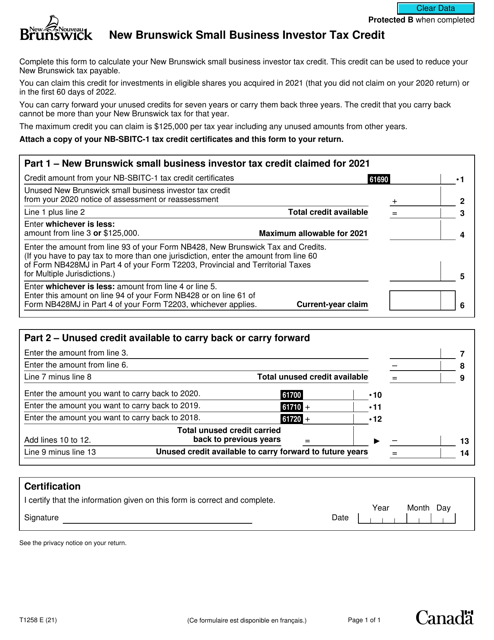

This version of the form is not currently in use and is provided for reference only. Download this version of

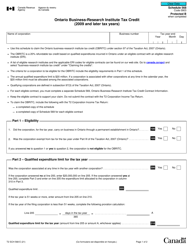

Form T1258

for the current year.

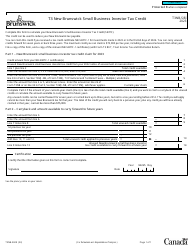

Form T1258 New Brunswick Small Business Investor Tax Credit - Canada

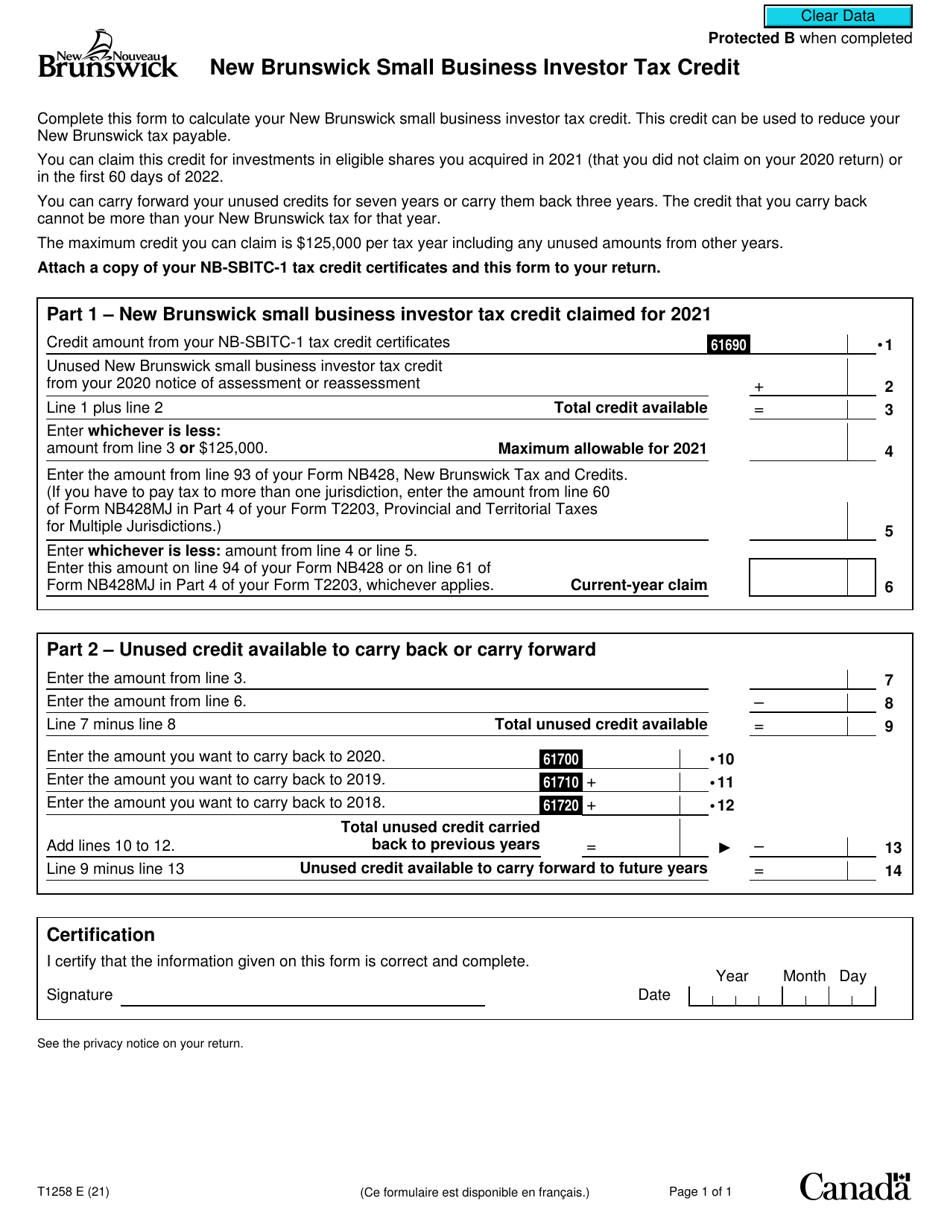

Form T1258 is used in Canada to claim the New Brunswick Small Business Investor Tax Credit. This tax credit is intended to encourage individuals to invest in small businesses located in New Brunswick. The form is used to calculate and report the amount of credit that can be claimed on the individual's tax return.

The Form T1258 New Brunswick Small Business Investor Tax Credit in Canada is filed by individuals or businesses who are claiming the small business investor tax credit in the province of New Brunswick.

FAQ

Q: What is Form T1258?

A: Form T1258 is a tax form used in Canada to claim the New Brunswick Small Business Investor Tax Credit.

Q: What is the New Brunswick Small Business Investor Tax Credit?

A: The New Brunswick Small Business Investor Tax Credit is a provincial tax credit in Canada that encourages individuals to invest in eligible small businesses in New Brunswick.

Q: Who is eligible for the New Brunswick Small Business Investor Tax Credit?

A: Individuals who have invested in eligible small businesses in New Brunswick may be eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the investment made in eligible small businesses, up to a maximum of $125,000 in a calendar year.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete Form T1258 and include it with your income tax return.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, you must file your income tax return and claim the tax credit by the due date, which is usually April 30th of the following year.

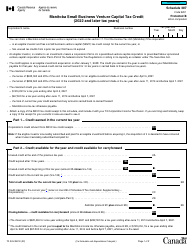

Q: Is the tax credit refundable?

A: No, the tax credit is non-refundable. It can only be used to reduce your tax payable.

Q: Are there any restrictions on eligible businesses?

A: Yes, eligible businesses must meet certain criteria set by the government of New Brunswick.

Q: Can I carry forward unused tax credits?

A: Yes, if you cannot use the full amount of the tax credit in the current year, you can carry it forward for up to 10 years.