This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1170

for the current year.

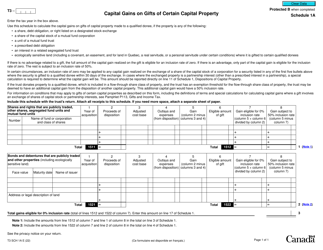

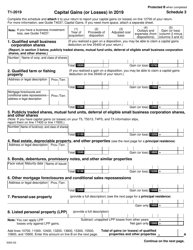

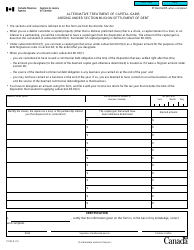

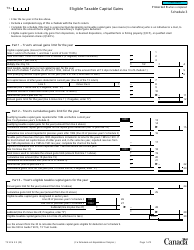

Form T1170 Capital Gains on Gifts of Certain Capital Property - Canada

Form T1170 is used in Canada to report the capital gains or losses from the transfer of certain capital property as a gift. This form helps the taxpayer calculate and report any taxable capital gains or losses for the given tax year.

The person who gives the gift must file Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada.

FAQ

Q: What is Form T1170?

A: Form T1170 is a form used in Canada to report capital gains on gifts of certain capital property.

Q: What is considered capital property?

A: Capital property includes assets such as stocks, real estate, and business assets.

Q: When do I need to use Form T1170?

A: You need to use Form T1170 when you have received a gift of certain capital property and want to report the capital gains on it.

Q: Do I need to pay taxes on gifts of capital property?

A: Yes, you may be required to pay taxes on the capital gains from gifts of capital property.

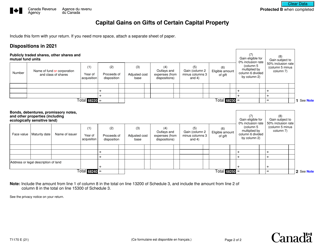

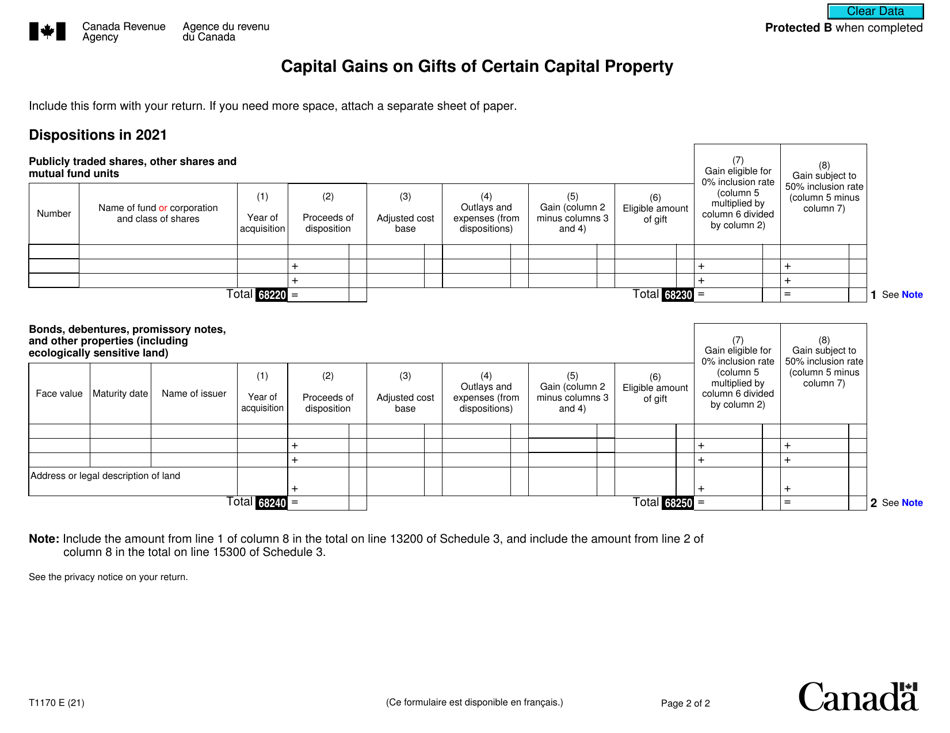

Q: How do I fill out Form T1170?

A: You will need to provide information about the property, the fair market value, and calculate the capital gains.

Q: Are there any exemptions for gifts of capital property?

A: There are certain exemptions available for gifts of capital property, such as the principal residence exemption for personal homes.