This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9414-S2) Schedule NU(S2)MJ

for the current year.

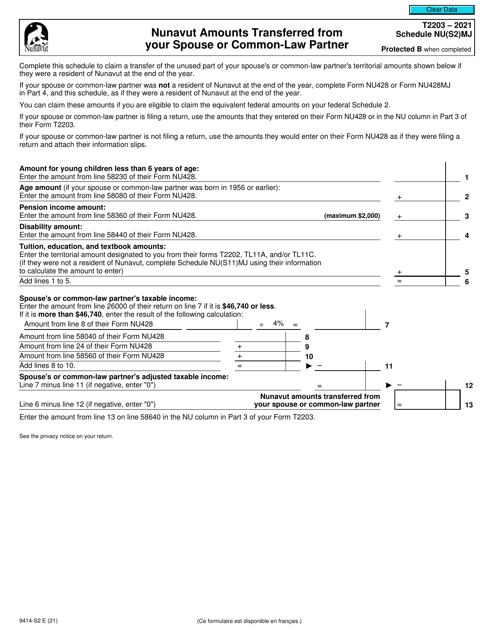

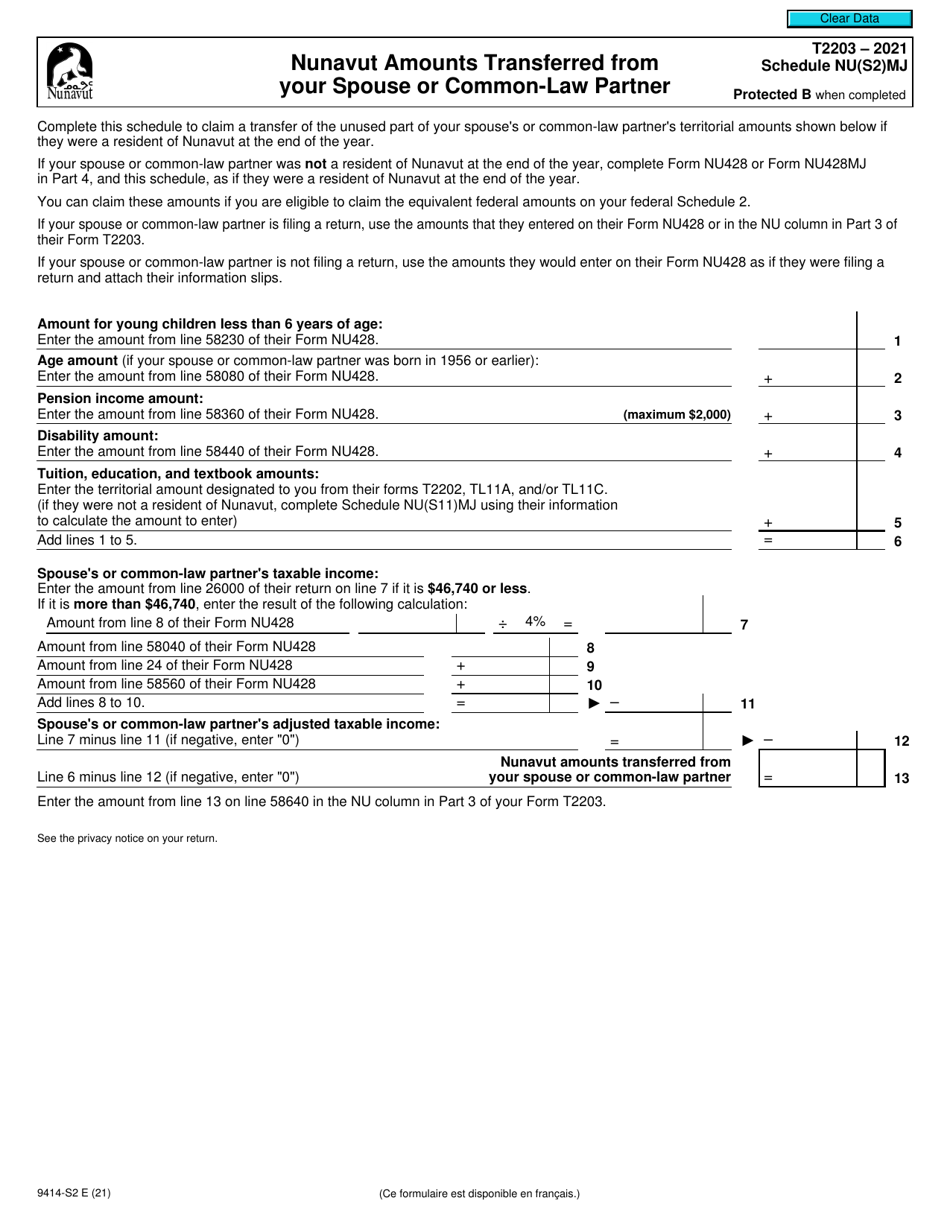

Form T2203 (9414-S2) Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner - Canada

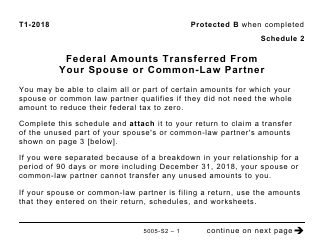

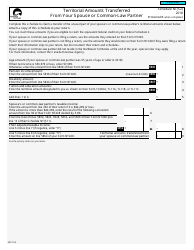

Form T2203 (9414-S2) Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner is used in Canada for reporting tax credits transferred from a spouse or common-law partner who resides in Nunavut. This form is specific to Nunavut and is part of the Canadian tax filing process.

The Form T2203 Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner is filed by individuals in Canada who have amounts to transfer from their spouse or common-law partner in Nunavut.

FAQ

Q: What is Form T2203 (9414-S2)?

A: Form T2203 (9414-S2) is a schedule used in Canada to report Nunavut amounts transferred from your spouse or common-law partner.

Q: What is Schedule NU(S2)MJ?

A: Schedule NU(S2)MJ is a specific section within Form T2203 (9414-S2) used to report Nunavut amounts transferred from your spouse or common-law partner.

Q: Who needs to fill out Form T2203 (9414-S2)?

A: You need to fill out Form T2203 (9414-S2) if you want to report Nunavut amounts transferred from your spouse or common-law partner.

Q: What are Nunavut amounts?

A: Nunavut amounts refer to certain tax credits or deductions that can be transferred from your spouse or common-law partner to reduce your tax liability.

Q: Can I transfer Nunavut amounts from my spouse or common-law partner?

A: Yes, if your spouse or common-law partner is eligible to claim Nunavut tax credits or deductions and you both agree to transfer them, you can do so using Form T2203 (9414-S2).