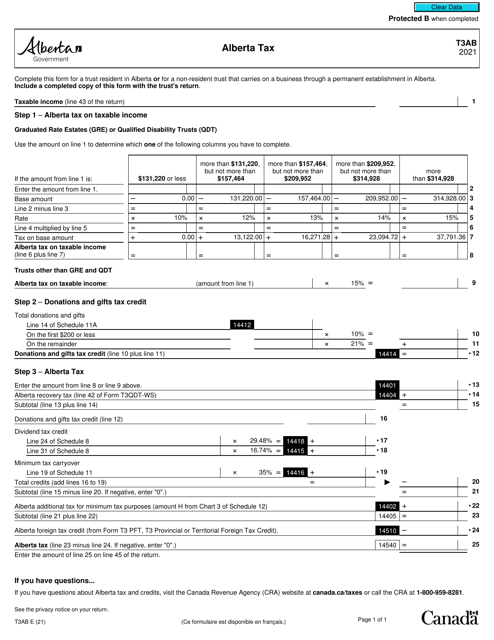

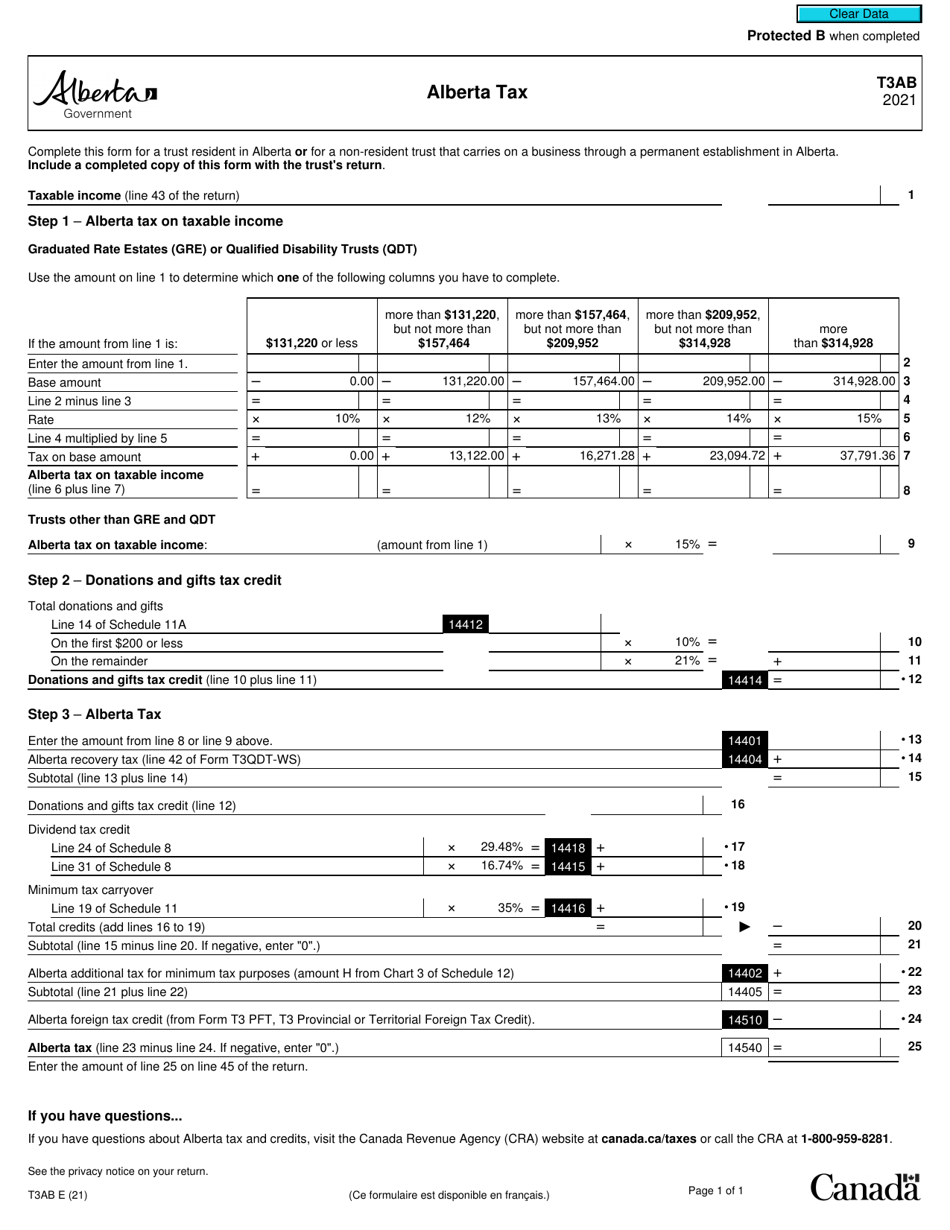

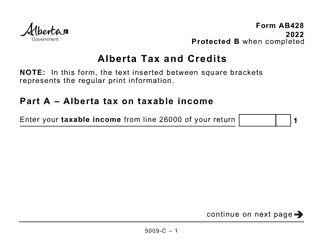

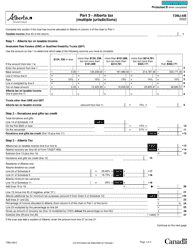

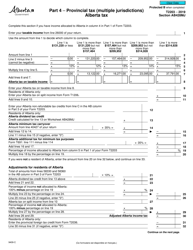

Form T3 AB Alberta Tax - Canada

Form T3 AB, Alberta Tax - Canada, is a tax form used by residents of the province of Alberta in Canada to report their income and calculate their provincial taxes owing. This form is specific to Alberta and is used in conjunction with the federal tax return.

The Form T3 AB Alberta Tax is filed by individuals or businesses in the province of Alberta, Canada.

FAQ

Q: What is Form T3 AB?

A: Form T3 AB is a tax form used in the province of Alberta, Canada.

Q: Who uses Form T3 AB?

A: Form T3 AB is used by individuals and businesses in Alberta to report their provincial taxes.

Q: What taxes are reported on Form T3 AB?

A: Form T3 AB is used to report various provincial taxes in Alberta, including income tax and sales tax.

Q: Do I need to file Form T3 AB?

A: If you are an individual or business in Alberta and meet the tax filing requirements, you may need to file Form T3 AB.

Q: What should I do if I need help with Form T3 AB?

A: If you need help with Form T3 AB, you can contact the Alberta provincial tax office or seek assistance from a tax professional.

Q: Is Form T3 AB the same as the federal tax return?

A: No, Form T3 AB is specific to the province of Alberta and is used to report provincial taxes. The federal tax return is a separate form used to report taxes to the federal government.

Q: Can I e-file Form T3 AB?

A: Yes, it is possible to e-file Form T3 AB. However, the availability of e-filing may depend on your specific situation and the tax year. It is best to check with the Alberta provincial tax office or consult with a tax professional to determine if e-filing is an option for you.