This version of the form is not currently in use and is provided for reference only. Download this version of

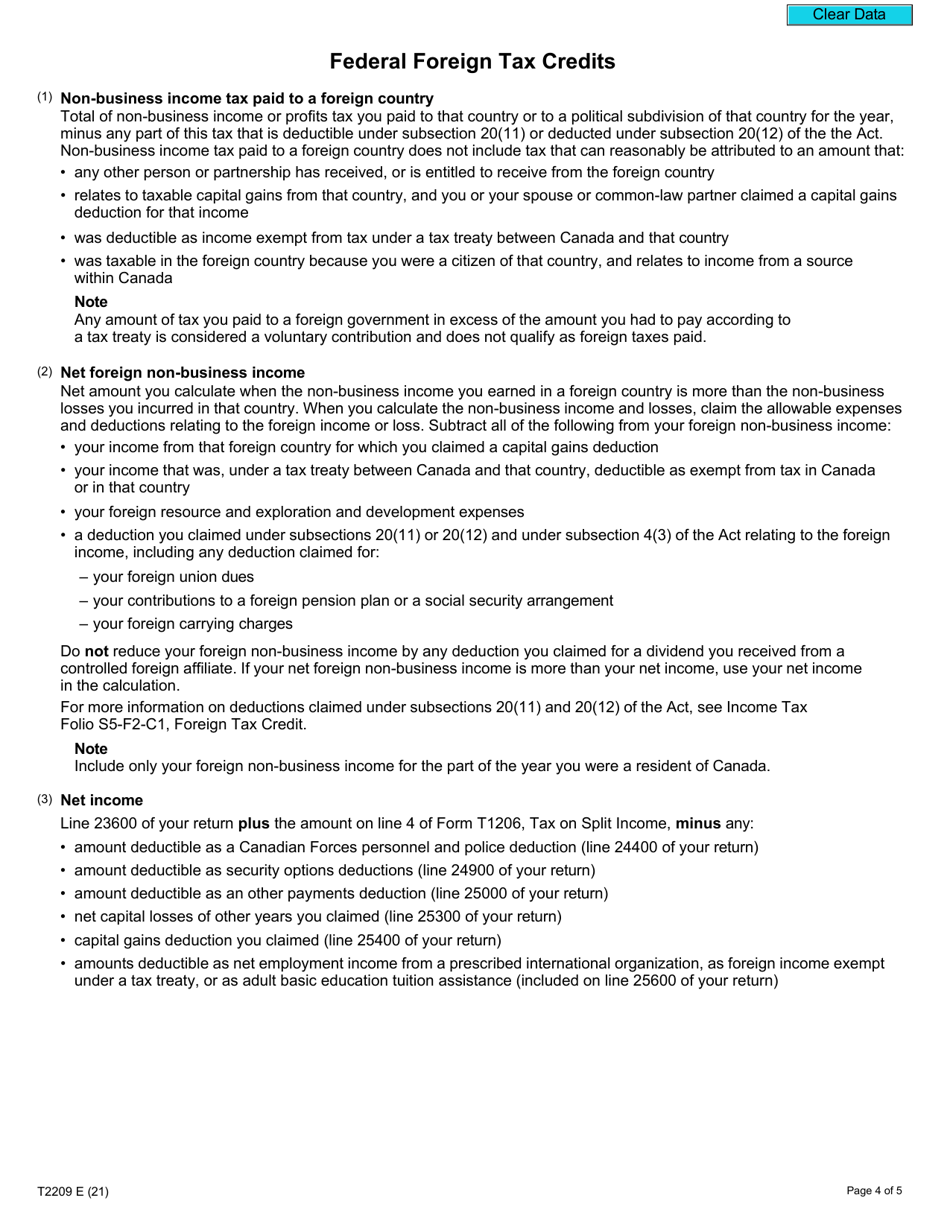

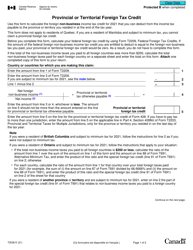

Form T2209

for the current year.

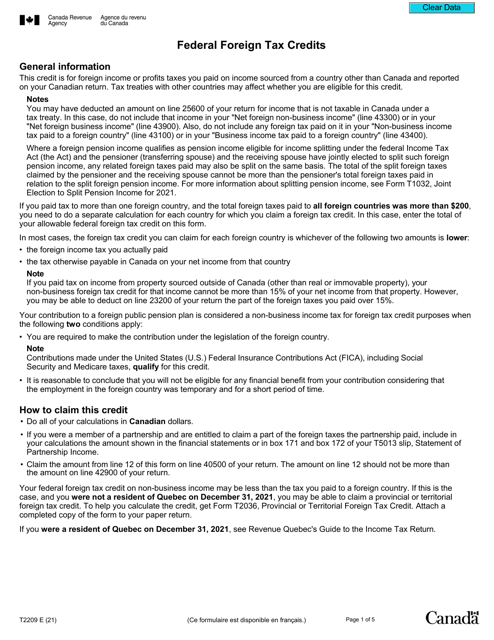

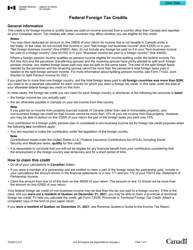

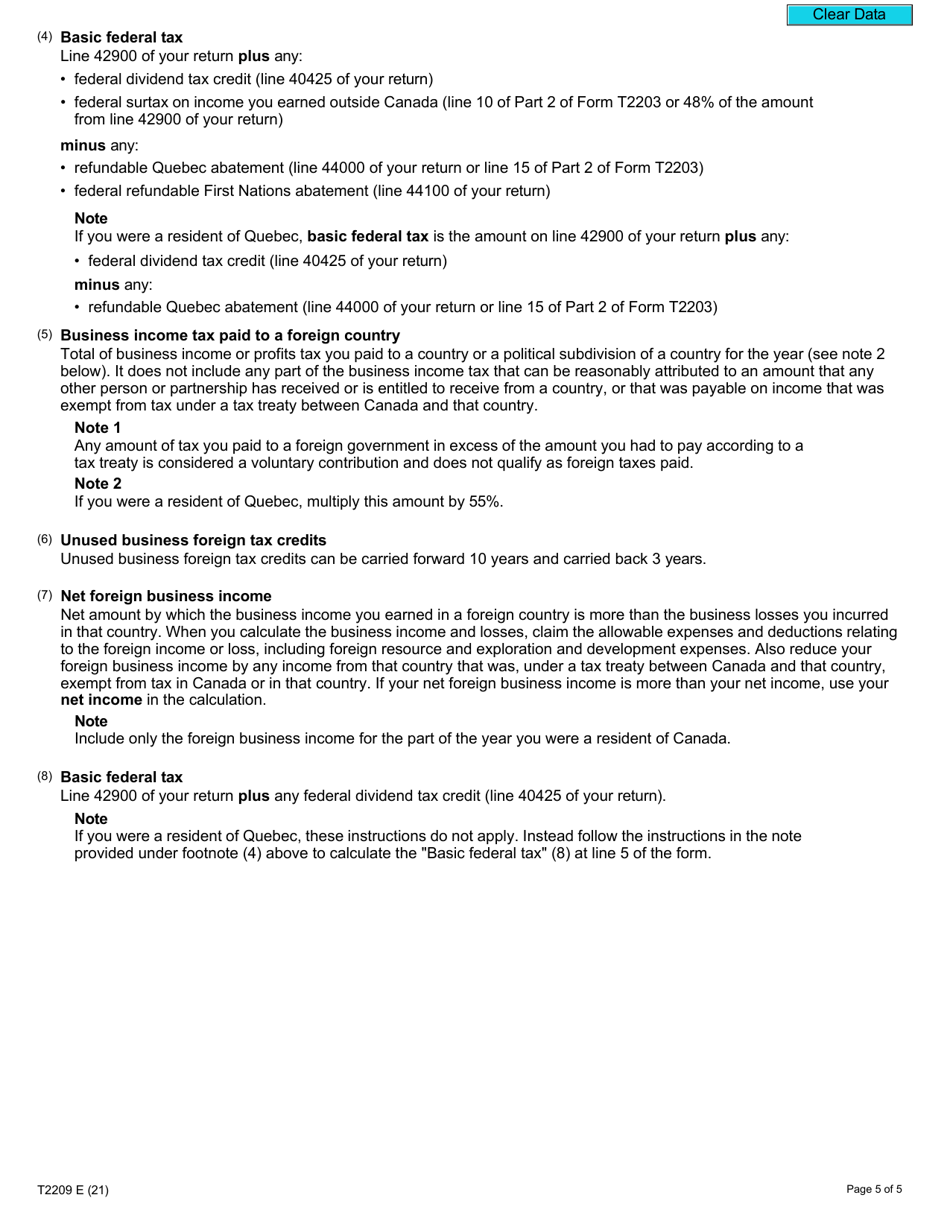

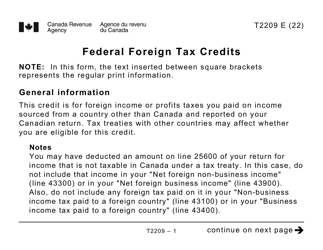

Form T2209 Federal Foreign Tax Credits - Canada

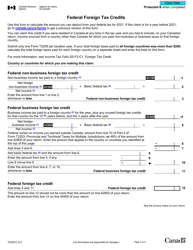

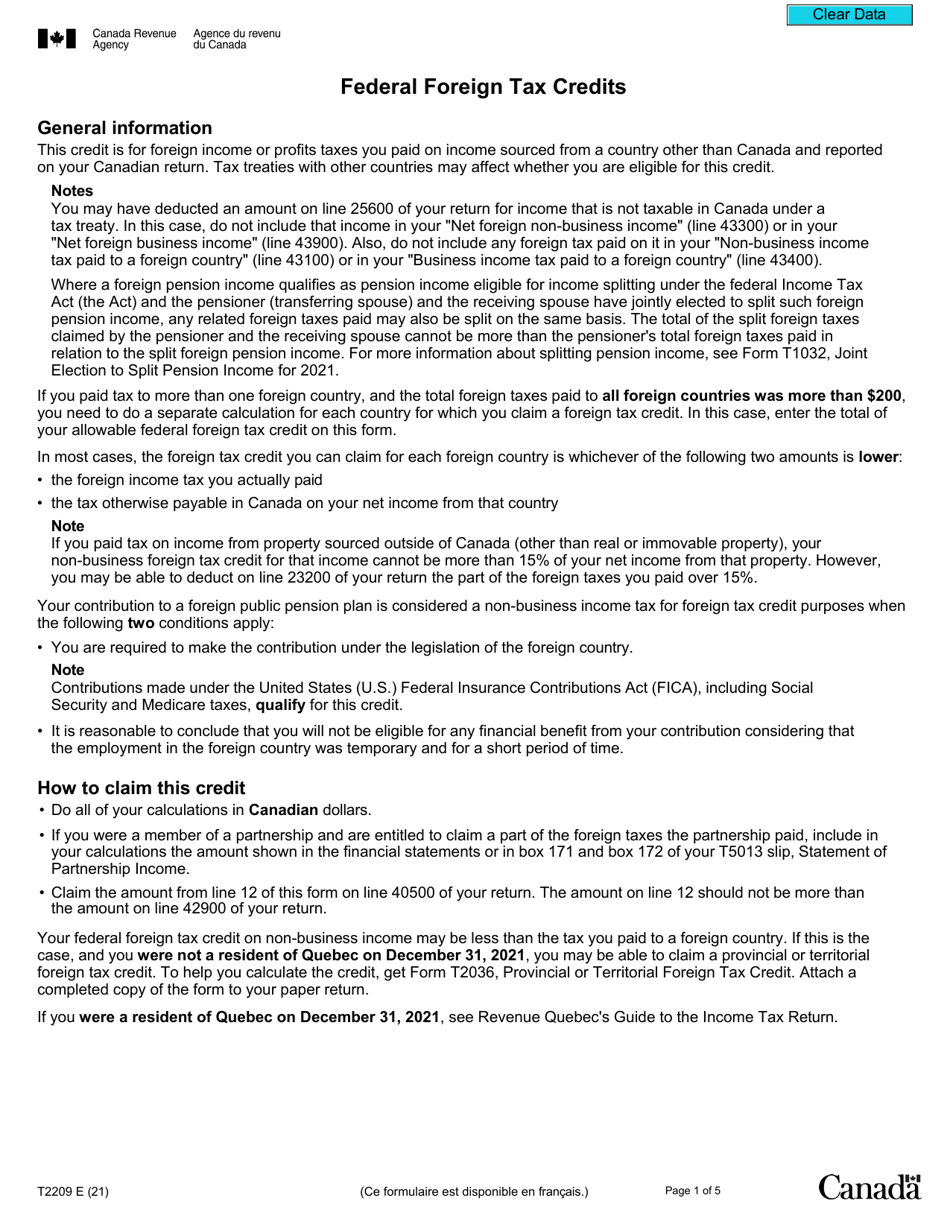

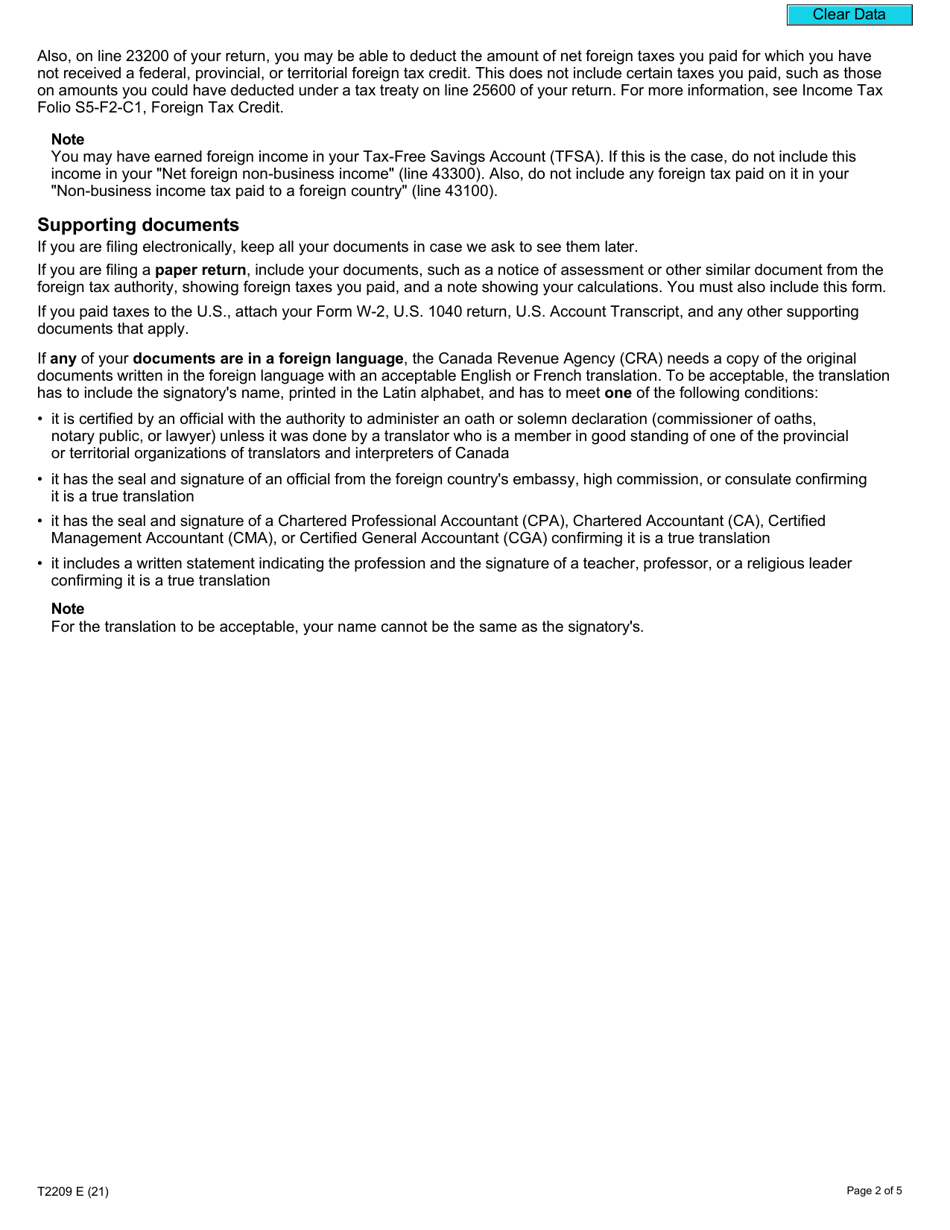

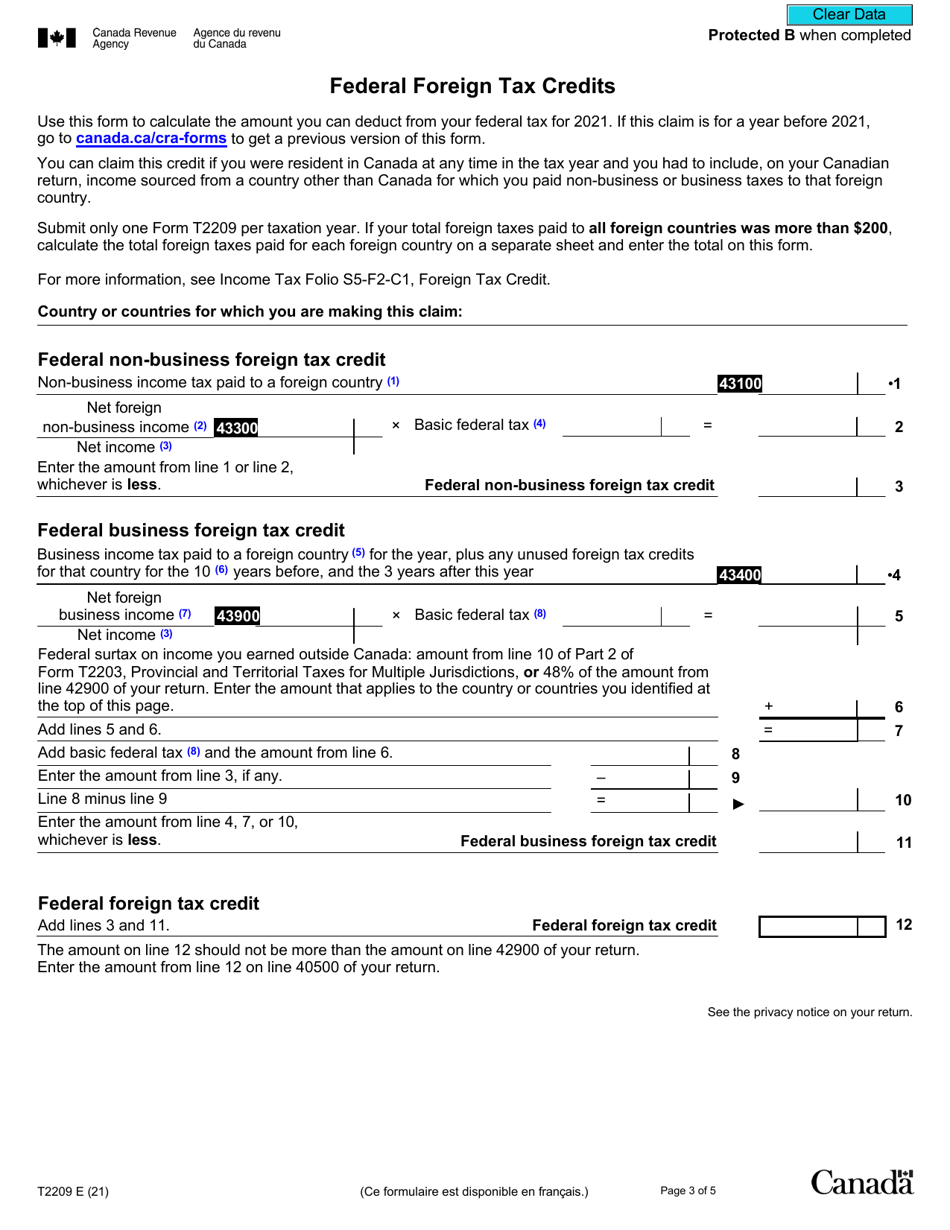

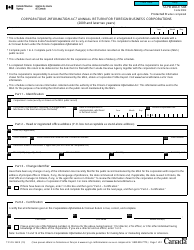

Form T2209 Federal Foreign Tax Credits - Canada is used by Canadian taxpayers to claim a credit for income tax paid to foreign countries on foreign-sourced income. This form helps taxpayers avoid double taxation on their foreign income.

The Form T2209 Federal Foreign Tax Credits in Canada is typically filed by Canadian residents or taxpayers who have paid foreign taxes on their income from foreign sources.

FAQ

Q: What is Form T2209?

A: Form T2209 is a form used in Canada to calculate and claim federal foreign tax credits.

Q: What are federal foreign tax credits?

A: Federal foreign tax credits are credits that can be claimed by Canadian residents for taxes paid to foreign countries on income earned outside of Canada.

Q: Who can use Form T2209?

A: Canadian residents who have paid taxes to foreign countries on income earned outside of Canada can use Form T2209.

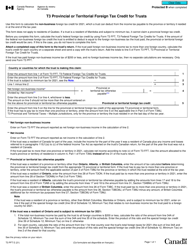

Q: How do I complete Form T2209?

A: To complete Form T2209, you need to provide details about the foreign taxes you paid, the type of income earned, and any available tax treaties.

Q: What should I do with Form T2209 once completed?

A: Once completed, Form T2209 should be attached to your Canadian income tax return.

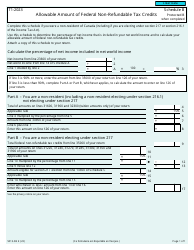

Q: Are there any limitations or restrictions on claiming federal foreign tax credits?

A: Yes, there are limitations and restrictions on claiming federal foreign tax credits. It is recommended to review the instructions for Form T2209 or consult a tax professional for more information.

Q: Can I claim federal foreign tax credits for taxes paid to any foreign country?

A: You can claim federal foreign tax credits for taxes paid to any foreign country, as long as you meet the eligibility criteria and provide the necessary documentation.

Q: What is the purpose of claiming federal foreign tax credits?

A: The purpose of claiming federal foreign tax credits is to help avoid double taxation on income earned outside of Canada.

Q: Is Form T2209 specific to Canada?

A: Yes, Form T2209 is specific to Canada and is used to calculate and claim federal foreign tax credits for Canadian residents.