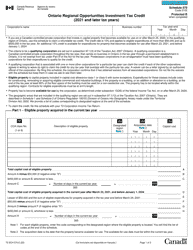

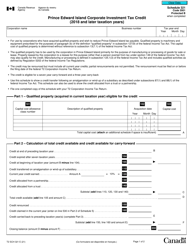

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1297

for the current year.

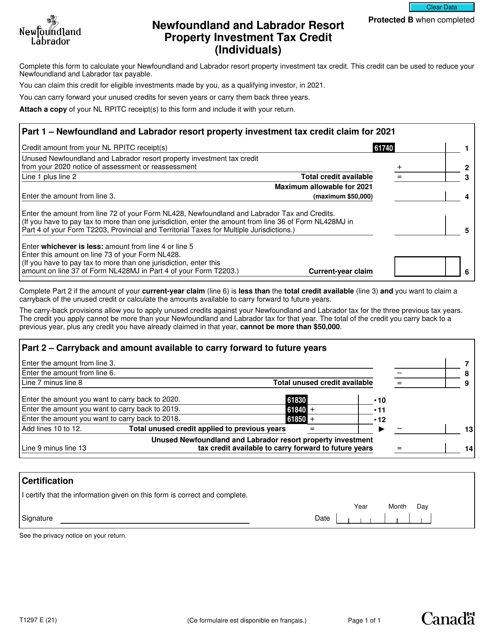

Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit (Individuals) - Canada

Form T1297 is a tax form in Canada specifically for individuals who have invested in resort property in Newfoundland and Labrador. It is used to claim the Resort Property Investment Tax Credit on their tax return. This tax credit is designed to encourage individuals to invest in resort properties in the region.

Individuals who have made eligible investments in resort properties in Newfoundland and Labrador can file the Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit.

FAQ

Q: What is Form T1297?

A: Form T1297 is the application form for the Newfoundland and Labrador Resort Property Investment Tax Credit for individuals in Canada.

Q: What is the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: The Newfoundland and Labrador Resort Property Investment Tax Credit is a tax credit offered by the government of Newfoundland and Labrador to individuals who invest in eligible resort properties in the province.

Q: Who is eligible for the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: Individuals who invest in eligible resort properties in Newfoundland and Labrador may be eligible for the tax credit. There are specific criteria outlined by the government to determine eligibility.

Q: How do I apply for the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: You can apply for the tax credit by completing Form T1297 and submitting it to the Canada Revenue Agency (CRA) along with any required supporting documents.

Q: What expenses are eligible for the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: Eligible expenses for the tax credit include the purchase or lease of an eligible resort property, as well as expenses related to the development or improvement of the property.

Q: How much is the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: The tax credit is equal to 15% of the eligible expenses incurred by an individual for the purchase, lease, development, or improvement of an eligible resort property, up to a maximum credit amount determined by the government.

Q: Are there any restrictions or limitations on the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: Yes, there are certain restrictions and limitations on the tax credit. For example, there are limits on the maximum credit amount that can be claimed and specific rules on how the credit can be applied against your taxes.

Q: When is the deadline to apply for the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: The deadline to apply for the tax credit is typically based on the tax year in which the eligible expenses were incurred. It is important to check with the CRA or the government of Newfoundland and Labrador for the specific deadline for each tax year.

Q: Can I claim the Newfoundland and Labrador Resort Property Investment Tax Credit if I don't live in the province?

A: Yes, you can still claim the tax credit even if you don't live in Newfoundland and Labrador. The credit is available to individuals who invest in eligible resort properties in the province, regardless of their residency.