This version of the form is not currently in use and is provided for reference only. Download this version of

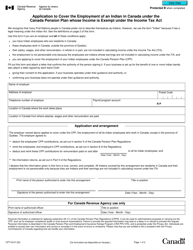

Form T3P

for the current year.

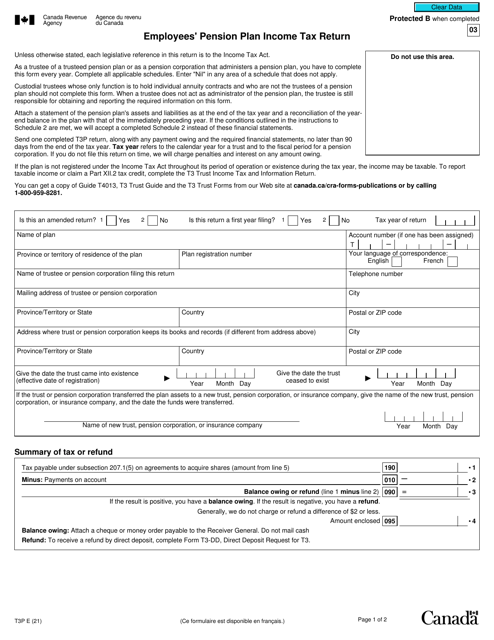

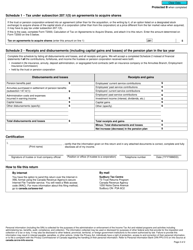

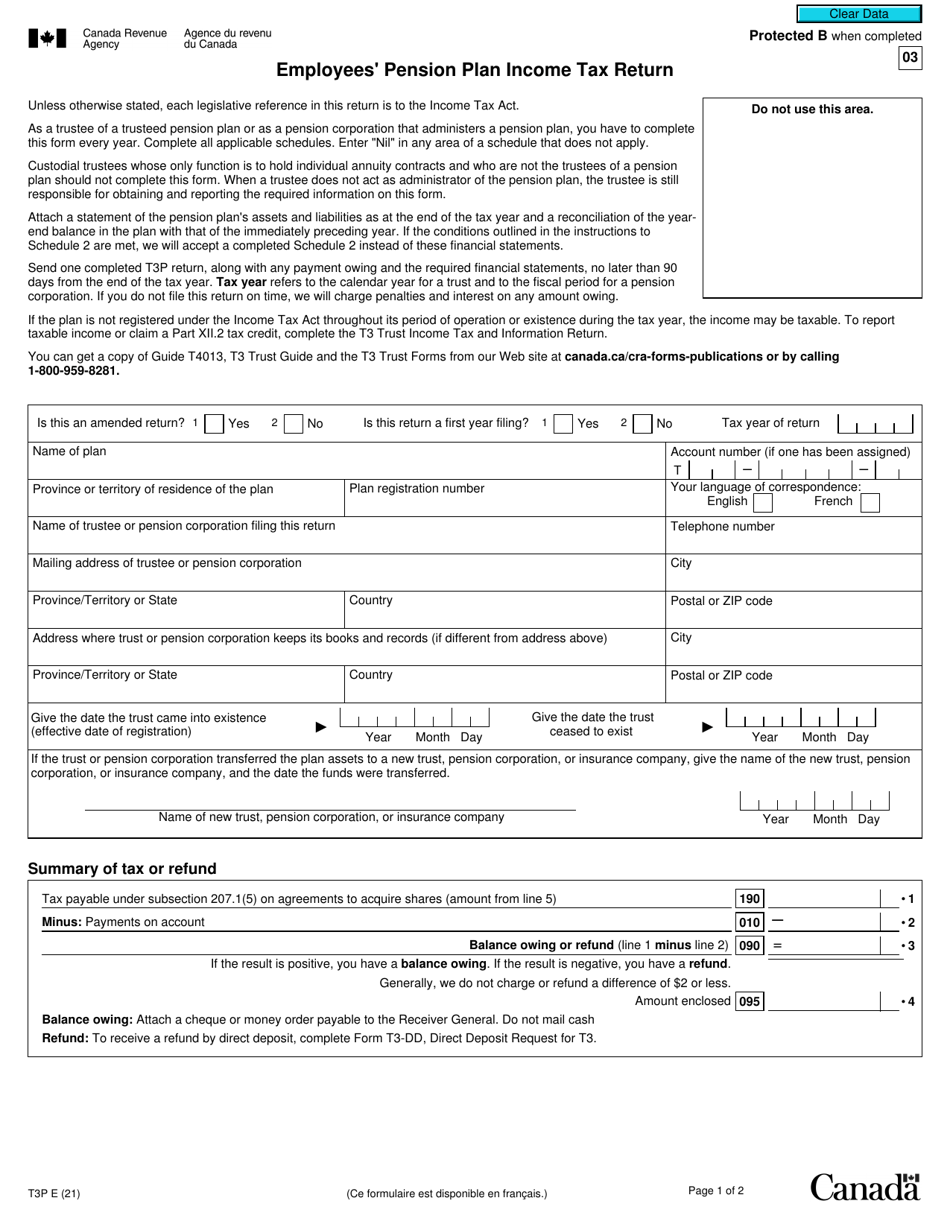

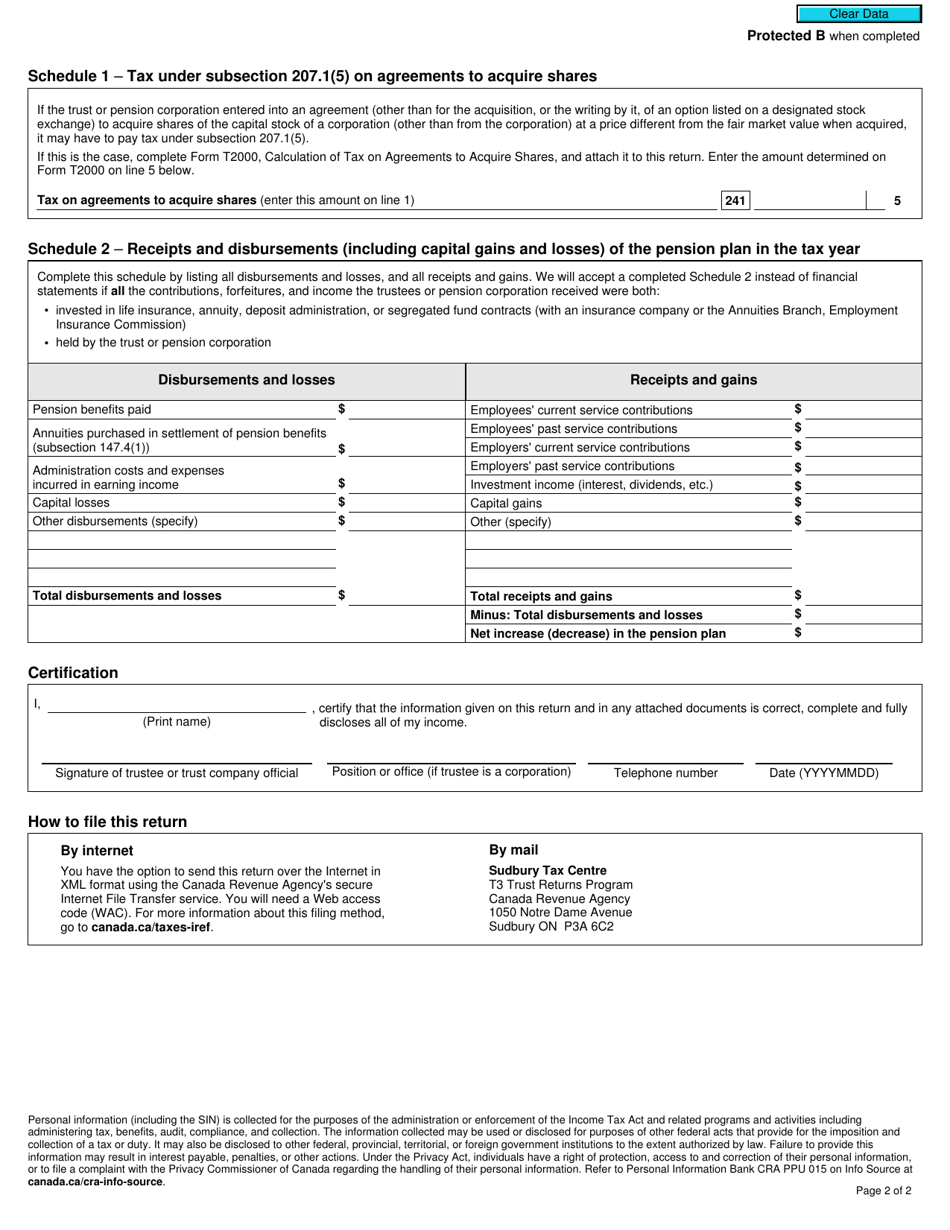

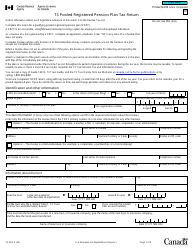

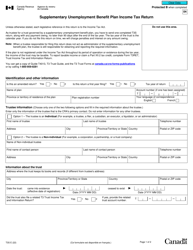

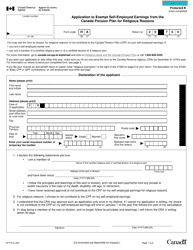

Form T3P Employees' Pension Plan Income Tax Return - Canada

Form T3P, Employees' Pension Plan Income Tax Return in Canada, is used by employers that have a registered pension plan to report the income and deductions related to the plan. It allows employers to calculate and report their pension plan income and ensure they are compliant with Canadian tax laws.

The employer or plan administrator files the Form T3P Employees' Pension Plan Income Tax Return in Canada.

FAQ

Q: What is Form T3P?

A: Form T3P is the income tax return for the Employees' Pension Plan in Canada.

Q: Who should file Form T3P?

A: Employers who have an employees' pension plan should file Form T3P.

Q: What is the purpose of Form T3P?

A: The purpose of Form T3P is to report the income and deductions related to an employees' pension plan.

Q: When is the deadline to file Form T3P?

A: The deadline to file Form T3P is typically March 31st of each year.

Q: Is there a penalty for late filing of Form T3P?

A: Yes, there may be penalties for late filing of Form T3P. It is important to file on time to avoid any penalties.