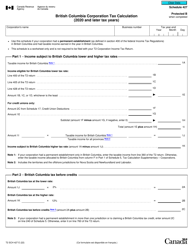

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 5

for the current year.

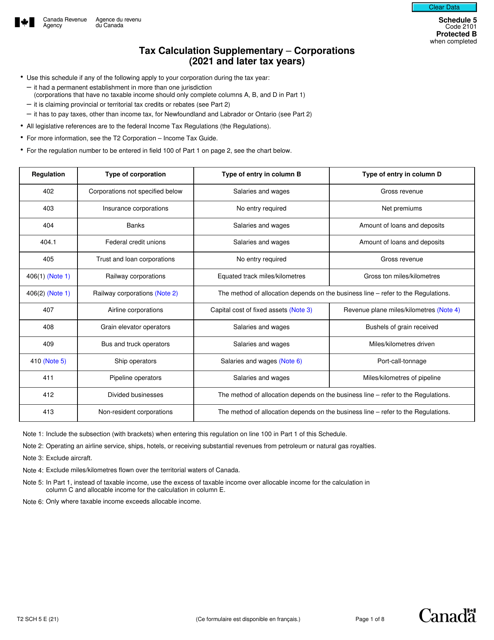

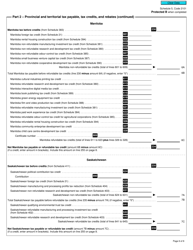

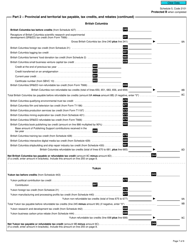

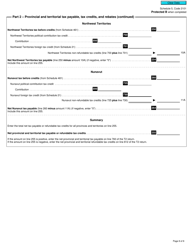

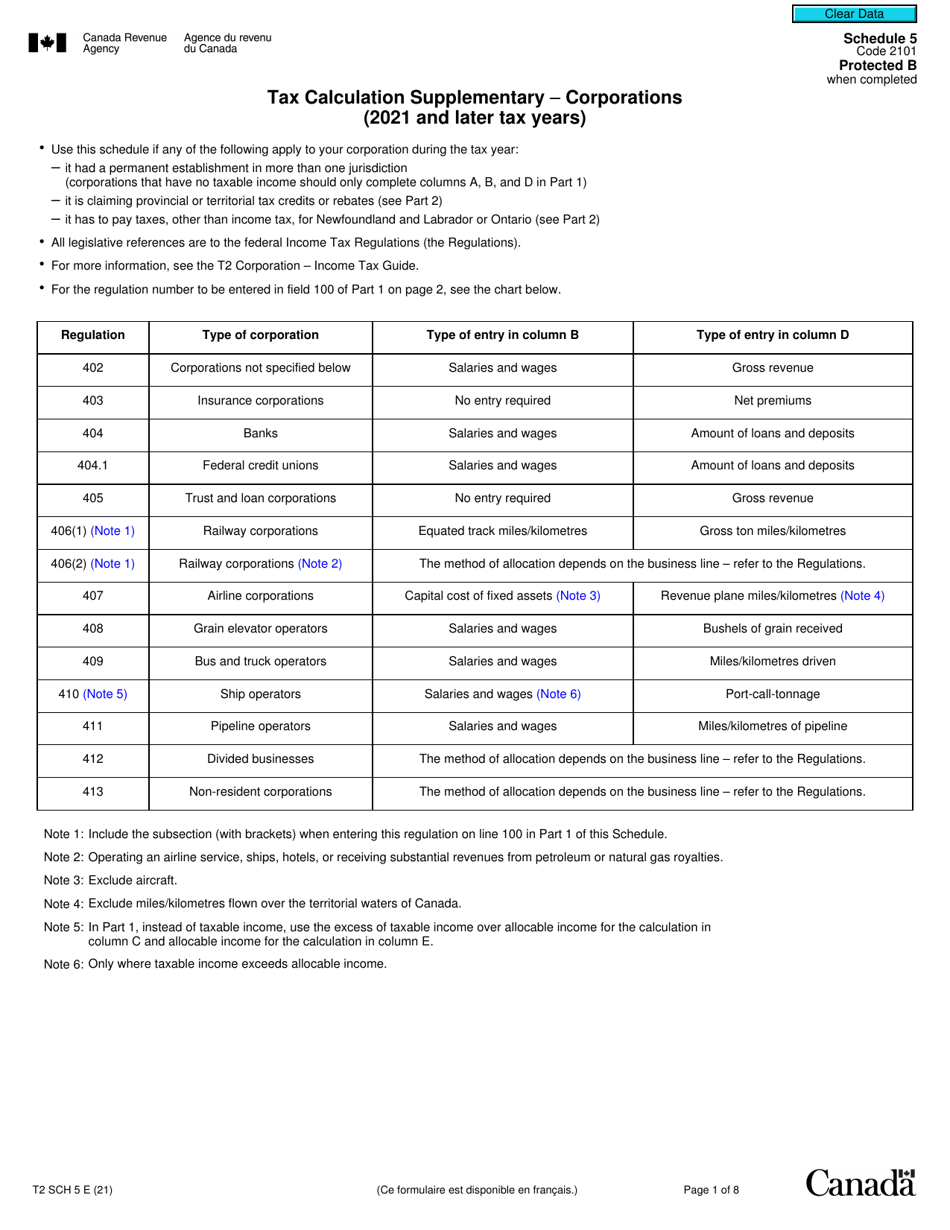

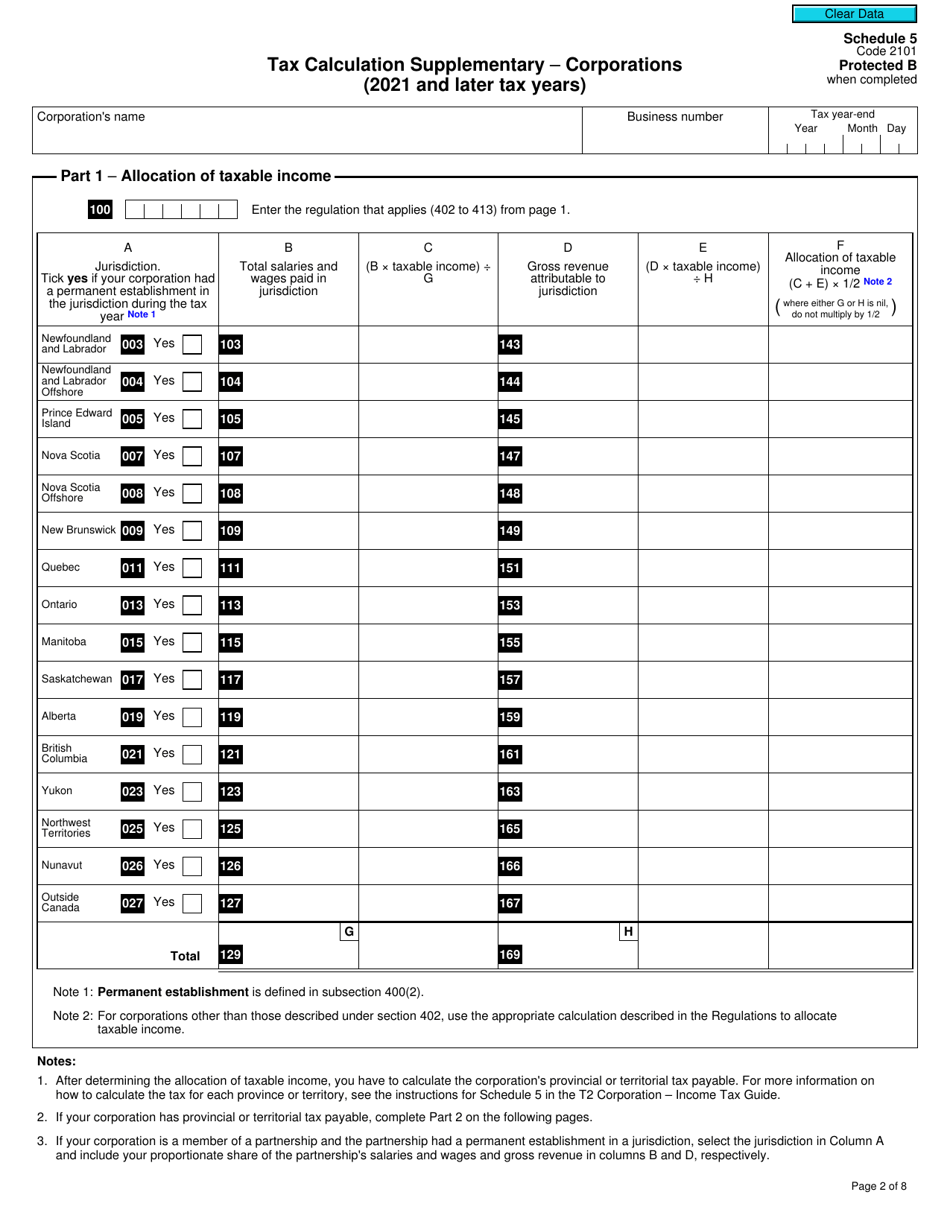

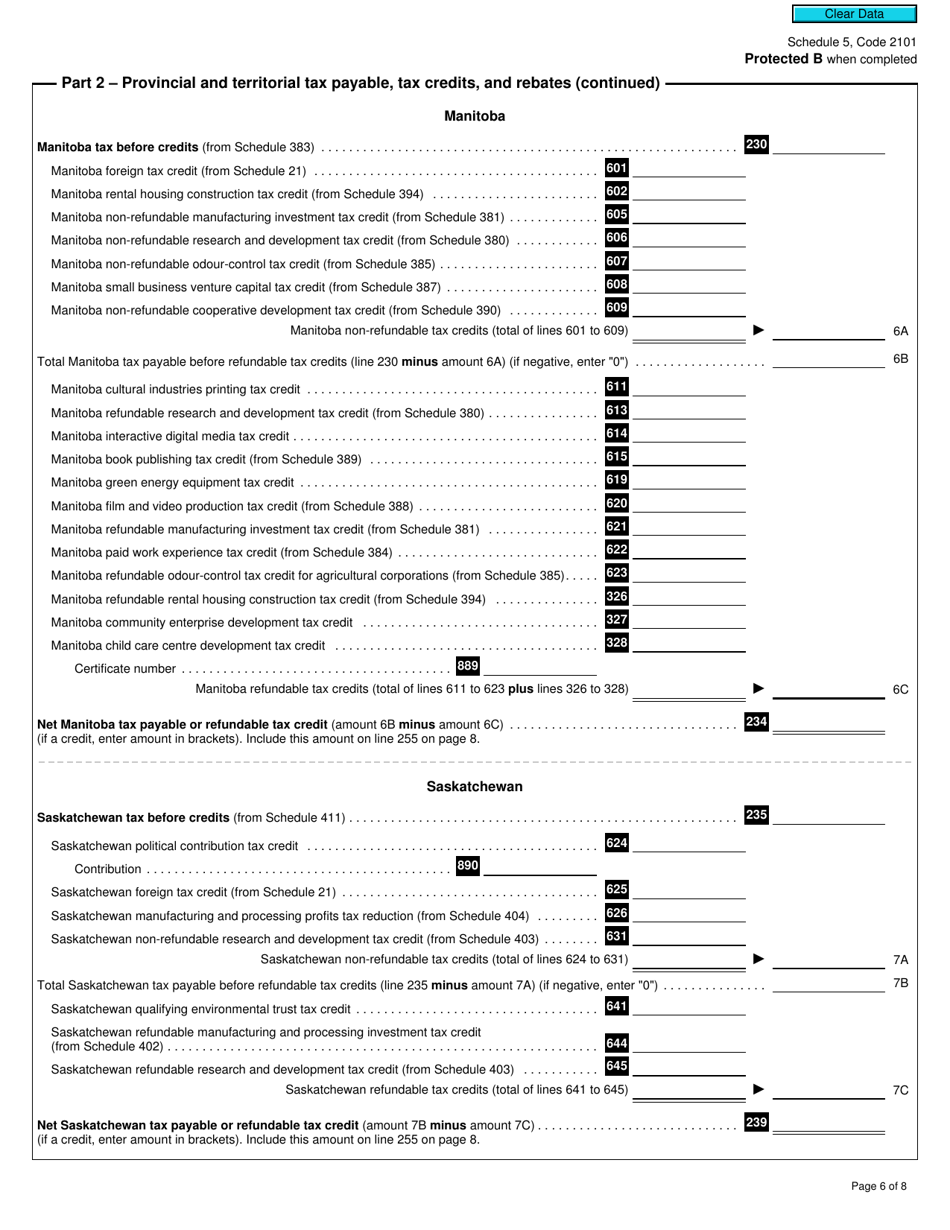

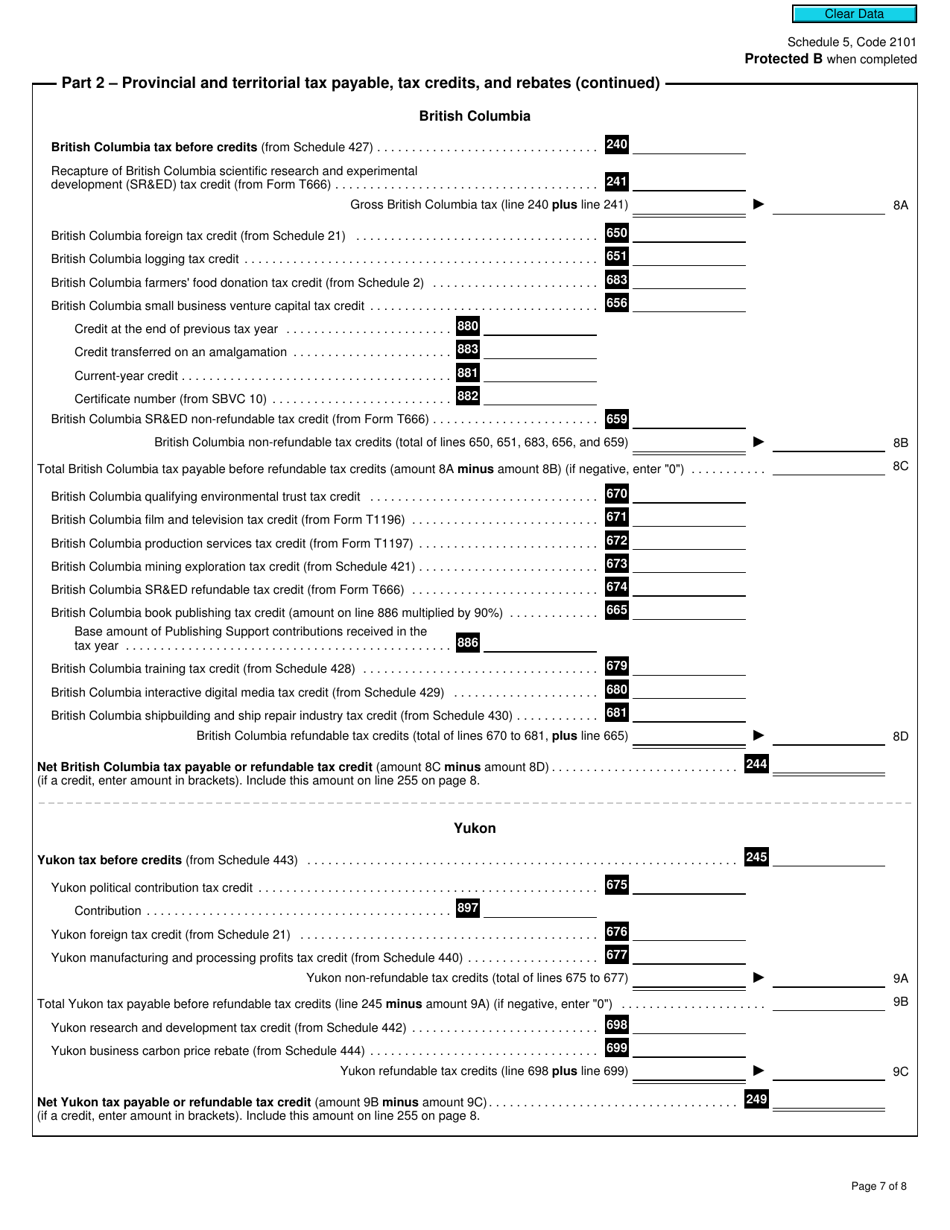

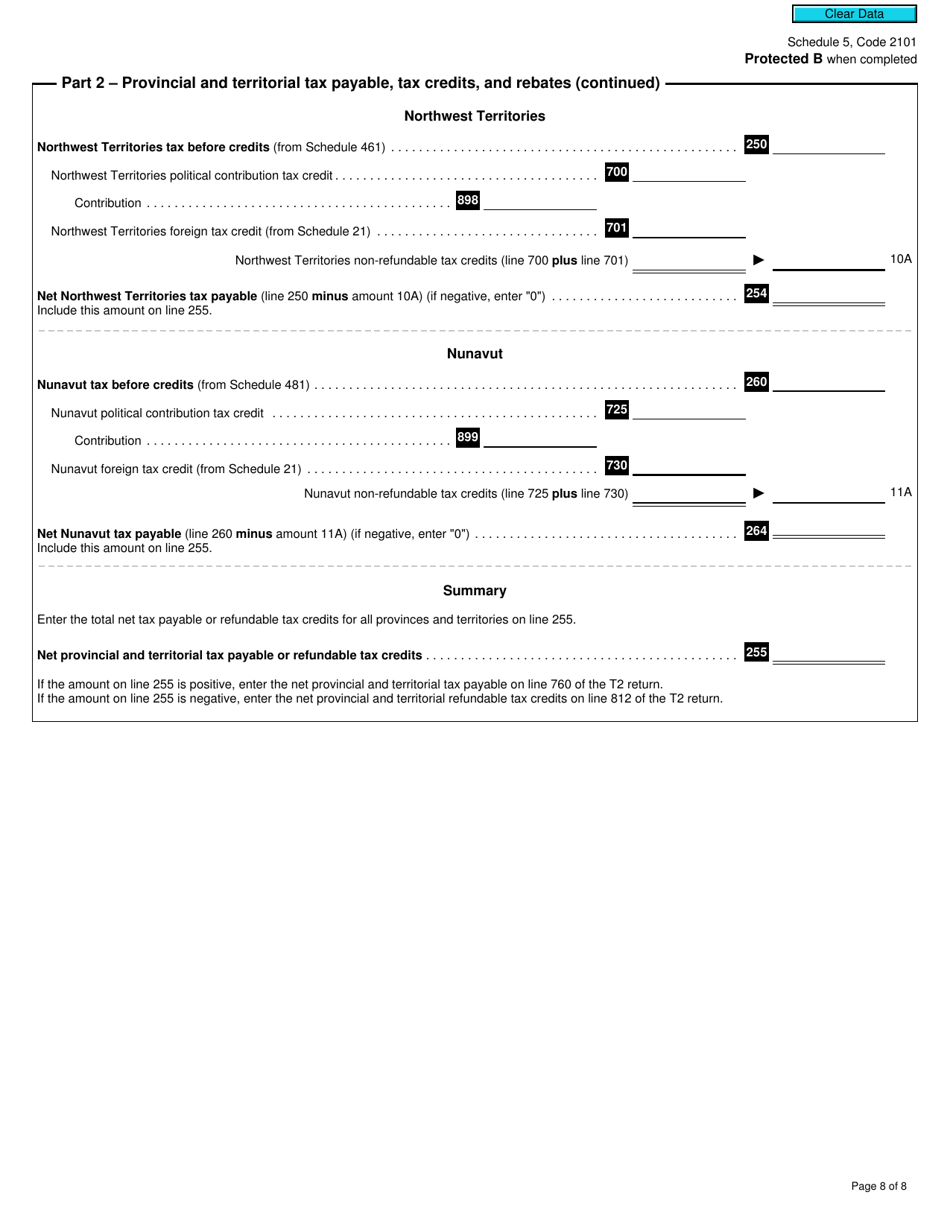

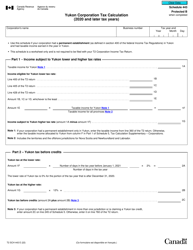

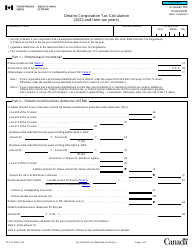

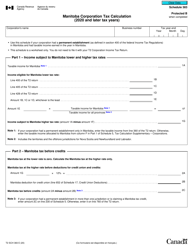

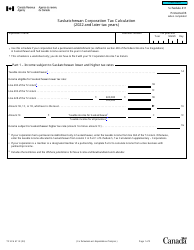

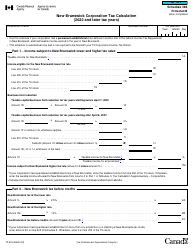

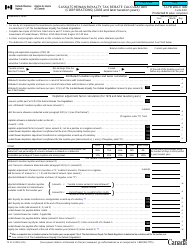

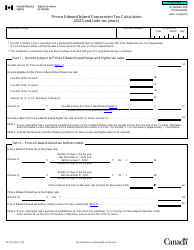

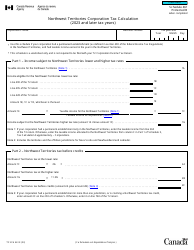

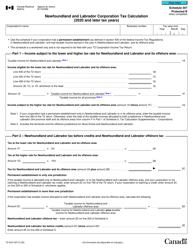

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2021 and Later Tax Years) - Canada

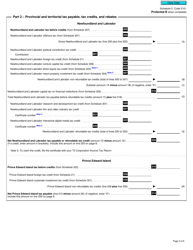

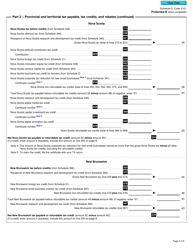

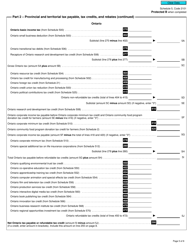

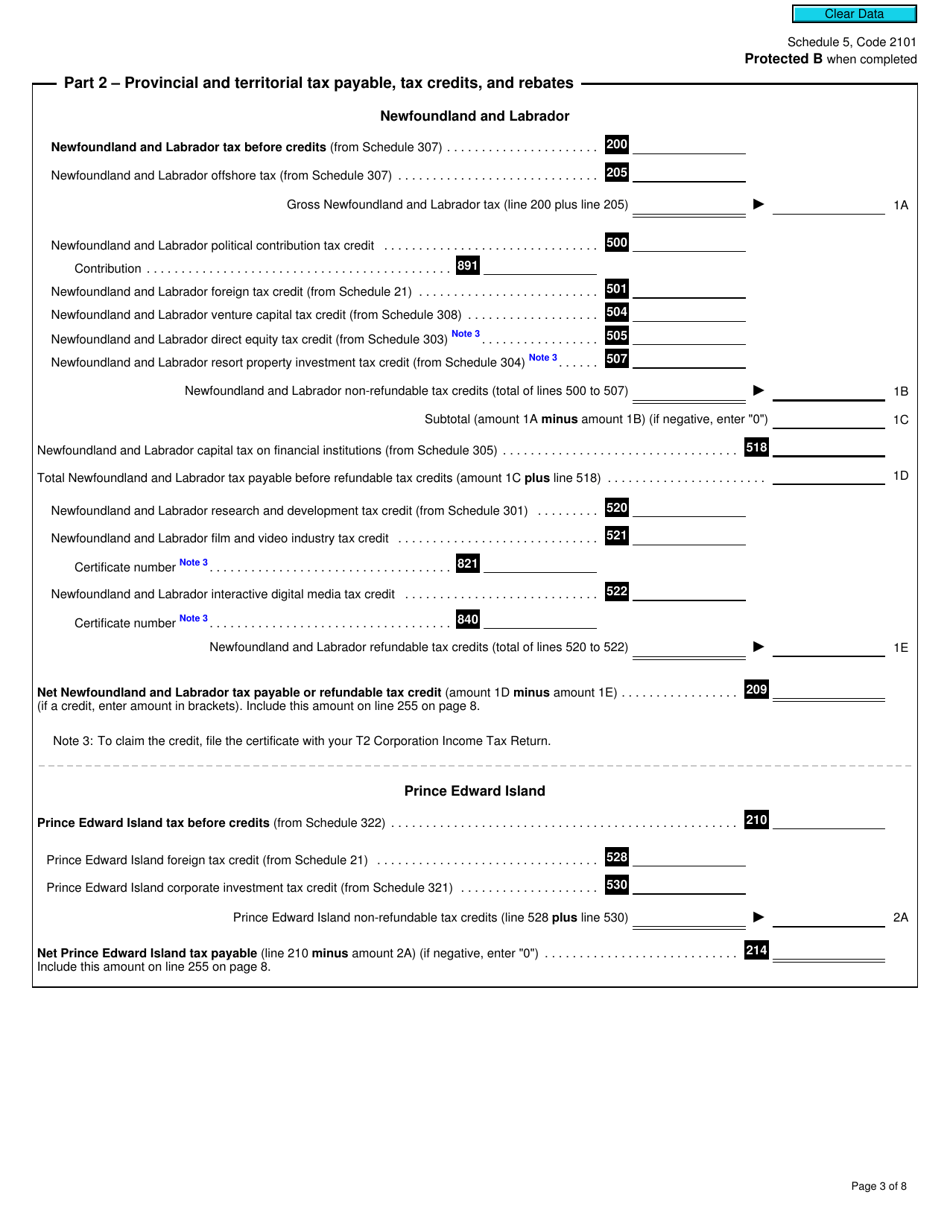

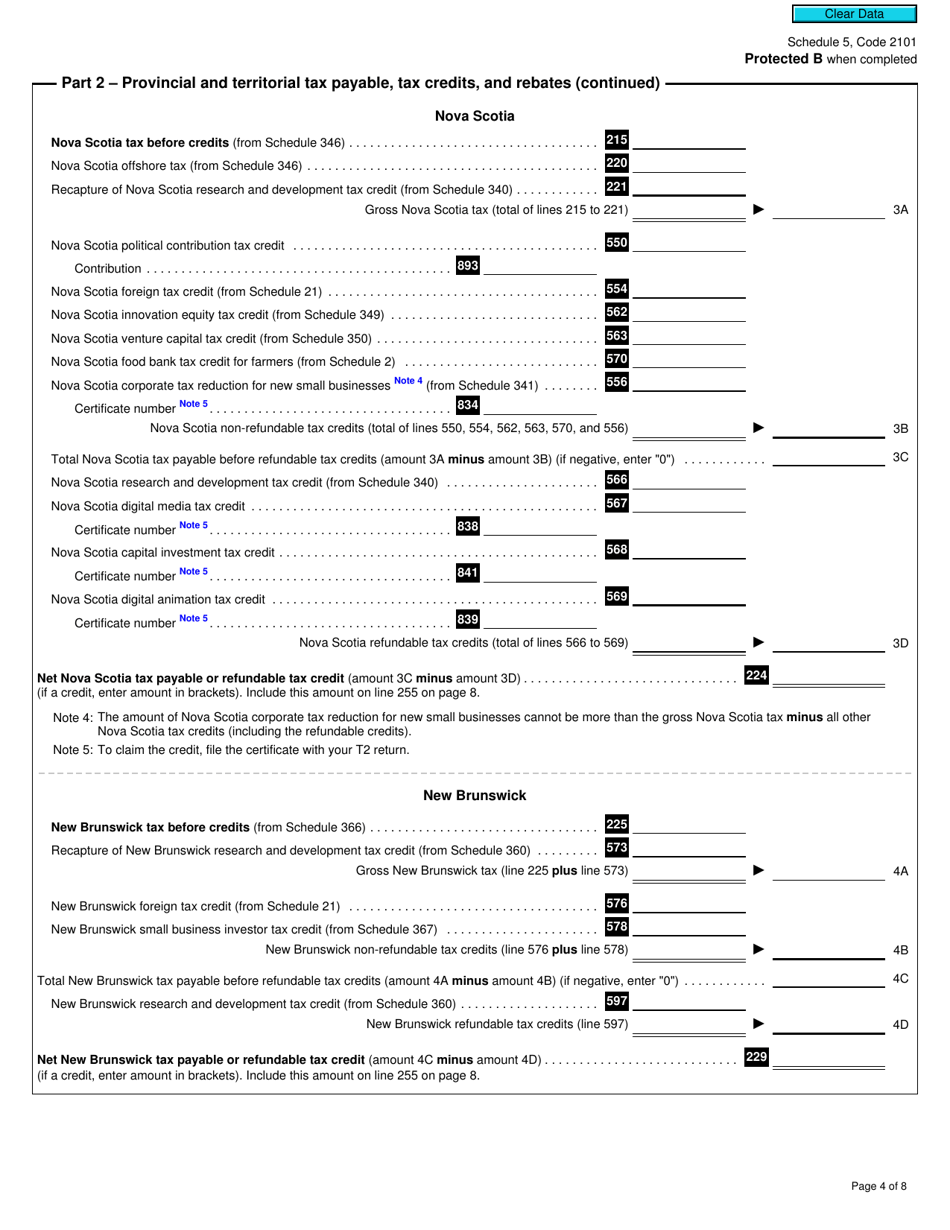

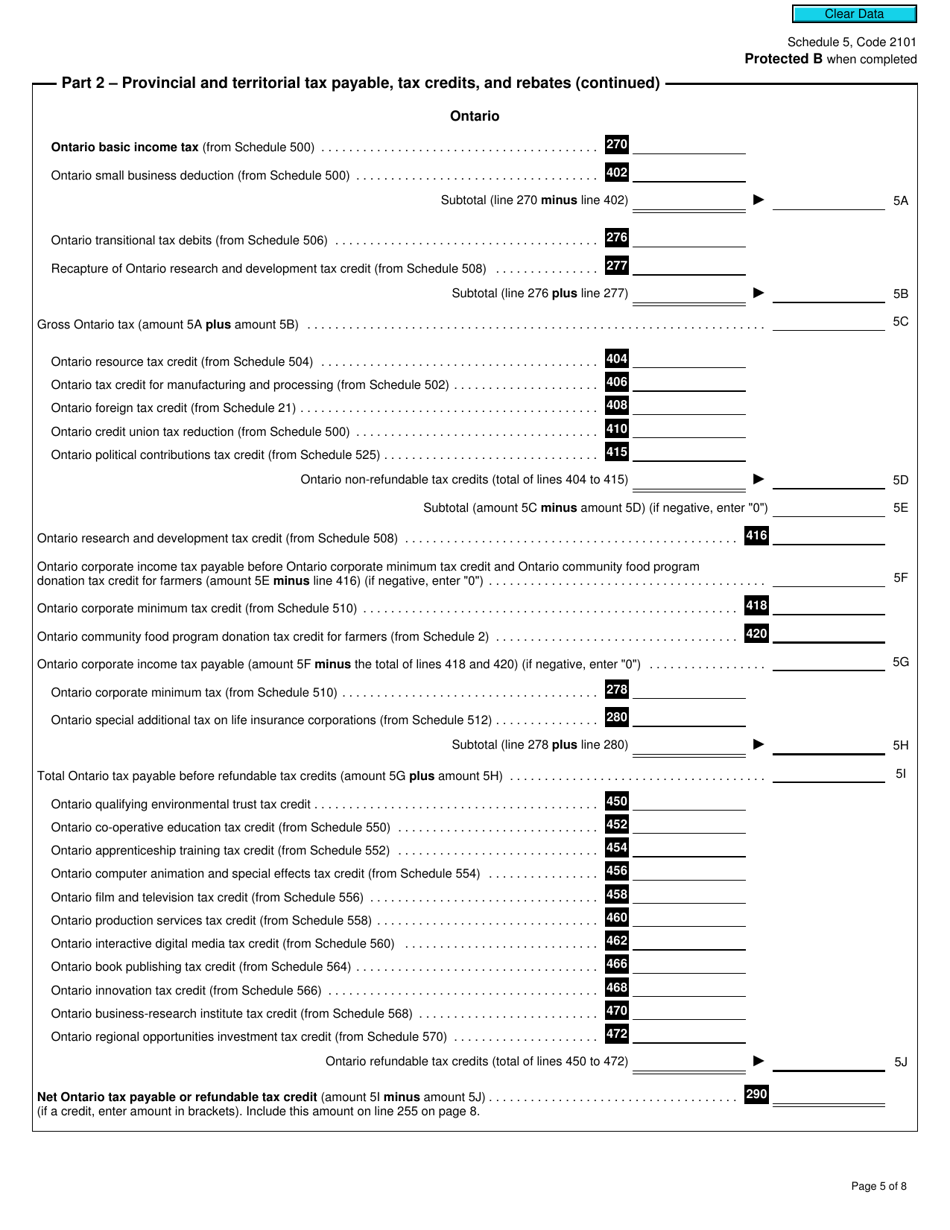

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2021 and Later Tax Years) in Canada is used to calculate the corporation's income tax liability. It provides additional information and calculations related to specific tax provisions or deductions that may apply to the corporation.

The Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2021 and Later Tax Years) in Canada is filed by corporations.

FAQ

Q: What is Form T2 Schedule 5?

A: Form T2 Schedule 5 is a tax calculation supplementary form for corporations in Canada, used for tax years 2021 and later.

Q: Who needs to file Form T2 Schedule 5?

A: Corporations in Canada need to file Form T2 Schedule 5 if they have a tax year that starts after 2020.

Q: What is the purpose of Form T2 Schedule 5?

A: The purpose of Form T2 Schedule 5 is to calculate certain tax amounts and provide additional information related to corporate taxes.

Q: What information is required on Form T2 Schedule 5?

A: Form T2 Schedule 5 requires information such as the corporation's taxable income, different tax rates, and certain tax credits.

Q: Is Form T2 Schedule 5 mandatory?

A: Yes, if you are a corporation in Canada with a tax year that starts after 2020, filing Form T2 Schedule 5 is mandatory.

Q: When is the deadline for filing Form T2 Schedule 5?

A: The deadline for filing Form T2 Schedule 5 is generally within six months after the end of the corporation's tax year.