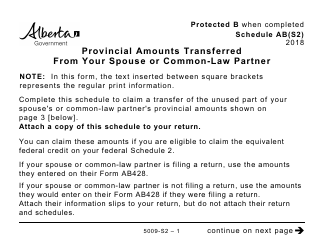

This version of the form is not currently in use and is provided for reference only. Download this version of

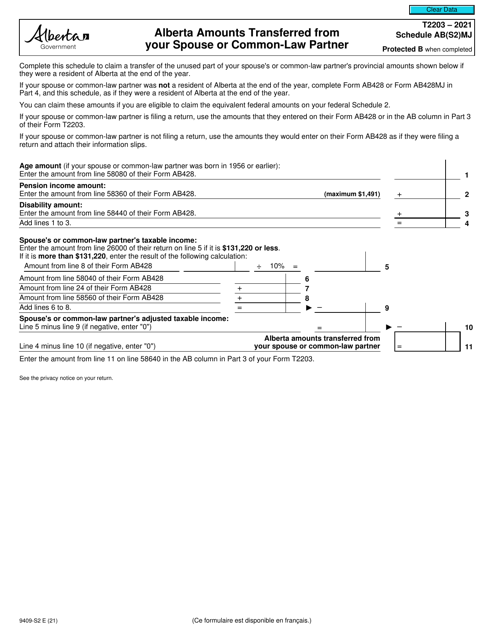

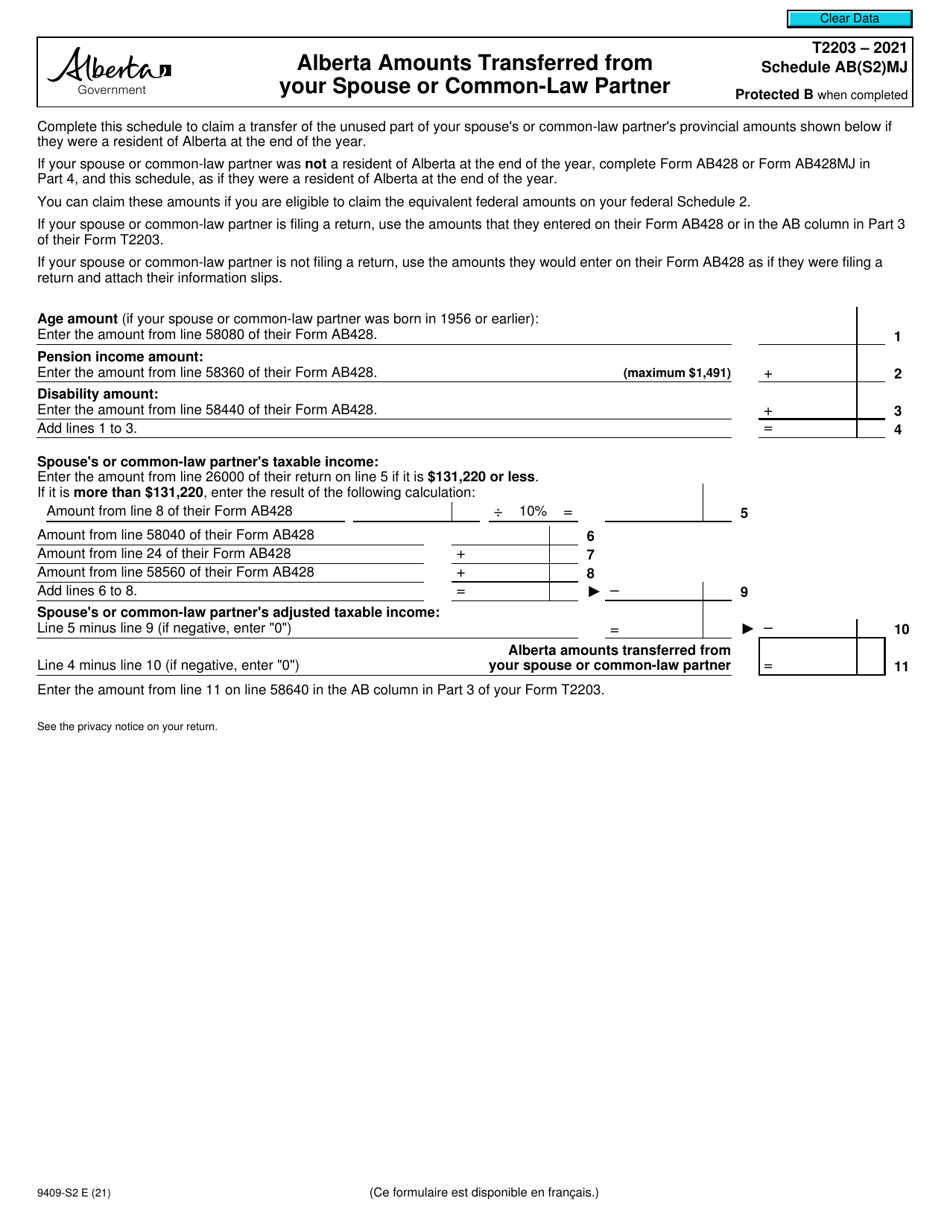

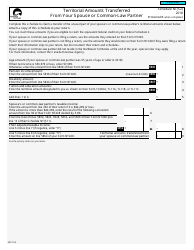

Form T2203 (9409-S2) Schedule AB(S2)MJ

for the current year.

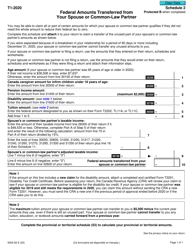

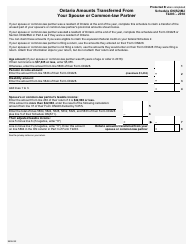

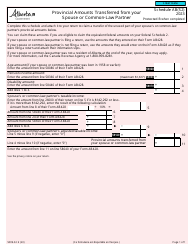

Form T2203 (9409-S2) Schedule AB(S2)MJ Alberta Amounts Transferred From Your Spouse or Common-Law Partner - Canada

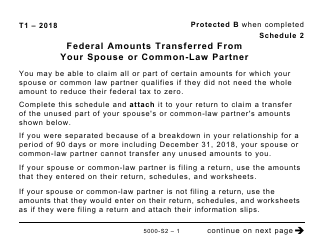

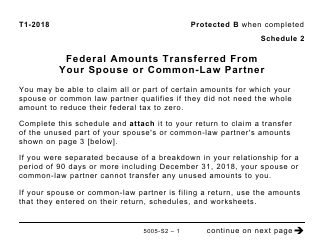

Form T2203 (9409-S2) Schedule AB(S2)MJ Alberta Amounts Transferred From Your Spouse or Common-Law Partner is used in Canada for reporting the transfer of certain amounts from your spouse or common-law partner in the province of Alberta. It is specific to tax purposes and helps determine the correct filing and reporting of income and deductions.

In Canada, the Form T2203 (9409-S2) Schedule AB(S2)MJ is filed by individuals who want to report the amounts transferred from their spouse or common-law partner in the province of Alberta.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is Schedule AB(S2)MJ Alberta?

A: Schedule AB(S2)MJ Alberta is a specific part of Form T2203.

Q: What does Schedule AB(S2)MJ Alberta do?

A: Schedule AB(S2)MJ Alberta is used to report amounts transferred from your spouse or common-law partner in Alberta.

Q: Who is required to fill out Form T2203?

A: Anyone who needs to report amounts transferred from their spouse or common-law partner in Alberta.

Q: Are there any specific rules or requirements for filling out Form T2203?

A: Yes, there are specific rules and requirements. It is advisable to consult the official instructions or seek professional advice.

Q: Is Form T2203 and Schedule AB(S2)MJ Alberta applicable only in Alberta?

A: Yes, Schedule AB(S2)MJ Alberta is specific to Alberta, but Form T2203 may be used in other provinces as well.