This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1256

for the current year.

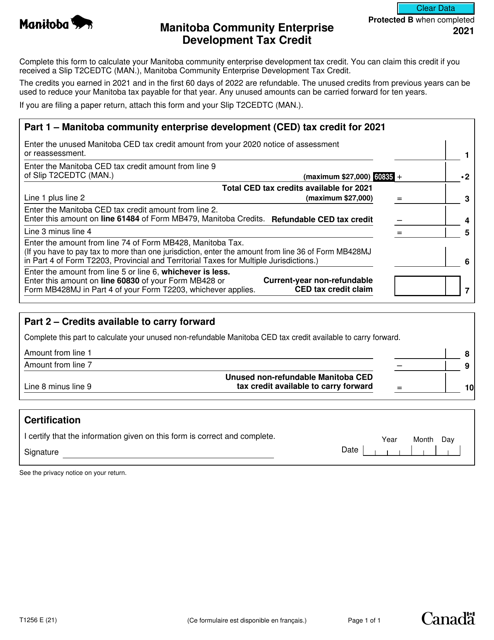

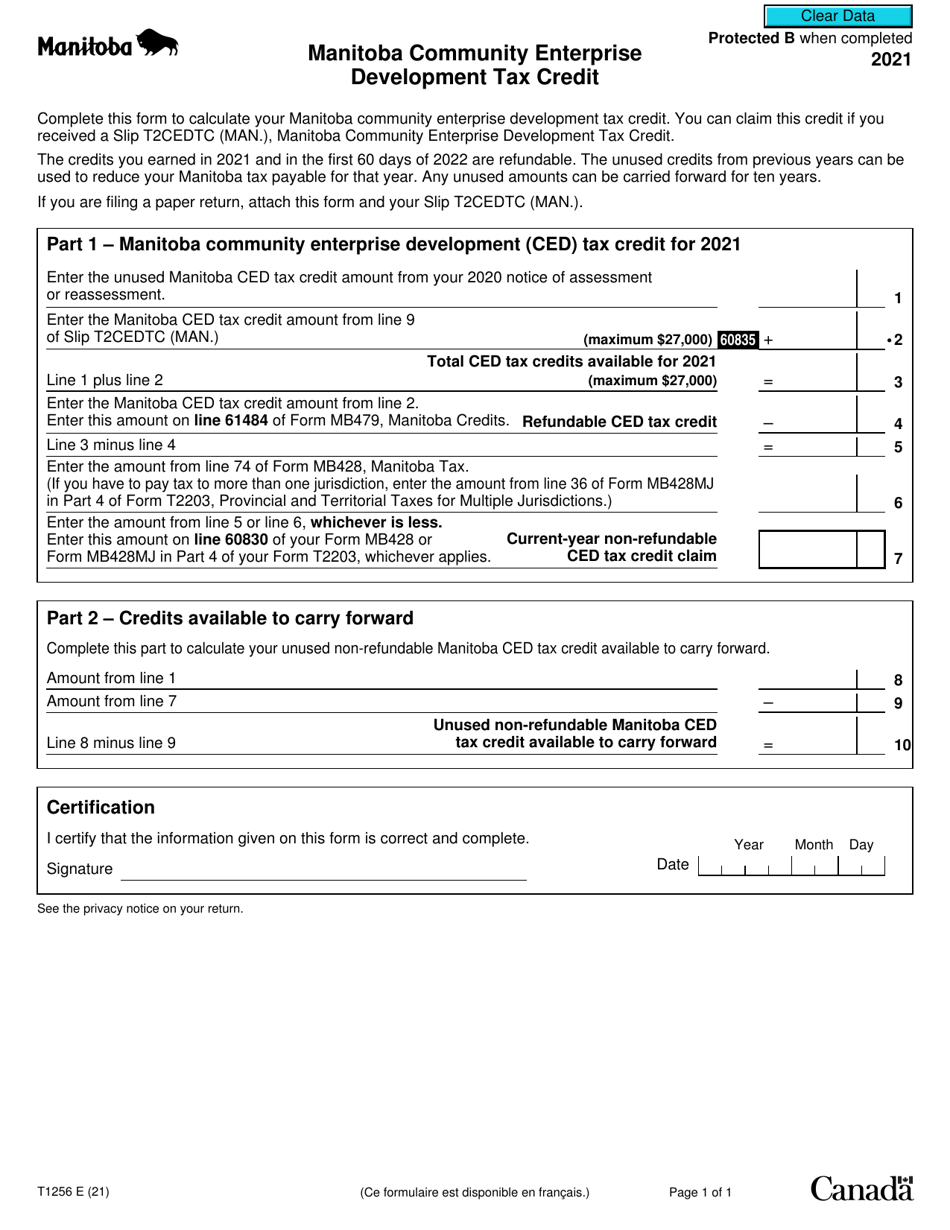

Form T1256 Manitoba Community Enterprise Development Tax Credit - Canada

Form T1256 - Manitoba Community Enterprise Development Tax Credit is used by individuals and corporations in Canada to claim tax credits for investments made in community enterprises in the province of Manitoba. This program encourages investment in local businesses that contribute to the economic development of Manitoba communities.

The individual or organization that is claiming the Manitoba Community Enterprise Development Tax Credit in Canada would file the Form T1256.

FAQ

Q: What is Form T1256?

A: Form T1256 is a tax form used in Canada.

Q: What is the Manitoba Community Enterprise Development Tax Credit?

A: The Manitoba Community Enterprise Development Tax Credit is a tax credit offered in Manitoba, Canada.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to encourage investment in community development projects in Manitoba.

Q: Who is eligible to claim the tax credit?

A: Individuals or corporations that invest in eligible community development projects in Manitoba may be eligible to claim the tax credit.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete and submit Form T1256 to the Canada Revenue Agency.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, there are specific deadlines for claiming the tax credit. It is important to check with the Canada Revenue Agency for the current deadlines.

Q: What documentation do I need to submit with Form T1256?

A: You may need to provide supporting documentation, such as investment statements or project details, along with Form T1256.

Q: Can I claim the tax credit if I live outside of Manitoba?

A: No, the Manitoba Community Enterprise Development Tax Credit is only available to individuals or corporations that reside in Manitoba.

Q: Is the tax credit refundable?

A: Yes, the tax credit is refundable, which means you may receive a refund if the credit exceeds your tax liability.