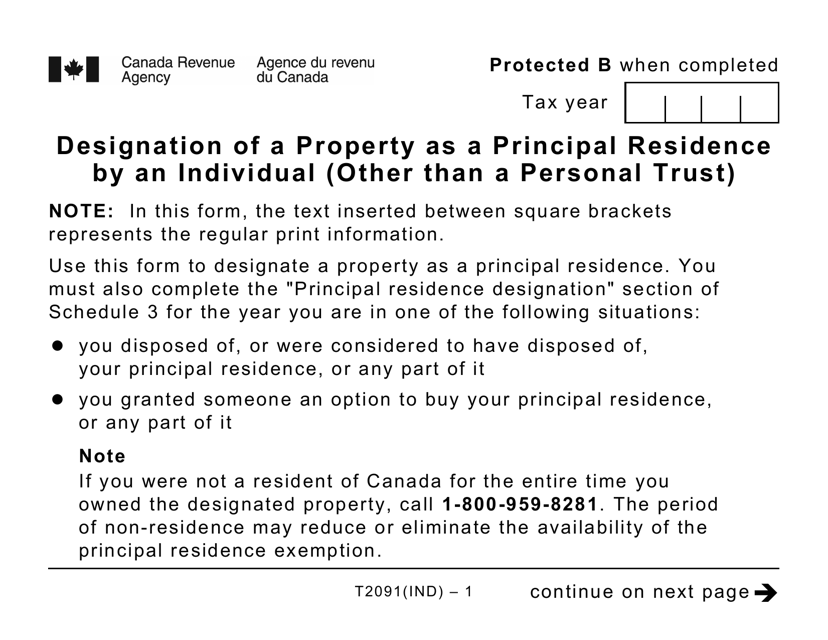

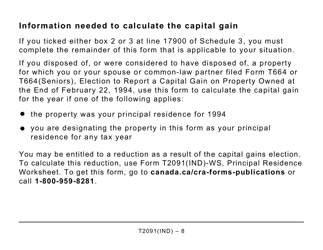

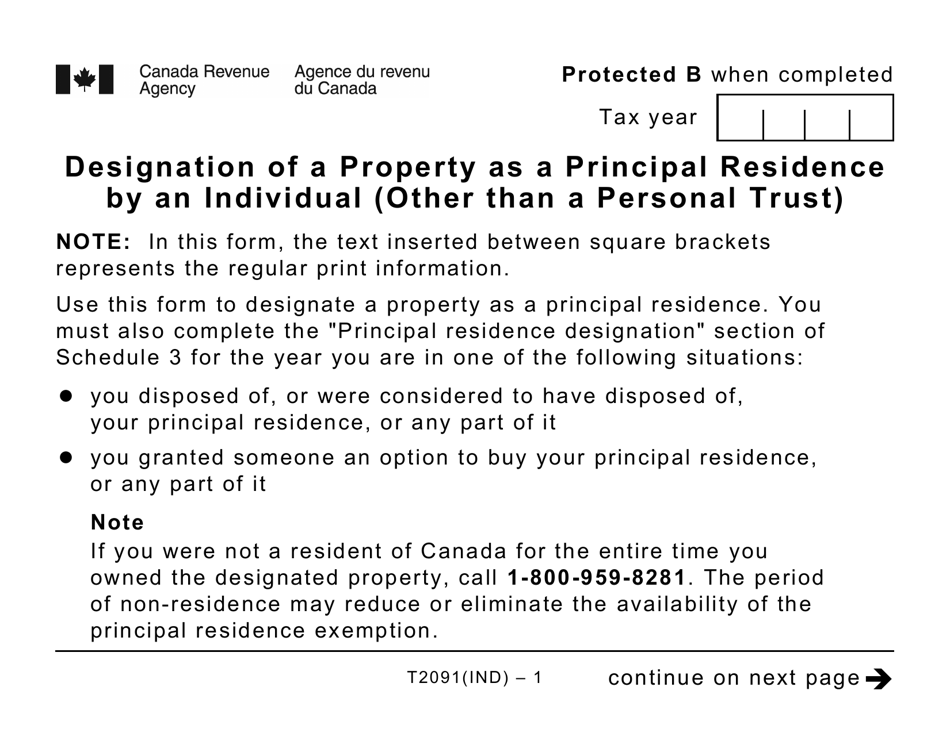

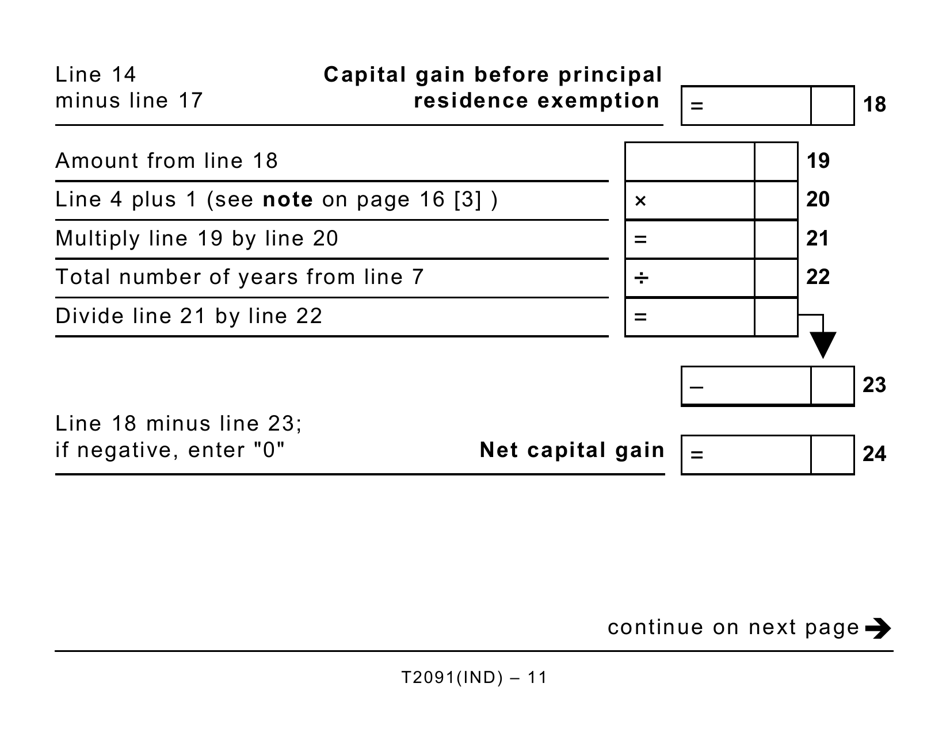

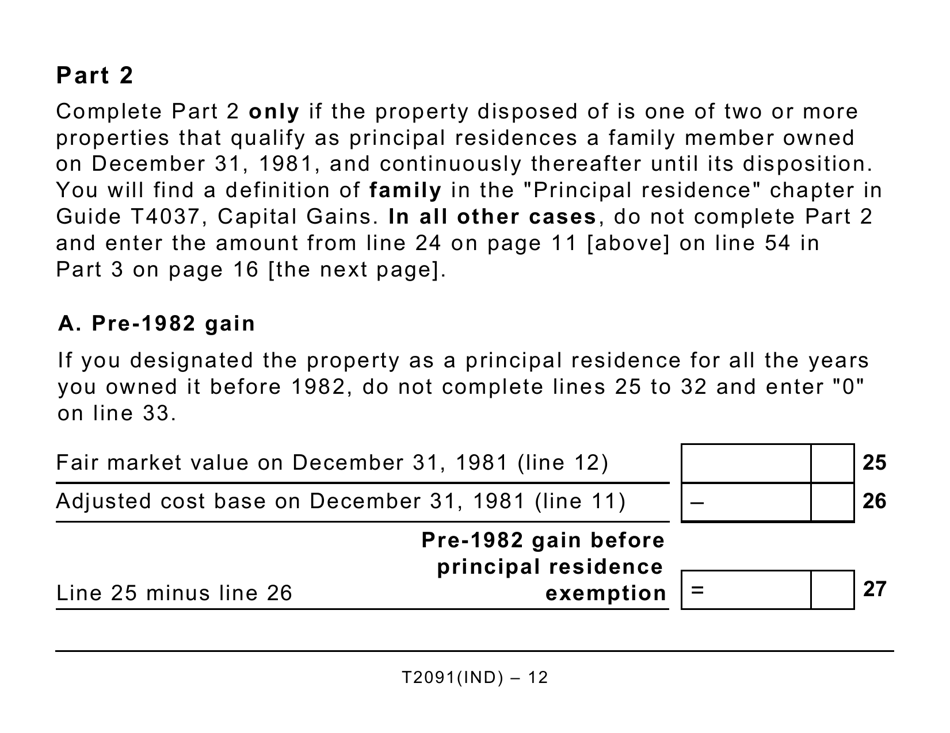

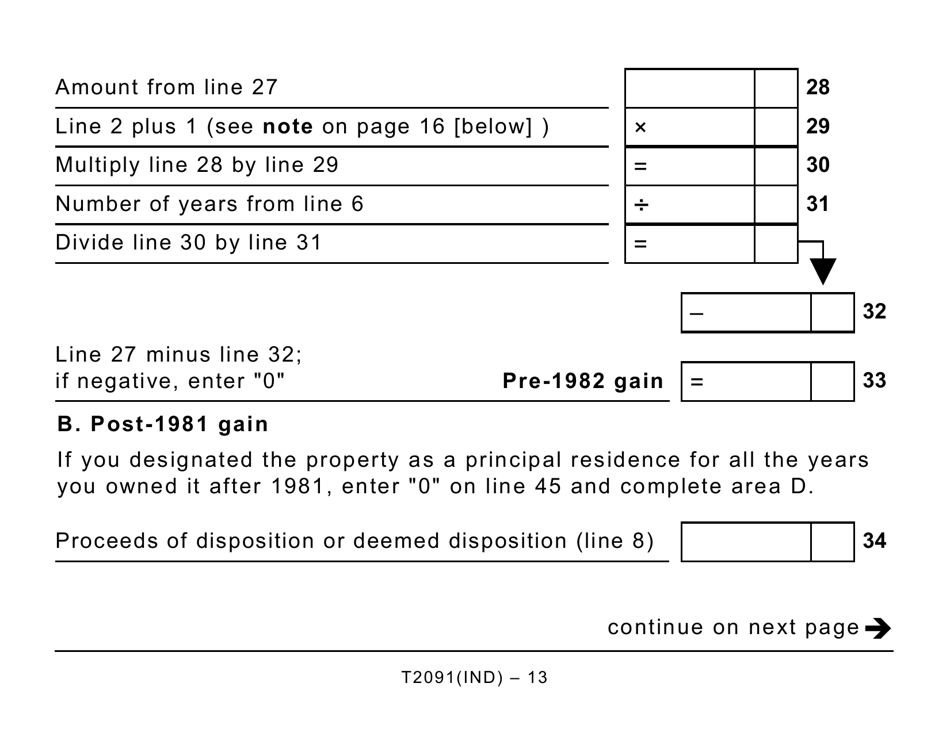

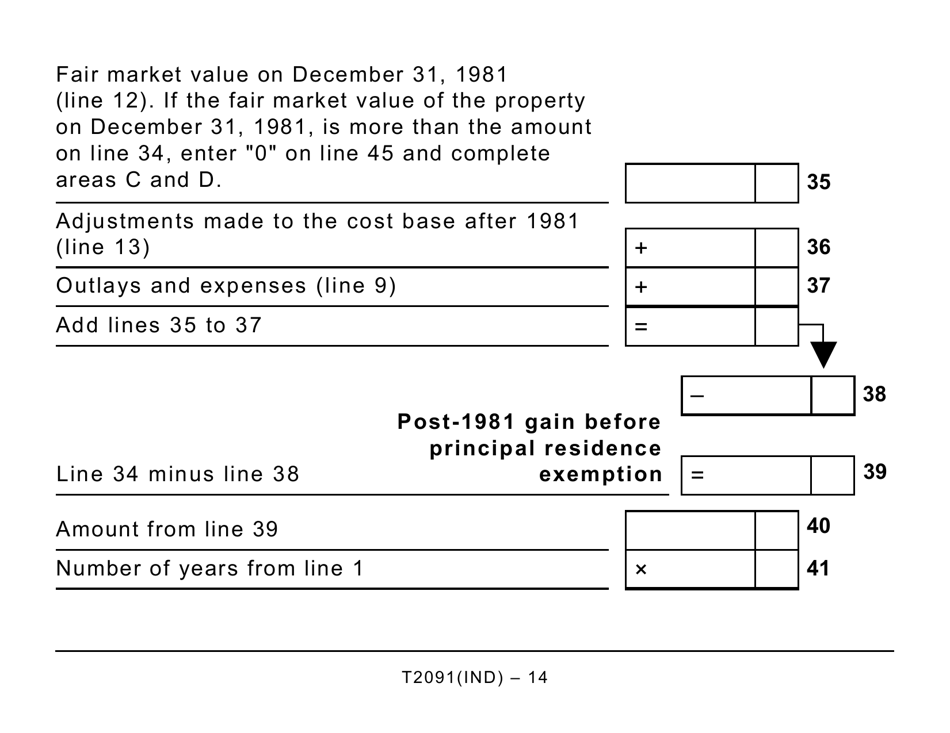

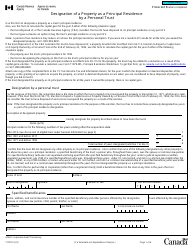

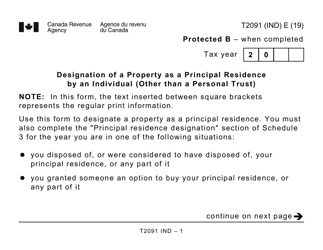

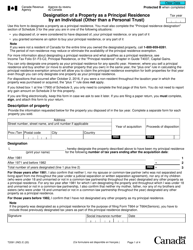

Form T2091IND Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) - Large Print - Canada

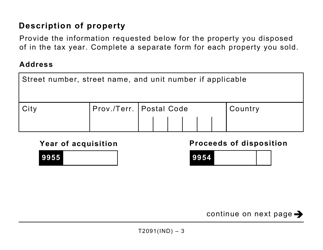

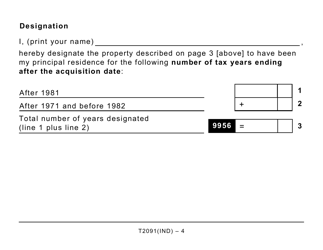

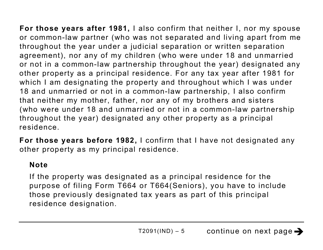

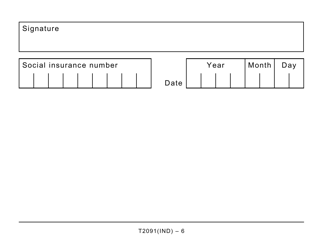

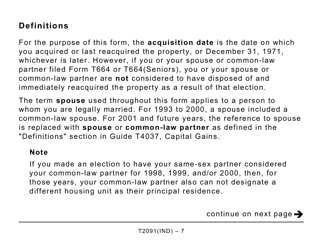

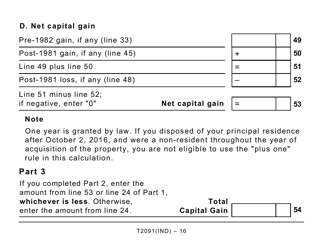

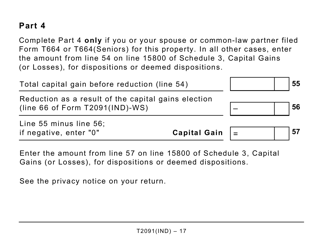

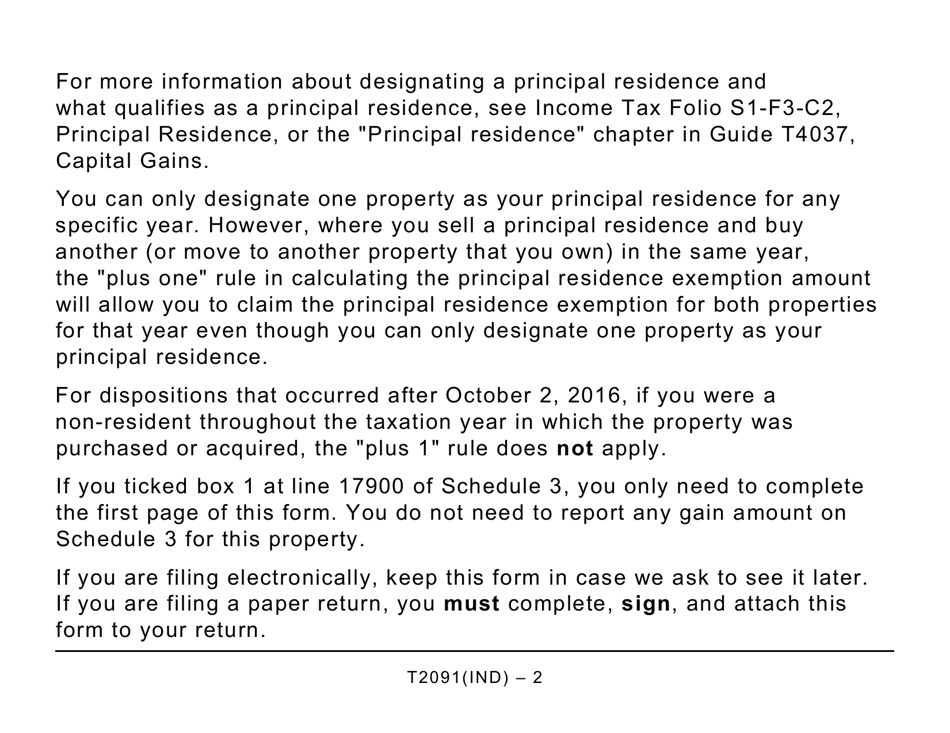

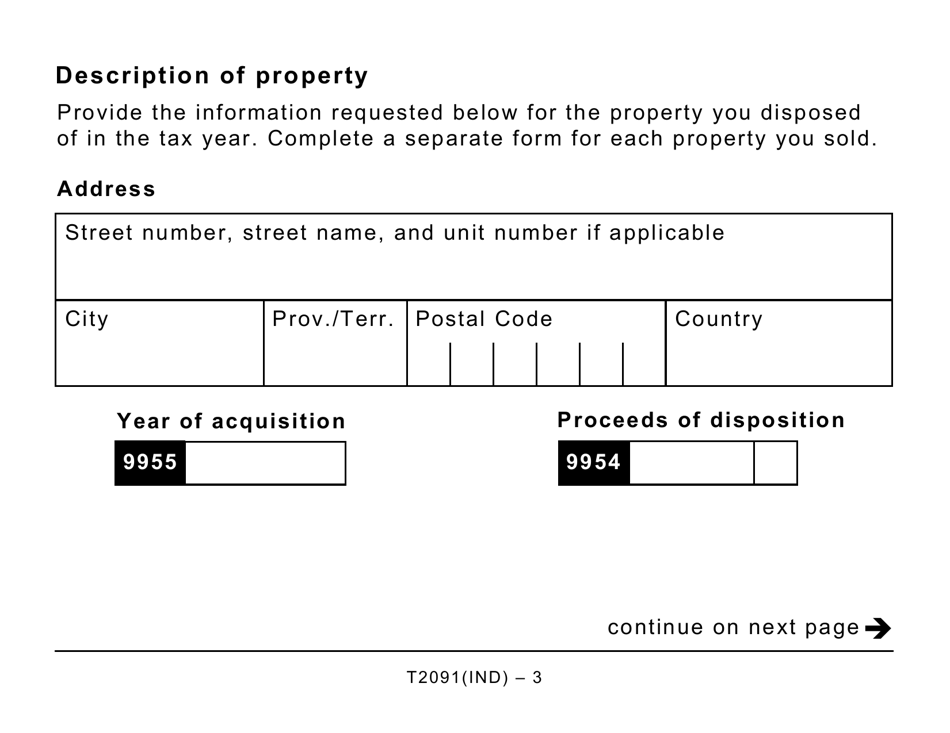

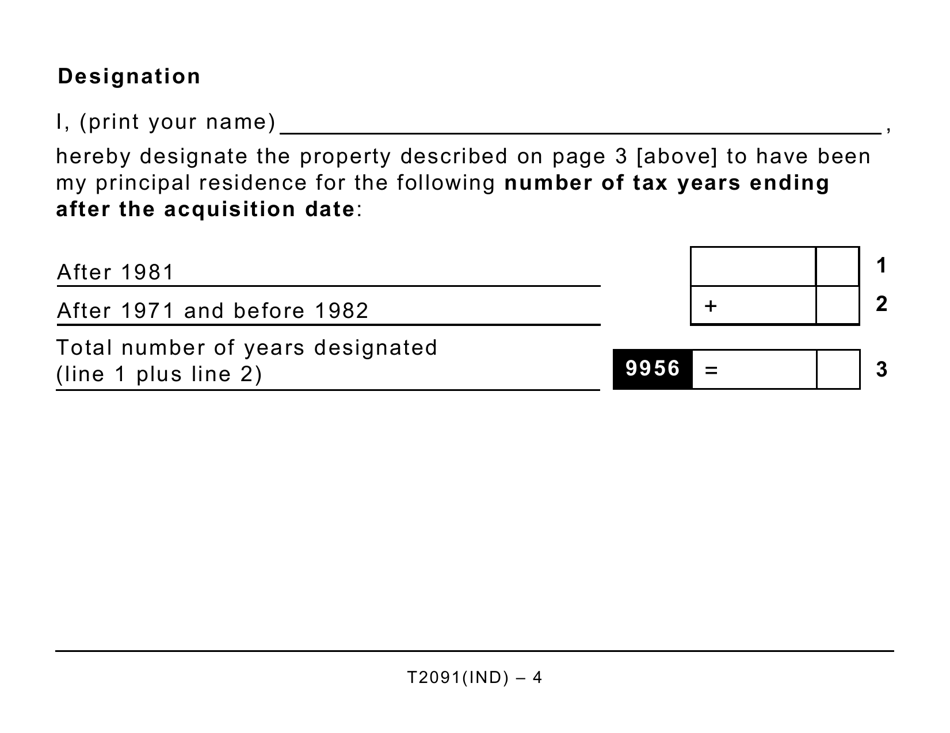

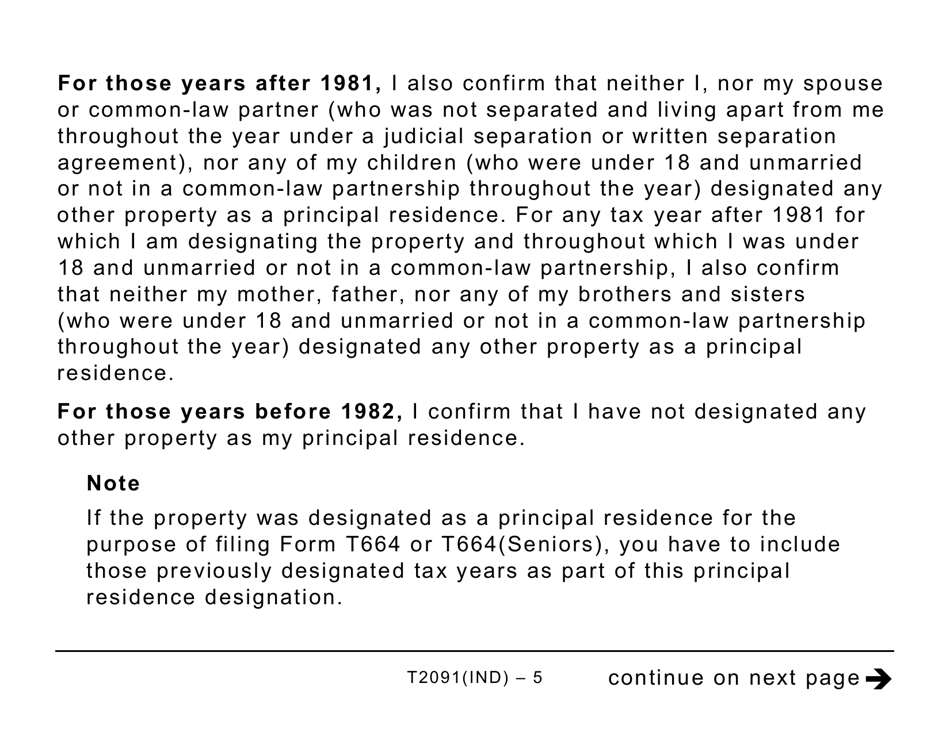

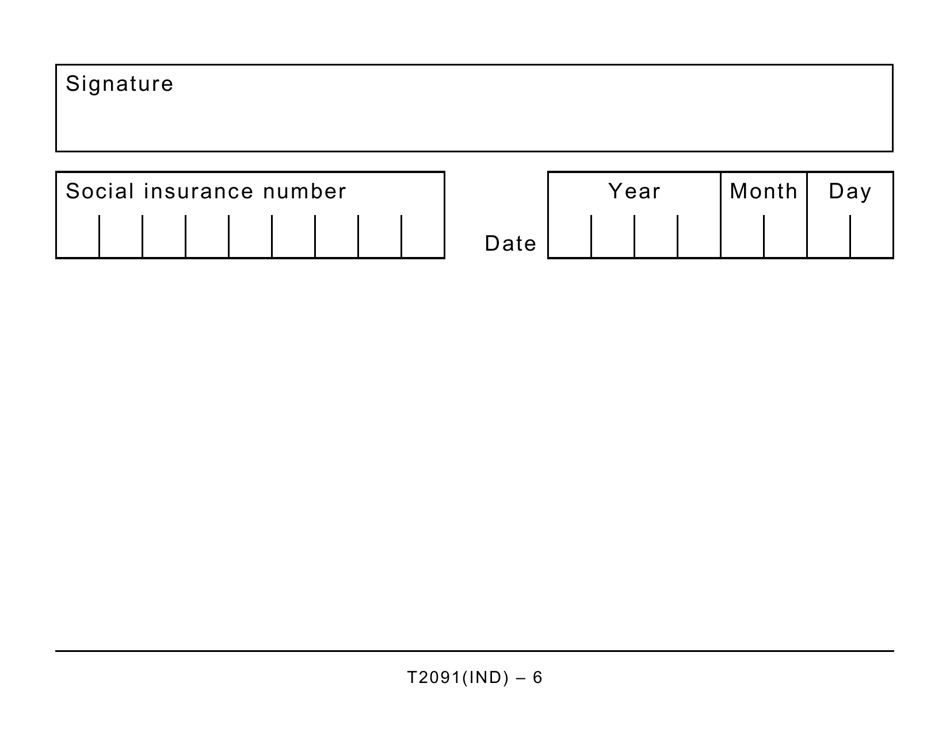

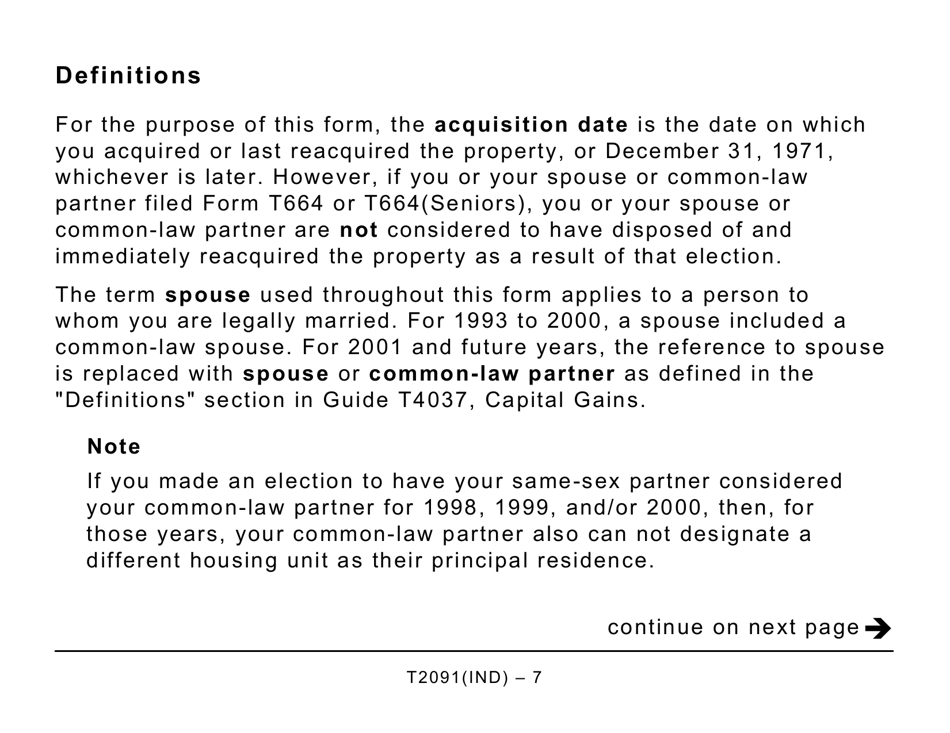

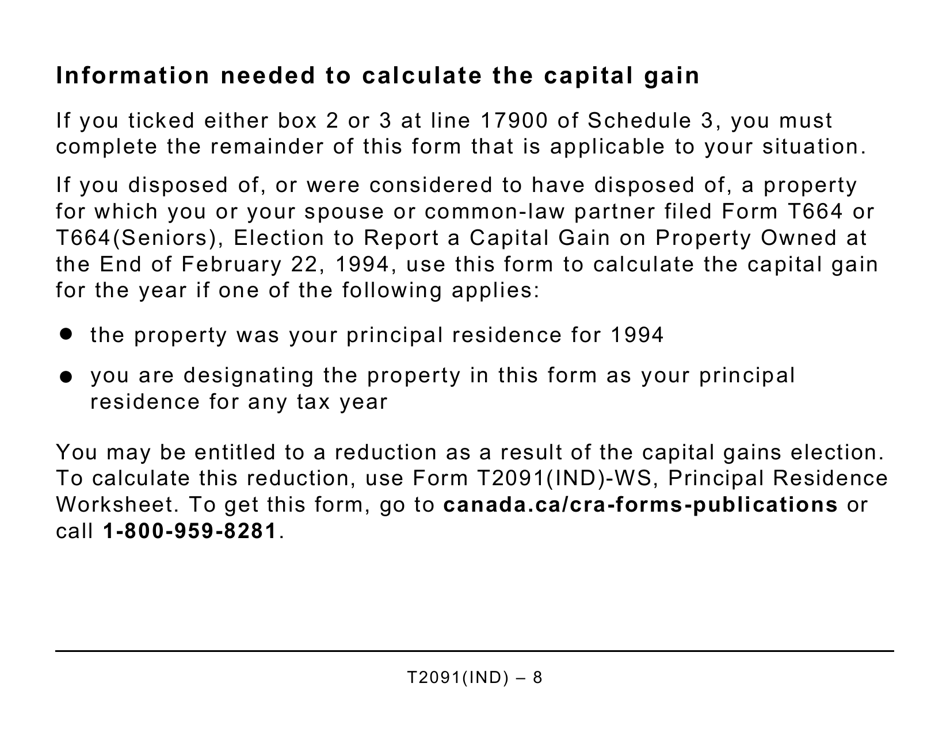

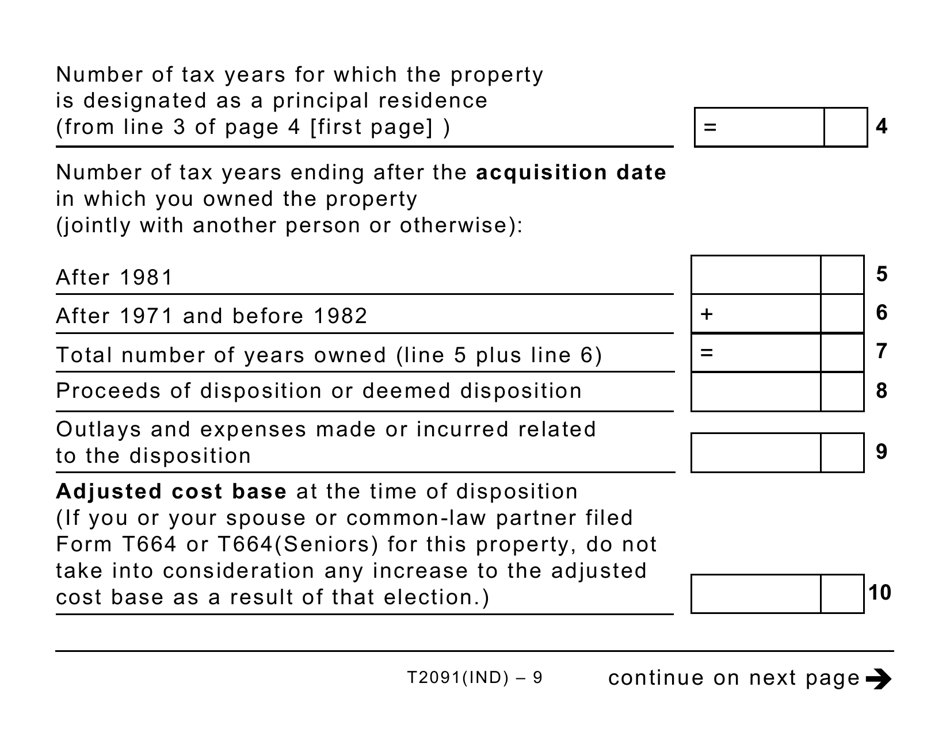

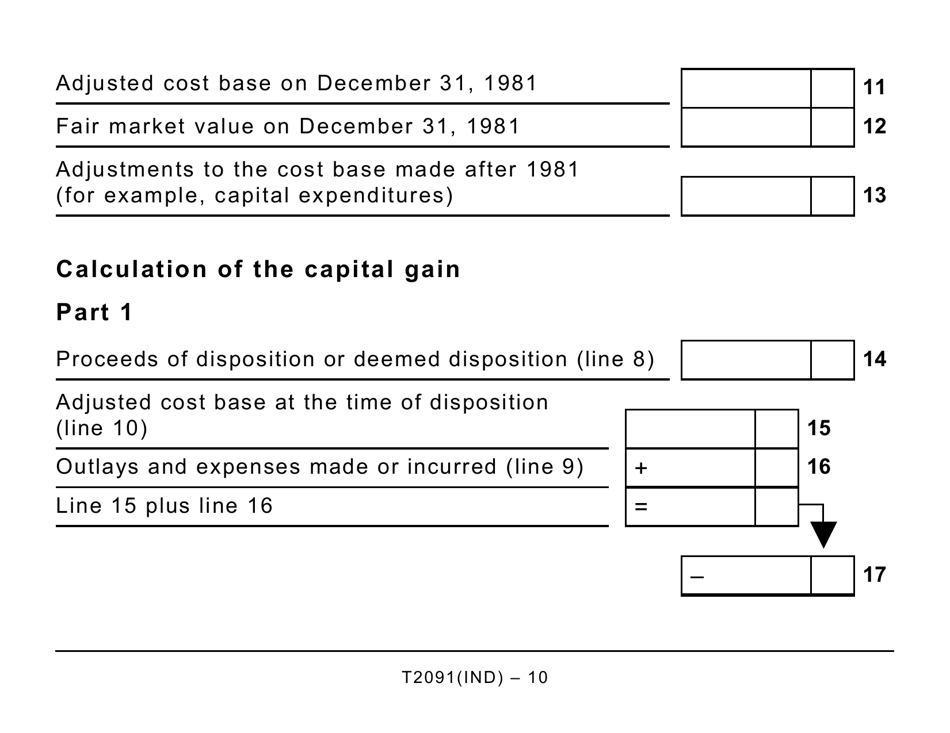

Form T2091IND is used in Canada to designate a property as a principal residence by an individual who is not a personal trust. The large print version is available to accommodate individuals with visual impairments. It helps individuals declare their property as their principal residence, which may have certain tax implications.

The Form T2091IND, Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) - Large Print, in Canada is typically filed by individuals who want to designate a property as their principal residence.

FAQ

Q: What is Form T2091IND?

A: Form T2091IND is a form used in Canada to designate a property as a principal residence by an individual, other than a personal trust.

Q: Who can use Form T2091IND?

A: This form can be used by individuals in Canada, other than personal trusts, to designate a property as their principal residence.

Q: What is the purpose of Form T2091IND?

A: The purpose of this form is to notify the Canada Revenue Agency (CRA) that a property is being designated as a principal residence.

Q: Is Form T2091IND for personal trusts?

A: No, Form T2091IND is not for personal trusts. It is only for individuals.

Q: Is Form T2091IND available in large print?

A: Yes, Form T2091IND is available in large print format.

Q: Is Form T2091IND specific to Canada?

A: Yes, Form T2091IND is specific to Canada and used for designating a property as a principal residence in Canada.