This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2220

for the current year.

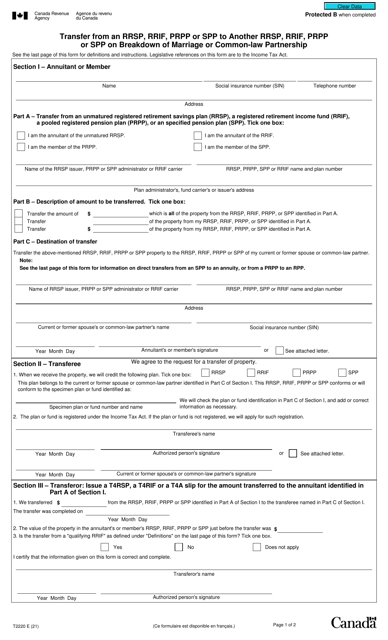

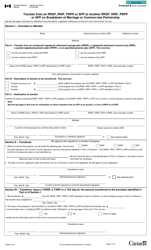

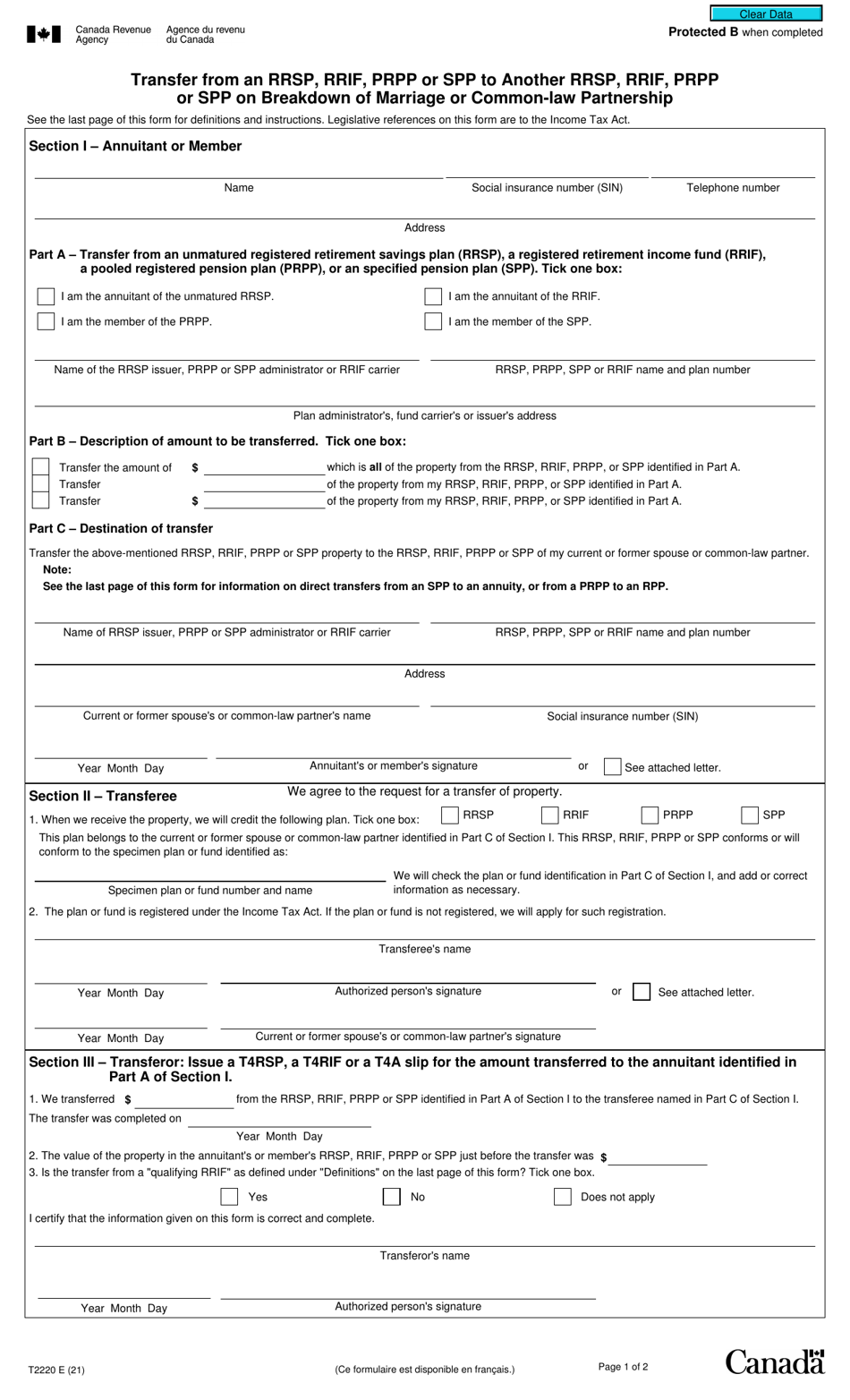

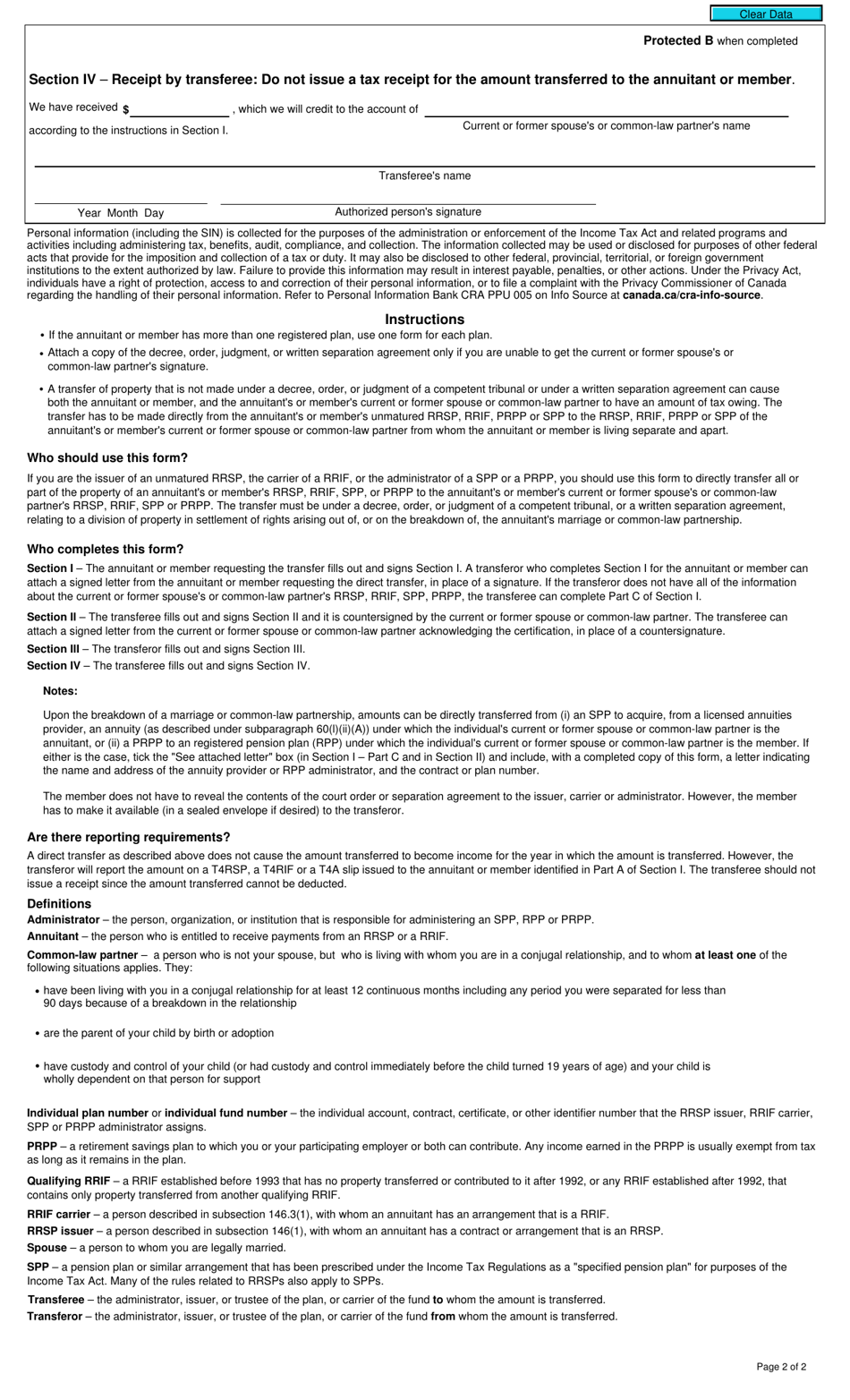

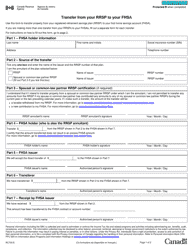

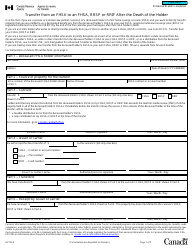

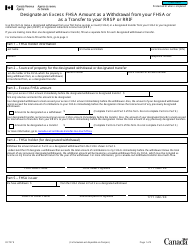

Form T2220 Transfer From an Rrsp, Rrif, Prpp or Spp to Another Rrsp, Rrif, Prpp or Spp on Breakdown of Marriage or Common-Law Partnership - Canada

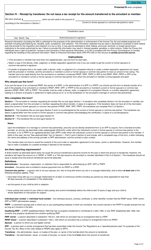

Form T2220 Transfer From an RRSP, RRIF, PRPP or SPP to Another RRSP, RRIF, PRPP or SPP on Breakdown of Marriage or Common-Law Partnership is used in Canada to report the transfer of retirement savings between spouses or common-law partners during a breakdown of their relationship. It allows for the tax-free transfer of these savings to avoid immediate tax implications.

The form T2220 Transfer From an RRSP, RRIF, PRPP, or SPP on Breakdown of Marriage or Common-Law Partnership in Canada is filed by the individual who is transferring their retirement savings from one registered plan to another as a result of a breakdown in their marriage or common-law partnership.

FAQ

Q: What is Form T2220 Transfer From an Rrsp, Rrif, Prpp or Spp to Another Rrsp, Rrif, Prpp or Spp on Breakdown of Marriage or Common-Law Partnership?

A: Form T2220 is a Canadian tax form used to transfer funds from one registered retirement savings plan (RRSP), registered retirement income fund (RRIF), pooled registered pension plan (PRPP), or specified pension plan (SPP) to another of the same type in the case of a marriage or common-law partnership breakdown.

Q: When is Form T2220 used?

A: Form T2220 is used when there is a breakdown of marriage or common-law partnership, and one individual wants to transfer their retirement savings from one registered plan to another.

Q: What types of plans can be transferred using Form T2220?

A: Form T2220 can be used to transfer funds from one RRSP, RRIF, PRPP, or SPP to another of the same type.

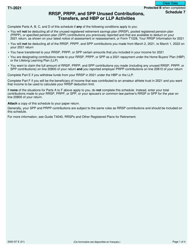

Q: Do I have to report the transferred amount as income?

A: No, the transferred amount is not considered income and does not need to be reported on your tax return.

Q: What is the deadline for submitting Form T2220?

A: Form T2220 should be submitted with your income tax return for the year in which the transfer is made.