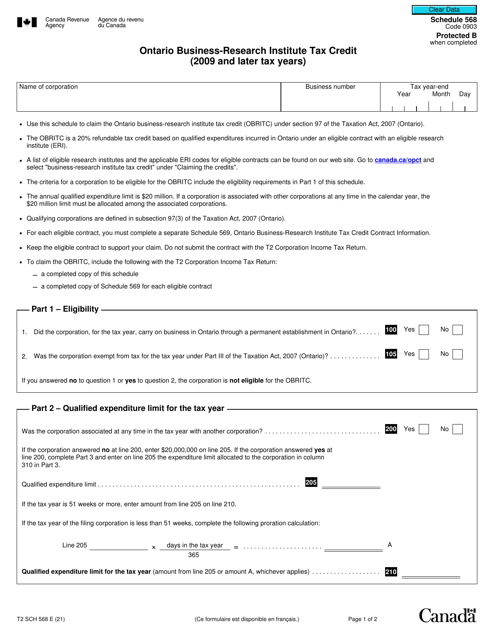

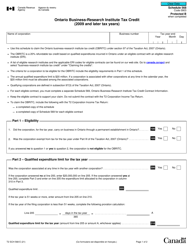

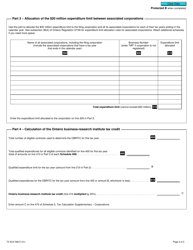

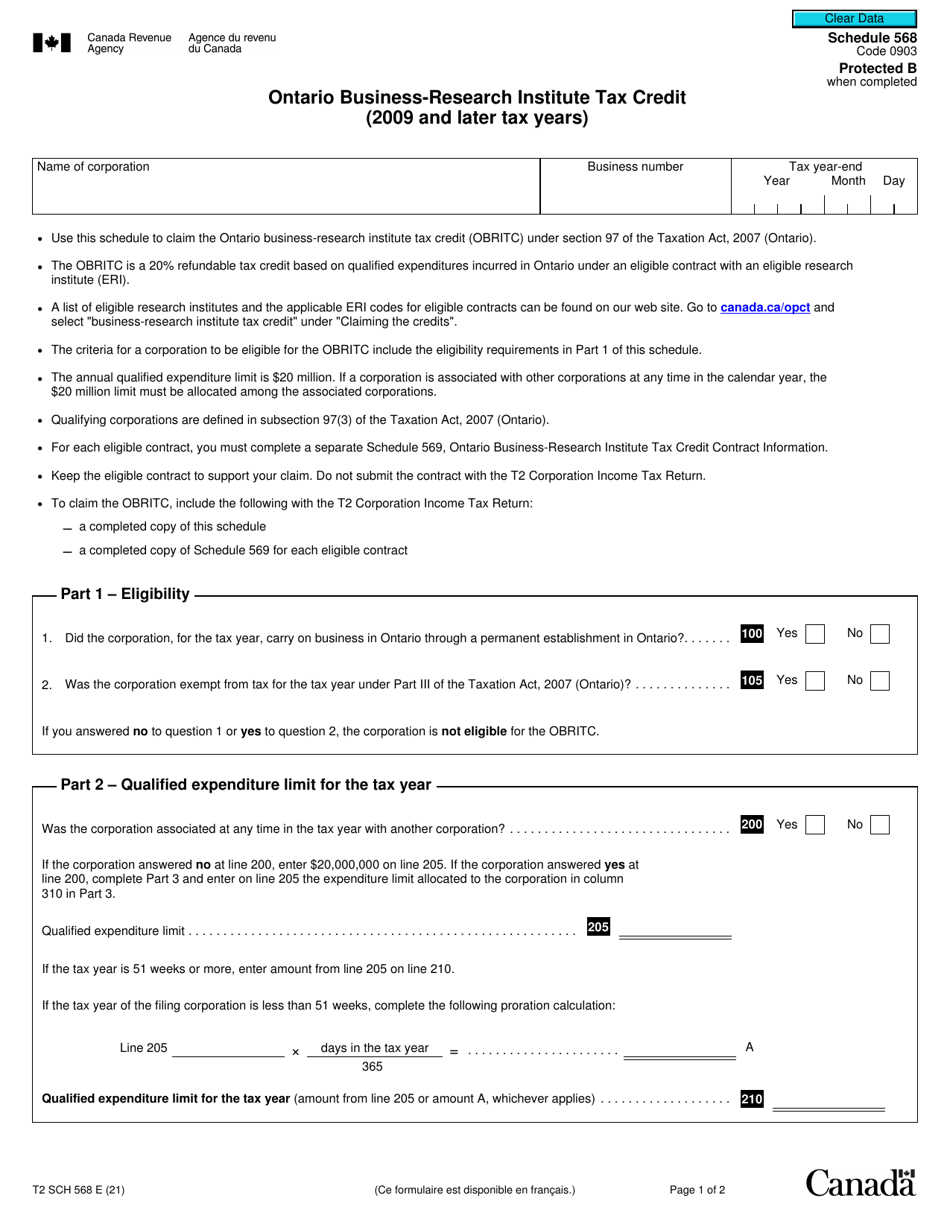

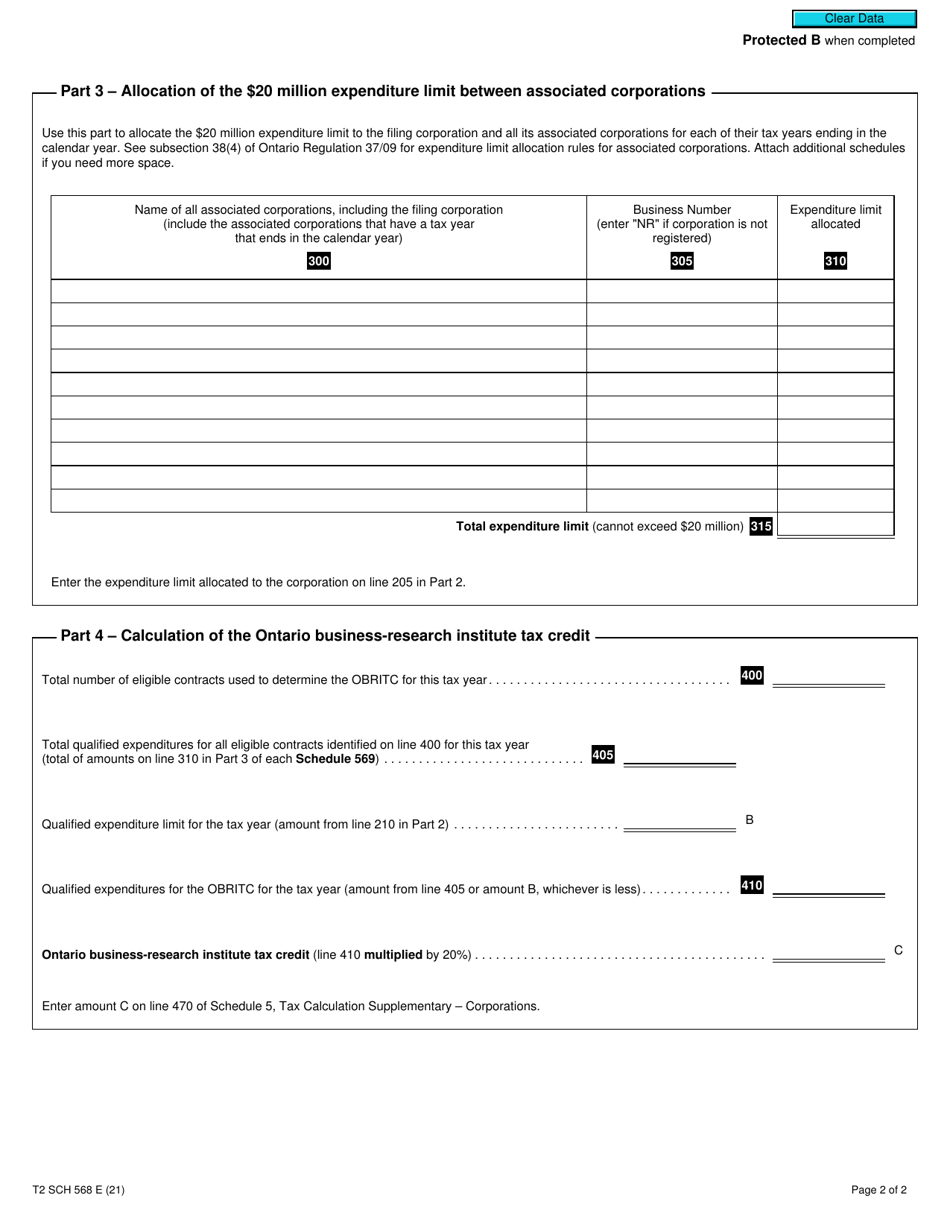

Form T2 Schedule 568 Ontario Business-Research Institute Tax Credit (2009 and Later Tax Years) - Canada

Form T2 Schedule 568 Ontario Business-Research Institute Tax Credit is used in Canada for claiming the Ontario Business-Research Institute Tax Credit for tax years 2009 and later. It is used by eligible businesses in Ontario to calculate and claim this tax credit.

FAQ

Q: What is Form T2 Schedule 568?

A: Form T2 Schedule 568 is a tax form used in Canada for claiming the Ontario Business-Research Institute Tax Credit.

Q: What is the Ontario Business-Research Institute Tax Credit?

A: The Ontario Business-Research Institute Tax Credit is a tax credit offered in Ontario, Canada for businesses that conduct eligible research and development activities.

Q: Who is eligible to claim the Ontario Business-Research Institute Tax Credit?

A: Businesses that are incorporated in Ontario and conduct eligible research and development activities are eligible to claim this tax credit.

Q: What tax years does Form T2 Schedule 568 cover?

A: Form T2 Schedule 568 is used for tax years starting in 2009 and onwards.