This version of the form is not currently in use and is provided for reference only. Download this version of

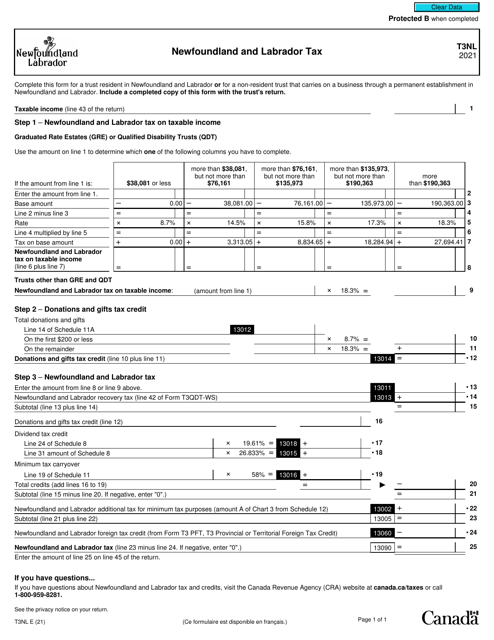

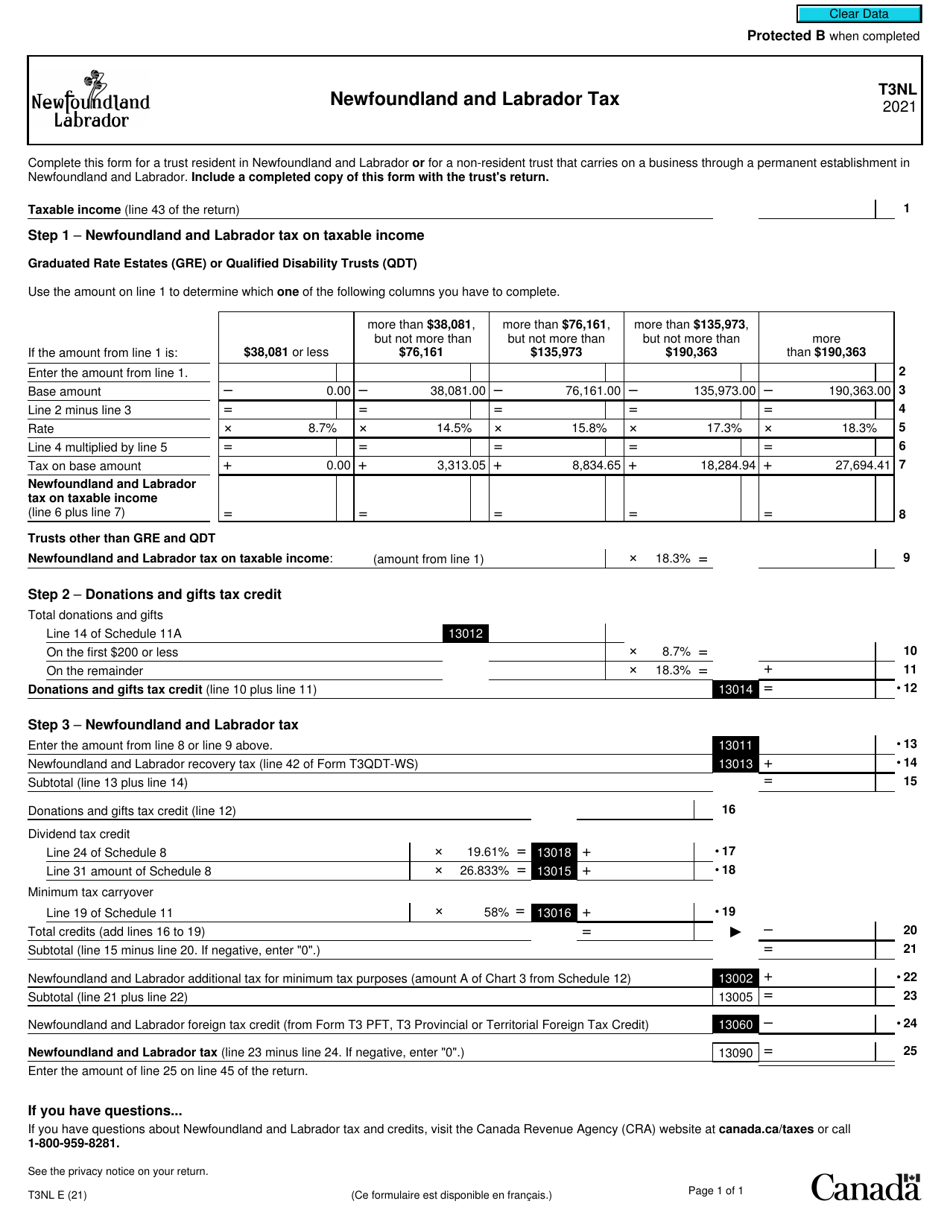

Form T3NL

for the current year.

Form T3NL Newfoundland and Labrador Tax - Canada

Form T3NL is used for individuals residing in Newfoundland and Labrador to report their provincial income tax within Canada. It is specifically designed for residents of Newfoundland and Labrador to calculate the amount of tax owed or the refund they are entitled to.

The filing of Form T3NL, Newfoundland and Labrador Tax, in Canada is done by residents of Newfoundland and Labrador for reporting their provincial income tax.

FAQ

Q: What is Form T3NL?

A: Form T3NL is a tax form specific to Newfoundland and Labrador, Canada.

Q: Who should use Form T3NL?

A: Residents of Newfoundland and Labrador who have taxable income should use Form T3NL.

Q: What is the purpose of Form T3NL?

A: Form T3NL is used to report and pay provincial tax owed by residents of Newfoundland and Labrador.

Q: When is the deadline to file Form T3NL?

A: The deadline to file Form T3NL is generally April 30th of the following year.

Q: Are there any penalties for late filing of Form T3NL?

A: Yes, there may be penalties for late filing or failure to file Form T3NL.

Q: Can I file Form T3NL electronically?

A: Yes, you can file Form T3NL electronically using NETFILE or EFILE services.