This version of the form is not currently in use and is provided for reference only. Download this version of

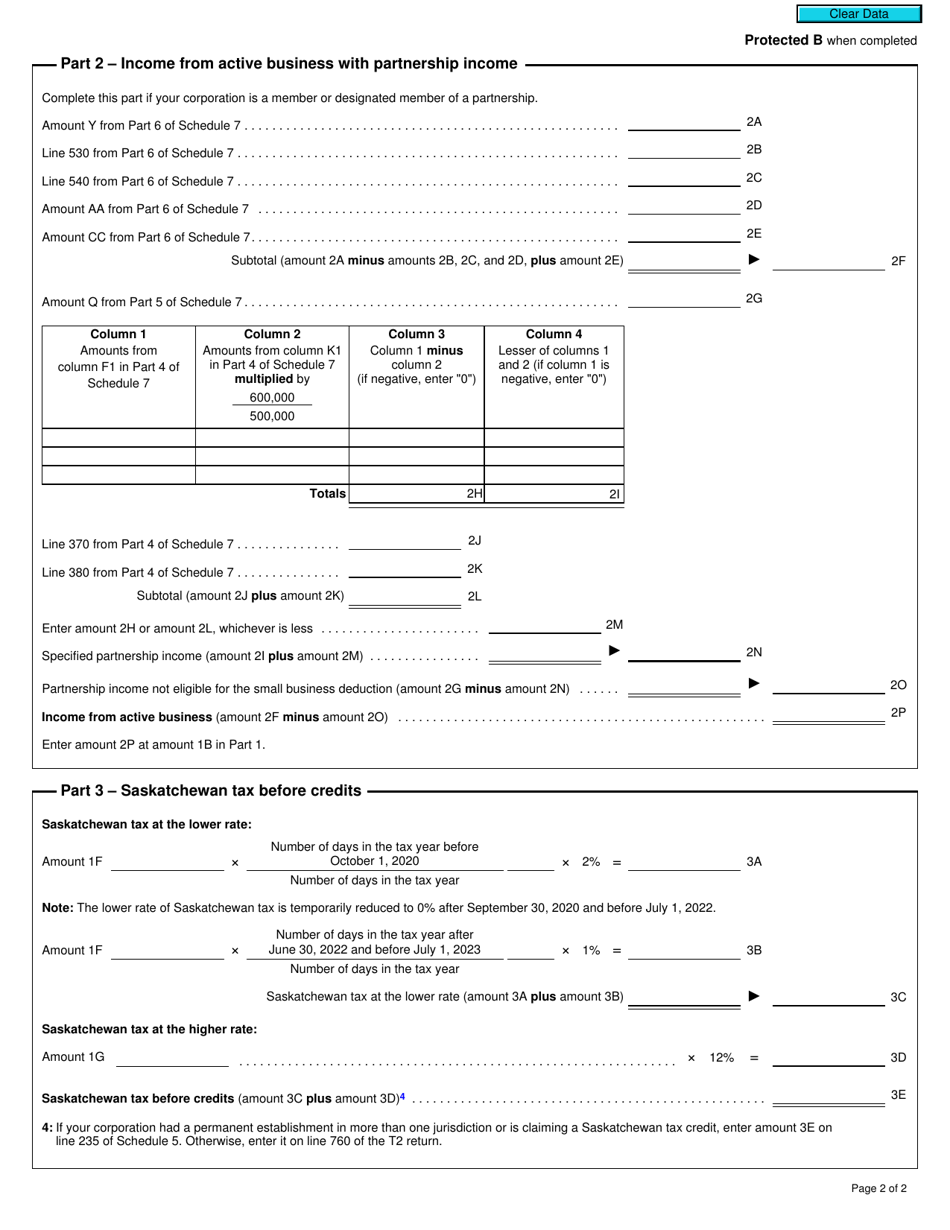

Form T2 Schedule 411

for the current year.

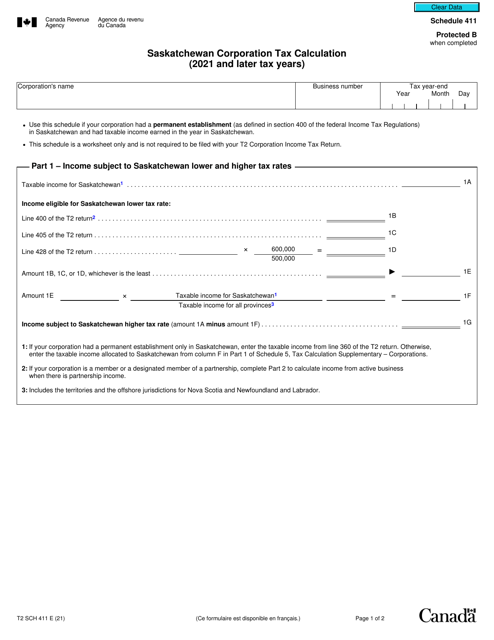

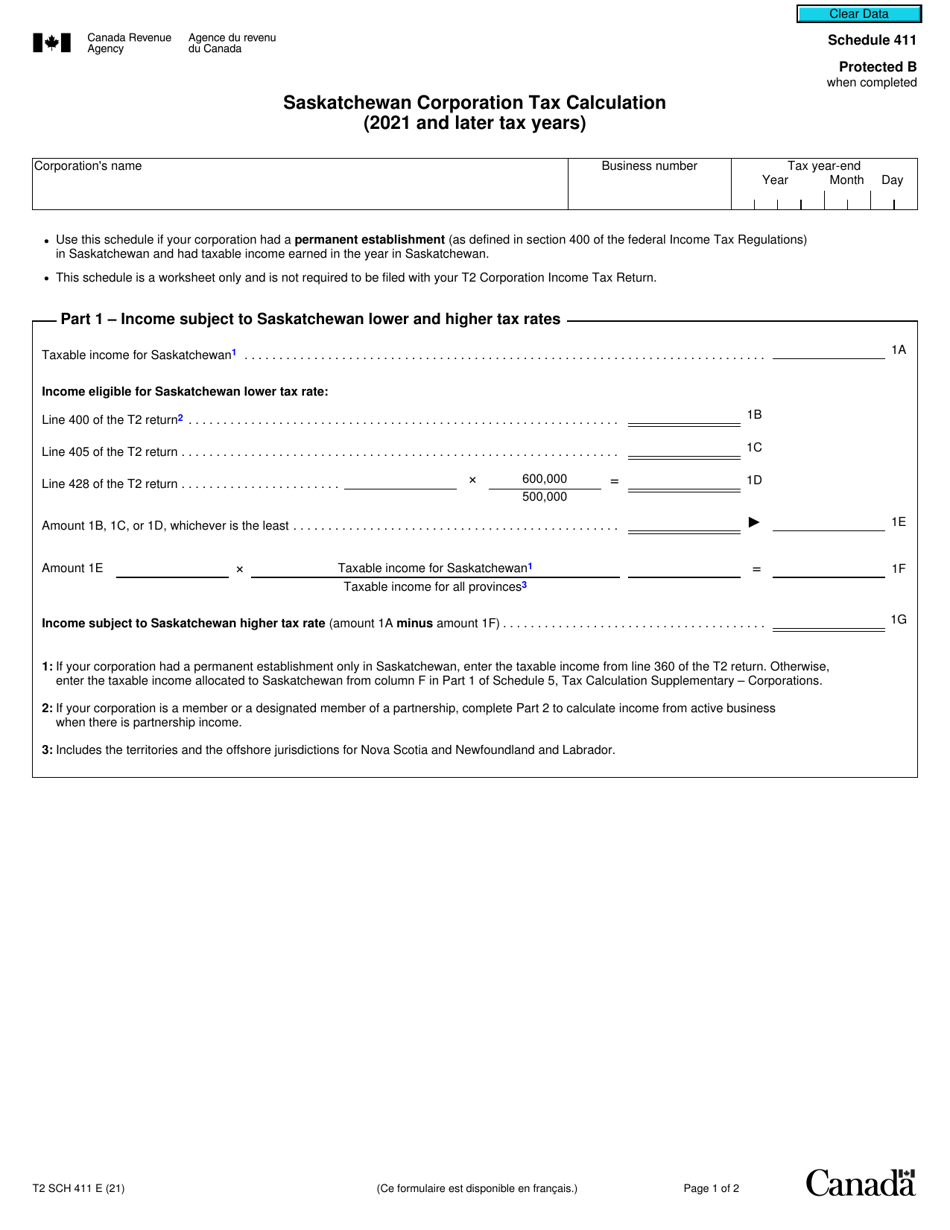

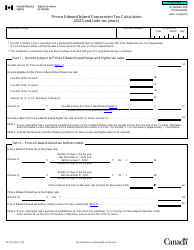

Form T2 Schedule 411 Saskatchewan Corporation Tax Calculation (2021 and Later Tax Years) - Canada

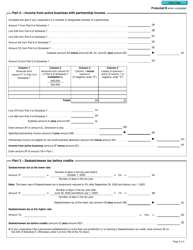

Form T2 Schedule 411 is used for calculating the Saskatchewan Corporation Tax for the tax years 2021 and onwards in Canada. It helps corporations determine the amount of tax they owe to the province of Saskatchewan.

The Form T2 Schedule 411 Saskatchewan Corporation Tax Calculation (2021 and Later Tax Years) in Canada is filed by Saskatchewan corporations for their provincial tax calculations.

FAQ

Q: What is Form T2 Schedule 411?

A: Form T2 Schedule 411 is a tax form used by Saskatchewan corporations to calculate their corporation tax for the tax years 2021 and later.

Q: Who needs to use Form T2 Schedule 411?

A: Saskatchewan corporations need to use Form T2 Schedule 411 to calculate their corporation tax for the tax years 2021 and later.

Q: What does Form T2 Schedule 411 calculate?

A: Form T2 Schedule 411 calculates the corporation tax payable by Saskatchewan corporations for the tax years 2021 and later.

Q: When should Form T2 Schedule 411 be filed?

A: Form T2 Schedule 411 should be filed along with the corporation's T2 income tax return for the tax years 2021 and later.

Q: Are there any deadlines for filing Form T2 Schedule 411?

A: Yes, the deadline for filing Form T2 Schedule 411 is the same as the deadline for filing the corporation's T2 income tax return for the tax years 2021 and later.

Q: What happens if Form T2 Schedule 411 is not filed on time?

A: If Form T2 Schedule 411 is not filed on time, the corporation may be subject to penalties and interest charges imposed by the CRA.

Q: Is there any fee associated with filing Form T2 Schedule 411?

A: No, there is no separate fee for filing Form T2 Schedule 411. However, there may be a fee for filing the corporation's T2 income tax return.

Q: Can I get help with filling out Form T2 Schedule 411?

A: Yes, the CRA provides resources and guides to help corporations in completing Form T2 Schedule 411. Additionally, professional tax advisors can assist with the process.