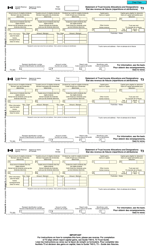

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3ATH-IND

for the current year.

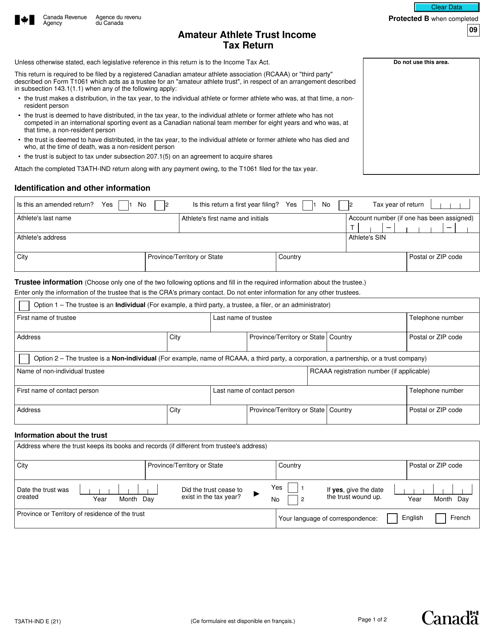

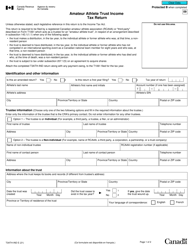

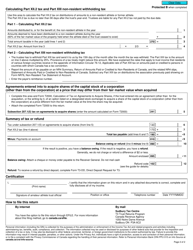

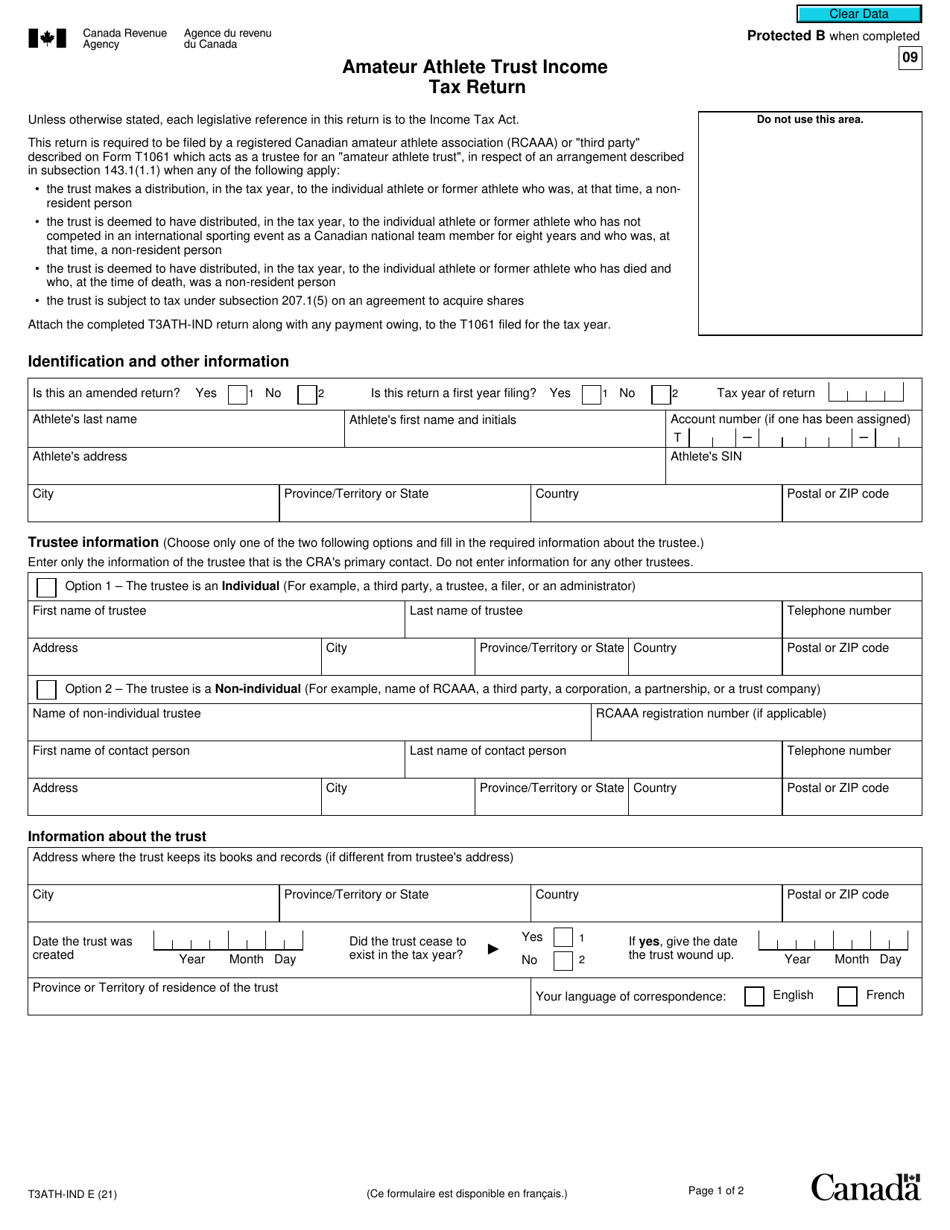

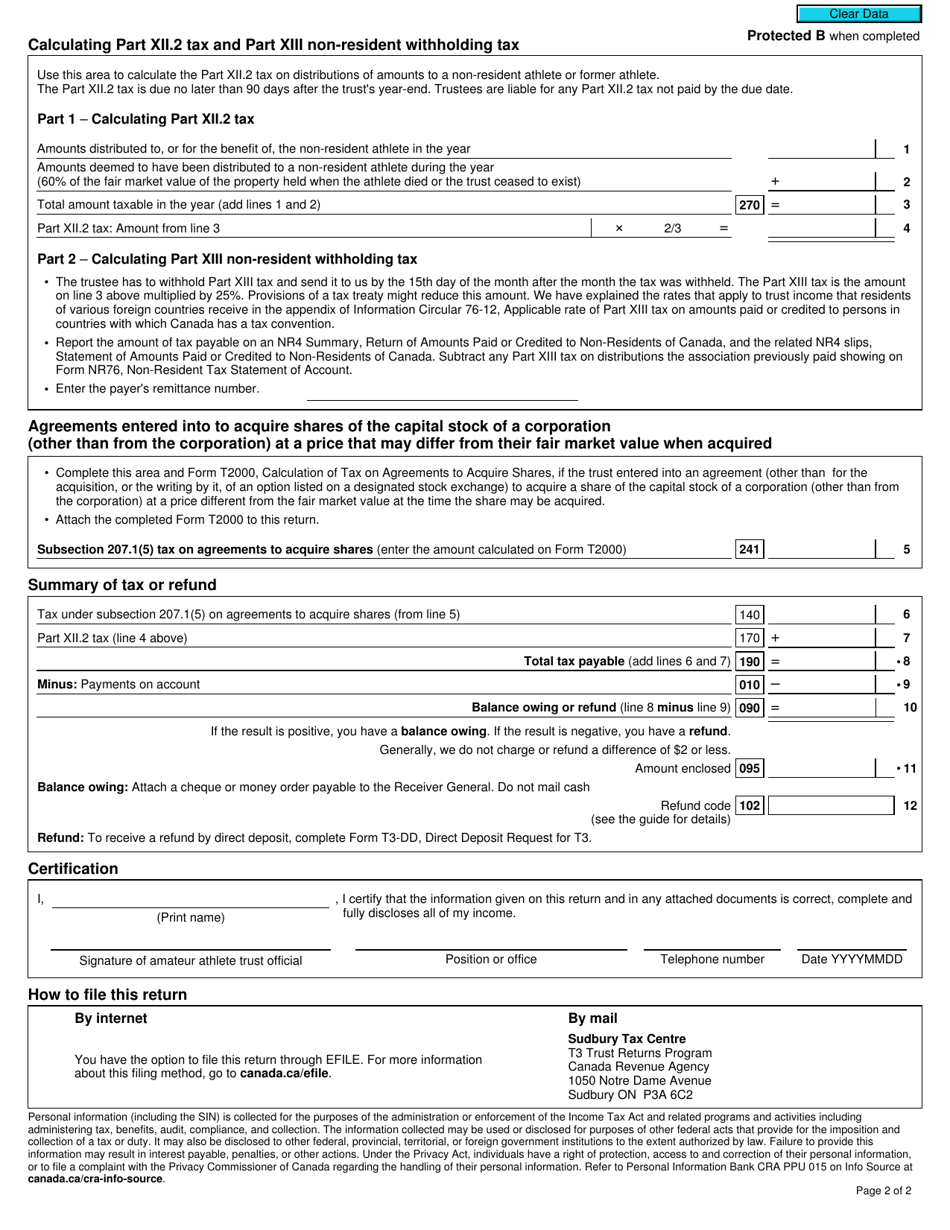

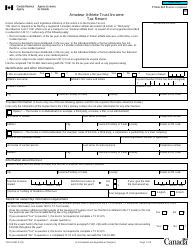

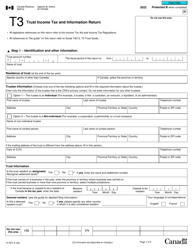

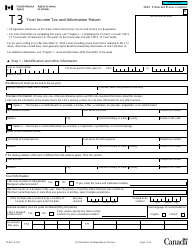

Form T3ATH-IND Amateur Athlete Trust Income Tax Return - Canada

Form T3ATH-IND, Amateur Athlete Trust Income Tax Return, in Canada is used to report income earned by amateur athletes from trusts. This form is specifically designed for Canadian athletes who have established a trust to manage their earnings.

The Form T3ATH-IND Amateur Athlete Trust Income Tax Return in Canada is filed by individual amateur athletes who have a trust and need to report their income from the trust.

FAQ

Q: What is Form T3ATH-IND?

A: Form T3ATH-IND is the Amateur Athlete Trust Income Tax Return in Canada.

Q: Who needs to file Form T3ATH-IND?

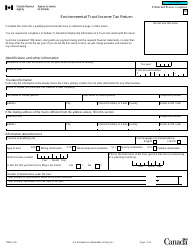

A: Amateur athletes who have a trust and earned income in the trust need to file Form T3ATH-IND.

Q: When is the deadline to file Form T3ATH-IND?

A: The deadline to file Form T3ATH-IND is usually within 90 days after the trust's fiscal period-end.

Q: What information is required to complete Form T3ATH-IND?

A: You will need to provide information about the trust, the income earned in the trust, and any expenses related to the trust.