This version of the form is not currently in use and is provided for reference only. Download this version of

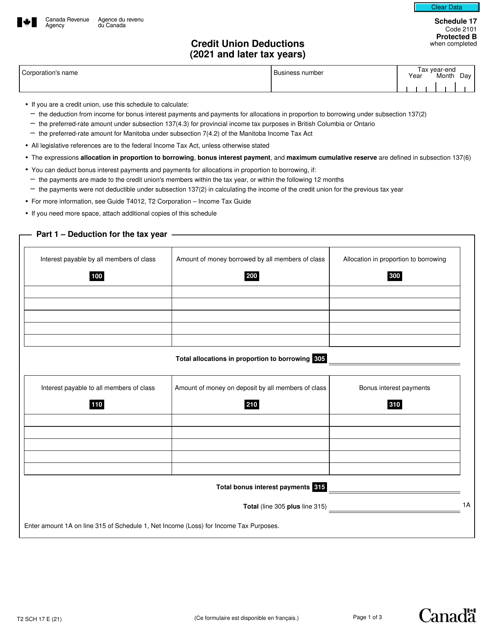

Form T2 Schedule 17

for the current year.

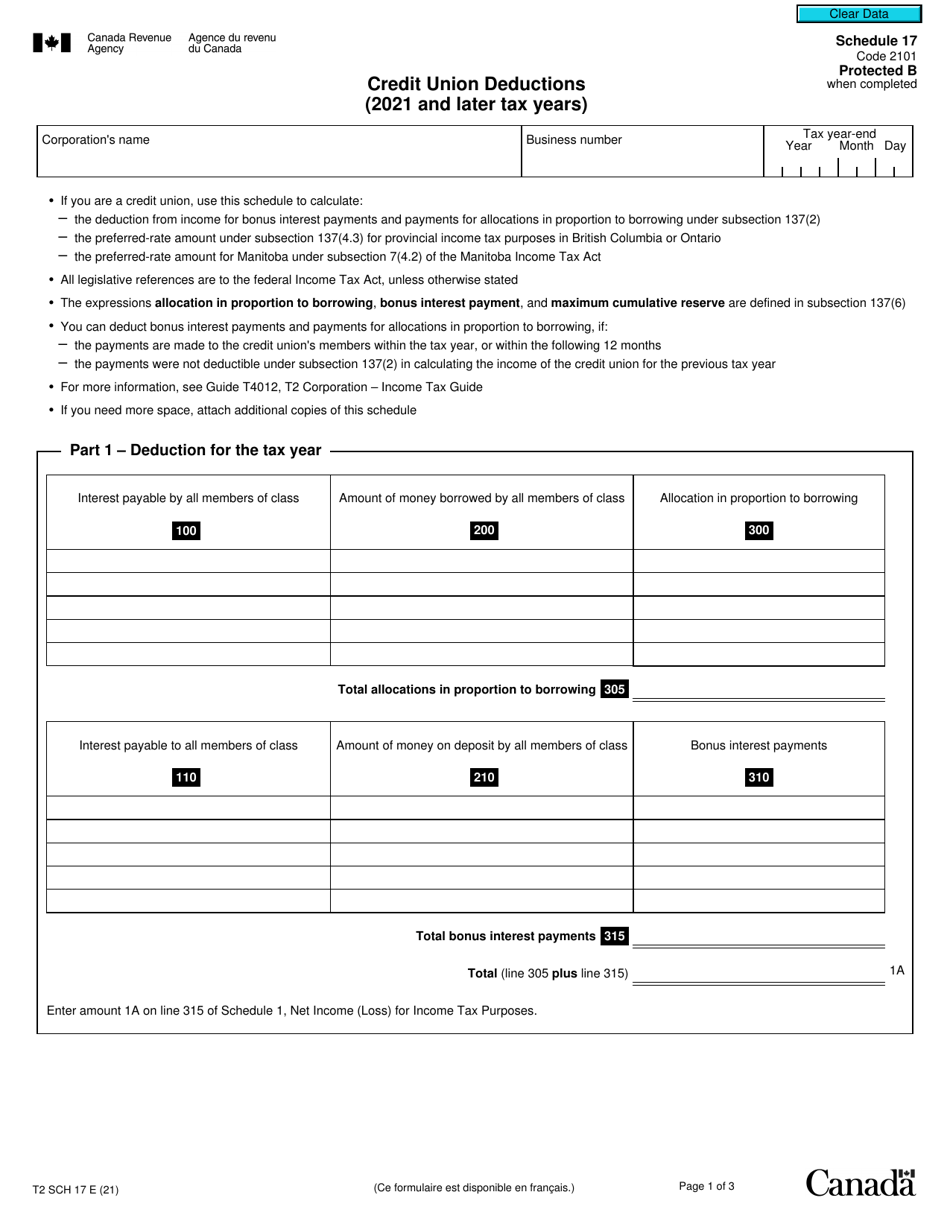

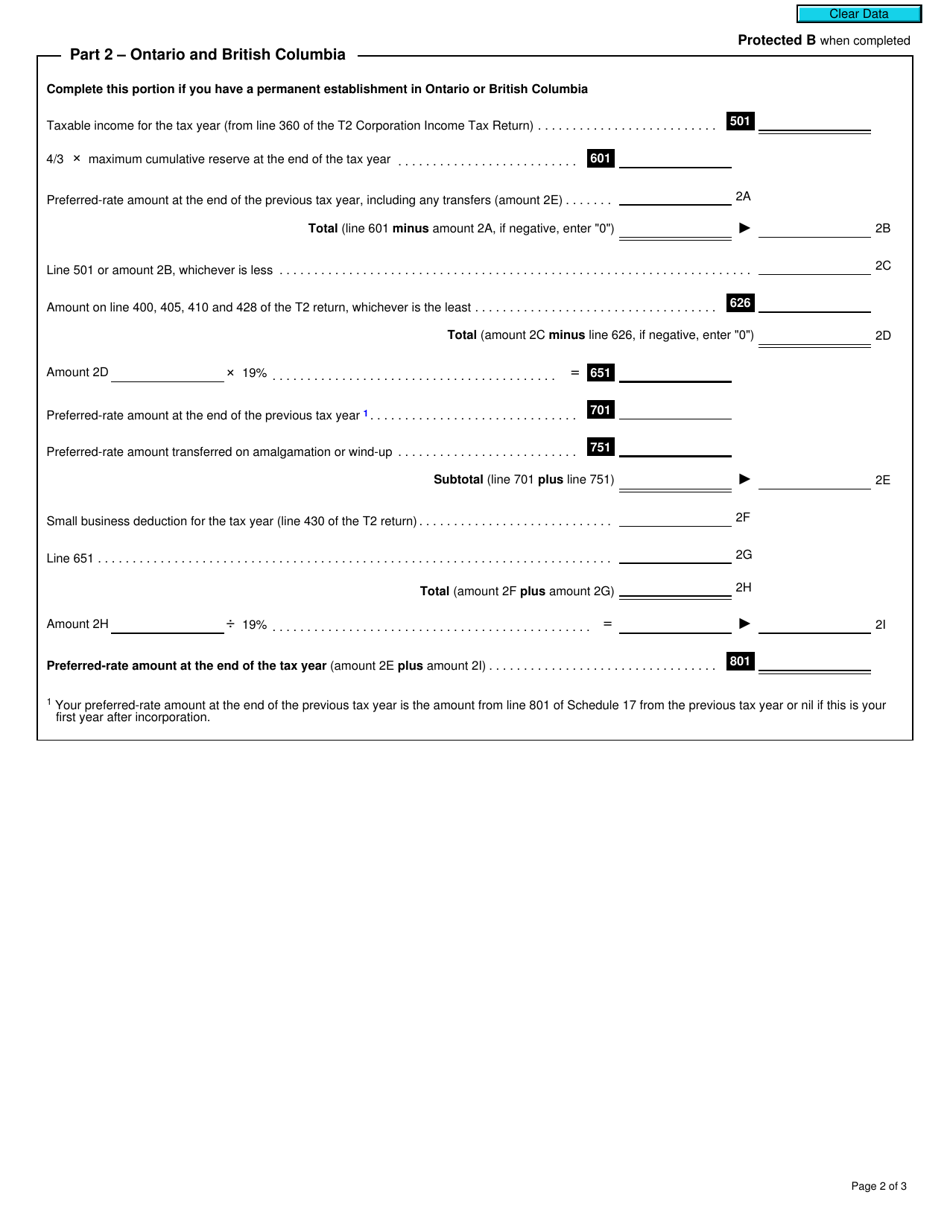

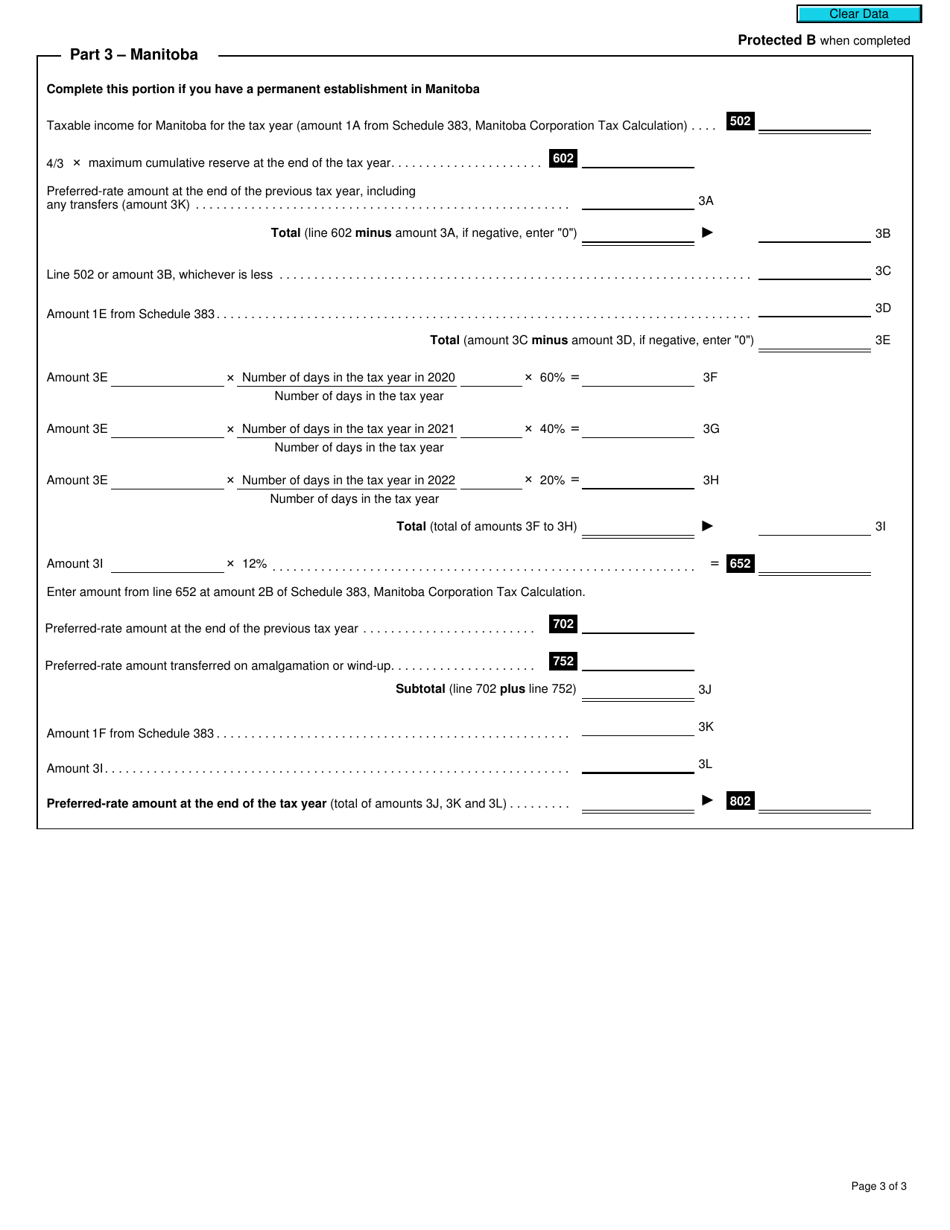

Form T2 Schedule 17 Credit Union Deductions (2021 and Later Tax Years) - Canada

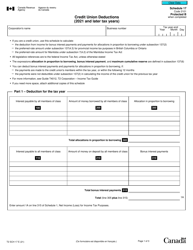

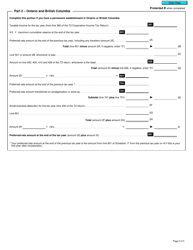

Form T2 Schedule 17 is used by credit unions in Canada to calculate and report their eligible deductions for income tax purposes. It helps credit unions determine the amount of income that is exempt or deductible, which in turn affects their overall tax liability.

The Form T2 Schedule 17 Credit Union Deductions is filed by Canadian credit unions.

FAQ

Q: What is Form T2 Schedule 17?

A: Form T2 Schedule 17 is a tax form used by Canadian corporations to claim deductions related to credit unions.

Q: What are credit union deductions?

A: Credit union deductions are specific expenses that Canadian corporations can claim related to credit unions, such as loan losses or contributions to credit union reserve funds.

Q: What tax year is Form T2 Schedule 17 used for?

A: Form T2 Schedule 17 is used for tax years starting in 2021 and later.

Q: Who is eligible to use Form T2 Schedule 17?

A: Canadian corporations that are members of a credit union and have eligible deductions can use Form T2 Schedule 17.

Q: What if a corporation has multiple credit unions?

A: If a corporation has multiple credit unions, it must complete a separate Form T2 Schedule 17 for each credit union.

Q: How do I file Form T2 Schedule 17?

A: Form T2 Schedule 17 should be filed along with the corporation's T2 Corporation Income Tax Return.

Q: Are there any deadlines for filing Form T2 Schedule 17?

A: The deadline for filing Form T2 Schedule 17 is the same as the deadline for the corporation's T2 Corporation Income Tax Return.

Q: Can I claim credit union deductions on personal income tax returns?

A: No, credit union deductions are only applicable to Canadian corporations and cannot be claimed on personal income tax returns.