This version of the form is not currently in use and is provided for reference only. Download this version of

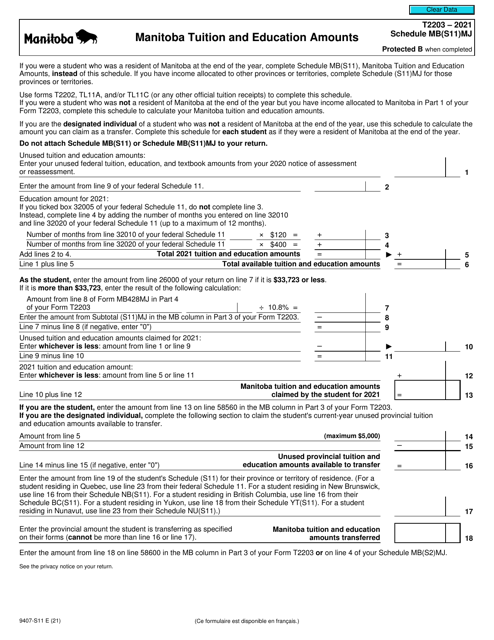

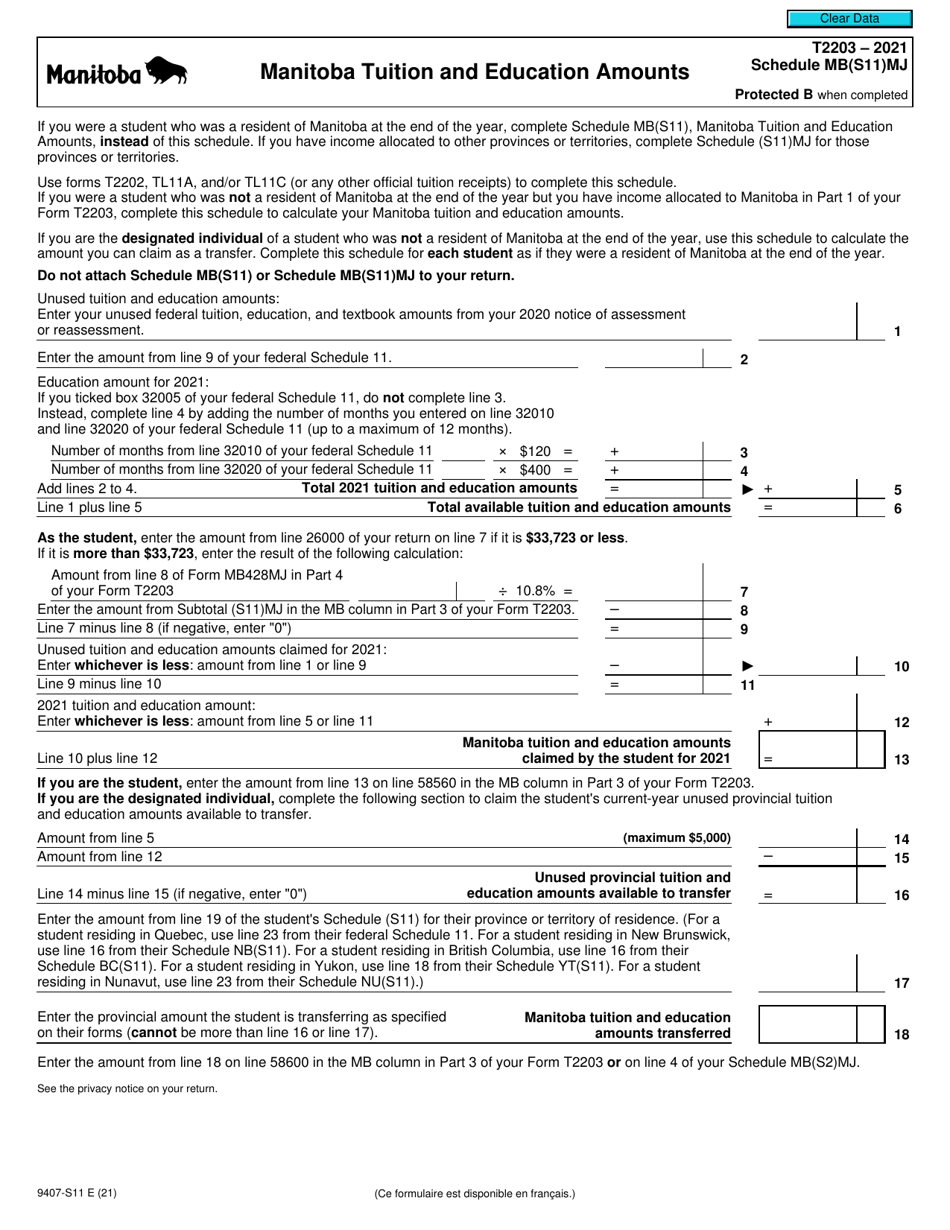

Form T2203 (9407-S11) Schedule MB(S11)MJ

for the current year.

Form T2203 (9407-S11) Schedule MB(S11)MJ Manitoba Tuition and Education Amounts - Canada

Form T2203 (9407-S11) Schedule MB(S11)MJ Manitoba Tuition and Education Amounts is used in Canada to claim tuition and education-related expenses specifically for residents of Manitoba. It allows individuals to calculate and report their eligible expenses for the purpose of claiming tax credits or deductions.

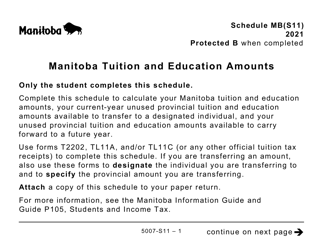

The Schedule MB (S11) MJ Manitoba Tuition and Education Amounts form is filed by residents of Manitoba, Canada who are claiming tuition and education tax credits.

FAQ

Q: What is Form T2203 (9407-S11)?

A: Form T2203 (9407-S11) is a schedule used to claim the Manitoba Tuition and Education Amounts in Canada.

Q: What is the purpose of Schedule MB(S11)?

A: The purpose of Schedule MB(S11) is to calculate the Manitoba Tuition and Education Amounts that can be claimed on your taxes.

Q: What are the Manitoba Tuition and Education Amounts?

A: The Manitoba Tuition and Education Amounts are credits that can be claimed to reduce your taxable income if you were a Manitoba resident and attended a post-secondary institution.

Q: Who is eligible to claim the Manitoba Tuition and Education Amounts?

A: Manitoba residents who attended a post-secondary institution are eligible to claim the Manitoba Tuition and Education Amounts.

Q: What information is required to complete Schedule MB(S11)?

A: To complete Schedule MB(S11), you will need information about your tuition fees, education amount, and other relevant expenses.

Q: When should I file Schedule MB(S11)?

A: You should file Schedule MB(S11) along with your annual tax return.

Q: Are there any deadlines for claiming the Manitoba Tuition and Education Amounts?

A: Yes, the deadline to claim the Manitoba Tuition and Education Amounts is the same as the deadline for filing your tax return, which is April 30th.

Q: Can I carry forward unused Manitoba Tuition and Education Amounts?

A: No, Manitoba Tuition and Education Amounts cannot be carried forward to future tax years.

Q: Is Schedule MB(S11) only for Manitoba residents?

A: Yes, Schedule MB(S11) is specifically for Manitoba residents who attended a post-secondary institution.