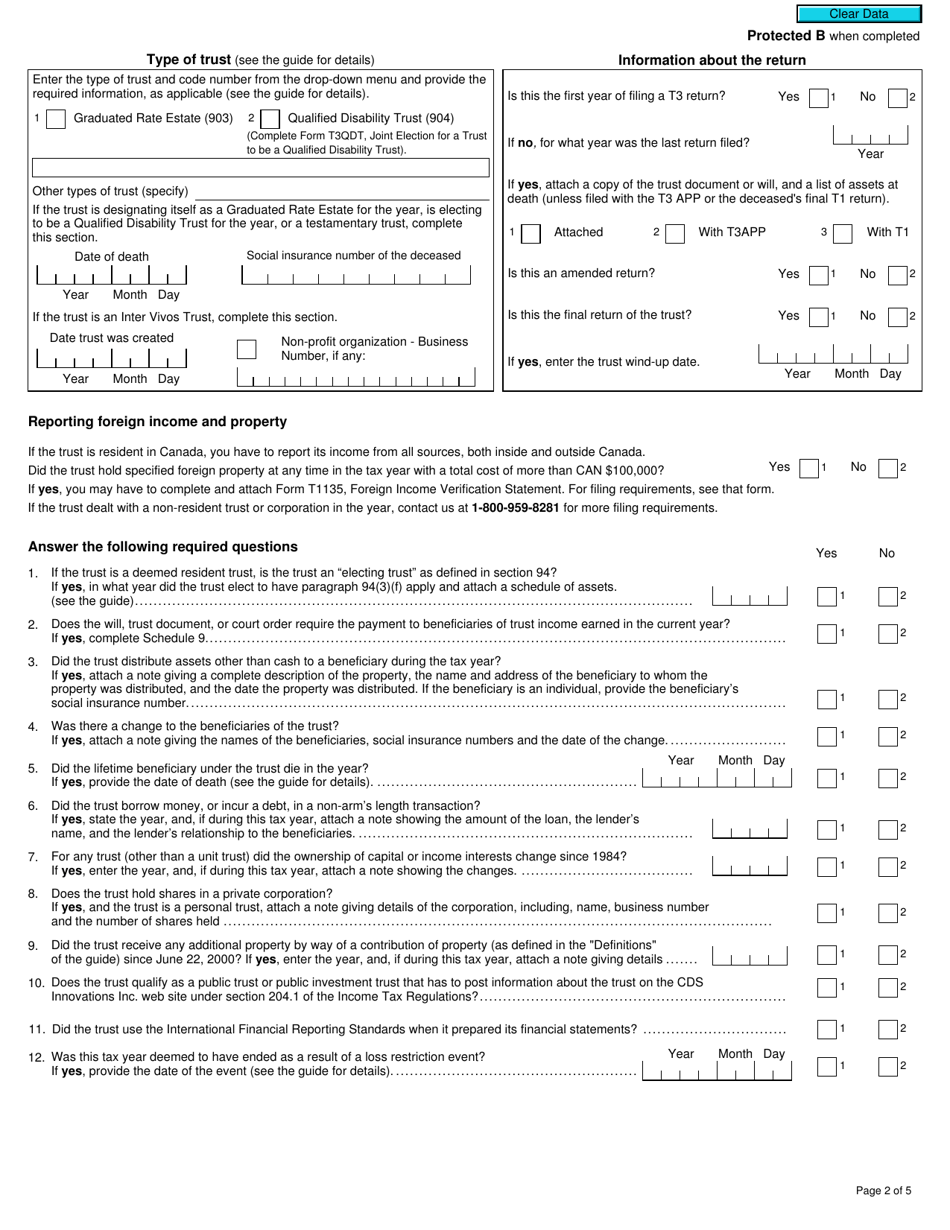

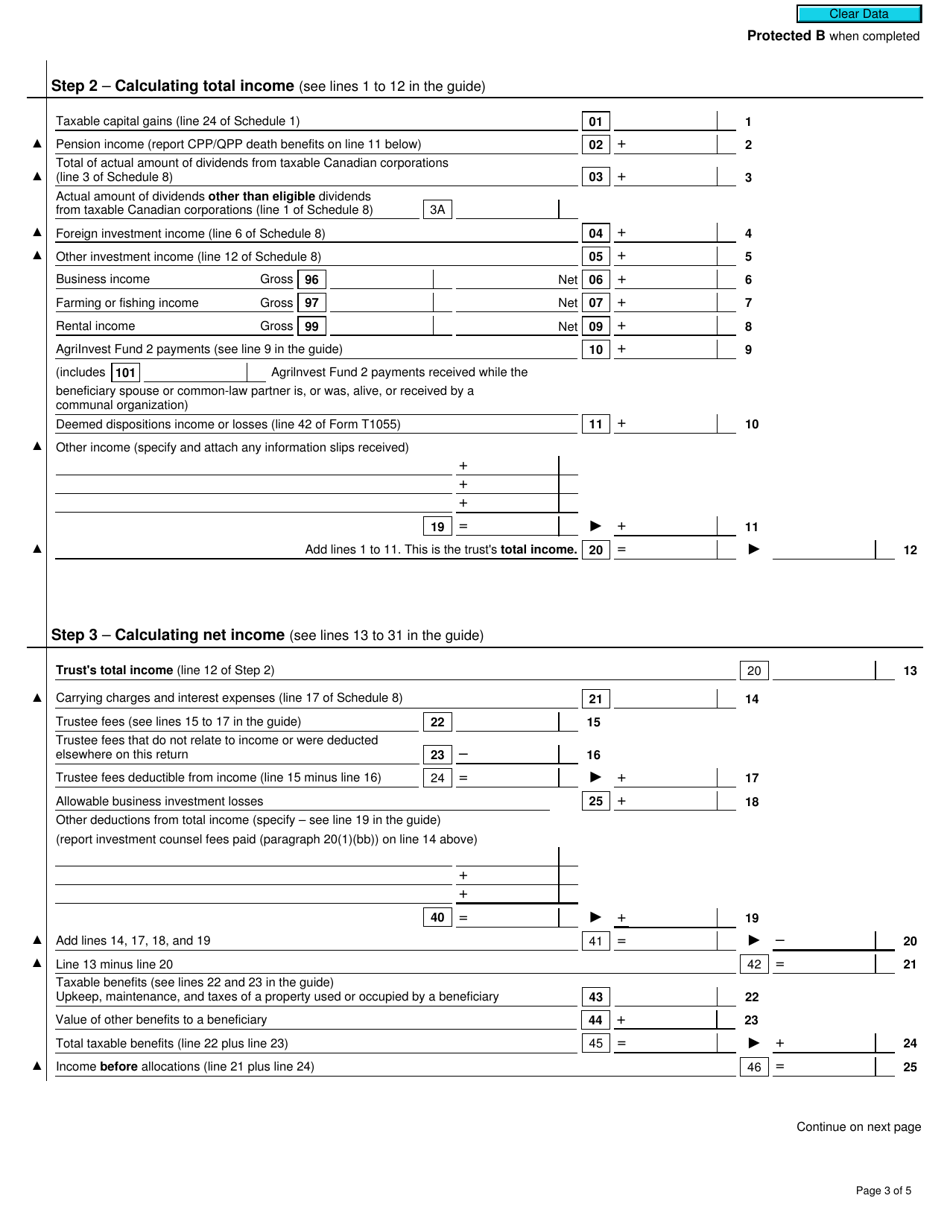

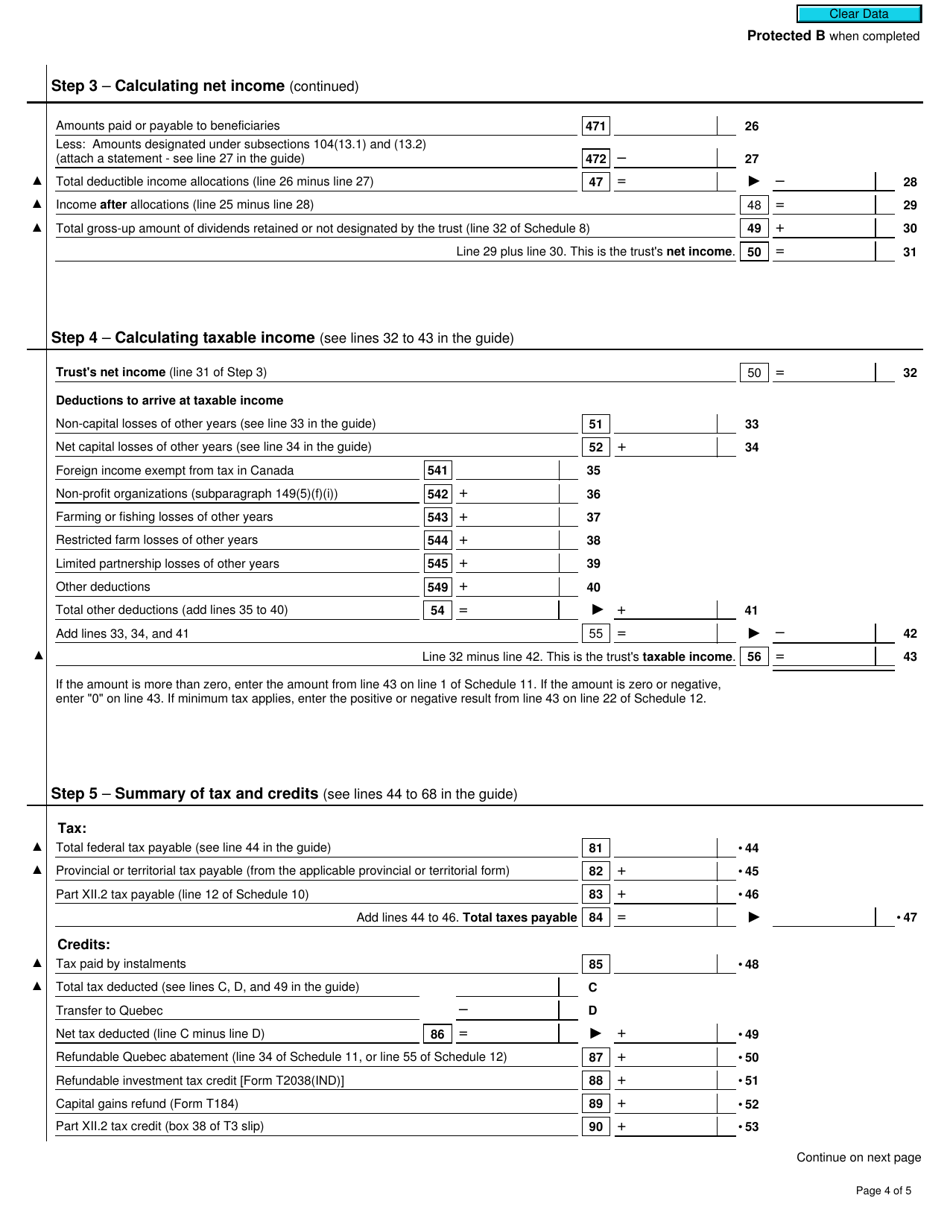

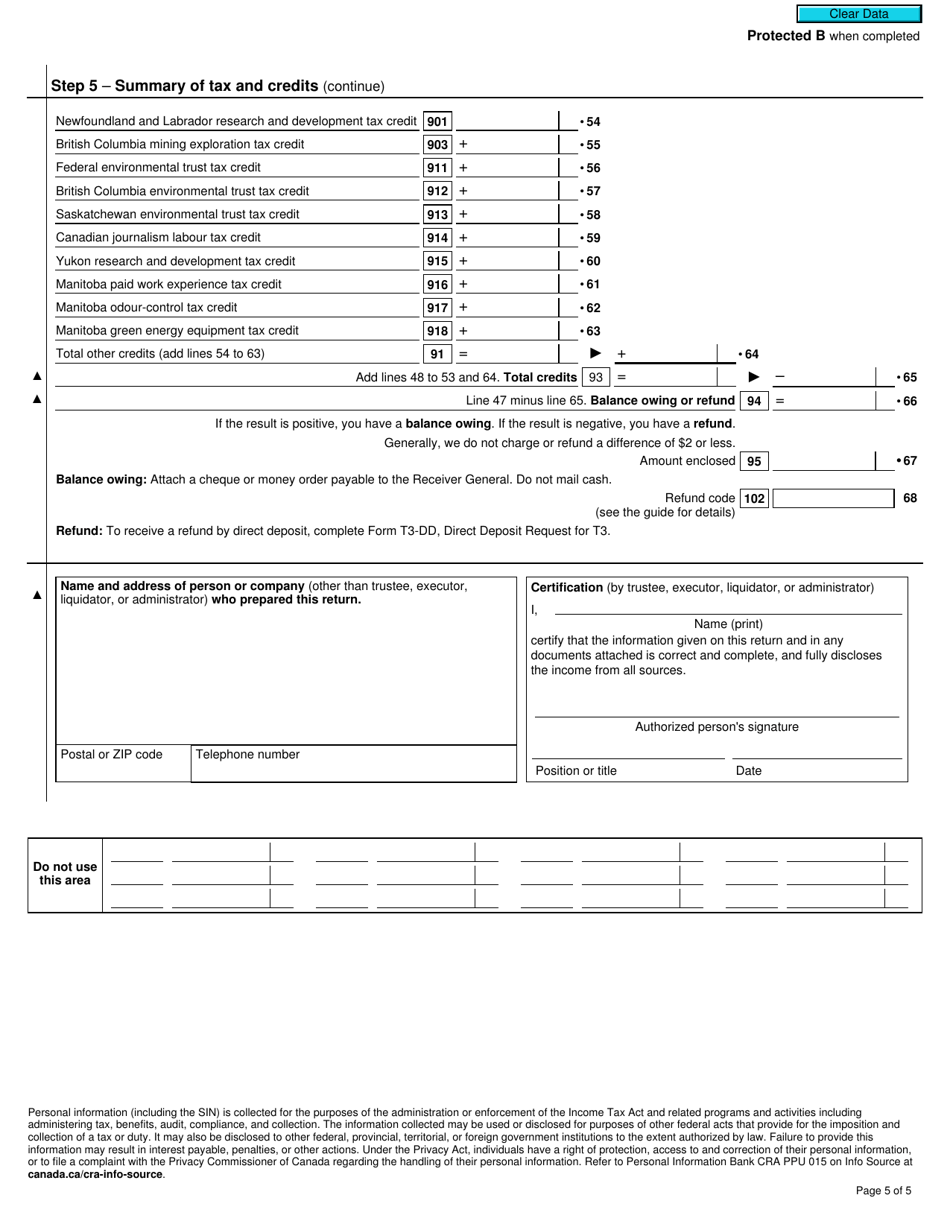

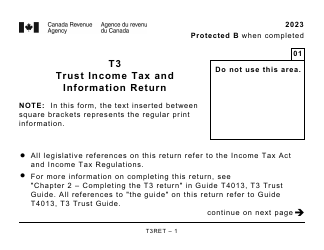

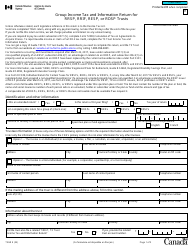

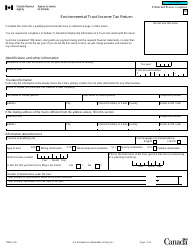

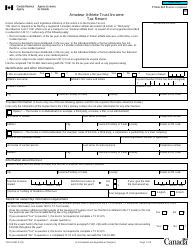

Form T3 RET Trust Income Tax and Information Return - Canada

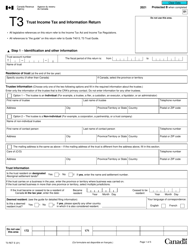

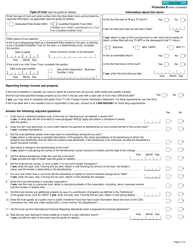

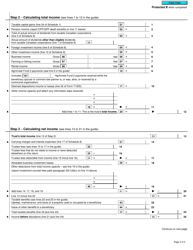

Form T3 RET Trust Income Tax and Information Return is used in Canada for reporting the income, deductions, and taxes of a trust. It is filed by the trustees of the trust to report the financial transactions of the trust and calculate the tax liability.

The Form T3 RET Trust Income Tax and Information Return is filed by Canadian trusts.

FAQ

Q: What is Form T3 RET?

A: Form T3 RET is the Trust Income Tax and Information Return form used in Canada.

Q: Who needs to file Form T3 RET?

A: Trusts in Canada that have income or are in the process of liquidating or terminating need to file Form T3 RET.

Q: When is Form T3 RET due?

A: Form T3 RET is due within 90 days after the end of the tax year for the trust.

Q: What information is required for Form T3 RET?

A: Form T3 RET requires information about the trust's income, expenses, assets, and distributions.