This version of the form is not currently in use and is provided for reference only. Download this version of

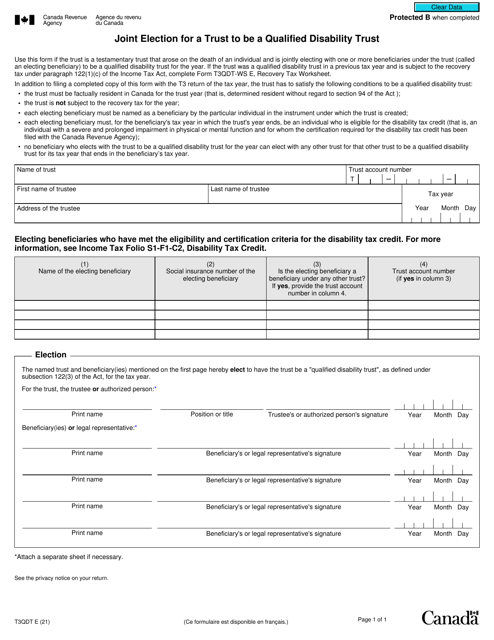

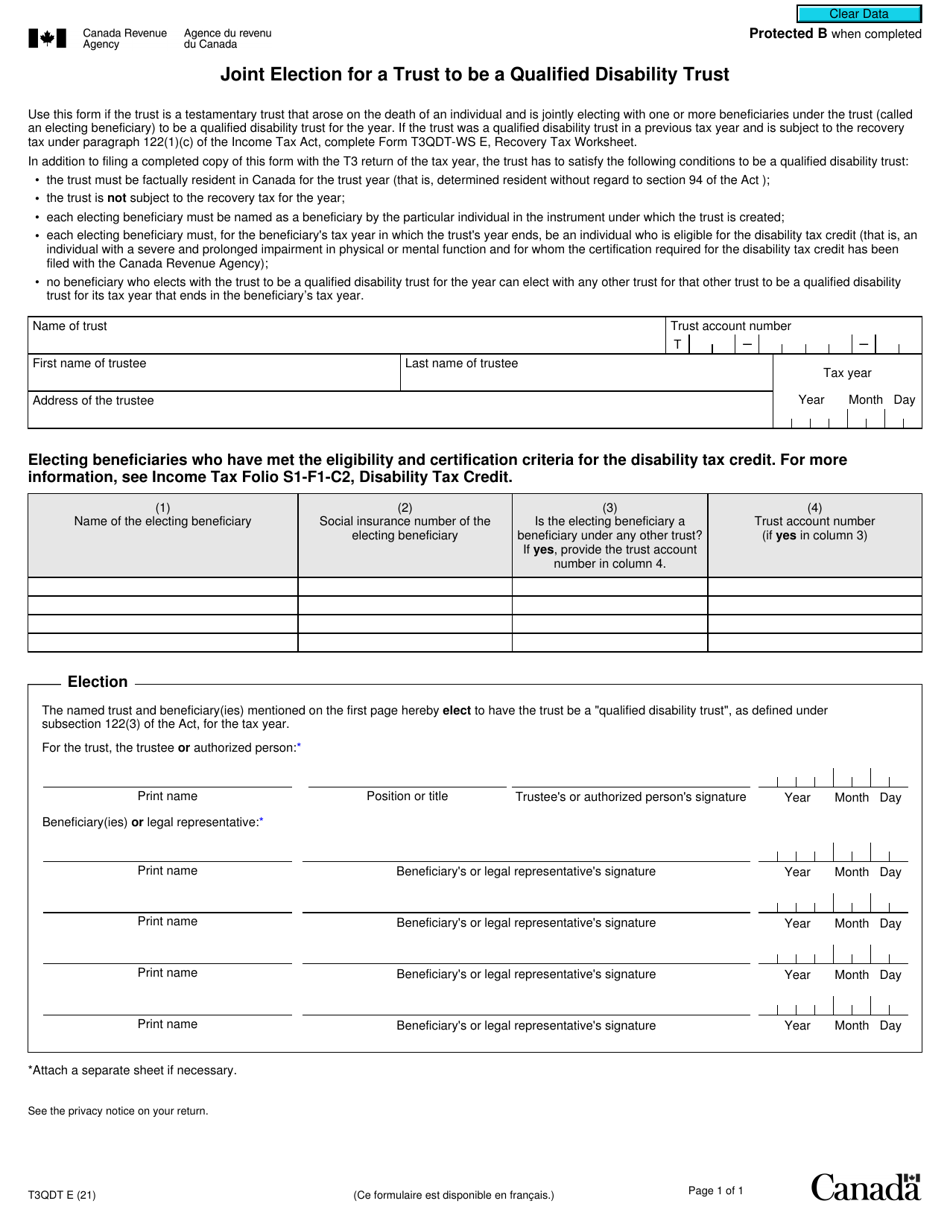

Form T3QDT

for the current year.

Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust - Canada

The Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust in Canada is used to make a joint election by a trust and a beneficiary to have the trust qualify as a Qualified Disability Trust (QDT) for tax purposes. A QDT is a special type of trust that is eligible for certain tax benefits when it has at least one beneficiary who is eligible for the Disability Tax Credit.

The form T3QDT Joint Election for a Trust to be a Qualified Disability Trust in Canada is typically filed jointly by the trustee(s) and the beneficiary of the trust.

FAQ

Q: What is a Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust?

A: Form T3QDT is a joint election made by a trust and a beneficiary to designate the trust as a Qualified Disability Trust (QDT) for tax purposes in Canada.

Q: What is a Qualified Disability Trust (QDT)?

A: A Qualified Disability Trust (QDT) is a type of trust in Canada that allows certain tax benefits for a beneficiary who has a severe and prolonged mental or physical impairment.

Q: Who can use Form T3QDT Joint Election?

A: Both the trust and the beneficiary must meet specific criteria outlined by the Canada Revenue Agency (CRA) to use Form T3QDT Joint Election.

Q: What are the benefits of designating a trust as a Qualified Disability Trust?

A: Designating a trust as a Qualified Disability Trust can provide tax advantages, such as eligibility for the Graduated Rate Estate tax rates and the ability to claim the Canada Caregiver Credit.

Q: Are there any deadlines for submitting Form T3QDT Joint Election?

A: Yes, the joint election must typically be filed no later than 90 days after the end of the calendar year in which the trust becomes a Qualified Disability Trust.

Q: Can a trust be designated as a Qualified Disability Trust retroactively?

A: In some cases, the CRA may allow retroactive designation of a trust as a Qualified Disability Trust, but there are specific rules and conditions that must be met for retroactive designation.

Q: Do I need to consult a tax professional when completing Form T3QDT Joint Election?

A: It is recommended to consult a tax professional or seek professional tax advice when completing Form T3QDT Joint Election to ensure compliance with the CRA guidelines and to maximize the tax benefits available.

Q: Are there any ongoing reporting requirements for trusts designated as Qualified Disability Trusts?

A: Yes, trusts designated as Qualified Disability Trusts are required to meet certain reporting obligations, including filing an annual T3 Trust Income Tax and Information Return with the CRA.