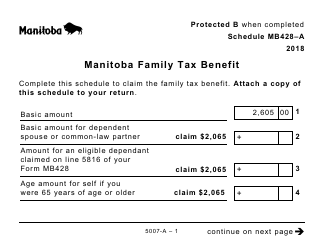

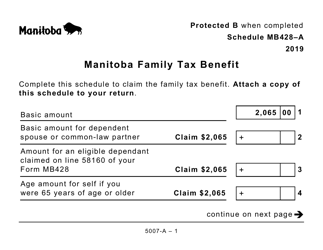

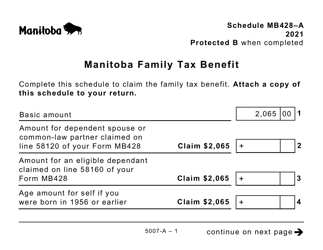

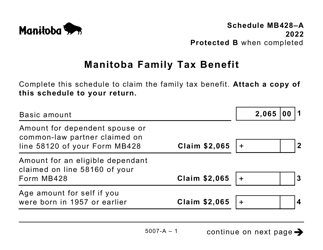

This version of the form is not currently in use and is provided for reference only. Download this version of

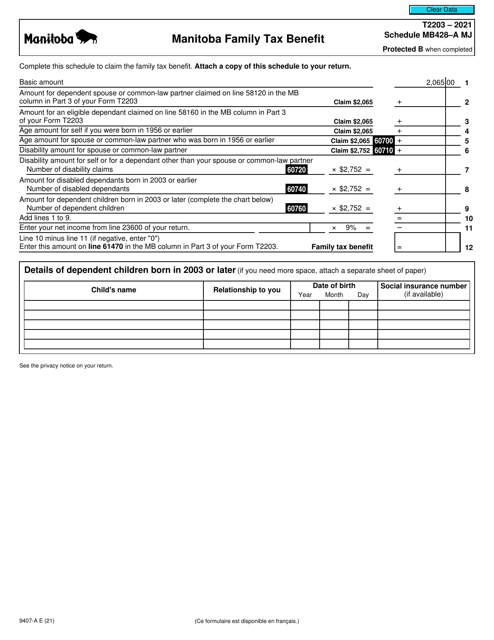

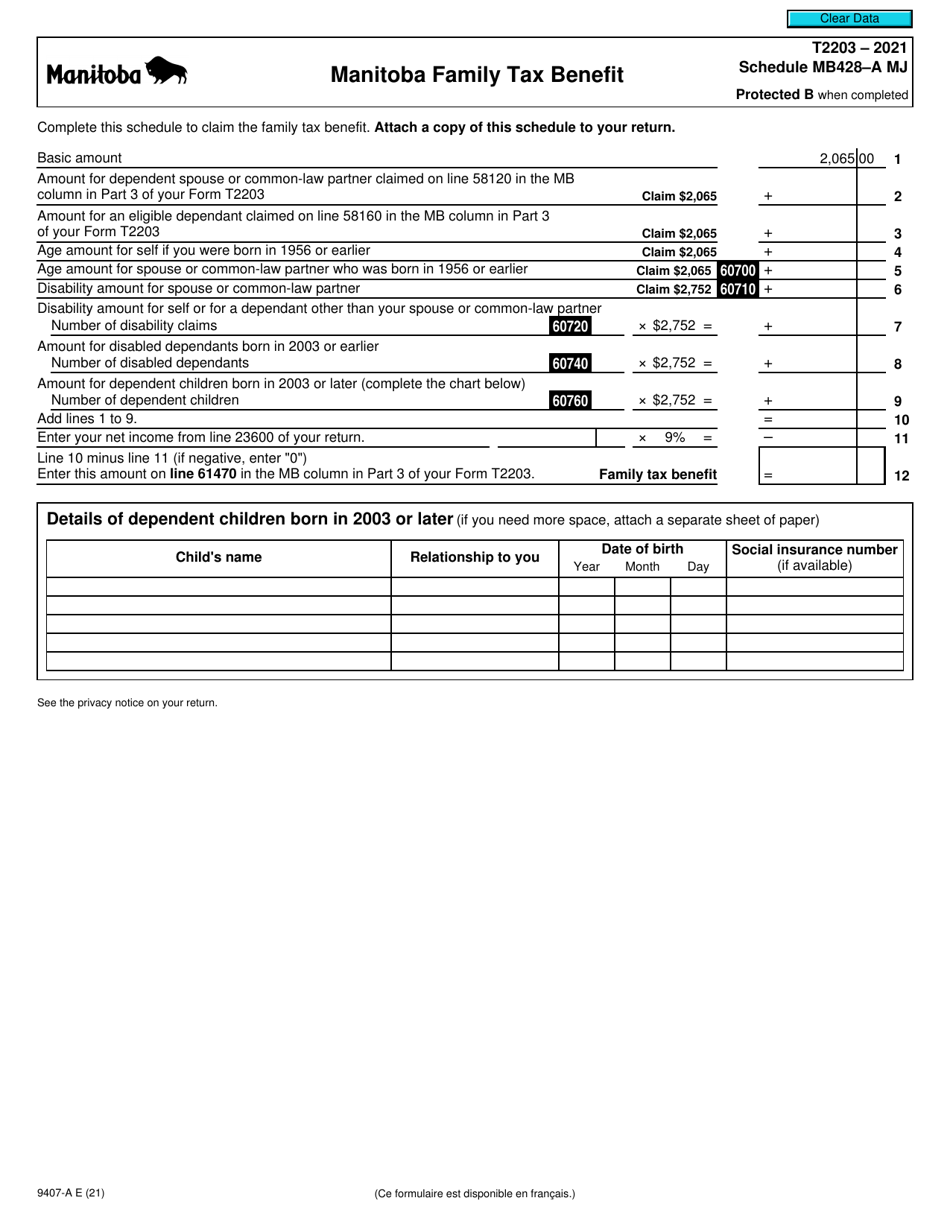

Form T2203 (9407-A) Schedule MB428-A MJ

for the current year.

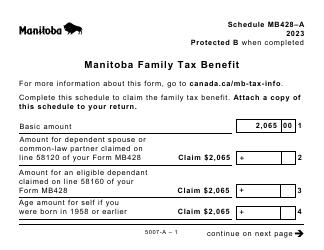

Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit - Canada

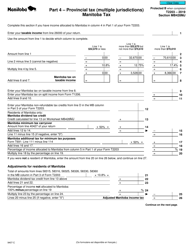

Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit is used in Canada for claiming the Manitoba Family Tax Benefit (MFTB). The MFTB is a tax benefit provided by the Province of Manitoba to help eligible low-income families with the cost of raising children. This form is used to calculate the amount of MFTB that a taxpayer is eligible for.

The Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit in Canada is filed by individuals and families who are residents of Manitoba and have children.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is Schedule MB428-A?

A: Schedule MB428-A is a part of the Manitoba Family Tax Benefit program in Canada.

Q: What is the MJ in Schedule MB428-A?

A: MJ stands for Manitoba in Schedule MB428-A.

Q: What is the Manitoba Family Tax Benefit?

A: The Manitoba Family Tax Benefit is a program that provides financial assistance to eligible low-income families in Manitoba, Canada.

Q: How do I apply for the Manitoba Family Tax Benefit?

A: You can apply for the Manitoba Family Tax Benefit by completing and submitting Schedule MB428-A with your tax return in Canada.