This version of the form is not currently in use and is provided for reference only. Download this version of

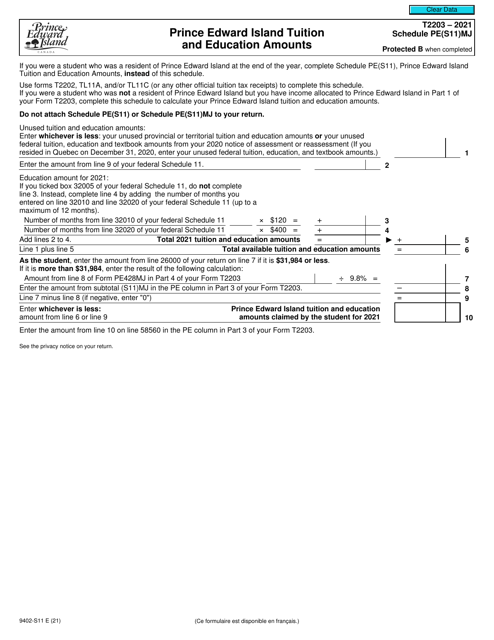

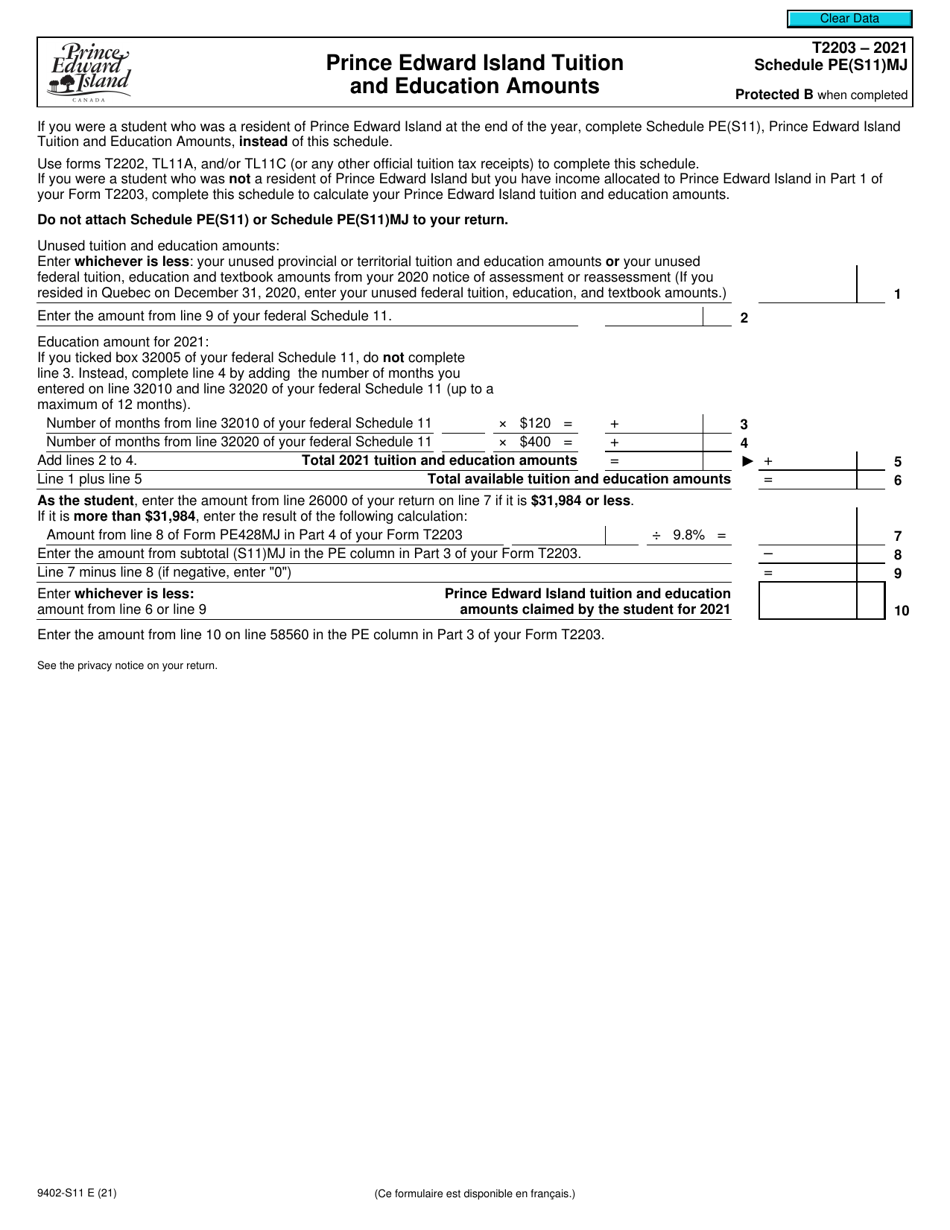

Form T2203 (9402-S11) Schedule PE(S11)MJ

for the current year.

Form T2203 (9402-S11) Schedule PE(S11)MJ Prince Edward Island Tuition and Education Amounts - Canada

Form T2203 (9402-S11) Schedule PE(S11) is used in Canada to claim the Prince Edward Island Tuition and Education Amounts. This form helps residents of Prince Edward Island to calculate and claim eligible tuition and education expenses for tax purposes. It allows them to reduce the amount of tax they owe or increase their refund. The form specifically applies to students attending post-secondary educational institutions in Prince Edward Island.

The Form T2203 (9402-S11) Schedule PE(S11)MJ is filed by residents of Prince Edward Island in Canada who want to claim tuition and education amounts.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form in Canada used to claim tuition and education amounts for Prince Edward Island.

Q: What is Schedule PE(S11)MJ?

A: Schedule PE(S11)MJ is a specific section within Form T2203 that is used to claim tuition and education amounts for Prince Edward Island residents.

Q: Who can use Form T2203?

A: Form T2203 is used by residents of Prince Edward Island in Canada who want to claim tuition and education amounts.

Q: What are tuition and education amounts?

A: Tuition and education amounts are deductions or credits that can be claimed on your tax return to reduce the amount of tax you owe.

Q: Why would I claim tuition and education amounts?

A: By claiming tuition and education amounts, you can reduce your taxable income and potentially lower the amount of tax you owe.

Q: How do I complete Form T2203?

A: To complete Form T2203, you will need to enter the relevant information about your tuition and education expenses for Prince Edward Island.