This version of the form is not currently in use and is provided for reference only. Download this version of

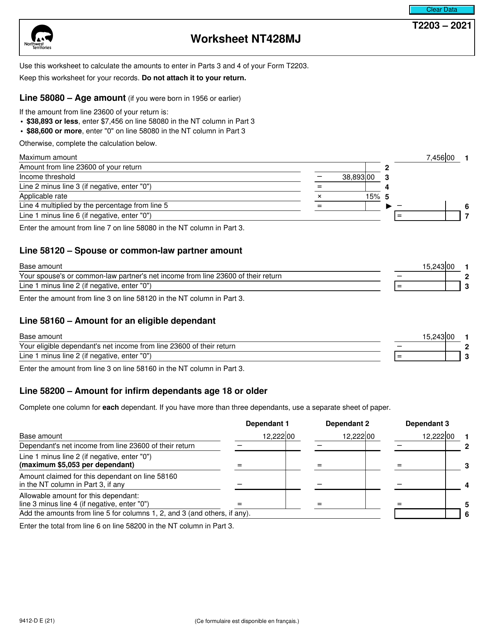

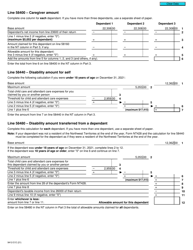

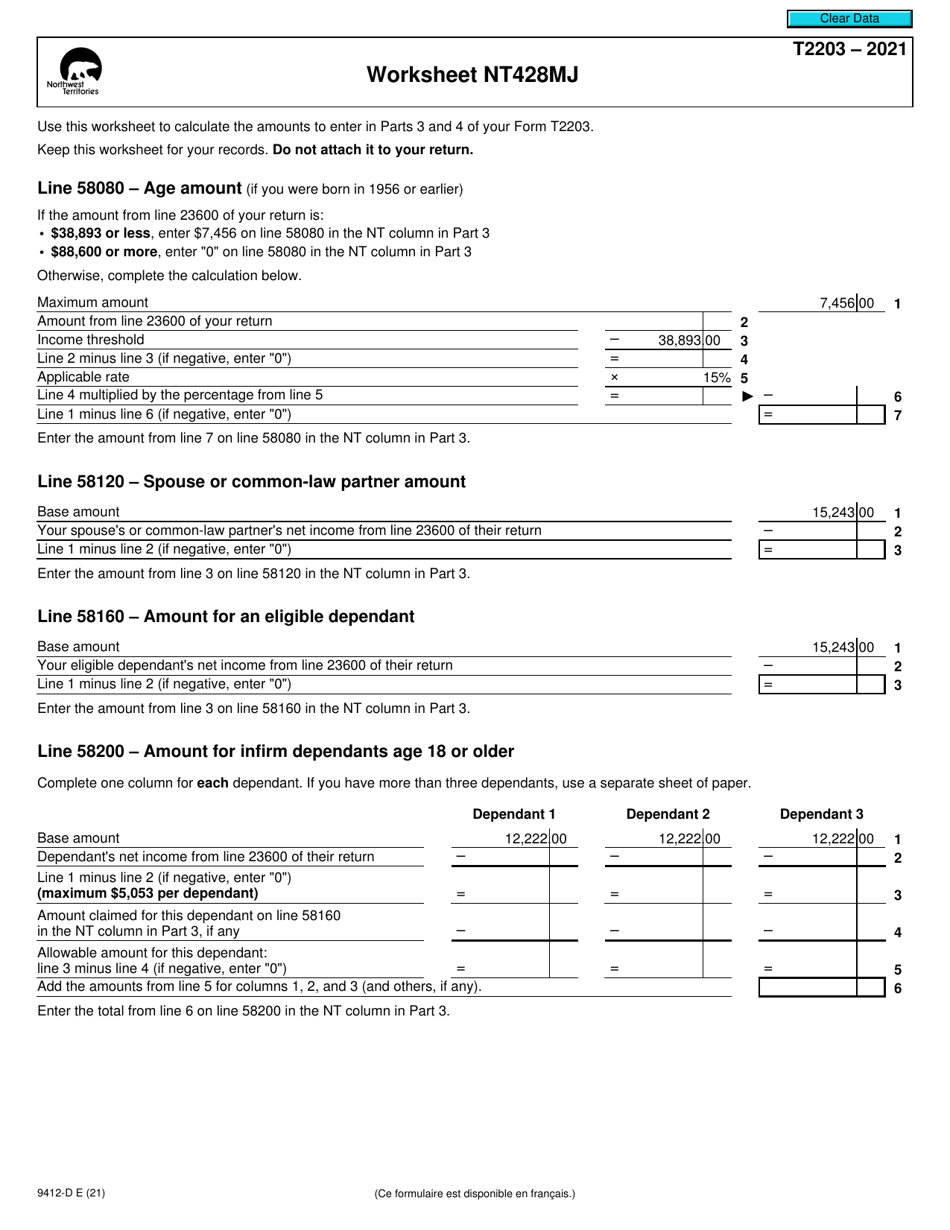

Form T2203 (9412-D) Worksheet NT428MJ

for the current year.

Form T2203 (9412-D) Worksheet NT428MJ Northwest Territories - Canada

Form T2203 (9412-D) Worksheet NT428MJ is used in the Northwest Territories, Canada for calculating the territorial tax for the individuals. It helps residents of the Northwest Territories determine the amount of tax they owe to the territorial government. The worksheet takes into account various factors such as income, deductions, and credits to calculate the final tax liability. It is an important tool in the tax filing process for residents of the Northwest Territories.

The Form T2203 (9412-D) Worksheet NT428MJ in Northwest Territories, Canada is typically filed by individuals who are resident in Northwest Territories and are claiming certain tax credits or deductions on their income tax return. This form is used to calculate and report these credits or deductions specific to Northwest Territories residents.

FAQ

Q: What is Form T2203 (9412-D) Worksheet NT428MJ?

A: Form T2203 (9412-D) Worksheet NT428MJ is an official tax form used by residents of the Northwest Territories in Canada to calculate their territorial taxes payable or refundable.

Q: What is the purpose of this worksheet?

A: The purpose of Form T2203 (9412-D) Worksheet NT428MJ is to help taxpayers determine their income tax liability or eligibility for a tax refund specifically for residents of the Northwest Territories.

Q: When should I use this form?

A: You should use Form T2203 (9412-D) Worksheet NT428MJ if you are a resident of the Northwest Territories and need to calculate your territorial income tax.

Q: Are there any specific instructions for completing this worksheet?

A: Yes, the worksheet comes with detailed instructions on how to fill it out accurately. Make sure to read the instructions thoroughly and follow them step by step.

Q: Can I claim any deductions or credits on this form?

A: Yes, you can claim various deductions and credits on Form T2203 (9412-D) Worksheet NT428MJ, such as the northern residents deductions or the Canada caregiver amount. Refer to the instructions provided with the form for a complete list.

Q: What should I do with the completed form after filling it out?

A: Keep a copy of the completed Form T2203 (9412-D) Worksheet NT428MJ for your records. If you are filing your taxes electronically, you may need to submit it as part of your digital tax return.