This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3D

for the current year.

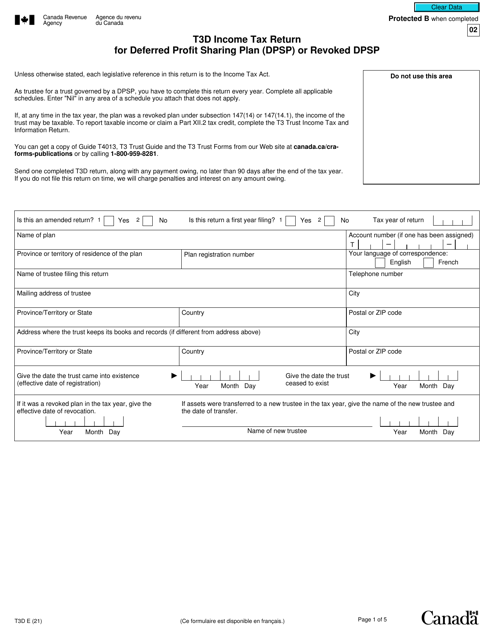

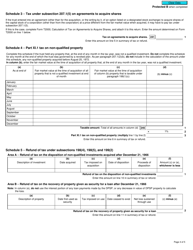

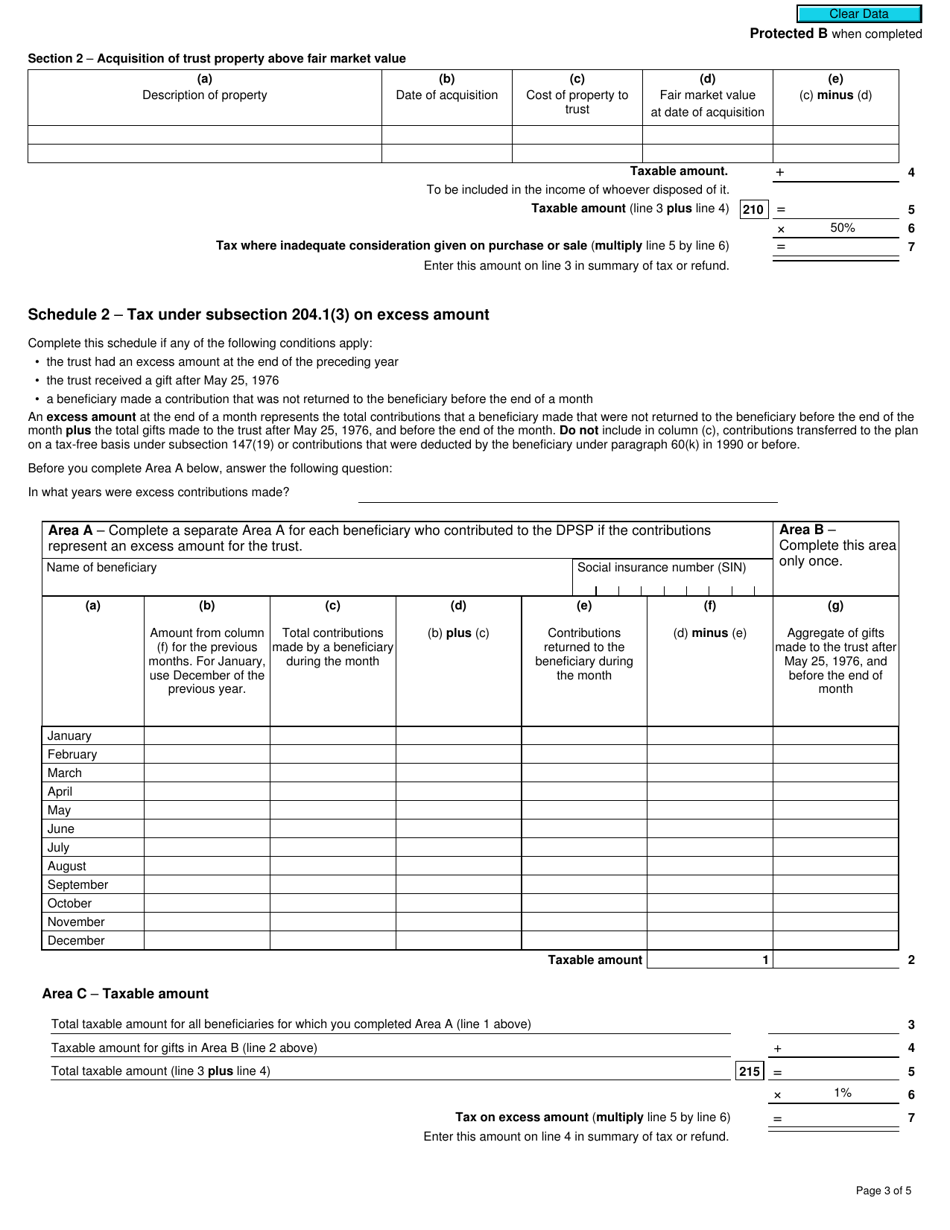

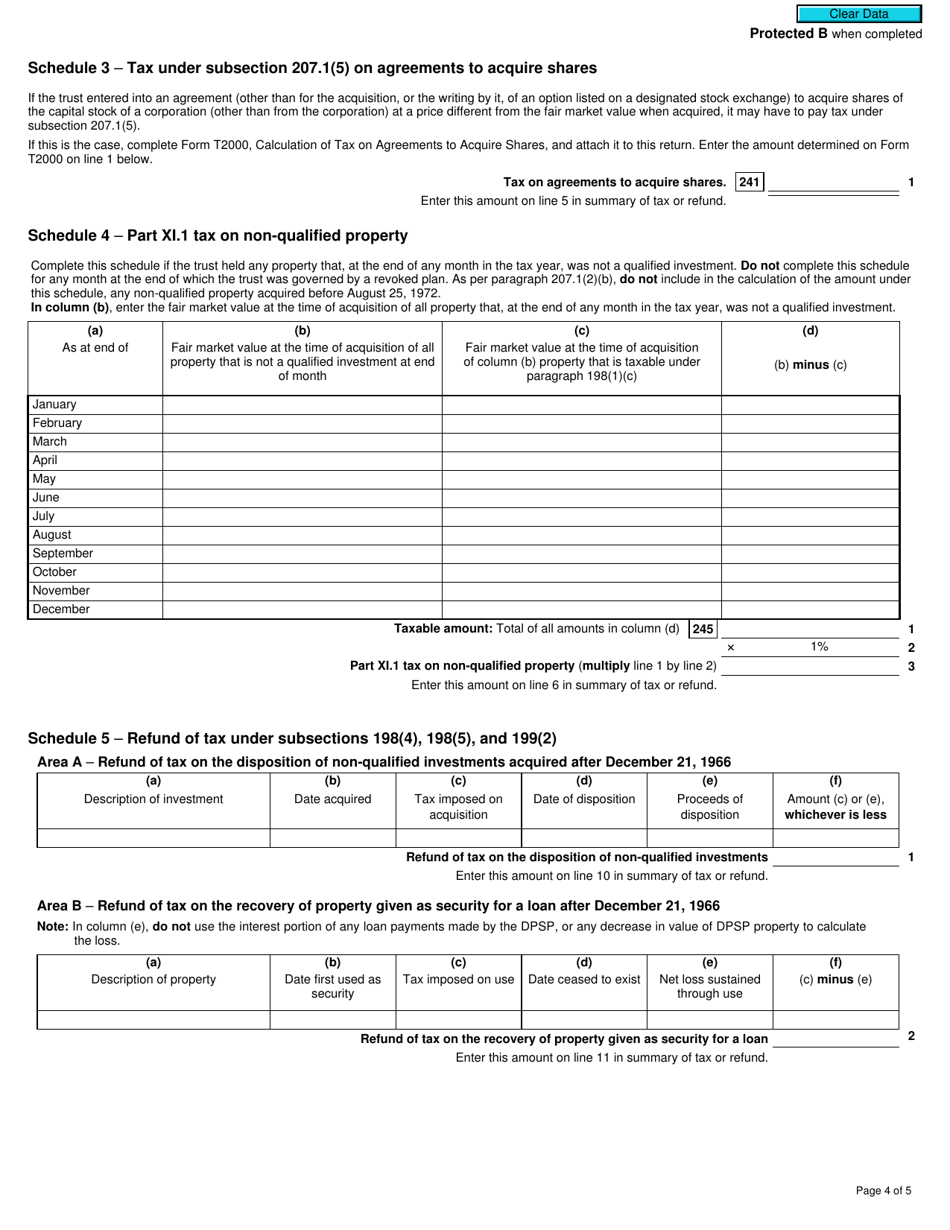

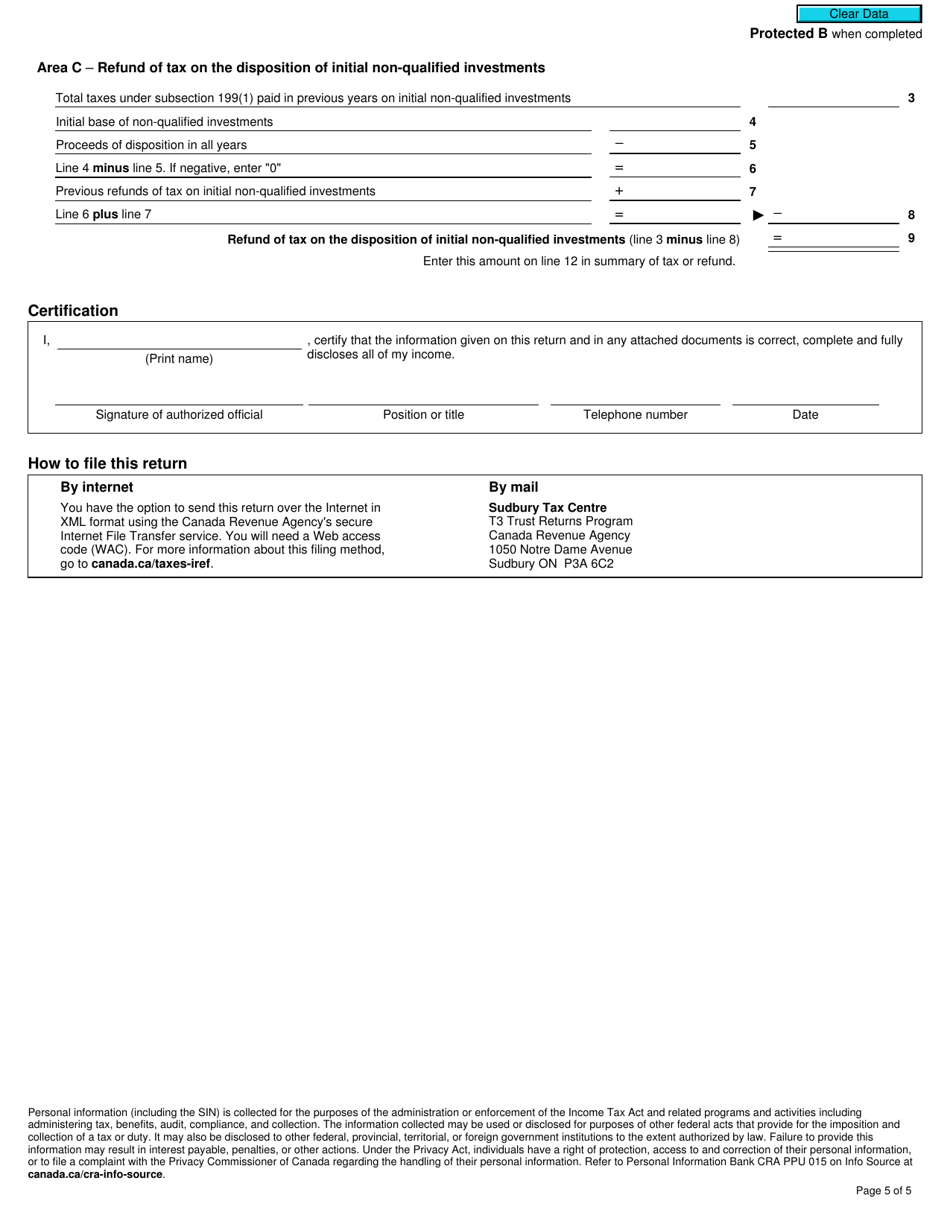

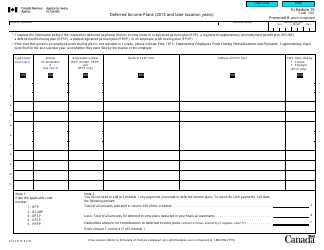

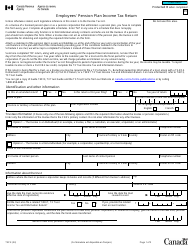

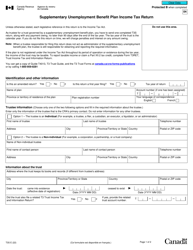

Form T3D Income Tax Return for Deferred Profit Sharing Plan (Dpsp) or Revoked Dpsp - Canada

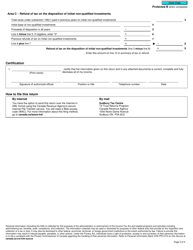

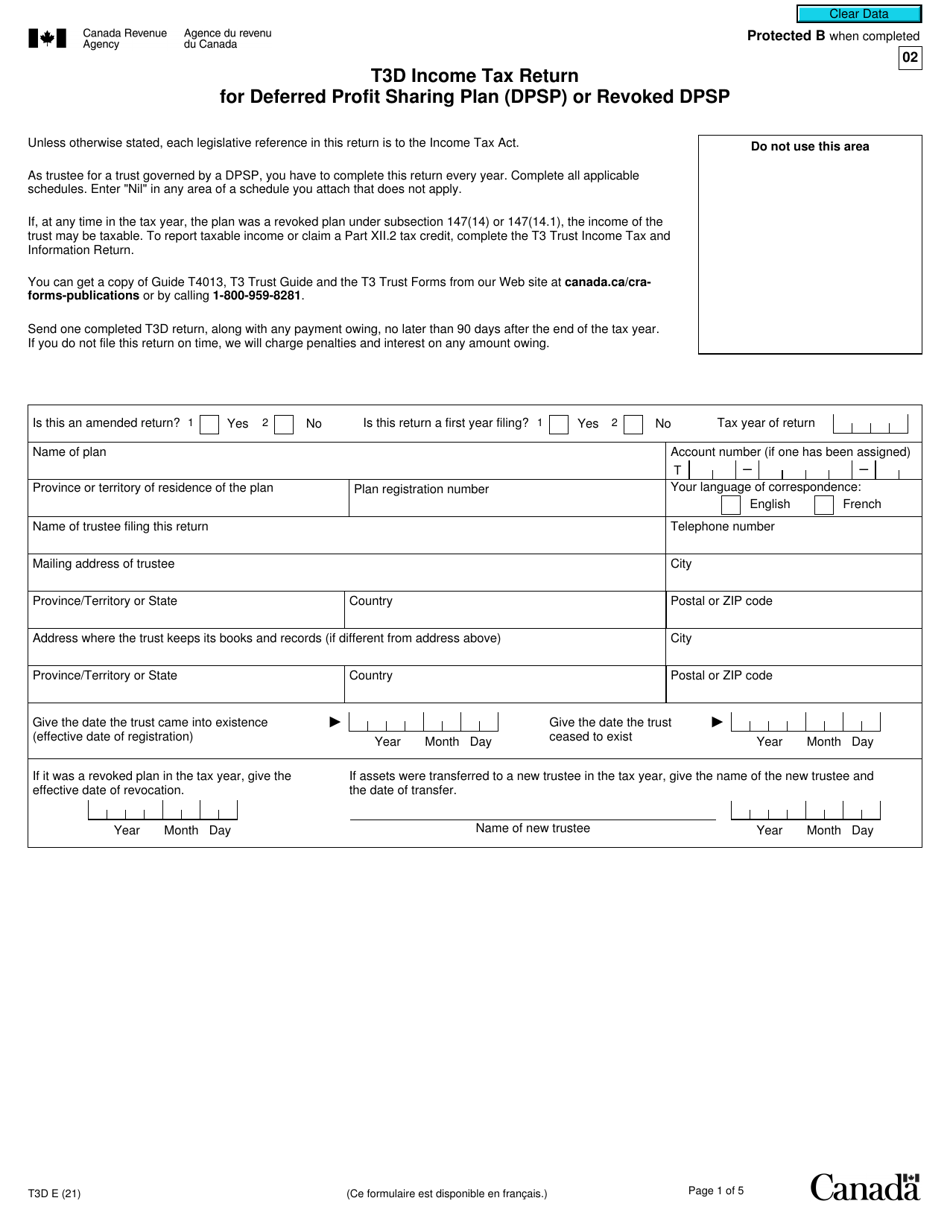

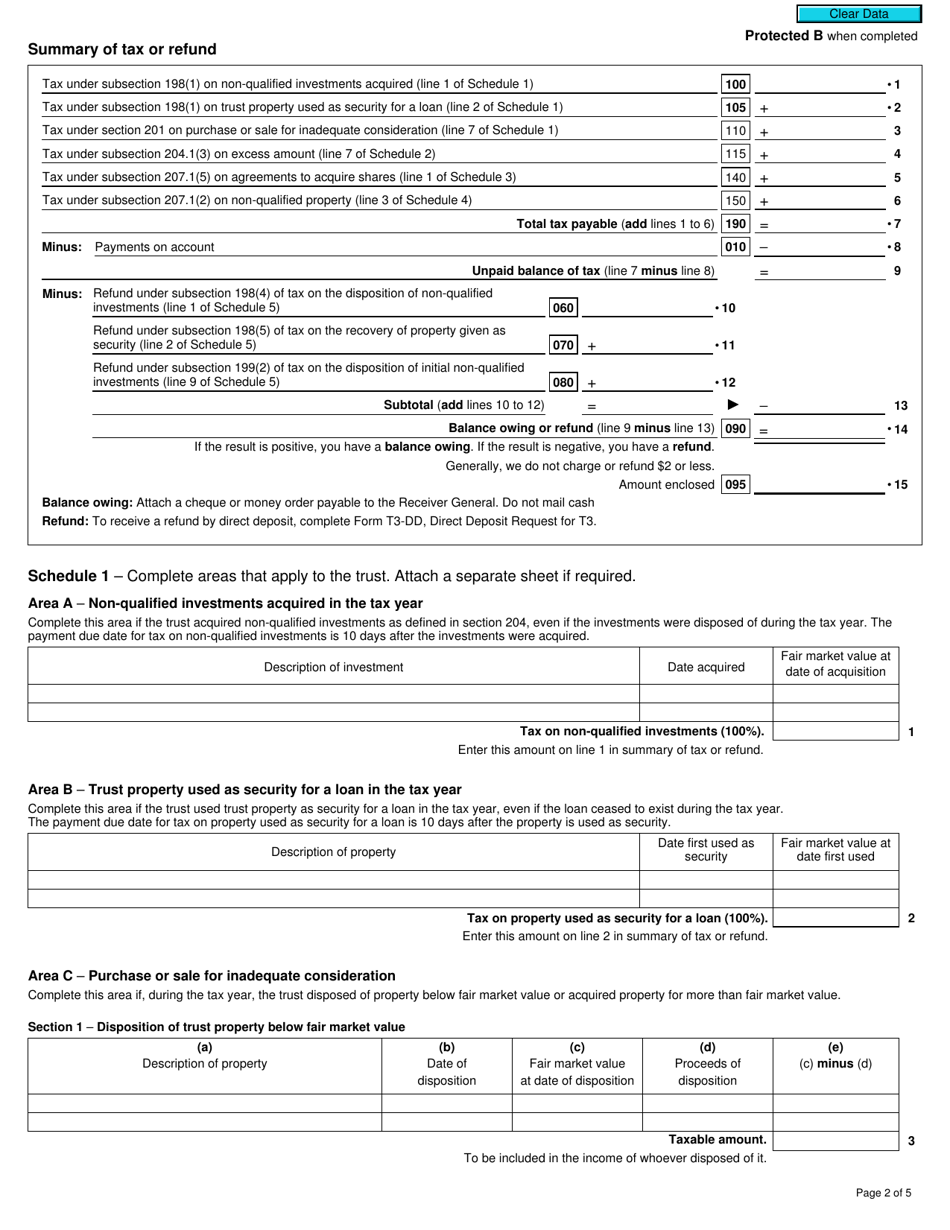

Form T3D Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP in Canada is used to report income earned and taxes payable for a deferred profit sharing plan or a revoked DPSP. It is filed by employers who have established a DPSP for their employees or for individuals who have received payments from a DPSP that has been revoked.

The employer or plan administrator files the Form T3D Income Tax Return for a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada.

FAQ

Q: What is a T3D income tax return?

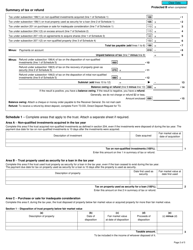

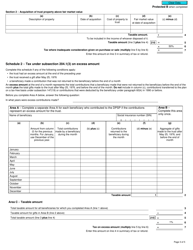

A: A T3D income tax return is a tax form specifically for reporting income from a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada.

Q: What is a Deferred Profit Sharing Plan (DPSP)?

A: A Deferred Profit Sharing Plan (DPSP) is a type of employer-sponsored retirement savings plan in Canada, where the employer contributes a portion of its profits to the plan for the benefit of the employees.

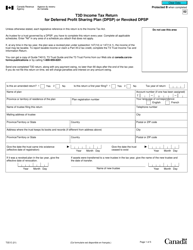

Q: Can you provide some examples of expenses that can be deducted on a T3D income tax return?

A: Some examples of expenses that can be deducted on a T3D income tax return include investment management fees, legal and accounting fees, and other costs related to the administration of the DPSP.

Q: Is a T3D income tax return only for individuals?

A: No, a T3D income tax return can be filed by individuals, corporations, trusts, and partnerships.

Q: When is the deadline for filing a T3D income tax return?

A: The deadline for filing a T3D income tax return is usually 90 days after the end of the calendar year, but it can vary depending on individual circumstances and extensions granted by the Canada Revenue Agency (CRA).