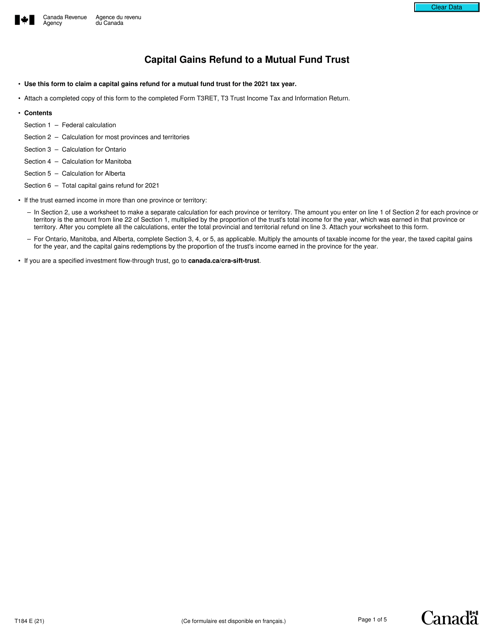

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T184

for the current year.

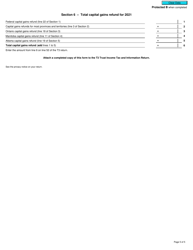

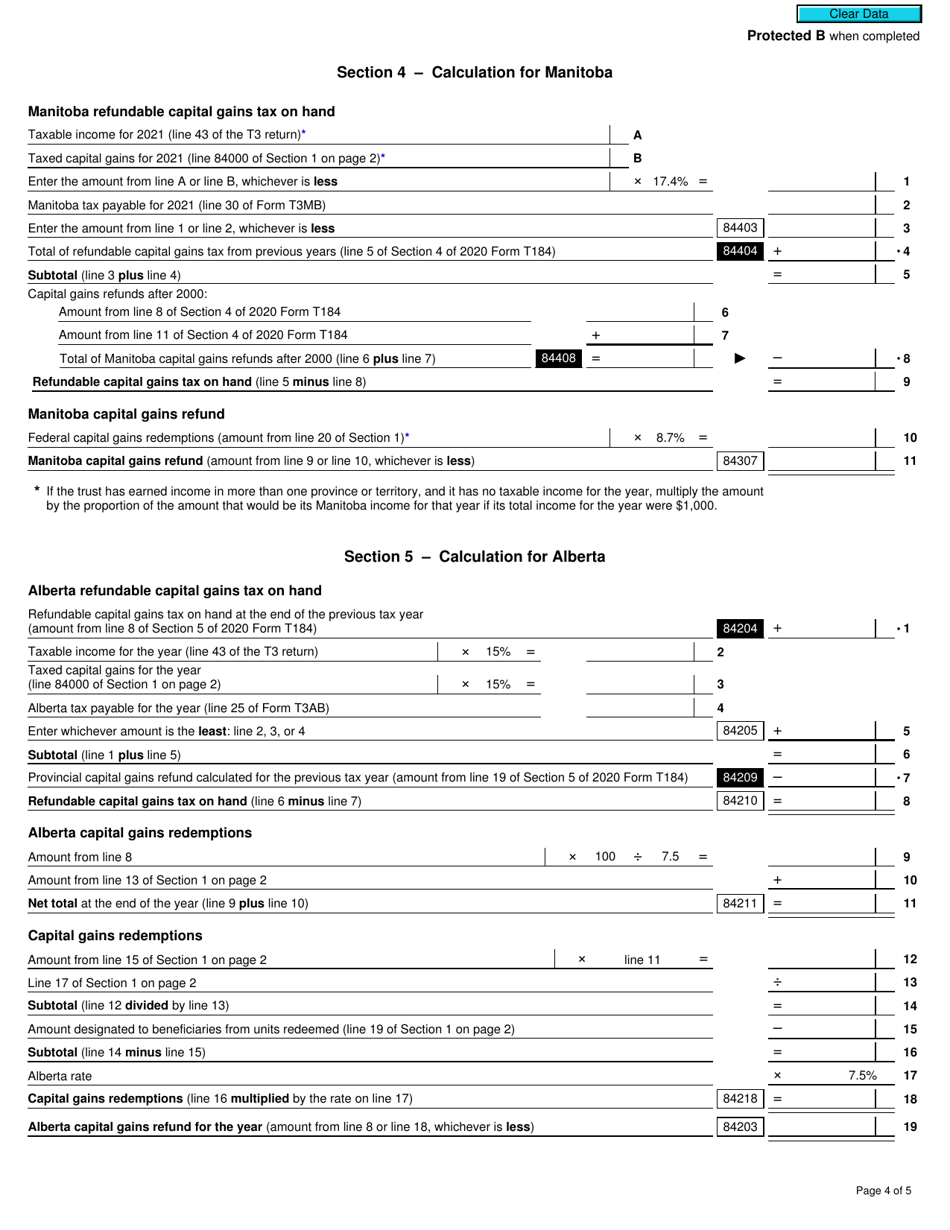

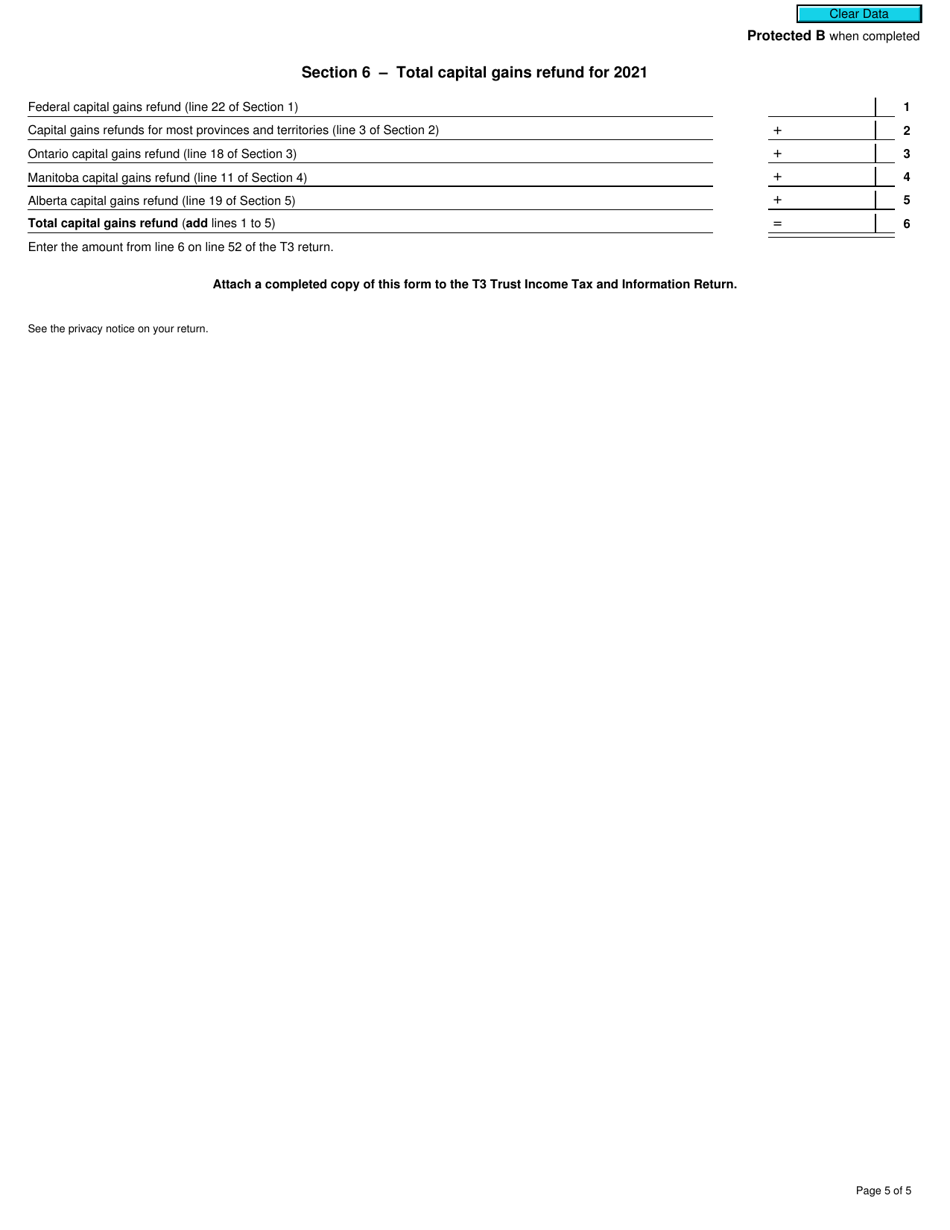

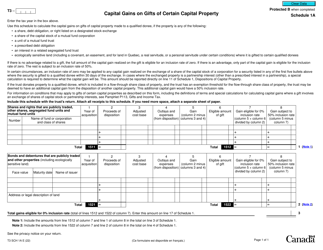

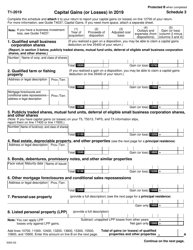

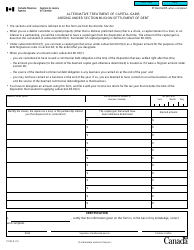

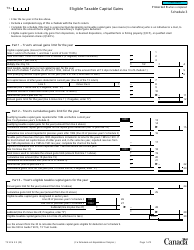

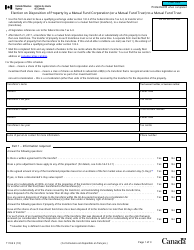

Form T184 Capital Gains Refund to a Mutual Fund Trust - Canada

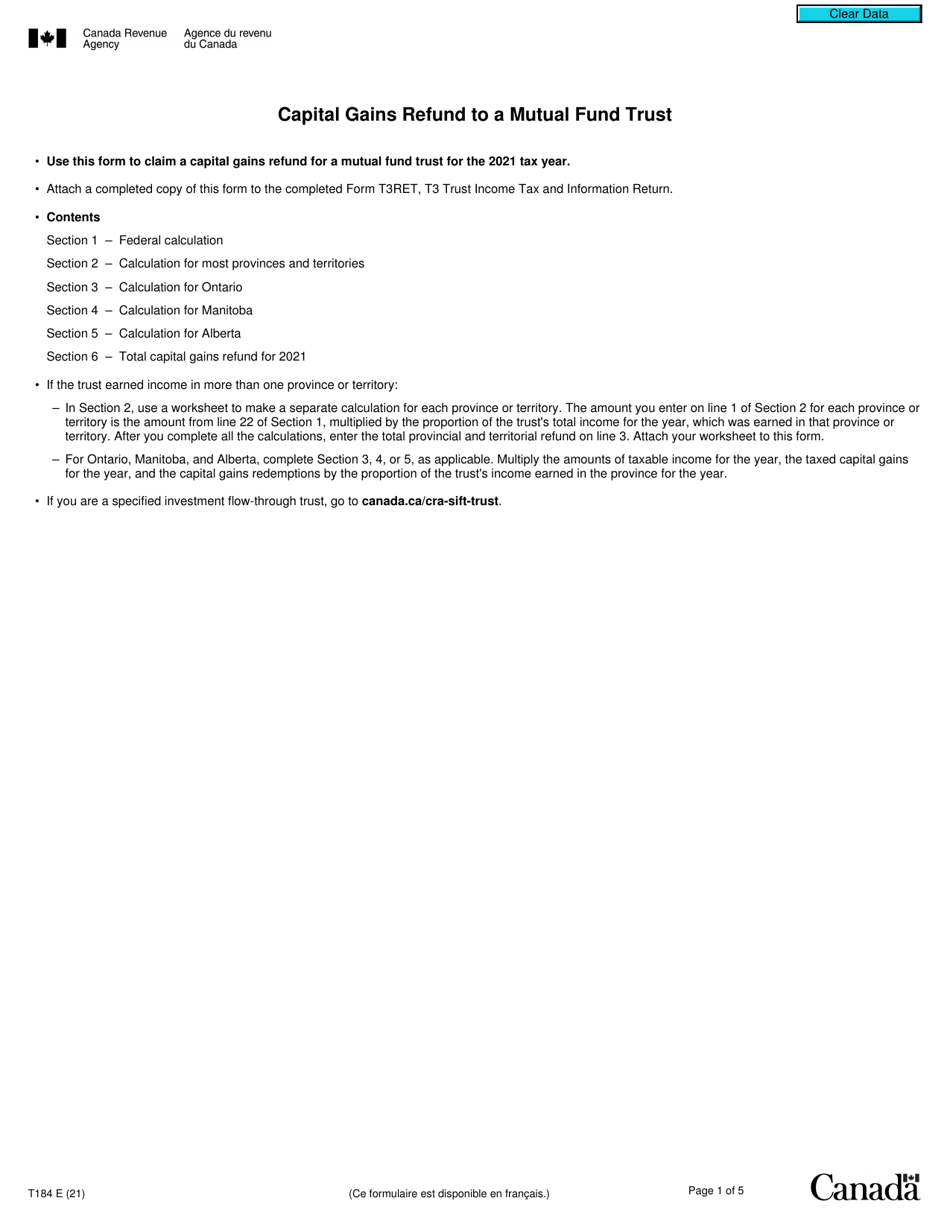

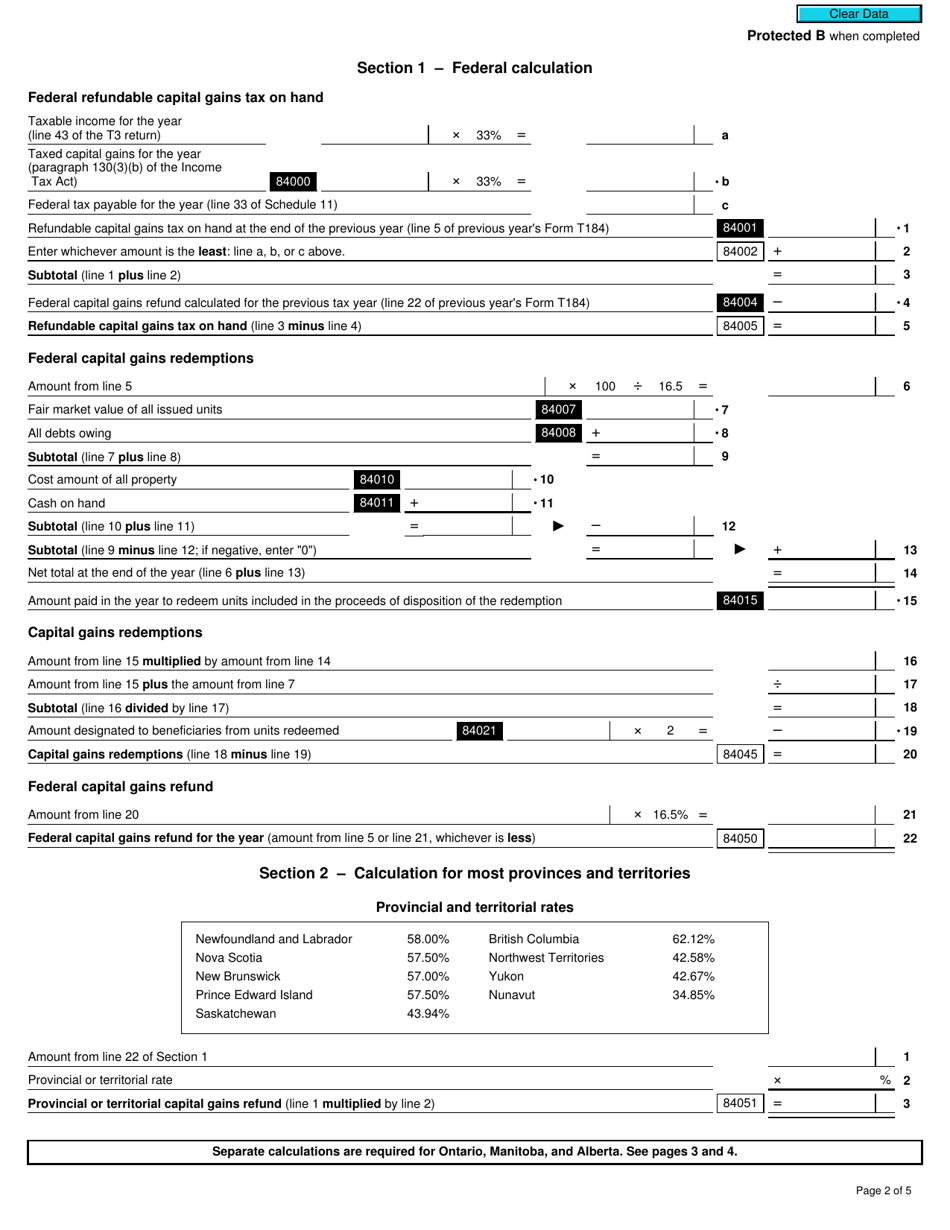

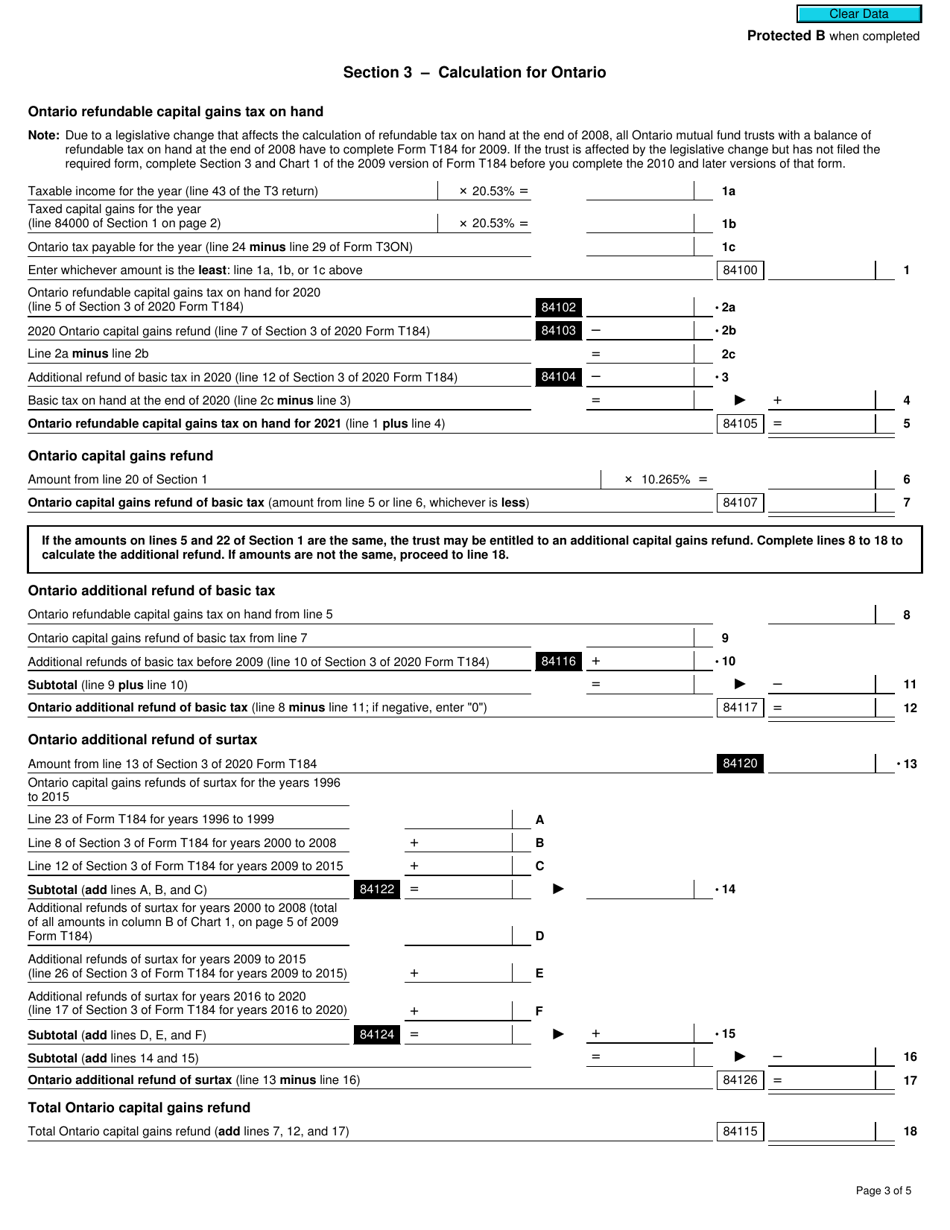

Form T184 Capital Gains Refund to a Mutual Fund Trust in Canada is used to claim a refund of capital gains tax paid by a mutual fund trust to its unitholders. This form helps the trust pass on the tax liability to the unitholders, allowing them to claim a credit or refund on their personal tax returns.

The individual investor or the trustee of the mutual fund trust files the Form T184 Capital Gains Refund in Canada.

FAQ

Q: What is Form T184?

A: Form T184 is a tax form used in Canada to request a capital gains refund from a mutual fund trust.

Q: What is a capital gains refund?

A: A capital gains refund is a refund of taxes paid on investment gains.

Q: Who can use Form T184?

A: Form T184 can be used by Canadian residents who have invested in a mutual fund trust.

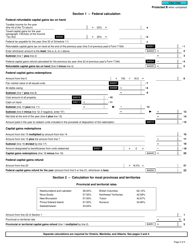

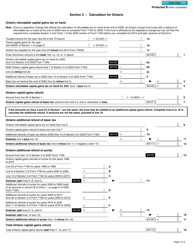

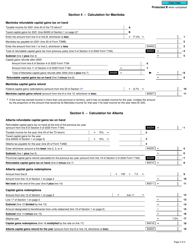

Q: How do I complete Form T184?

A: You will need to provide information about the mutual fund trust, your investment, and the taxes paid.

Q: Can I get a capital gains refund for investments in other types of funds?

A: No, Form T184 is specifically for mutual fund trusts.

Q: How long does it take to receive a capital gains refund?

A: The processing time can vary, but it typically takes several weeks to receive a refund.

Q: What should I do if I have more questions about Form T184?

A: You can contact the Canada Revenue Agency or consult a tax professional for assistance.