This version of the form is not currently in use and is provided for reference only. Download this version of

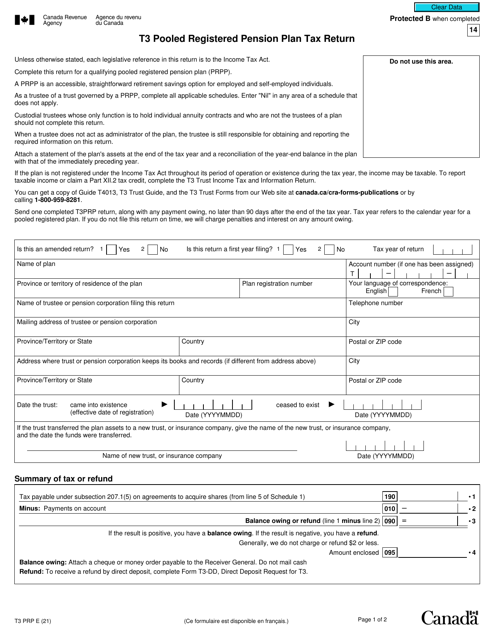

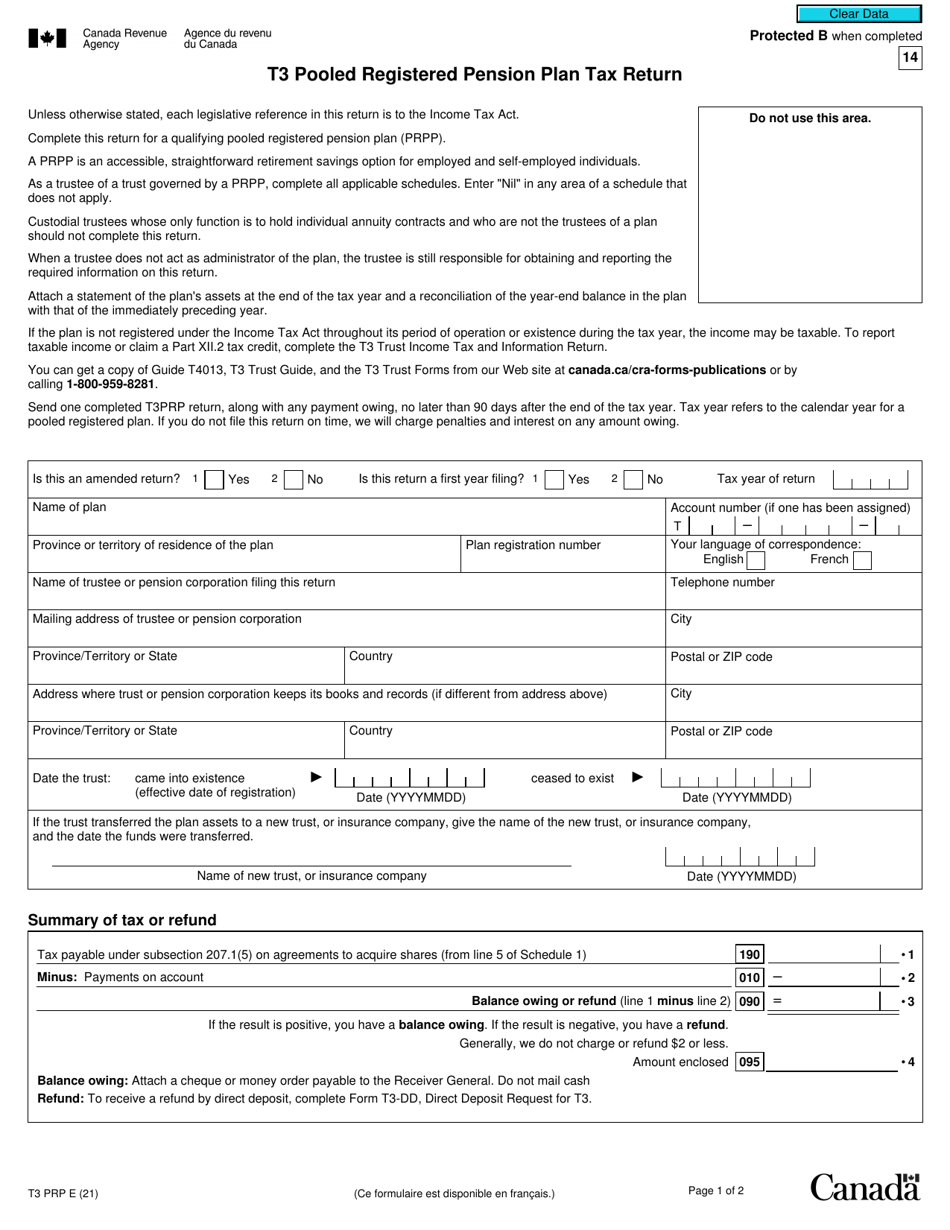

Form T3 PRP

for the current year.

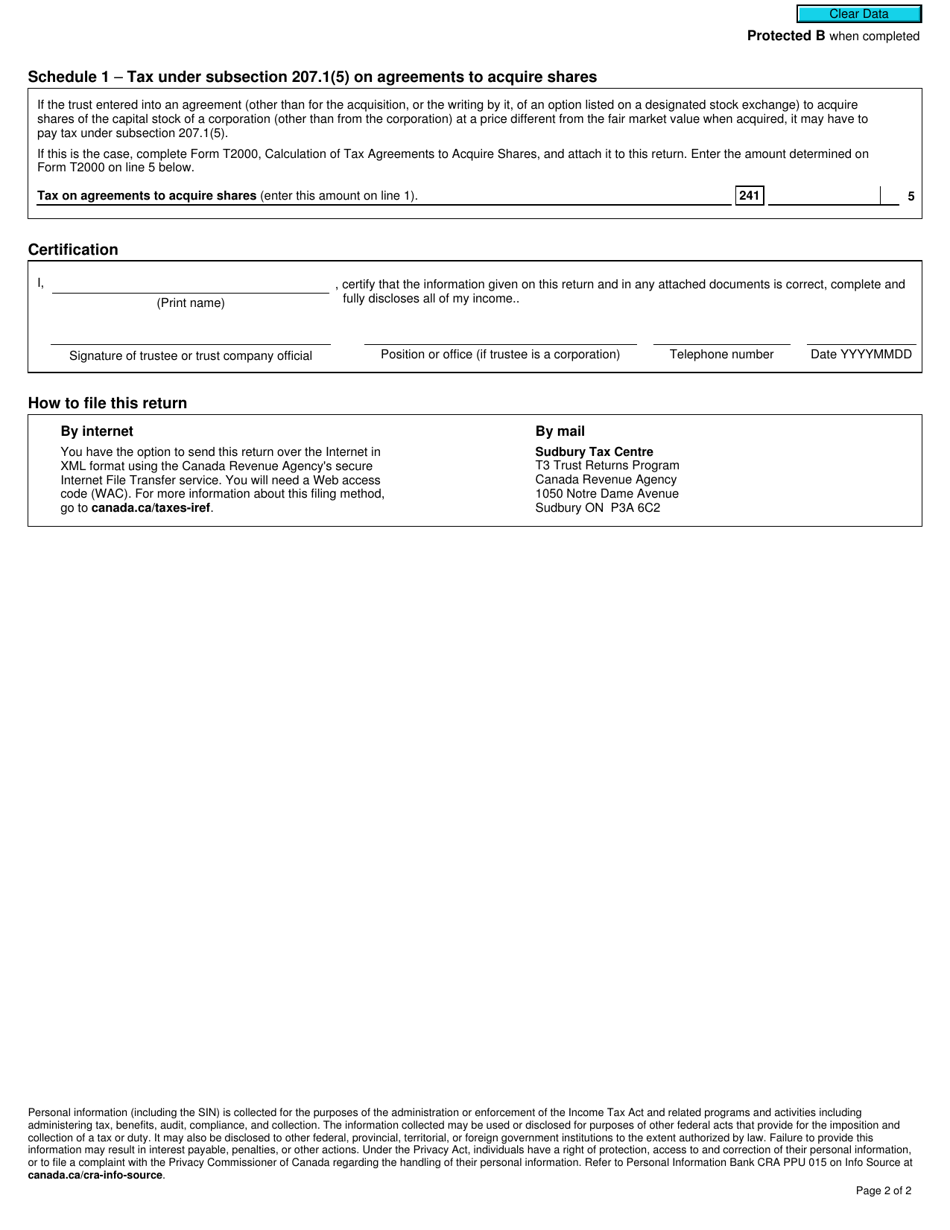

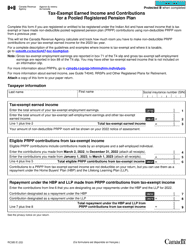

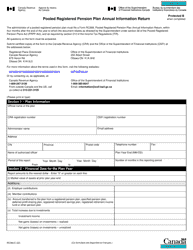

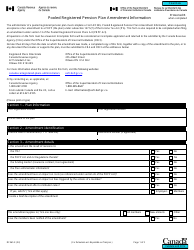

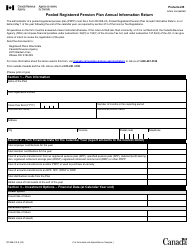

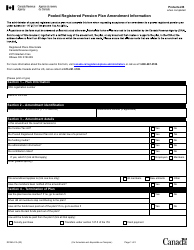

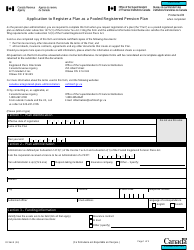

Form T3 PRP T3 Pooled Registered Pension Plan Tax Return - Canada

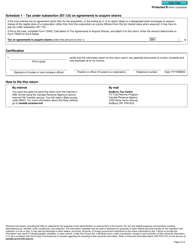

Form T3 PRP is a tax return form in Canada that is used specifically for Pooled Registered Pension Plans (PRPs). The PRP is a type of retirement savings plan offered by some employers or financial institutions. This form is used to report income, deductions, and taxes related to PRPs.

The administrator of the Pooled Registered Pension Plan (PRPP) files the Form T3 PRP T3 Pooled Registered Pension Plan Tax Return in Canada.

FAQ

Q: What is a T3 PRP?

A: A T3 PRP is the T3 tax return form for Pooled Registered Pension Plans (PRP) in Canada.

Q: Who needs to file a T3 PRP?

A: Anyone who administers a PRP must file a T3 PRP tax return.

Q: What information is required on the T3 PRP?

A: The T3 PRP requires information such as the plan's income, expenses, and member details.

Q: When is the deadline to file a T3 PRP?

A: The deadline to file a T3 PRP tax return is 90 days after the end of the plan's fiscal year.

Q: Are there any penalties for late filing of the T3 PRP?

A: Yes, there are penalties for late filing of the T3 PRP tax return.

Q: Is there any tax payable on the T3 PRP?

A: Yes, there may be tax payable on the T3 PRP depending on the plan's income and deductions.