This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3ON

for the current year.

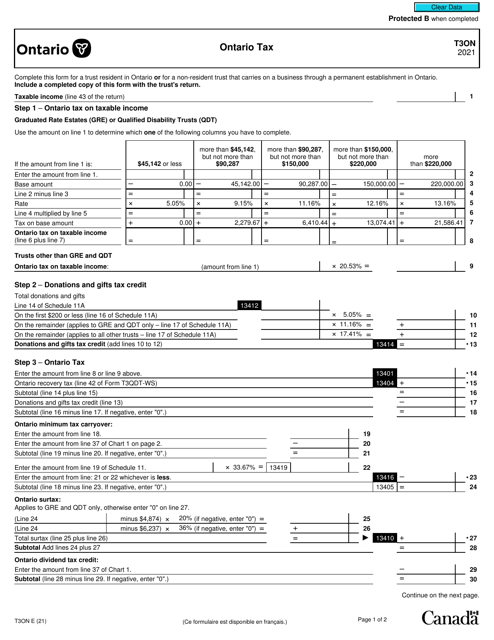

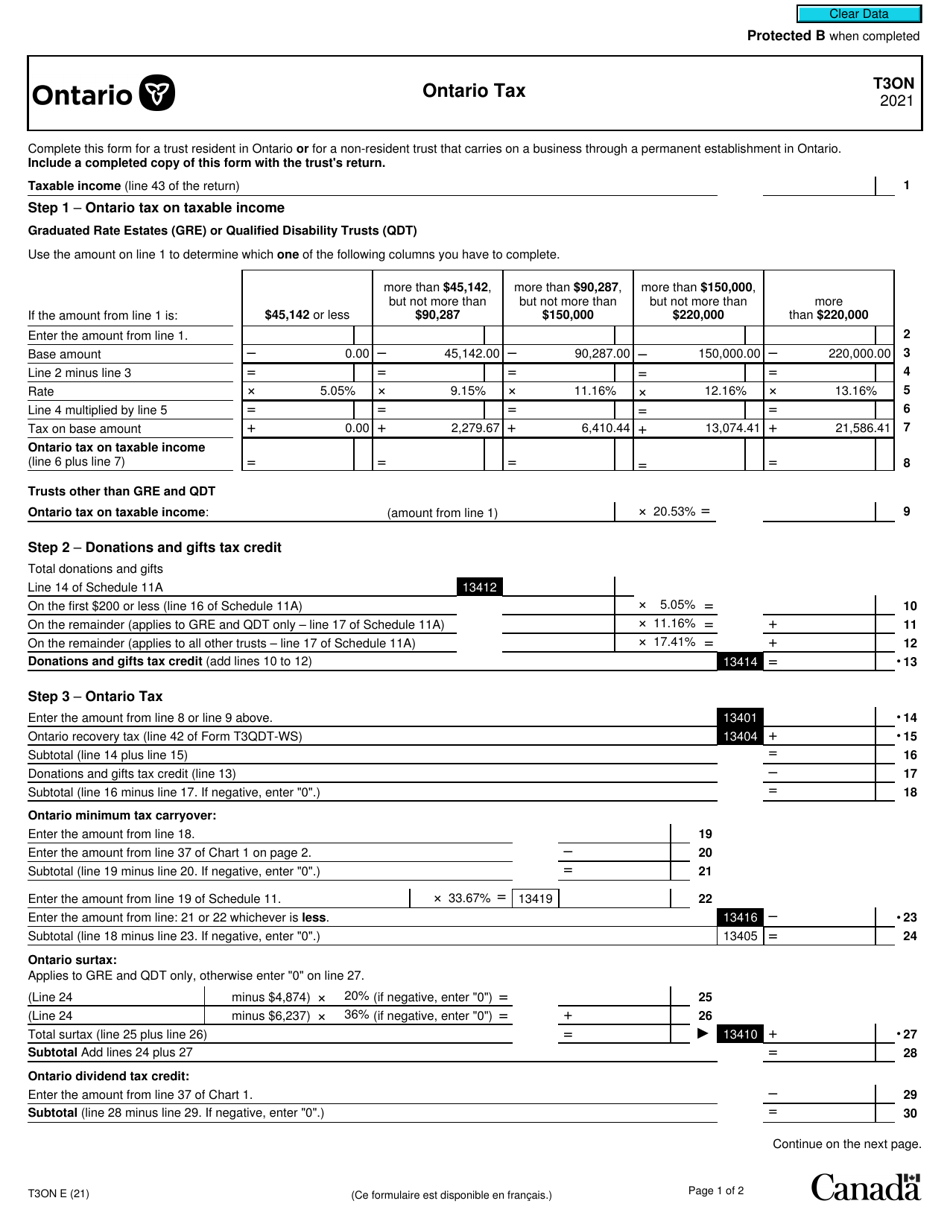

Form T3ON Ontario Tax - Canada

Form T3ON, also known as the Ontario Tax - Canada form, is used to report and pay provincial income tax in the province of Ontario, Canada. It is specifically for individuals or businesses that have earned income in Ontario and need to fulfill their tax obligations to the provincial government.

The Form T3ON Ontario Tax is typically filed by individuals who are residents of Ontario and need to report their taxes to the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T3ON?

A: Form T3ON is a tax form used in Ontario, Canada.

Q: What is Form T3ON used for?

A: Form T3ON is used to report income and calculate taxes owed for residents in Ontario.

Q: Who needs to file Form T3ON?

A: Residents of Ontario who have taxable income and meet certain criteria need to file Form T3ON.

Q: When is Form T3ON due?

A: Form T3ON is generally due on or before April 30 of each year.

Q: What if I need help with Form T3ON?

A: If you need help with Form T3ON, you can contact the Canada Revenue Agency (CRA) or consult a tax professional.

Q: Can I file Form T3ON electronically?

A: Yes, you can file Form T3ON electronically using the Netfile system or through approved tax software.

Q: What happens if I don't file Form T3ON?

A: If you don't file Form T3ON on time, you may face penalties and interest charges from the Canada Revenue Agency (CRA).

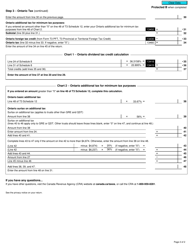

Q: Are there any deductions or credits available on Form T3ON?

A: Yes, there are various deductions and credits available on Form T3ON, such as the Ontario Trillium Benefit and the Northern Ontario Energy Credit.