This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3A

for the current year.

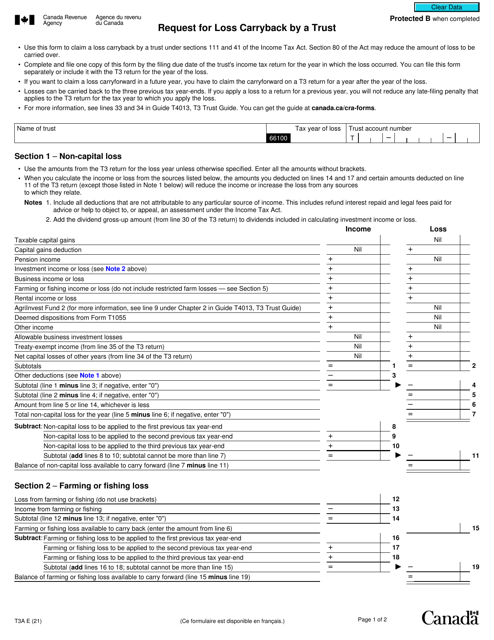

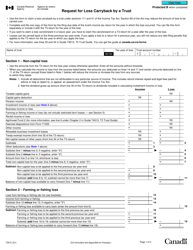

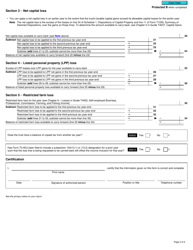

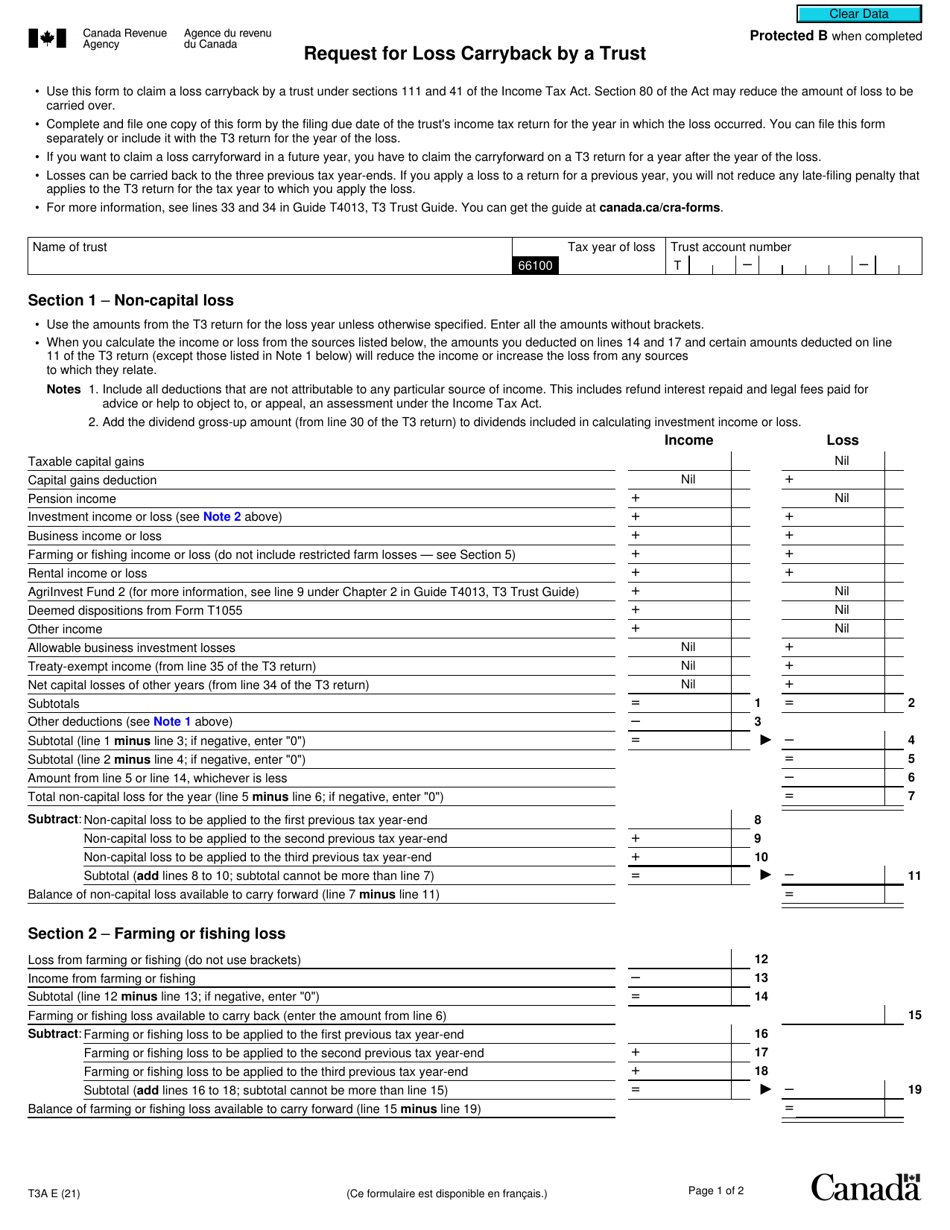

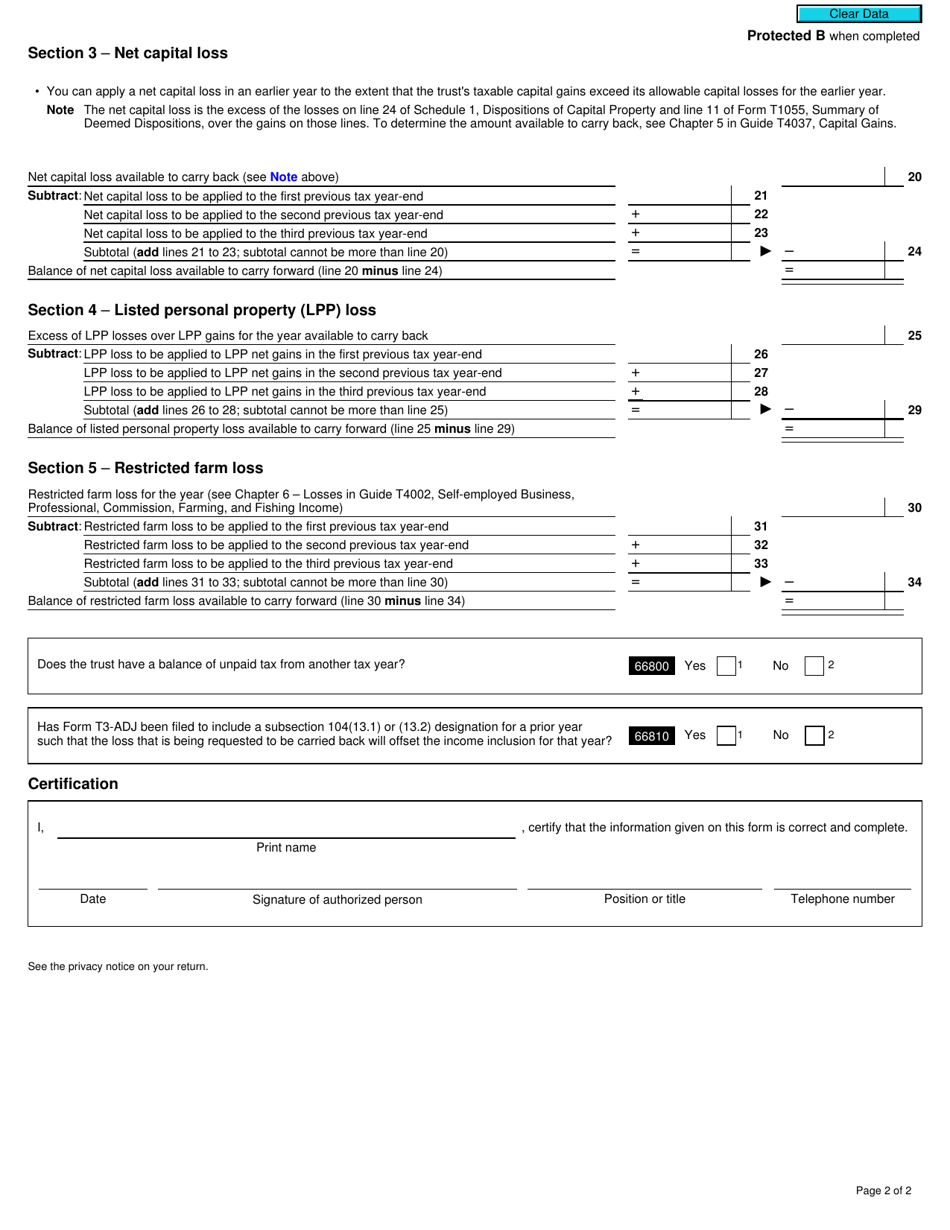

Form T3A Request for Loss Carryback by a Trust - Canada

Form T3A Request forLoss Carryback by a Trust in Canada is used for requesting to carry back a trust's loss to a previous year for the purpose of reducing taxable income. This can result in a tax refund or reduce the amount of tax payable by the trust.

The trust that wants to carry back losses files the Form T3A Request for Loss Carryback in Canada.

FAQ

Q: What is Form T3A?

A: Form T3A is a form used by trusts in Canada to request a loss carryback.

Q: What is a loss carryback?

A: A loss carryback is a tax provision that allows a business or trust to apply a current year's net loss against a prior year's taxable income to reduce taxes payable.

Q: Who can use Form T3A?

A: Form T3A can be used by trusts in Canada that have a net loss in the current year and want to carry it back to a previous year to reduce their tax liability.

Q: What information is required in Form T3A?

A: Form T3A requires information about the trust, its loss in the current year, the taxation years to which the loss is to be carried back, and the calculation of the loss carryback.