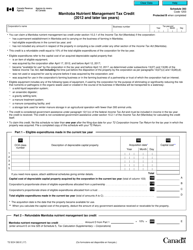

This version of the form is not currently in use and is provided for reference only. Download this version of

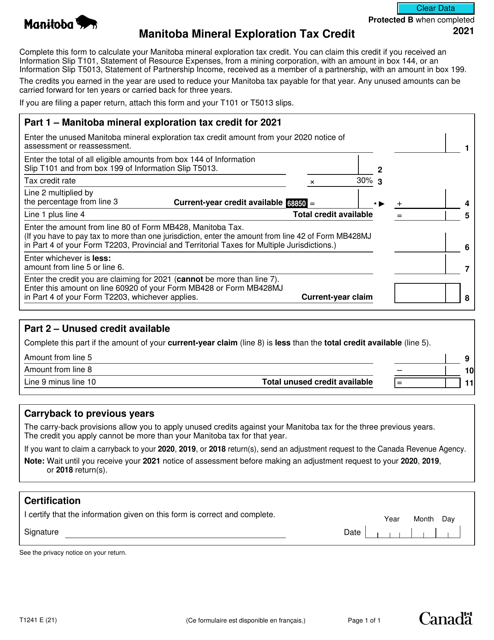

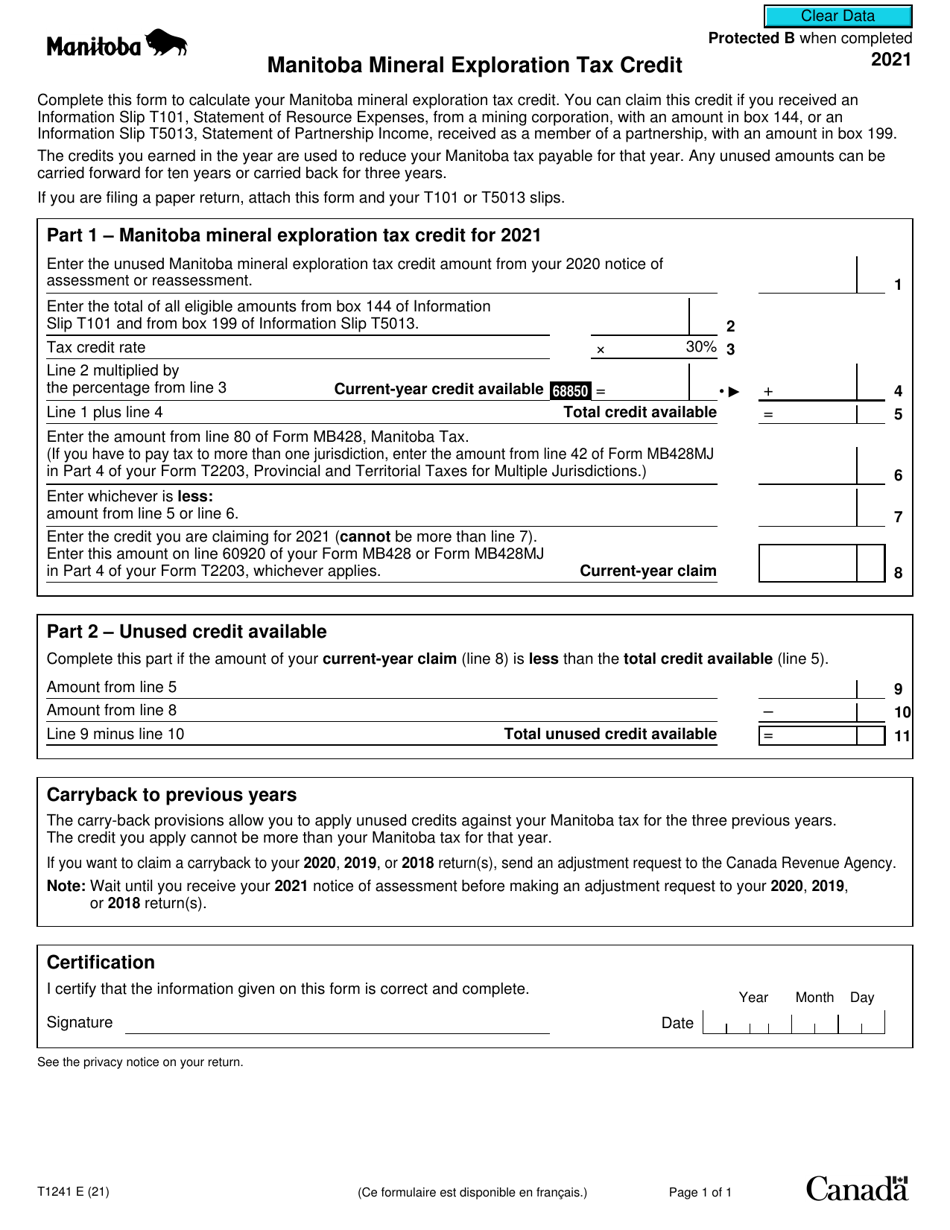

Form T1241

for the current year.

Form T1241 Manitoba Mineral Exploration Tax Credit - Canada

Form T1241 is a tax form specifically related to the Manitoba Mineral Exploration Tax Credit in Canada. This form is used by individuals or corporations engaged in mineral exploration activities in the province of Manitoba to claim a non-refundable tax credit. The tax credit is designed to encourage and support mineral exploration, which plays a vital role in the economic development of Manitoba. The form allows eligible taxpayers to calculate and claim the credit, which can offset their overall tax liability.

The Form T1241 Manitoba Mineral Exploration Tax Credit in Canada is typically filed by corporations or individuals who incur eligible exploration expenses in Manitoba for the purpose of mineral exploration. It allows them to claim the Manitoba Mineral Exploration Tax Credit.

FAQ

Q: What is Form T1241?

A: Form T1241 is the Manitoba Mineral Exploration Tax Credit form.

Q: What is the purpose of Form T1241?

A: Form T1241 is used to claim the Manitoba Mineral Exploration Tax Credit.

Q: Who is eligible to claim the Manitoba Mineral Exploration Tax Credit?

A: Individuals and corporations that carry on mineral exploration activities in Manitoba may be eligible to claim the tax credit.

Q: What is the benefit of claiming the Manitoba Mineral Exploration Tax Credit?

A: The tax credit provides financial assistance to individuals and corporations engaged in mineral exploration activities in Manitoba.

Q: Are there any specific requirements to claim the Manitoba Mineral Exploration Tax Credit?

A: Yes, there are specific requirements that must be met in order to claim the tax credit. These requirements include being certified by the Minister of Growth, Enterprise and Trade as a qualifying person.

Q: How much is the Manitoba Mineral Exploration Tax Credit?

A: The tax credit is equal to a percentage of the eligible exploration expenses incurred in Manitoba.