This version of the form is not currently in use and is provided for reference only. Download this version of

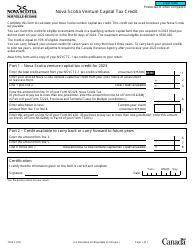

Form T2 Schedule 387

for the current year.

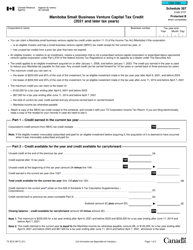

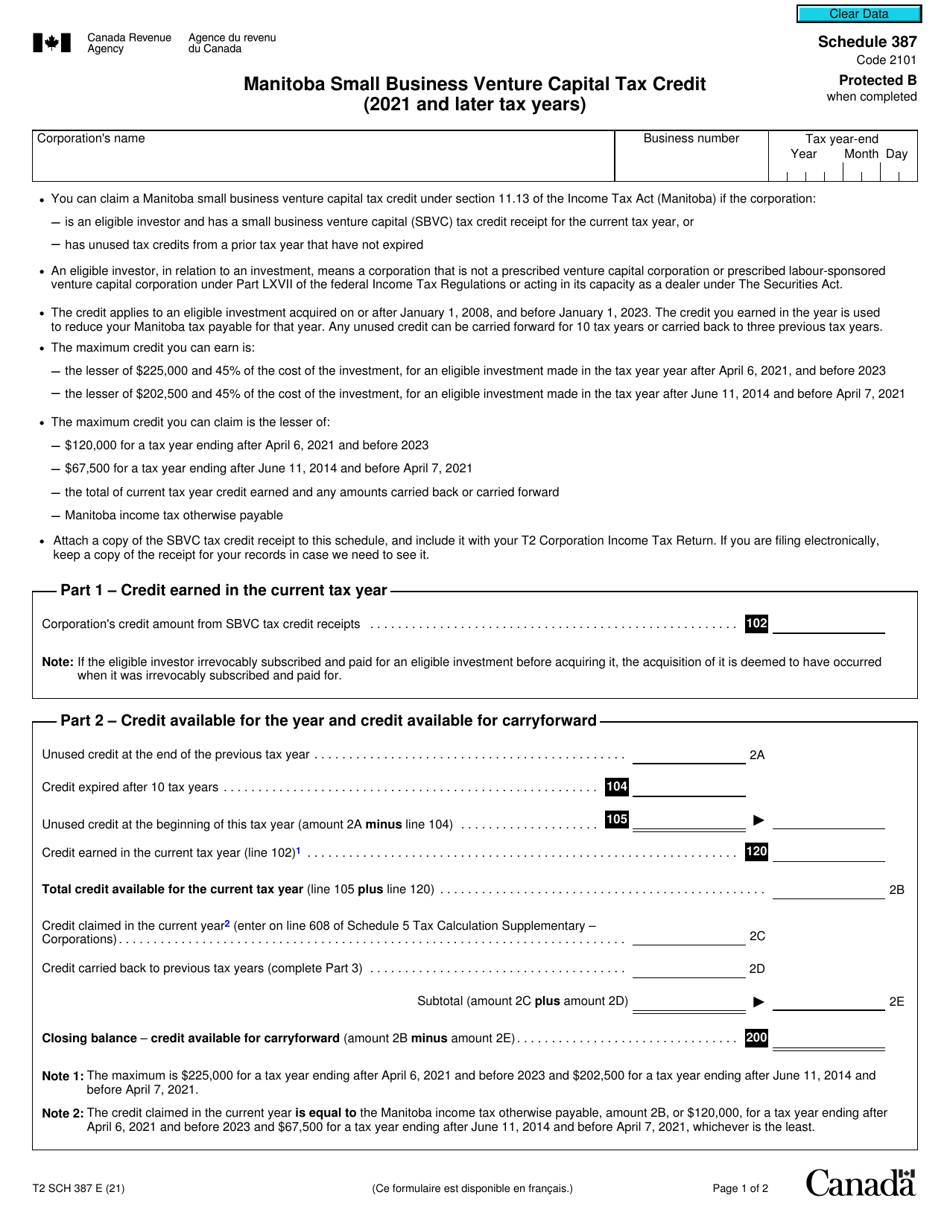

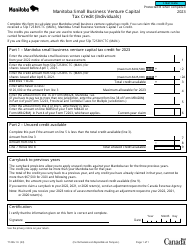

Form T2 Schedule 387 Manitoba Small Business Venture Capital Tax Credit (2021 and Later Tax Years) - Canada

Form T2 Schedule 387 is used in Canada for claiming the Manitoba Small Business Venture Capital Tax Credit. This tax credit is available for small businesses in Manitoba and is meant to encourage investments in these businesses by providing a tax credit to eligible investors.

The Form T2 Schedule 387 is filed by small businesses in Manitoba who want to claim the Small Business Venture Capital Tax Credit.

FAQ

Q: What is Form T2 Schedule 387?

A: Form T2 Schedule 387 is a tax form used in Canada for the Manitoba Small Business Venture Capital Tax Credit.

Q: Who should use Form T2 Schedule 387?

A: This form should be used by small businesses in Manitoba that are eligible for the Small Business Venture Capital Tax Credit.

Q: What is the purpose of the Manitoba Small Business Venture Capital Tax Credit?

A: The purpose of this tax credit is to encourage investment in small businesses in Manitoba by providing tax incentives to investors.

Q: When should Form T2 Schedule 387 be filed?

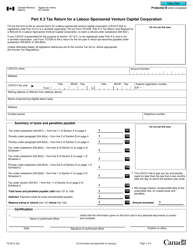

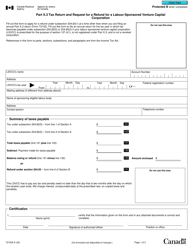

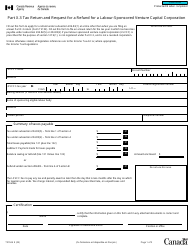

A: This form should be filed along with your T2 Corporation Income Tax Return for the applicable tax year.

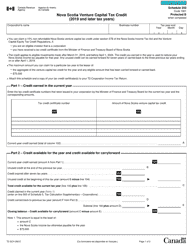

Q: What information is required on Form T2 Schedule 387?

A: You will need to provide details about your corporation, the investors, and the investments made in eligible small businesses in Manitoba.

Q: Are there any deadlines for claiming the Manitoba Small Business Venture Capital Tax Credit?

A: Yes, there are specific deadlines for claiming this tax credit. It is important to refer to the official guidelines or consult with a tax professional to ensure you meet the deadlines.

Q: Is the Manitoba Small Business Venture Capital Tax Credit refundable?

A: Yes, this tax credit is refundable, which means it can be used to reduce taxes payable or potentially result in a refund if the credit exceeds the taxes owed.

Q: Can I carry forward unused Manitoba Small Business Venture Capital Tax Credit?

A: No, unused portions of this tax credit cannot be carried forward to future tax years. It is only applicable for the current tax year.